Subscription revenue growth reached 13% in

FXN

Gross profit increased by 16% in FXN, reaching

a margin of 75%

Non-GAAP operating income margin and Free Cash

flow margin reached 20%

VTEX (NYSE: VTEX), the composable and complete commerce platform

for premier brands and retailers, today announced results for the

fourth quarter and fiscal year ended December 31, 2024. VTEX

results have been prepared in accordance with International

Financial Reporting Standards as issued by the International

Accounting Standards Board (“IFRS Accounting Standards”) and

interpretations issued by the IFRS Accounting Standards

Interpretations Committee (“IFRS Accounting Standards IC”)

applicable to companies reporting under IFRS Accounting

Standards.

Geraldo Thomaz Jr., founder and co-CEO of VTEX, commented, “We

closed 2024 with our underlying business performing stronger than

ever and delivering significant enterprise customers additions,

high gross retention, product expansion, and operational

efficiency. Despite the FX volatility and existing customers' GMV

softness, we continue to see a robust sales momentum in signing new

enterprise customers globally, demonstrated by the number of

customers above $250k in revenue to VTEX growing 23% in 2024. We

are establishing VTEX as the global commerce suite of choice for

bold CIOs and CEOs, redefining value creation for enterprises.”

Mariano Gomide de Faria, founder and co-CEO of VTEX, added, “We are

witnessing a new wave of global commerce transformation where B2C

demands efficiency, and B2B accelerates toward digital adoption. At

VTEX, our strong and consistent contract-signing momentum

underscores our position as a trusted partner for brands and

retailers navigating this shift. By empowering enterprises to

modernize operations, unlock new revenue streams, and adapt to a

rapidly evolving digital landscape, we are poised to seize this

significant opportunity and drive growth across both new and

established markets.”

Fourth Quarter 2024 Financial Highlights

- GMV reached US$5.4 billion in the fourth quarter of 2024,

representing a YoY increase of 0.2% in USD and 10.9% on an FX

neutral basis.

- Total revenue increased to US$61.5 million in the fourth

quarter of 2024 from US$60.7 million in the fourth quarter of 2023,

representing a YoY increase of 1.3% in USD and 12.3% on an FX

neutral basis.

- Subscription revenue represented 96.6% of total revenues,

reaching US$59.5 million in the fourth quarter of 2024, from

US$58.2 million in the fourth quarter of 2023. This represents a

YoY increase of 2.1% in USD and 13.4% on an FX neutral basis.

- Non-GAAP subscription gross profit was US$46.9 million in the

fourth quarter of 2024, compared to US$45.8 million in the fourth

quarter of 2023, representing a YoY increase of 2.5% in USD and

15.7% on an FX neutral basis.

- Non-GAAP subscription gross margin was 78.9% in the fourth

quarter of 2024, compared to 78.6% in the same quarter of

2023.

- Non-GAAP income from operations was US$12.4 million during the

fourth quarter of 2024, compared to a Non-GAAP income from

operations of US$11.6 million in the same quarter of 2023.

- Non-GAAP free cash flow was US$12.4 million during the fourth

quarter of 2024, compared to a Non-GAAP free cash flow of US$9.5

million in the same quarter of 2023.

- As of December 31, 2024, our total headcount was 1,368,

decreasing 2.9% QoQ and increasing 7.1% YoY.

- On December 3, 2024 our board of directors authorized the

repurchase of shares of our Class A common shares for an aggregate

consideration of up to US$30.0 million, which is scheduled to

expire on December 2, 2025. During the fourth quarter of 2024,

1,835,638 Class A common shares had been repurchased pursuant to

this share buyback program, at an average price of US$6.08 per

share for a total cost of US$11.2 million.

Fourth Quarter 2024 Commercial Highlights:

New customers who initiated their operations with us, among

others:

- Bonvivir in Argentina;

- Dakota Criações, Donna Carioca, Guess, Hortifruti, Ortobom, and

Rissul in Brazil;

- Torre and Maritex in Chile;

- Habib Droguerias, STP Networks, and Swante in Colombia;

- Dispaso in Ecuador;

- Pashmina in India;

- An enterprise multinational fashion retailer in Ireland;

- Coolbox, Hanes, REMO Motos, and ZucarMex in Mexico;

- Sameca in Portugal; and

- Rahr Corporation and Lyon Bakery in the US.

