Sales and earnings results consistent with

expectations

Company reiterates year-over-year improvement

for fiscal 2025

Unifi, Inc. (NYSE: UFI) (together with its consolidated

subsidiaries, “UNIFI”), leading innovator in recycled and synthetic

yarn, today released operating results for the first fiscal quarter

ended September 29, 2024.

First Quarter Fiscal 2025

Overview

- Net sales were $147.4 million, an increase of 6% from the first

quarter of fiscal 2024, primarily driven by higher sales

volumes.

- Revenues from REPREVE Fiber products were $44.7 million and

represented 30% of net sales, compared to $42.5 million or 31% of

net sales for the first quarter of fiscal 2024.

- Gross profit was $9.5 million and gross margin was 6.4%,

representing a year-over-year improvement through existing

cost-saving initiatives and increased productivity.

- Net loss was $7.6 million, or $0.42 per share, compared to a

net loss of $13.3 million, or $0.73 per share, for the first

quarter of fiscal 2024.

- Adjusted EBITDA* was $3.3 million, compared to $(4.8) million

for the first quarter of fiscal 2024.

- Subsequent to quarter end, the Company entered into an

additional $25.0 million credit facility.

Eddie Ingle, Chief Executive Officer of Unifi, Inc., stated,

“Our financial results for the first quarter were in line with our

expectations, highlighting our continued progress toward

repositioning our business for future growth. The strategic

initiatives that we put into place during the previous fiscal year

have continued to benefit our financial results, which is evident

by the significant improvement we experienced in gross profit

during the period. To help sustain this positive momentum, we

continue to take steps to strengthen our balance sheet, which

included entering into a credit agreement that allows us to ensure

our capital is deployed to the best long-term investments. We are

confident that the improvements we have made to our business so far

have positioned us well to enhance our future financial performance

and increase shareholder value.”

First Quarter Fiscal 2025 Compared to

First Quarter Fiscal 2024

Net sales increased to $147.4 million from $138.8 million,

primarily due to higher sales volumes in the Brazil Segment,

partially offset by severe weather and seasonality impacts in the

Americas Segment, and difficult economic conditions in the Asia

Segment.

Gross profit increased to $9.5 million from a gross loss of $0.6

million. Americas Segment gross profit improved by $6.0 million,

primarily due to higher sales and production levels. Brazil Segment

gross profit improved by $5.8 million, primarily due to pricing and

market share gains. Asia Segment gross profit decreased by $1.7

million, primarily due to unfavorable economic conditions and

pricing dynamics in the region.

Operating loss was $3.2 million compared to $12.0 million. The

underlying improvement was primarily due to the increase in gross

profit. Net loss was $7.6 million compared to $13.3 million. EPS

was ($0.42) and Adjusted EBITDA* was $3.3 million, compared to

$(0.73) and $(4.8) million, respectively.

Fiscal 2025 Outlook

Second Quarter Fiscal 2025

UNIFI expects the following second quarter fiscal 2025

results:

- Net sales between $140.0 million and $145.0 million;

- Adjusted EBITDA** loss between $(4.0) million and $(2.0)

million;

- Capital expenditures between $4.0 million and $5.0 million;

and

- Continued volatility in the effective tax rate.

Full Year Fiscal 2025

UNIFI expects the following for fiscal 2025:

- Net sales to increase 10% over fiscal 2024, as underlying

portfolio and REPREVE Fiber momentum continues while macroeconomic

and inflationary uncertainties remain pronounced until calendar

2025.

- Gross profit, gross margin, and Adjusted EBITDA** expected to

increase significantly from fiscal 2024 to fiscal 2025, benefiting

from higher sales volumes, initiatives from the previously

announced Profitability Improvement Plan, and portfolio

strength.

- Capital expenditures of approximately $12.0 million.

Ingle concluded, “We are excited about the opportunities that

lie ahead of us for both our REPREVE Fiber business and our growing

beyond apparel initiatives, which we believe are poised to benefit

from the growing customer demand for sustainable solutions. As we

look ahead, we will continue to focus on diligently managing our

operations, maintaining a healthy balance sheet, and driving future

growth that will help create value for all our stakeholders.”

