Business and support function consolidation as

well as exit of virgin polycarbonate production expected to result

in $45 million to $50 million of annualized profitability

improvement

Trinseo (NYSE: TSE) (Trinseo or “the Company”), a specialty

materials solutions provider, today announced restructuring

initiatives to better position the business for longer-term growth,

improved profitability, and increased cash generation.

Effective October 1, 2024, the Company is combining the

management of its Engineered Materials, Plastics Solutions and

Polystyrene businesses, resulting in a reduction in workforce due

to the consolidation of business management roles and support

functions. These actions began in the third quarter of 2024 and are

anticipated to be substantially complete by the end of 2025. The

expected annualized run rate cost savings is $30 million with

approximately $25 million realized in 2025 and the full run rate

achieved by the end of 2026.

The newly combined Engineered Materials, Plastics Solutions and

Polystyrene businesses will be led by Francesca Reverberi, SVP,

Engineered Materials. Bregje “Bee” Van Kessel, who currently leads

the Plastics Solutions and Polystyrene businesses, will assume the

role of SVP, Corporate Finance and Investor Relations reporting to

David Stasse, EVP, Chief Financial Officer. Han Hendriks, who leads

technology and innovation, will add oversight responsibilities for

the Company’s sustainability activities as Chief Technology and

Sustainability Officer.

Additionally, the Company has decided to exit virgin

polycarbonate production at its Stade, Germany production facility

following discussions with the relevant works councils. Production

is anticipated to end by January 2025 with severance and related

benefit payments expected to complete by the end of 2026. Once

operations have ceased, all the Company’s polycarbonate needs for

its downstream, differentiated compounded products will be

purchased from external suppliers, including its licensees, with

the exception of its dissolution-based polycarbonate production.

This purchasing change is expected to result in an annualized run

rate profitability improvement of $15 million to $20 million

relative to manufacturing at Stade.

“These measures are the result of a thoughtful analysis of our

portfolio and industry trends, combined with an understanding of

the global competitive environment. We believe they will result in

a more streamlined organizational structure that will fuel our

ability to continue to grow strategically, while improving service

to our customers and reducing costs,” said Trinseo President and

CEO, Frank Bozich.

The Company expects to record total pre-tax restructuring

charges of $23 million to $28 million, principally comprised of $22

million to $26 million of severance and related benefit costs and

$1 million to $2 million of asset-related and contract termination

charges, primarily related to the virgin polycarbonate

manufacturing site in Stade, Germany.

“None of these actions are taken lightly, especially those

directly impacting our colleagues. These are extremely difficult

decisions that are in many ways driven by macroeconomic factors

that are simply beyond our control,” said Bozich. Additionally,

Bozich said, “The contributions of our talented employees are

greatly valued, and we are committed to doing everything we can to

help them transition during this challenging time. We also greatly

appreciate the continued focus and resiliency of our dedicated

employees around the world as we navigate these changes

together.”

About Trinseo

Trinseo (NYSE: TSE), a specialty material solutions provider,

partners with companies to bring ideas to life in an imaginative,

smart, and sustainably focused manner by combining its premier

expertise, forward-looking innovations, and best-in-class materials

to unlock value for companies and consumers.

From design to manufacturing, Trinseo taps into decades of

experience in diverse material solutions to address customers’

unique challenges in a wide range of industries, including building

and construction, consumer goods, medical and mobility.

Trinseo’s approximately 3,100 employees bring endless creativity

to reimagining the possibilities with clients all over the world

from the company’s locations in North America, Europe, and Asia

Pacific. Trinseo reported net sales of approximately $3.7 billion

in 2023. Discover more by visiting www.trinseo.com and connecting

with Trinseo on LinkedIn, Twitter, Facebook, and WeChat.

Cautionary Note on Forward-Looking Statements

This Press Release may contain forward-looking statements

including, without limitation, statements concerning plans,

objectives, goals, projections, forecasts, strategies, future

events or performance, and underlying assumptions and other

statements, which are not statements of historical facts or

guarantees or assurances of future performance. Forward-looking

statements may be identified by the use of words like “expect,”

“anticipate,” “believe,” “intend,” “forecast,” “outlook,” “will,”

“may,” “might,” “see,” “tend,” “assume,” “potential,” “likely,”

“target,” “plan,” “contemplate,” “seek,” “attempt,” “should,”

“could,” “would” or expressions of similar meaning. Forward-looking

statements reflect management’s evaluation of information currently

available and are based on the Company’s current expectations and

assumptions regarding its business, the economy, its current

indebtedness, accessibility of debt markets, and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict. Factors

that might cause future results to differ from those expressed by

the forward-looking statements include, but are not limited to, our

ability to successfully implement proposed restructuring

initiatives and to successfully generate cost savings and increase

profitability through such initiatives; our ability to successfully

execute our business and transformation strategy; increased costs

or disruption in the supply of raw materials; deterioration of our

credit profile limiting our access to commercial credit; increased

energy costs; compliance with laws and regulations impacting our

business; any disruptions in production at our chemical

manufacturing facilities, including those resulting from accidental

spills or discharges; conditions in the global economy and capital

markets; our current and future levels of indebtedness and ability

to service our debt; our ability to meet the covenants under our

existing indebtedness; our ability to generate cash flows from

operations; and those discussed in our Annual Report on Form 10-K,

under Part I, Item 1A —”Risk Factors” and elsewhere in our other

reports, filings and furnishings made with the U.S. Securities and

Exchange Commission from time to time. As a result of these or

other factors, the Company’s actual results, performance or

achievements may differ materially from those contemplated by the

forward-looking statements. Therefore, we caution you against

relying on any of these forward-looking statements. The

forward-looking statements included in this Press Release are made

only as of the date hereof. The Company undertakes no obligation to

publicly update or revise any forward-looking statement as a result

of new information, future events or otherwise, except as otherwise

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930267680/en/

Trinseo Contact: Andy Myers Tel: +1 610-240-3221 Email:

aemyers@trinseo.com

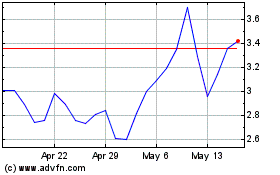

Trinseo (NYSE:TSE)

Historical Stock Chart

From Oct 2024 to Nov 2024

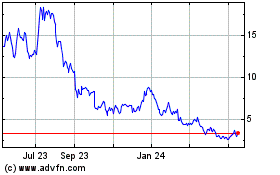

Trinseo (NYSE:TSE)

Historical Stock Chart

From Nov 2023 to Nov 2024