Existing customers expanding their operations with us by opening

new online stores, among others:

- Amo Beleza has launched a new brand, Mascavo, and now operates

two B2C stores in Brazil;

- Cartamundi has introduced the Grimaud brand in France,

extending its operations to Europe in addition to its two B2C

stores in the US;

- Keune continues to expand its B2B presence across Europe,

adding Germany to its Belgium, France, Netherlands, and UK

operations;

- La Espumeria, active in Argentina and Uruguay, has expanded its

brand portfolio by opening a Serta store in Argentina;

- Mazda is further strengthening its European presence with the

addition of France, which is now operating in four countries;

- Solla has expanded to B2B in Colombia with two new accounts,

Solla B2B and Distraves B2B, adding to their two existing B2C

stores in the country;

- Sony is enhancing its Latin American footprint by launching a

store in Bolivia, and it now operates in nine countries across the

region; and

- VOIT has expanded its B2C presence into the US, complementing

its operations in Mexico.

Fourth Quarter 2024 Operational Highlights:

We innovate aligned with our guiding principles. We express our

brand through the success of our customers. VTEX key operational

highlights this quarter are:

- Zero friction onboarding and collaboration:

- ASICS, a global leader in sportswear, leveraged VTEX Live

Shopping to launch the Novablast 5, creating an engaging and

interactive shopping experience that strengthened customer

connections. The initiative drove impressive results, including a

135% increase in orders compared to non-live shopping periods, a

48% growth in orders over the previous live session, and 2,408

unique viewers during the broadcast. The seamless implementation of

VTEX Live Shopping enabled ASICS to deliver carefully curated

sessions that enhanced brand perception and delivered significant

commercial impact. This success drew the attention of ASICS' global

headquarters, positioning the Brazilian operation as a benchmark

for innovation.

- Dimak, a Chilean company specializing in supermarkets and

distribution, faced the challenge of modernizing its processes

amidst a competitive environment. With many clients in remote areas

and limited access to technology, the company needed a digital

solution that could enhance salesforce efficiency and provide an

accessible online shopping experience. VTEX’s flexible ecommerce

platform, integrated with internal systems and supported by a

collaborative approach involving both salespeople and clients,

helped Dimak seamlessly transition to digital. As a result, online

sales grew by 166%, sessions increased by 84%, and new clients

accounted for 5% of the customer base, proving the strategy's

success. The ecommerce channel is now more profitable than

traditional ones, and Dimak continues to strengthen its role as a

strategic partner for small retailers.

- Dow Química, a global leader in materials science, revamped its

Daimo B2B marketplace on VTEX to optimize the supply chain and

enhance user experiences for buyers and sellers. With features like

intelligent search, personalized showcases, and progressive

discount integration, the company simplified navigation for complex

SKUs, improving accessibility and boosting customer satisfaction.

The implementation of the VTEX Seller Portal granted sellers

greater autonomy, accelerating catalog updates and promotional

activities. With a rapid three-month migration to VTEX IO, Dow

achieved a scalable, one-stop-shop marketplace, enhancing

operational efficiency, improving visibility through SEO, and

solidifying its position in the resins market.

- Pashmina.com, a leader in luxury handcrafted Kashmiri

pashminas, transformed its operations by migrating to VTEX’s

platform. This shift enabled 85% export-driven global growth with

features like multilingual support, local currency options, and

enhanced scalability. The partnership empowers Pashmina.com to

expand globally while streamlining operations and preserving its

heritage.

- The Smart Storage Solutions division of Stanley Black &

Decker launched its new digital commerce store on the VTEX

FastStore platform, replacing a content-only Sitecore website. This

upgrade delivers a seamless browsing and purchasing experience for

brands like Vidmar, LISTA, and CribMaster. Leveraging proven

architecture from Stanley Engineered Fastening's webstore, Smart

Storage expanded its assortment and enhanced commerce capabilities,

catering to the growing demands of digitally-native B2B customers.

The migration marks a significant step in optimizing operations and

driving stronger customer engagement in the B2B sector.

- Single control panel for every order:

- An enterprise multinational fashion retailer in Ireland

partnered with VTEX to overcome technical and operational

challenges. Previously reliant on a limited ecommerce textile

platform, they aimed to integrate inventory from 100+ stores,

centralize digital sales, and boost revenue and efficiency. VTEX

implemented its core platform with a white-label B2C operation,

out-of-the-box features like color and sizing options, a redesigned

front end, and middleware integration via Logic. Early results show

improved sales efficiency and usability with smart checkout.

- Cetro Máquinas, an innovator in Brazil’s industrial equipment

sector, redefined customer engagement with VTEX Personal Shopper,

delivering immersive and highly personalized service. The solution

bridged the gap for technical clarity on complex machinery,

seamlessly bringing the in-person experience to the digital realm.

With real-time video consultations powered by expert sales

representatives, customer satisfaction and trust soared. This

game-changing approach boosted the NPS for video calls to an

impressive 8, surpassing the 7 achieved via traditional phone

support. Customers praised the innovation and personalized

attention, while the sales team celebrated its impact on

conversions. Together with VTEX, Cetro Máquinas is setting a bold

new benchmark for customer experience.