* Adjusted EBITDA is a non-GAAP financial measure. The schedules

included in this press release reconcile each non-GAAP financial

measure to its most directly comparable GAAP financial measure.

** Guidance provided is a non-GAAP figure presented on an

adjusted basis. For further details, see the non-GAAP financial

measures information presented in the schedules included in this

press release.

First Quarter Fiscal 2025 Earnings

Conference Call

UNIFI will provide additional commentary regarding its first

quarter fiscal 2025 results and other developments during its

earnings conference call on October 31, 2024, at 9:00 a.m., Eastern

Time. The call can be accessed via a live audio webcast on UNIFI’s

website at http://investor.unifi.com. Additional supporting

materials and information related to the call will also be

available on UNIFI’s website.

About UNIFI

UNIFI, Inc. (NYSE: UFI) is a global leader in fiber science and

sustainable synthetic textiles. Using proprietary recycling

technology, UNIFI is a pioneer in scaling the transformation of

post-industrial and post-consumer waste into sustainable products.

Through REPREVE, the world’s leading brand of traceable, recycled

fiber and resin, UNIFI is changing the way industries think about

the materials they use – and reuse. A vertically-integrated

manufacturer, the company has direct operations in the United

States, Colombia, El Salvador, and Brazil, and sales offices all

over the world. UNIFI envisions a future where circular and

sustainable solutions are the only choice. For more information

about UNIFI, visit www.unifi.com.

Financial Statements, Business Segment

Information and Reconciliations of Reported Results to Adjusted

Results to Follow

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per

share amounts)

For the Three Months

Ended

September 29, 2024

October 1, 2023

Net sales

$

147,372

$

138,844

Cost of sales

137,914

139,419

Gross profit (loss)

9,458

(575

)

Selling, general and administrative

expenses

11,842

11,609

Provision (benefit) for bad debts

312

(209

)

Other operating expense, net

520

54

Operating loss

(3,216

)

(12,029

)

Interest income

(257

)

(581

)

Interest expense

2,507

2,485

Equity in earnings of unconsolidated

affiliates

(11

)

(200

)

Loss before income taxes

(5,455

)

(13,733

)

Provision (benefit) for income taxes

2,177

(463

)

Net loss

$

(7,632

)

$

(13,270

)

Net loss per common share:

Basic

$

(0.42

)

$

(0.73

)

Diluted

$

(0.42

)

$

(0.73

)

Weighted average common shares

outstanding:

Basic

18,255

18,084

Diluted

18,255

18,084

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

September 29, 2024

June 30, 2024

ASSETS

Cash and cash equivalents

$

13,703

$

26,805

Receivables, net

77,885

79,165

Inventories

145,350

131,181

Income taxes receivable

1,355

164

Other current assets

12,923

11,618

Total current assets

251,216

248,933

Property, plant and equipment, net

189,744

193,723

Operating lease assets

8,411

8,245

Deferred income taxes

5,156

5,392

Other non-current assets

12,452

12,951

Total assets

$

466,979

$

469,244

LIABILITIES AND SHAREHOLDERS’

EQUITY

Accounts payable

$

41,250

$

43,622

Income taxes payable

1,510

754

Current operating lease liabilities

2,434

2,251

Current portion of long-term debt

12,153

12,277

Other current liabilities

18,923

17,662

Total current liabilities

76,270

76,566

Long-term debt

119,324

117,793

Non-current operating lease

liabilities

6,092

6,124

Deferred income taxes

1,869

1,869

Other long-term liabilities

3,715

3,507

Total liabilities

207,270

205,859

Commitments and contingencies

Common stock

1,826

1,825

Capital in excess of par value

71,419

70,952

Retained earnings

251,765

259,397

Accumulated other comprehensive loss

(65,301

)

(68,789

)

Total shareholders’ equity

259,709

263,385

Total liabilities and shareholders’

equity

$

466,979

$

469,244

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

For the Three Months

Ended

September 29, 2024

October 1, 2023

Cash and cash equivalents at beginning of

period

$

26,805

$

46,960

Operating activities:

