Notice of Full Redemption to the Holders of the EUR 500,000,000 1.875 Per Cent. Notes Due 26 May 2026 Issued by Vivendi SE on 26 May 2016

November 14 2024 - 1:35AM

Business Wire

ISIN: FR0013176310

Regulatory News:

Reference is made to the terms and conditions included in the

prospectus dated 24 May 2016 which was approved by the Autorité des

marchés financiers under n°16-197 on 24 May 2016, (the "Terms

and Conditions"), of the EUR 500,000,000 aggregate principal

amount of 1.875 per cent. Notes due 26 May 2026 (the

"Notes") issued by Vivendi SE (the "Issuer")

(Paris:VIV).

All capitalized terms used herein and not otherwise defined in

this notice shall have the meanings assigned to them in the Terms

and Conditions.

The Issuer hereby gives irrevocable notice to all Noteholders

that the Issuer has elected to exercise its make-whole redemption

option of the outstanding Notes, in whole, in accordance with

Condition 5(i) (Make-whole redemption option) and Condition 12

(Notices) of the Terms and Conditions (the “Redemption”).

The Optional Redemption Date is set to 13 December 2024 (the

"Optional Redemption Date").

This notice, together with the Redemption, are conditional on

the adoption, by the Issuer’s Combined General Shareholders’

Meeting to be held on 9 December 2024, of any of the resolutions

(and such resolutions becoming effective) regarding the proposed

spin-off of the Issuer’s group submitted to its vote, as such

resolutions are set forth in the notice of meeting (avis de

réunion) published in the Bulletin des Annonces Légales

Obligatoires (BALO) on 30 October 2024 and available on the

Issuer’s website

(https://www.vivendi.com/en/shareholders-investors/shareholders-meeting/)

and may subsequently be amended or completed by the Issuer’s

Management Board (Directoire) at its own initiative, as the case

may be. For the avoidance of doubt, should the Issuer’s Combined

General Shareholders’ Meeting be cancelled or not held, no

Redemption should occur.

As set out in the Terms and Conditions, all Notes will be

redeemed at their Optional Redemption Amount (the "Optional

Redemption Amount"), as calculated by the Calculation Agent

in accordance with Condition 5(i) (Make-whole redemption option) of

the Terms and Conditions. The Optional Redemption Amount, along

with the Redemption Rate (which will be determined as per Condition

5(i) (Make-whole redemption option) of the Terms and Conditions),

will be published in accordance with the Terms and

Conditions.

In accordance with Condition 6 (Payments) of the Terms and

Conditions, the Optional Redemption Amount will be paid in euros by

the Paying Agent (BNP Paribas Securities Services -Les

Grands Moulins de Pantin 9 rue du Débarcadère, 93500 Pantin) on the

Optional Redemption Date to the Account Holders for the benefit of

the Noteholders.

Pursuant to Condition 5(l) (Cancellation) of the Terms and

Conditions, all Notes so redeemed will be cancelled and an

application for their delisting will be made to Euronext.

The results of the Issuer’s Combined General Shareholders’

Meeting to be held on 9 December 2024 will be published by the

Issuer in a press release and made available on its website, and

will also be communicated by the Issuer to the Paying Agent.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114578265/en/

Vivendi SE

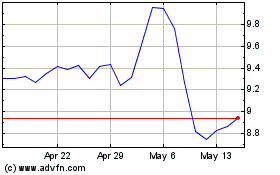

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Nov 2024 to Dec 2024

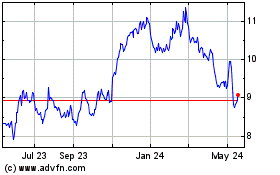

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Dec 2023 to Dec 2024