- Coca-Cola Andina Paraguay, a key bottler for The Coca-Cola

Company in Paraguay, transitioned from a solely B2B model to a

hybrid B2B-D2C model. With VTEX's help, the company developed a

personalized online portal, allowing customers to make tailored

orders and manage product returns. This digital shift improved

efficiency, customer satisfaction, and loyalty, while allowing for

geographic expansion and seamless integration with existing B2B

operations. In its first year, the D2C strategy increased consumer

engagement in Asunción and Gran Asunción, establishing a solid

foundation for further growth and reinforcing Coca-Cola's

sustainability goals with its reverse logistics system.

- Rimax, the leading home plastics company in Colombia with over

71 years of experience, is leveraging VTEX to drive its digital

expansion into Mexico. By building its own ecommerce platform and

establishing a strong presence on leading marketplaces like

Falabella and Mercado Libre, Rimax has achieved a 30% sales MoM.

With its migration to VTEX, Rimax is positioned to consolidate its

digital ecosystem and aims to make its online store the

fastest-growing B2C channel in the region.

- Sony, the renowned global electronics company, deployed VTEX

Sales App across seven stores in Ecuador and Chile, optimizing

in-store sales operations. With plans to expand to Peru, Panama,

Colombia, and Mexico, covering 18 stores in total, Sales App has

become Sony’s exclusive platform for LATAM. This rollout

exemplifies its effectiveness in unifying and streamlining regional

sales operations.

- Commerce on auto-pilot and co-pilot:

- Drogal, one of Brazil's most traditional pharmacy chains with

over 350 stores, achieved remarkable results by partnering with

VTEX to enhance its digital operations. The implementation of a

customized pricing solution for pharmacy agreements and seamless

omnichannel integration led to a 30% increase in conversion rates.

By streamlining inventory management, automating catalog updates

for 14,000 SKUs, and offering a transparent, personalized purchase

journey, Drogal improved operational efficiency and customer

satisfaction. Today, its ecommerce channel stands as the company's

primary driver of growth, supported by an agile and innovative

digital strategy.

- Heineken Brazil, home to some of the most beloved alcoholic

beverage brands, leveraged VTEX Ads for their digital campaigns,

achieving exceptional fourth-quarter 2024 results with

above-average ROAS. By analyzing first-party data from Zona Sul,

including transaction insights and search behavior, campaigns were

optimized to target high-intent shoppers across multiple SKUs. This

data-driven approach provided actionable insights into sell-out and

market share, helping refine their strategy for continued

success.

- Newell Brands, a global leader in consumer products, has

successfully transformed its B2B ecommerce strategy with VTEX.

Integrating renowned brands like Rubbermaid, Sharpie, and Coleman,

the company now offers cross-selling and upselling opportunities

tailored to customer behavior, achieving greater personalization

through AI. Operating 24/7 via VTEX, Newell Brands processes over

30% of its B2B orders during off-hours, demonstrating enhanced

availability. With a focus on supply chain optimization, digital

innovation, and agile methodologies, the partnership has

strengthened customer engagement and positioned Newell Brands as a

benchmark for B2B digital commerce.

- The development platform of choice for digital commerce:

- BGH, an Argentine brand with over 110 years of history in

technology and appliances, partnered with VTEX and successfully

launched a new mobile brand, achieving a strong market position in

Argentina while expanding its operations to Colombia and Mexico.

This collaboration strengthened its digital ecosystem, optimized

omnichannel capabilities, and enhanced its B2C operations, setting

the stage for sustained growth and product diversification across

the region.

- Walmart, the multinational discount store operator and one of

the largest corporations in the global retail industry, launched

new apps in Costa Rica and Guatemala to enhance mobile shopping

across Central America. Built on VTEX IO, the apps improve speed,

usability, and customer satisfaction while adapting to varied store

formats. This innovation lays the groundwork for further regional

expansion, positioning Walmart as a leader in retail

digitalization.

- Zapälla, the premium menswear brand from the Mixed Group,

merged its tradition and sophistication with VTEX IO to translate

the experience of its physical stores into the digital realm. With

the help of Wicomm, the brand chose VTEX IO to optimize its

ecommerce performance, focusing on reducing load times and

improving the conversion rate. The use of React and SEO practices

made navigation faster, resulting in a 71% increase in total

revenue and a 149% boost in the conversion rate. The migration

process took 3 months and included training for the team to have

more autonomy in content management. The digital adaptation also

led to a 32% increase in session duration and a 102% rise in

engagement rate, consolidating the brand's online presence without

losing its essence of quality and sophistication.

Full-Year 2024 Operational and Financial Highlight

- GMV reached US$18.2 billion in the full-year 2024, representing

a YoY increase of 10.4% in USD and 16.2% on an FX neutral

basis.

