Additional Proxy Soliciting Materials (definitive) (defa14a)

May 25 2023 - 10:03AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

| | | | | | | | | | | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| | | | | |

| UnitedHealth Group Incorporated |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

UnitedHealth Group Incorporated Supplemental Proxy Materials

For the Annual Meeting of Shareholders on June 5, 2023

May 25, 2023

Deliver to: Kathryn Cohen

Head of the Research Helpdesk

Institutional Shareholder Services

Dear Ms. Cohen,

We are writing regarding your recommendation of a “for” vote on Proposal 7 in our 2023 Proxy Statement – Shareholder Proposal Seeking Shareholder Ratification of Termination Pay. We believe there is a flaw underlying your recommendation, along with an important omission of fact, and would request that you urgently review and change your recommendation to be “against” the proposal.

The conclusion of your analysis on page 34 of the report states:

The company maintains a severance policy that establishes a reasonable limit on cash severance. However, the proxy does not disclose a clear requirement that shareholder approval is required for payments in excess of the maximum severance provided under the policy. Without such a requirement, shareholders do not have sufficient assurances against excessive severance payments (or payments that exceed market norms) that could be made at the discretion of the committee, without requiring shareholder approval.

Here is why we believe this to be problematic:

On page 80 of the Proxy, we state: “We have a policy that we will not pay cash severance to executive officers exceeding 2.99x the sum of base salary and bonus.” Later on the same page we state, “Our Compensation and Human Resources Committee has adopted a policy which sets forth that we will not pay cash severance exceeding 2.99x the sum of base salary and bonus to executive officers, rendering the adoption of the proposal unnecessary.”

We do not believe there is any meaningful difference between a policy not to do something, and a policy not to do it without shareholder approval. In our view the categorical nature of the policy, not qualified by an exception based on obtaining shareholder approval, provides at least as much assurance that safeguards against excessive severance payments as a policy that does have the qualification. As a technical matter, we would note that including a reference to shareholder approval gives no more assurance than not including it, since a Board would still be free to change the policy at its discretion.

As to the omission, you state in your conclusion, “Further, the proposal only applies to future severance arrangements, current agreements will not be affected.” However, our policy is not to pay cash severance exceeding 2.99x the sum of base salary and bonus to executive officers, regardless of when the severance arrangement was entered into. And, in fact, all our existing arrangements provide for cash severance of 2x, not 2.99x base salary and bonus. Consequently, our policy is STRONGER than the proposal in applying to ALL severance arrangements for executive officers, current and future, and in being categorical that the cap will not be exceeded.

That having been said, we are pleased that your report acknowledges that our policy limit on cash severance is a reasonable one. Second, we are also pleased by your acknowledgement that “shareholders may consider the proposal's inclusion of equity awards within the calculation of severance is not in line with established market norms”. All shareholders we spoke to in the pre-Proxy consultation were comfortable with the acceleration of equity awards in the very limited circumstances of termination on death, disability or the “double trigger” following a change of control, and that the value of that equity acceleration not be included in the severance cap.

In light of these factors, we respectfully request that you reconsider your position and change your recommendation to vote against the proposal.

Sincerely,

/s/ Rupert M. Bondy

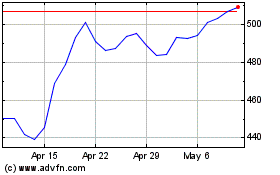

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024