UnitedHealth Boosts Profit Targets After Upbeat First Quarter -- Update

April 16 2019 - 12:01PM

Dow Jones News

By Kimberly Chin and Anna Wilde Mathews

UnitedHealth Group Inc. raised its profit guidance for the year,

as revenue growth across all of the company's businesses helped it

post strong first-quarter results.

The company now projects earnings of $13.80 to $14.05 a share

and adjusted earnings of $14.50 to $14.75 a share. Previously,

UnitedHealth expected earnings of $13.70 to $14 a share and

adjusted earnings of $14.40 to $14.70 a share.

Officials at the company, the parent of the nation's biggest

health insurer, weighed in during a call with analysts on issues

such as Democrats' proposals for universal government coverage and

moves by the Trump administration to change the handling of drug

rebates in the Medicare program.

The recent focus in Washington has helped push down the shares

of the entire managed-care sector.

UnitedHealth Chief Executive David Wichmann argued against

so-called Medicare for All and other broad government-coverage

plans, saying they would disrupt health care and hurt Americans'

relationship with their doctors.

Mr. Wichmann said Universal coverage was better achieved through

current government and private approaches.

UnitedHealth officials also played down the impact of various

changes to the handling of drug rebates.

John Prince, CEO of UnitedHealth's pharmacy-benefit manager,

OptumRx, said the company expects "minimal impact on margins" from

changes to rebates, because roughly 98% of clients already get

rebates passed through to them.

Mr. Wichmann said the company's move to push drug rebates to

individual consumers, which will take effect in plans sold to new

clients starting next year, might pose some risk if customers don't

want to make that shift.

So far, he said, customers have been "a little bit slower to

adopt" the approach. He and Mr. Prince said the change is better

for consumers and helps improve their compliance to drug

regimens.

UnitedHealth officials also said a new Trump administration

tweak designed to ease the impact of proposed changes on rebates in

Medicare drug plans won't fully eliminate the proposal's upward

impact on premiums, but will help.

For the first quarter, UnitedHealth said its revenue increased

9% from a year earlier to $60.31 billion. Analysts polled by

Refinitiv were expecting sales of $59.71 billion. Revenue from the

UnitedHealthcare segment rose 7% to $48.9 billion, while sales at

the Optum segment increased 13% to $26.4 billion.

First-quarter profit rose 22% to $3.47 billion, or $3.56 a

share. Analysts had expected per-share earnings of $3.41.

UnitedHealth posted an adjusted profit of $3.73 a share,

compared with analysts' estimates of $3.60 a share.

Mr. Wichmann said UnitedHealth had made progress in its Medicaid

business, but it was still underperforming. The company recently

said it would leave the Iowa Medicaid market. UnitedHealth is

likely to achieve the lower end of its target margin range of 3% to

5% next year, he said.

Shares in UnitedHealth, which were off 7.6% this year through

Monday, were down a further 3.5% at $221.99 at midday Tuesday.

Write to Kimberly Chin at kimberly.chin@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

April 16, 2019 12:46 ET (16:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

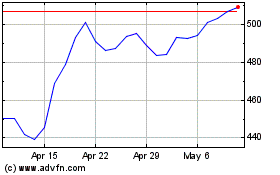

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024