- Number of customers totaled 2.4 thousand in 2024. The number of

customers with Annual Recurring Revenue ("ARR") with more than

US$250 thousand increased to 155 from 126 the prior year,

representing a 23% YoY increase.

- Number of stores totaled 3.4 thousand in 2024 across 43

countries. Our top 100 customers have an average of 6.1 stores per

customer, up from 6.0 in 2023. Active stores with more than US$25

thousand in ARR represented 87.5% of our revenue and reached an

average ARR per store of US$131.0 thousand.

- Total revenues increased to US$226.7 million in 2024, from

US$201.5 million in 2023, representing a YoY increase of 12.5% in

USD and 18.1% on an FX neutral basis.

- In 2024, our same-store-sales (“SSS”) were 4.8% in USD and

10.3% on a FX Neutral basis.

- Revenue from existing stores increased to US$169.0 million in

2024, with a net revenue retention rate (“NRR”) of 99.3% in USD and

104.3% on a FX Neutral basis.

- Revenues from new stores increased to US$27.9 million in 2024

compared to US$27.7 million in the fiscal year 2023.

- Subscription revenue represented 96.0% of total revenues and

increased to US$217.7 million in 2024, from US$190.3 million in

2023, a YoY increase of 14.4% in USD and 20.2% on an FX neutral

basis.

- In 2024, Brazil subscription revenues increased by 27.6%, Latin

America excluding Brazil by 5.8% and Rest of the World by 33.8% on

a YoY FX neutral basis. In 2024, Brazil, Latin America excluding

Brazil and Rest of the World represented 57%, 32% and 11% of our

total revenue respectively, compared to 54%, 35% and 11%

respectively in 2023.

- In 2024, R&D reached 504 employees, increasing 20.9% YoY,

S&M reached 340 employees, decreasing 1.2% YoY, G&A reached

260, increasing 5.7% YoY, and under COGS we have our customer

excellence teams which represented 264 employees, decreasing 2.2%

YoY.

Business Outlook

VTEX is well-positioned to capture an attractive global market

opportunity, and we are encouraged by the strength of our business

in terms of adding new enterprise customers, gross retention, our

product leadership and platform expansion, and our operational

efficiency. With the recent slowdown in GMV growth, especially in

Brazil, we anticipate more muted same-store sales in the short

term. However, we are encouraged by implementing recently signed

customers, signing new enterprise customers, and enhancing our

product offering. Consequently, we remain confident in our global

expansion and ability to sustain a profitable growth trajectory and

global expansion.

In this context, we are currently targeting FX neutral YoY

subscription revenue growth of 13% to 15% for the first quarter of

2025, implying a US$51.0 million to US$52.0 million range.

For the full year 2025, as we continue executing our profitable

growth strategy, we are targeting FX neutral YoY subscription

revenue growth of 14% to 17%, implying a range of US$235.0 million

to US$241.0 million based on the quarter-to-date average FX rate.

We are targeting non-GAAP operating income and free cash flow

margins of mid teens.

Given the evolution of our partner ecosystem, we plan to

increasingly rely on VTEX's ecosystem of system integrators for new

customer implementations.

We are confident in VTEX's ability to capitalize on current

market opportunities. We are empowering our customers to digitally

transform their commerce operations while helping them to

outperform the market.

The business outlook provided above constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

Actual results could vary materially as a result of numerous

factors, including certain risk factors, many of which are beyond

VTEX’s control. See the cautionary note regarding “Forward-Looking

Statements” below. Fluctuations in VTEX’s operating results may be

particularly pronounced in the current economic environment. There

can not be an assurance that VTEX will achieve these results.

Transition to U.S. GAAP Reporting

As part of our ongoing efforts to enhance financial transparency

and comparability with industry peers, VTEX intends to transition

its financial reporting standards from IFRS to U.S. GAAP (GAAP)

beginning from the fiscal year commencing on January 1, 2025.

We believe that adopting GAAP may expand our access to a broader

investor base, facilitate inclusion in additional stock indices,

and improve financial reporting alignment within our sector.

Our Board of Directors has approved this transition, and we will

be seeking shareholder approval at the annual shareholders meeting

to be held on April 25, 2025. If approved, the transition is

expected to become effective in the first quarter of 2025.

To support this change, we will furnish supplementary financial

information on April 15, 2025, providing a reconciliation from IFRS

to GAAP.

Preliminarily, the primary impacts of this transition will

be:

- Share-based compensation: GAAP allows for

“straight-line” ratable expense recognition instead of “graded”

front-loaded expense recognition, which is currently done under

IFRS. Payroll taxes and social charges related to share-based

compensation are recognized on the vesting date under GAAP, unlike

IFRS, where these expenses are allocated progressively throughout

the vesting period. These changes may introduce quarterly

fluctuations in our Income from Operations.