Net loss

(7,632

)

(13,270

)

Adjustments to reconcile net loss to net

cash (used) provided by operating activities:

Equity in earnings of unconsolidated

affiliates

(11

)

(200

)

Depreciation and amortization expense

6,547

7,026

Non-cash compensation expense

435

212

Deferred income taxes

344

(679

)

Other, net

80

(62

)

Changes in assets and liabilities

(12,597

)

14,092

Net cash (used) provided by operating

activities

(12,834

)

7,119

Investing activities:

Capital expenditures

(2,018

)

(2,937

)

Other, net

—

457

Net cash used by investing activities

(2,018

)

(2,480

)

Financing activities:

Proceeds from long-term debt

47,500

31,100

Payments on long-term debt

(46,108

)

(30,513

)

Other, net

(162

)

17

Net cash provided by financing

activities

1,230

604

Effect of exchange rate changes on cash

and cash equivalents

520

(688

)

Net (decrease) increase in cash and cash

equivalents

(13,102

)

4,555

Cash and cash equivalents at end of

period

$

13,703

$

51,515

BUSINESS SEGMENT

INFORMATION

(Unaudited)

(In thousands)

Net sales and gross profit (loss) details

for each reportable segment of UNIFI are as follows:

For the Three Months

Ended

September 29, 2024

October 1, 2023

Americas

$

86,283

$

81,573

Brazil

34,310

29,909

Asia

26,779

27,362

Consolidated net sales

$

147,372

$

138,844

For the Three Months

Ended

September 29, 2024

October 1, 2023

Americas

$

(1,378

)

$

(7,380

)

Brazil

7,937

2,167

Asia

2,899

4,638

Consolidated gross profit (loss)

$

9,458

$

(575

)

RECONCILIATIONS OF REPORTED RESULTS TO

ADJUSTED RESULTS (Unaudited) (In thousands)

EBITDA and Adjusted EBITDA (Non-GAAP

Financial Measures)

The reconciliations of the amounts reported under U.S. generally

accepted accounting principles (“GAAP”) for Net loss to EBITDA and

Adjusted EBITDA are set forth below.

For the Three Months

Ended

September 29, 2024

October 1, 2023

Net loss

$

(7,632

)

$

(13,270

)

Interest expense, net

2,250

1,904

Provision (benefit) for income taxes

2,177

(463

)

Depreciation and amortization expense

(1)

6,504

6,988

EBITDA

3,299

(4,841

)

Other adjustments (2)

—

—

Adjusted EBITDA

$

3,299

$

(4,841

)

(1)

Within this reconciliation,

depreciation and amortization expense excludes the amortization of

debt issuance costs, which are reflected in interest expense, net.

Within the condensed consolidated statements of cash flows,

amortization of debt issuance costs is reflected in depreciation

and amortization expense.

(2)

For the periods presented, there were no

other adjustments necessary to reconcile Net loss to Adjusted

EBITDA.

Net Debt (Non-GAAP Financial

Measure)

Reconciliations of Net Debt are as follows:

September 29, 2024

June 30, 2024

Long-term debt

$

119,324

$

117,793

Current portion of long-term debt

12,153

12,277

Unamortized debt issuance costs

214

229

Debt principal

131,691

130,299

Less: cash and cash equivalents

13,703

26,805

Net Debt

$

117,988

$

103,494

Cash and cash equivalents

At September 29, 2024 and June 30, 2024, UNIFI’s foreign

operations held nearly all consolidated cash and cash

equivalents.

REPREVE Fiber

REPREVE Fiber represents UNIFI’s collection of fiber products on

its recycled platform, with or without added technologies.

Non-GAAP Financial

Measures

Certain non-GAAP financial measures included herein are designed

to complement the financial information presented in accordance

with GAAP. These non-GAAP financial measures include Earnings

Before Interest, Taxes, Depreciation and Amortization (“EBITDA”),

Adjusted EBITDA, Adjusted Net (Loss) Income, Adjusted EPS, and Net

Debt (together, the “non-GAAP financial measures”).

- EBITDA represents Net (loss) income before net interest

expense, income tax expense, and depreciation and amortization

expense.

