Additional Proxy Soliciting Materials (definitive) (defa14a)

May 25 2023 - 10:05AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

| | | | | | | | | | | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| | | | | |

| UnitedHealth Group Incorporated |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

UnitedHealth Group Incorporated Supplemental Proxy Materials

For the Annual Meeting of Shareholders on June 5, 2023

May 25, 2023

Deliver to: Starlar Burns

Lead Analyst

Glass Lewis

Dear Mr. Burns,

We are writing to ask Glass Lewis to correct a substantial and serious mistake in its recent report on UnitedHealth Group.

In the analysis of Proposal 7, a shareholder proposal regarding “Ratification of Termination Pay,” the first bullet point of the Glass Lewis rationale reads:

Above a 2.99 threshold, based on the executive’s average annual compensation for the most recent five years, the company can no longer deduct severance payments as an expense, and thus shareholders are deprived of a valuable benefit without an offsetting incentive to the executive; [emphasis added]

This statement is not correct because UnitedHealth Group and other health insurers are subject to an annual $500,000 tax deduction limit per person under Section 162(m)(6) of the Internal Revenue Code, as previously disclosed in the proxy statement.

This means, of course, that the lower deductibility threshold would be crossed for benefits well under 2.99x total compensation for many situations, including disability. Making tax savings the rationale is unwarranted because it simply is not relevant for companies like ours.

We are, of course, always interested in hearing shareholder perspectives on our compensation practices, including separation benefits. In this instance, however, this proposal is detrimental to the business and based on an inaccurate assessment.

In light of these factors, we respectfully request that you reconsider your position and change your recommendation to vote against the proposal.

Sincerely,

/s/ Rupert M. Bondy

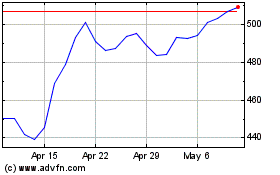

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024