- Hyperinflationary Currency Adjustment: under GAAP, VTEX

Argentina's, whilst operating in a highly inflationary economy,

will be subject to specific accounting treatment, where its figures

will be remeasured as if its functional currency were U.S. dollars.

Consequently, this change would result in the reversal of the

non-cash adjustment of hyperinflation under IFRS. This change may

mainly impact our Financial Result.

- Leases: GAAP classifies office leases as operating

leases, whereas under IFRS, office leases are accounted for as

finance leases. These changes may impact the classification of

expenses while not resulting in material differences in total lease

expenses.

- Income tax accounting: this will be affected by the

above accounting changes, in addition to various tax-specific

guidance, including the requirements and methodologies for deferred

tax recognition and valuation allowances.

Preliminarily, the above topics are expected to have an

immaterial impact on revenue, gross profit, non-GAAP operating

income. Free cash flow should be adjusted by the operational

leasing reclassification, while net income should have a negative

impact in 2023 and a positive impact in 2024, both primarily driven

by the remeasurement of Argentina's figures as if its functional

currency were USD and the reversal of the non-cash adjustment of

hyperinflation financial expense.

The following table summarizes certain key financial and

operating metrics for the three and twelve months ended December

31, 2024 and 2023.

Three months ended December

31,

Twelve months ended December

31,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

GMV

5,392.9

5,382.7

18,247.5

16,524.2

GMV growth YoY FXN (1)

10.9%

29.9%

16.2%

25.3%

Revenue

61.5

60.7

226.7

201.5

Revenue growth YoY FXN (1)

12.3%

24.9%

18.1%

23.7%

Non-GAAP subscription gross profit

(2)(4)

46.9

45.8

170.3

145.1

Non-GAAP subscription gross profit margin

(3)(4)

78.9%

78.6%

78.2%

76.2%

Non-GAAP income (loss) from operations

(4)

12.4

11.6

29.5

7.7

Total number of employees

1,368

1,277

1,368

1,277

(1)

Calculated by using the average

monthly exchange rates for the applicable months during 2023,

adjusted by inflation in countries with hyperinflation, and

applying them to the corresponding months in 2024, as applicable,

so as to calculate what our results would have been had exchange

rates remained stable from one year to the next.

(2)

Corresponds to our subscription

revenues minus our subscription costs.

(3)

Corresponds to our subscription

gross profit divided by subscription revenues.

(4)

Reconciliation of Non-GAAP

metrics can be found in tables below.

Conference Call and Webcast

The conference call may be accessed by dialing +1-888-500-3691

(Conference ID – 18526 –) and requesting inclusion in the call for

VTEX.

The live conference call can be accessed via audio webcast at

the investor relations section of the Company's website, at

https://www.investors.vtex.com/.

An archive of the webcast will be available for one week

following the conclusion of the conference call.

Definition of Selected Operational Metrics

“ARR” means annual recurring revenue, calculated as

subscription revenue in the most recent quarter multiplied by

four.

“Customers” means companies ranging from small and

medium-sized businesses to larger enterprises that pay to use

VTEX’s platform.

“GMV” means the total value of customer orders processed

through our platform, including value-added taxes and shipping. Our

GMV does not include the value of orders processed by our SMB

customers or B2B transactions.

“FX Neutral” or “FXN” means a way of using the

average monthly exchange rates for each month during the previous

year, adjusted by inflation in countries with hyper-inflation, and

applying them to the corresponding months of the current year, so

as to calculate what results would have been had exchange rates

remained stable from one year to the next.

“NRR” means net revenue retention, calculated on a

monthly basis by dividing the subscription revenue from our

platform during the current period by the subscription revenue in

the same period of the previous year for the same base of online

stores that were active in the same period of the previous

year.

“SSS” means same-store-sales calculated on a yearly basis

by dividing the GMV of active online stores in the current period

by the GMV of the same active online same stores in the prior

period.

“Stores” or “Active Stores” means the number of

unique domains generating gross merchandise value. Each customer

might have multiple stores.

Special Note Regarding Non-GAAP financial metrics

For the convenience of investors, this document presents certain

Non-GAAP financial measures, which are not recognized under IFRS

Accounting Standards, specifically Non-GAAP subscription gross

profit, Non-GAAP income (loss) from operations, free cash flow and

FX Neutral measures.

We understand that Non-GAAP subscription gross profit, Non-GAAP

income (loss) from operations, free cash flow and FX Neutral

measures have limitations as analytical tools, and you should not

consider them in isolation or as substitutes for analysis of our

results of operations presented in accordance with IFRS Accounting

Standards. Additionally, our calculations of Non-GAAP subscription

gross profit, Non-GAAP income (loss) from operations, free cash

flow and FX Neutral measures may be different from the calculation

used by other companies, including our competitors, and therefore,

our measures may not be comparable to those of other companies.