- Adjusted EBITDA represents EBITDA adjusted to exclude, from

time to time, certain adjustments necessary to understand and

compare the underlying results of UNIFI.

- Adjusted Net (Loss) Income represents Net (loss) income

calculated under GAAP adjusted to exclude certain amounts.

Management believes the excluded amounts do not reflect the ongoing

operations and performance of UNIFI and/or exclusion may be

necessary to understand and compare the underlying results of

UNIFI.

- Adjusted EPS represents Adjusted Net (Loss) Income divided by

UNIFI’s weighted average common shares outstanding.

- Net Debt represents debt principal less cash and cash

equivalents.

The non-GAAP financial measures are not determined in accordance

with GAAP and should not be considered a substitute for performance

measures determined in accordance with GAAP. The calculations of

the non-GAAP financial measures are subjective, based on

management’s belief as to which items should be included or

excluded in order to provide the most reasonable and comparable

view of the underlying operating performance of the business. We

may, from time to time, modify the amounts used to determine our

non-GAAP financial measures.

We believe that these non-GAAP financial measures better reflect

UNIFI’s underlying operations and performance and that their use,

as operating performance measures, provides investors and analysts

with a measure of operating results unaffected by differences in

capital structures, capital investment cycles, and ages of related

assets, among otherwise comparable companies.

This press release also includes certain forward-looking

information that is not presented in accordance with GAAP.

Management believes that a quantitative reconciliation of such

forward-looking information to the most directly comparable

financial measure calculated and presented in accordance with GAAP

cannot be made available without unreasonable efforts because a

reconciliation of these non-GAAP financial measures would require

UNIFI to predict the timing and likelihood of potential future

events such as restructurings, M&A activity, contract

modifications, and other infrequent or unusual gains and losses.

Neither the timing nor likelihood of these events, nor their

probable significance, can be quantified with a reasonable degree

of accuracy. Accordingly, a reconciliation of such forward-looking

information to the most directly comparable GAAP financial measure

is not provided.

Management uses Adjusted EBITDA (i) as a measurement of

operating performance because it assists us in comparing our

operating performance on a consistent basis, as it removes the

impact of (a) items directly related to our asset base (primarily

depreciation and amortization) and (b) items that we would not

expect to occur as a part of our normal business on a regular

basis; (ii) for planning purposes, including the preparation of our

annual operating budget; (iii) as a valuation measure for

evaluating our operating performance and our capacity to incur and

service debt, fund capital expenditures, and expand our business;

and (iv) as one measure in determining the value of other

acquisitions and dispositions. Adjusted EBITDA is a key performance

metric utilized in the determination of variable compensation. We

also believe Adjusted EBITDA is an appropriate supplemental measure

of debt service capacity, because it serves as a high-level proxy

for cash generated from operations.

Management uses Adjusted Net (Loss) Income and Adjusted EPS (i)

as measurements of net operating performance because they assist us

in comparing such performance on a consistent basis, as they remove

the impact of (a) items that we would not expect to occur as a part

of our normal business on a regular basis and (b) components of the

provision for income taxes that we would not expect to occur as a

part of our underlying taxable operations; (ii) for planning

purposes, including the preparation of our annual operating budget;

and (iii) as measures in determining the value of other

acquisitions and dispositions.

Management uses Net Debt as a liquidity and leverage metric to

determine how much debt would remain if all cash and cash

equivalents were used to pay down debt principal.

In evaluating non-GAAP financial measures, investors should be

aware that, in the future, we may incur expenses similar to the

adjustments included herein. Our presentation of non-GAAP financial

measures should not be construed as indicating that our future

results will be unaffected by unusual or non-recurring items. Each

of our non-GAAP financial measures has limitations as an analytical

tool, and investors should not consider it in isolation or as a

substitute for analysis of our results or liquidity measures as

reported under GAAP. Some of these limitations are (i) it is not

adjusted for all non-cash income or expense items that are

reflected in our statements of cash flows; (ii) it does not reflect

the impact of earnings or charges resulting from matters we

consider not indicative of our ongoing operations; (iii) it does

not reflect changes in, or cash requirements for, our working

capital needs; (iv) it does not reflect the cash requirements

necessary to make payments on our debt; (v) it does not reflect our

future requirements for capital expenditures or contractual

commitments; (vi) it does not reflect limitations on or costs

related to transferring earnings from our subsidiaries to us; and

(vii) other companies in our industry may calculate this measure

differently than we do, limiting its usefulness as a comparative

measure.