Reconciliation of Non-GAAP measures

The following table presents a reconciliation of our Non-GAAP

subscription gross profit to subscription gross profit for the

following periods:

Three months ended December

31,

Twelve months ended December

31,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Subscription revenue

59.5

58.2

217.7

190.3

Subscription cost

(12.6)

(12.5)

(47.6)

(45.4)

Subscription gross profit

46.8

45.8

170.1

144.9

Share-based compensation

0.1

0.0

0.2

0.2

Non-GAAP subscription gross

profit

46.9

45.8

170.3

145.1

Non-GAAP subscription gross

margin

78.9%

78.6%

78.2%

76.2%

The following table presents a reconciliation of our Non-GAAP

S&M expenses to S&M expenses for the following periods:

Three months ended December

31,

Twelve months ended December

31,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Sales & Marketing expense

(17.0)

(15.1)

(67.9)

(59.5)

Share-based compensation expense

0.9

1.0

4.0

4.4

Amortization related to acquisitions

0.3

0.3

1.2

1.2

Earn out expenses related to

acquisitions

0.3

-

0.4

-

Non-GAAP Sales & Marketing

expense

(15.5)

(13.8)

(62.3)

(53.9)

The following table presents a reconciliation of our Non-GAAP

R&D expenses to R&D expenses for the following periods:

Three months ended December

31,

Twelve months ended December

31,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Research & Development expense

(13.3)

(14.3)

(53.6)

(60.1)

Share-based compensation expense

1.2

1.8

3.9

7.4

Amortization related to acquisitions

0.1

0.3

0.5

1.2

Earn out expenses related to

acquisitions

0.2

-

0.3

-

Non-GAAP Research & Development

expense

(11.7)

(12.3)

(48.9)

(51.5)

The following table presents a reconciliation of our Non-GAAP

G&A expenses to G&A expenses for the following periods:

Three months ended December

31,

Twelve months ended December

31,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

General & Administrative expense

(8.1)

(9.1)

(34.4)

(33.7)

Share-based compensation expense

2.1

2.3

8.4

7.3

Amortization related to acquisitions

0.0

0.0

0.0

0.0

Non-GAAP General & Administrative

expense

(6.0)

(6.8)

(26.0)

(26.4)

The following table presents a reconciliation of our Non-GAAP

income (loss) from operations to income (loss) from operations for

the following periods:

Three months ended December

31,

Twelve months ended December

31,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Income (loss) from operations

7.1

5.7

10.1

(14.6)

Share-based compensation expense

4.3

5.3

17.0

19.7

Amortization related to acquisitions

0.4

0.6

1.8

2.6

Earn out expenses related to

acquisitions

0.5

-

0.6

-

Non-GAAP income (loss) from

operations

12.4

11.6

29.5

7.7

The following table presents a reconciliation of our free cash

flow to net cash provided by (used in) operating activities for the

following periods:

Three months ended December

31,

Twelve months ended December

31,

(in millions of US$, except as otherwise

indicated)

2024

2023

2024

2023

Net cash provided by (used in) operating

activities

12.8

9.7

27.3

4.3

Acquisitions of property and equipment

(0.4)

(0.2)

(2.1)

(0.5)

Free Cash Flow

12.4

9.5

25.2

3.8

The following table sets forth the FX neutral measures related

to our reported results of the operations for the three months

ended December 31, 2024:

As Reported

FXN

As Reported

FXN

(in millions of US$, except as otherwise

indicated)

4Q24

4Q23

% Change

4Q24

4Q23

% Change

Subscription revenue

59.5

58.2

2.1%

66.0

58.2

13.4%

Services revenue

2.1

2.5

(17.4)%

2.2

2.5

(12.8)%

Total revenue

61.5

60.7

1.3%

68.2

60.7

12.3%

Gross profit

46.1

44.9

2.7%

51.9

44.9

15.7%

Income (loss) from operations

7.1

5.7

24.9%

9.1

5.7

59.6%

This announcement does not contain sufficient information to

constitute an interim financial report as defined in International

Financial Reporting Standards as issued by the International

Accounting Standards Board (“IFRS Accounting Standards”) IAS 34

Interim Financial Reporting, "Interim Financial Reporting" nor a

financial statement as defined by IFRS Accounting Standards 1

"Presentation of Financial Statements". The financial information

in this press release has not been audited. Numbers have been

calculated using whole amounts rather than rounded amounts. This

might cause some figures not to total due to rounding.