Because of these limitations, these non-GAAP financial measures

should not be considered as a measure of discretionary cash

available to us to invest in the growth of our business or as a

measure of cash that will be available to us to meet our

obligations, including those under our outstanding debt

obligations. Investors should compensate for these limitations by

relying primarily on our GAAP results and using these measures only

as supplemental information.

Cautionary Statement on Forward-Looking

Statements

Certain statements included herein contain “forward-looking

statements” within the meaning of federal securities laws about the

financial condition and results of operations of UNIFI that are

based on management’s beliefs, assumptions and expectations about

our future economic performance, considering the information

currently available to management. An example of such

forward-looking statements include, among others, guidance

pertaining to our financial outlook. The words “believe,” “may,”

“could,” “will,” “should,” “would,” “anticipate,” “plan,”

“estimate,” “project,” “expect,” “intend,” “seek,” “strive” and

words of similar import, or the negative of such words, identify or

signal the presence of forward-looking statements. These statements

are not statements of historical fact, and they involve risks and

uncertainties that may cause our actual results, performance or

financial condition to differ materially from the expectations of

future results, performance or financial condition that we express

or imply in any forward-looking statement.

Factors that could contribute to such differences include, but

are not limited to: the competitive nature of the textile industry

and the impact of global competition; changes in the trade

regulatory environment and governmental policies and legislation;

the availability, sourcing, and pricing of raw materials; general

domestic and international economic and industry conditions in

markets where UNIFI competes, including economic and political

factors over which UNIFI has no control; changes in consumer

spending, customer preferences, fashion trends, and end-uses for

UNIFI's products; the financial condition of UNIFI’s customers; the

loss of a significant customer or brand partner; natural disasters,

industrial accidents, power or water shortages, extreme weather

conditions, and other disruptions at one of our facilities; the

disruption of operations, global demand, or financial performance

as a result of catastrophic or extraordinary events, including, but

not limited to, epidemics or pandemics; the success of UNIFI’s

strategic business initiatives; the volatility of financial and

credit markets, including the impacts of counterparty risk (e.g.,

deposit concentration and recent depositor sentiment and activity);

the ability to service indebtedness and fund capital expenditures

and strategic business initiatives; the availability of and access

to credit on reasonable terms; changes in foreign currency

exchange, interest, and inflation rates; fluctuations in production

costs; the ability to protect intellectual property; the strength

and reputation of our brands; employee relations; the ability to

attract, retain, and motivate key employees; the impact of climate

change or environmental, health, and safety regulations; and the

impact of tax laws, the judicial or administrative interpretations

of tax laws, and/or changes in such laws or interpretations.

All such factors are difficult to predict, contain uncertainties

that may materially affect actual results and may be beyond our

control. New factors emerge from time to time, and it is not

possible for management to predict all such factors or to assess

the impact of each such factor on UNIFI. Any forward-looking

statement speaks only as of the date on which such statement is

made, and we do not undertake any obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which such statement is made, except as may be required

by federal securities laws. The above and other risks and

uncertainties are described in UNIFI’s most recent Annual Report on

Form 10-K, and additional risks or uncertainties may be described

from time to time in other reports filed by UNIFI with the

Securities and Exchange Commission pursuant to the Securities

Exchange Act of 1934, as amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030758659/en/

Josh Carroll or Blaine McNulty Alpha IR Group 312-445-2870

UFI@alpha-ir.com

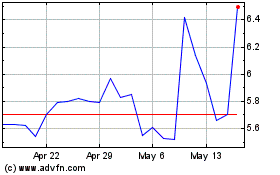

Unifi (NYSE:UFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Unifi (NYSE:UFI)

Historical Stock Chart

From Dec 2023 to Dec 2024