About VTEX

VTEX (NYSE: VTEX) is the composable and complete commerce

platform that delivers more efficiency and less maintenance to

organizations seeking to make smarter IT investments and modernize

their tech stack. Through our pragmatic composability approach, we

empower brands, distributors, and retailers with unparalleled

flexibility and comprehensive solutions, enabling them to invest

solely in what provides a clear business advantage and boosts

profitability.

VTEX is trusted by 2.4 thousand global B2C and B2B customers,

including Carrefour, Colgate, Motorola, Sony, Stanley Black &

Decker, and Whirlpool, having 3.4 thousand active online stores

across 43 countries (as of FY ended on December 31, 2024). For more

information, visit www.vtex.com.

Forward-looking Statements

This announcement contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1993, as

amended, and Section 21E of the Securities Exchange of 1934, as

amended. Statements contained herein that are not clearly

historical in nature, including statements about the VTEX

strategies and business plans, are forward-looking, and the words

“anticipate,” “believe,” “continues,” “expect,” “estimate,”

“intend,” ”strategy,” “project,” “target” and similar expressions

and future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “can,” “may,” or similar expressions are

generally intended to identify forward-looking statements.

VTEX may also make forward-looking statements in its periodic

reports filed with the U.S. Securities and Exchange Commission, or

the SEC, in press releases and other written materials and in oral

statements made by its officers and directors. These

forward-looking statements speak only as of the date they are made

and are based on the VTEX’s current plans and expectations and are

subject to a number of known and unknown uncertainties and risks,

many of which are beyond VTEX’s control. A number of factors and

risks could cause actual results to differ materially from those

contained in any forward-looking statement. Further information

regarding these and other risks is included in VTEX filings with

the SEC.

As a consequence, current plans, anticipated actions and future

financial position and results of operations may differ

significantly from those expressed in any forward-looking

statements in this announcement. You are cautioned not to unduly

rely on such forward-looking statements when evaluating the

information presented as there is no guarantee that expected

events, trends or results will actually occur. We undertake no

obligation to update or revise any forward-looking statements,

whether as a result of new information or future events or for any

other reason.

This announcement may also contain estimates and other

information concerning our industry that are based on industry

publications, surveys and forecasts. This information involves a

number of assumptions and limitations, and we have not

independently verified the accuracy or completeness of the

information.

VTEX

Consolidated statements of profit or

loss

In thousands of U.S. dollars, unless

otherwise indicated

Three months ended

(unaudited)

Year ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Subscription revenue

59,462

58,224

217,706

190,302

Services revenue

2,062

2,497

9,003

11,215

Total revenue

61,524

60,721

226,709

201,517

Subscription cost

(12,625)

(12,472)

(47,648)

(45,420)

Services cost

(2,833)

(3,385)

(11,770)

(15,529)

Total cost

(15,458)

(15,857)

(59,418)

(60,949)

Gross profit

46,066

44,864

167,291

140,568

Operating expenses

General and administrative

(8,090)

(9,132)

(34,431)

(33,673)

Sales and marketing

(17,008)

(15,129)

(67,862)

(59,461)

Research and development

(13,290)

(14,344)

(53,620)

(60,116)

Other losses

(552)

(556)

(1,275)

(1,920)

Income (loss) from operations

7,126

5,703

10,103

(14,602)

Financial income

6,339

20,801

33,142

46,374

Financial expense

(5,578)

(20,442)

(33,584)

(43,367)

Financial result, net

761

359

(442)

3,007

Equity results

—

19

2

1,008

Income (loss) before income tax

7,887

6,081

9,663

(10,587)

Income tax

Current

(1,331)

(2,865)

(1,414)

(5,182)

Deferred

(280)

7

3,746

2,075

Total income tax

(1,611)

(2,858)

2,332

(3,107)

Net income (loss) for the

period

6,276

3,223

11,995

(13,694)

Attributable to controlling

shareholders

6,264

3,226

11,998

(13,687)

Non-controlling interest

12

(3)

(3)

(7)

Earnings (loss) per share

Basic earnings (loss) per share

0.034

0.018

0.065

(0.073)

Diluted earnings (loss) per

share

0.033

0.016

0.062

(0.073)

VTEX

Condensed balance sheets

In thousands of U.S. dollars, unless

otherwise indicated

December 31, 2024

December 31, 2023

ASSETS

Current assets

Cash and cash equivalents

18,673

28,035

Short-term investments

196,135

181,374

Trade receivables

52,519

44,122

Recoverable taxes

10,327

6,499

Deferred commissions

1,671

1,005

Prepaid expenses

5,120

5,143

Derivative financial instruments

—

53

Other current assets

145

22

Total current assets

284,590

266,253

Non-current assets

Long-term investments

9,649

2,000

Trade receivables

11,384

7,415

Deferred tax assets

19,047

19,926

Prepaid expenses

66

155

Recoverable taxes

1,364

4,454

Deferred commissions

4,853

2,924

Other non-current assets

1,053

902

Right-of-use assets

2,783

3,277

Property and equipment, net

2,999

2,697

Intangible assets, net

28,990

30,024

Investments in joint venture

—

1,118

Total non-current assets

82,188

74,892

Total assets

366,778

341,145

VTEX

Condensed balance sheets

In thousands of U.S. dollars, unless

otherwise indicated

December 31, 2024

December 31, 2023

LIABILITIES

Current liabilities

Accounts payable and accrued expenses

36,951

39,728

Taxes payable

7,863

8,219

Lease liabilities

1,617

1,863

Deferred revenue

32,521

25,948

Accounts payable from acquisition of

subsidiaries

29

—

Other current liabilities

1,989

1,486

Total current liabilities

80,970

77,244

Non-current liabilities

Accounts payable and accrued expenses

2,151

1,632

Taxes payable

160

—

Lease liabilities

1,695

2,233

Accounts payable from acquisition of

subsidiaries

943

—

Deferred revenue

22,217

16,584

Deferred tax liabilities

2,478

2,668

Other non-current liabilities

363

452

Total non-current liabilities

30,007

23,569

EQUITY

Issued capital

18

18

Capital reserve

374,681

370,821

Other reserves

(892)

(486)

Accumulated losses

(118,062)

(130,060)

Equity attributable to VTEX’s

shareholders

255,745

240,293

Non-controlling interests

56

39

Total shareholders’ equity

255,801

240,332

Total liabilities and equity

366,778

341,145

VTEX

Condensed statements of cash flows

In thousands of U.S. dollars, unless

otherwise indicated

Year ended

December 31, 2024

December 31, 2023

Net income (loss) for the

period

11,995

(13,694)

Adjustments for:

Depreciation and amortization

4,363

5,018

Deferred income tax

(3,746)

(2,075)

Loss on disposal of rights of use,

property, equipment, and intangible assets

120

874

Expected credit losses from trade

receivables

1,082

1,472

Share-based compensation

15,552

16,360

Provision for payroll taxes (share-based

compensation)

1,419

3,326

Adjustment of hyperinflation

6,908

19,369

Equity results

(2)

(1,008)

Accrued interest

(14,168)

(23,757)

Fair value gains

(2,024)

(10,332)

Others and foreign exchange, net

9,352

8,298

Change in operating assets and

liabilities

Trade receivables

(22,679)

(13,137)

Recoverable taxes

(3,486)

(3,597)

Prepaid expenses

(466)

(598)

Other assets

(531)

583

Accounts payable and accrued expenses

(227)

855

Taxes payable

3,577

7,347

Deferred revenue

21,125

6,948

Other liabilities

1,011

1,925

Cash provided by (used in) operating

activities

29,175

4,177

Income tax paid

(1,919)

82

Net cash provided by (used in)

operating activities

27,256

4,259

Cash flows from investing

activities

Dividends received from joint venture

—

1,138

Proceeds from joint venture

1,026

—

Purchase of short and long-term

investment

(133,671)

(135,442)

Redemption of short-term investment

120,915

171,200

Interest and dividend received from

short-term investments

691

2,106

Acquisition of subsidiaries net of cash

acquired

(2,919)

—

Acquisitions of property and equipment

(2,069)

(472)

Derivative financial instruments

(3,987)

(105)

Net cash provided by (used in)

investing activities

(20,014)

38,425

Cash flows from financing

activities

Changes in restricted cash

—

1,660

Proceeds from the exercise of stock

options

3,898

1,031

Net-settlement of share-based payment

(4,675)

(2,488)

Buyback of shares

(11,202)

(35,243)

Payment of loans and financing

(71)

(1,238)

Interest paid

—

(5)

Principal elements of lease payments

(1,615)

(1,574)

Lease interest paid

(369)

(573)

Net cash used in financing

activities

(14,034)

(38,430)

Net decrease in cash and cash

equivalents

(6,792)

4,254

Cash and cash equivalents, beginning of

the year

28,035

24,394

Effect of exchange rate changes

(2,570)

(613)

Cash and cash equivalents, end of the

year

18,673

28,035

Non-cash transactions:

Lease liabilities arising from obtaining

right-of-use assets and remeasurement

1,530

(251)

Unpaid amount related to business

combinations

972

-

Transactions with non-controlling

interests

20

27

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225248619/en/

Julia Vater Fernández VP of Investor Relations

investors@vtex.com

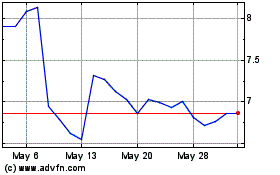

VTEX (NYSE:VTEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

VTEX (NYSE:VTEX)

Historical Stock Chart

From Feb 2024 to Feb 2025