UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

(Mark one):

☒ ANNUAL REPORT PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER 1-8606

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

| | |

| VERIZON SAVINGS AND SECURITY PLAN |

| FOR WEST REGION HOURLY EMPLOYEES |

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

VERIZON COMMUNICATIONS INC.

1095 Avenue of the Americas

New York, New York 10036

VERIZON SAVINGS AND SECURITY PLAN FOR WEST REGION HOURLY EMPLOYEES

TABLE OF CONTENTS

| | | | | | |

| | Page | |

| | |

| | |

| | |

| FINANCIAL STATEMENTS | | |

| | |

Statements of Net Assets Available for Benefits | | |

As of December 31, 2021 and 2020 | | |

| | |

Statement of Changes in Net Assets Available for Benefits | | |

For the year ended December 31, 2021 | | |

| | |

| | |

| | |

| SUPPLEMENTAL SCHEDULE * | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 23.1 CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | |

|

* All other schedules required by Section 2520.103-10 of the Department of Labor Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are omitted as they are not applicable or not required.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Verizon Employee Benefits Committee and Plan Participants

Verizon Savings and Security Plan for West Region Hourly Employees

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Verizon Savings and Security Plan for West Region Hourly Employees (the Plan) as of December 31, 2021 and 2020, and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2021, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 2002.

/s/ Mitchell & Titus, LLP

New York, New York

June 27, 2022

| | | | | | | | | | | | | | | | | | | | |

| | | | | | 80 Pine Street

New York, NY 10005

T +1 212 709 4500

F +1 212 709 4680

mitchelltitus.com |

VERIZON SAVINGS AND SECURITY PLAN FOR WEST REGION HOURLY EMPLOYEES

Statements of Net Assets Available for Benefits

As of December 31, 2021 and 2020

(in thousands of dollars)

| | | | | | | | |

| | 2021 | 2020 |

| Assets | | |

| Plan interest in Verizon Master Savings Trust | $ | 362,395 | | $ | 367,373 | |

| Plan interest in Bell Atlantic Master Trust | 249 | | 220 | |

| Investments at contract value | 27,993 | | 29,344 | |

| Total investments | 390,637 | | 396,937 | |

| | |

| Notes receivable from participants | 4,102 | | 4,264 | |

| | |

| Net assets available for benefits | $ | 394,739 | | $ | 401,201 | |

The accompanying notes are an integral part of these financial statements.

- 2 -

VERIZON SAVINGS AND SECURITY PLAN FOR WEST REGION HOURLY EMPLOYEES

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2021

(in thousands of dollars)

| | | | | |

| 2021 |

| Additions to net assets attributed to: | |

| Investment Income | |

| Net increase in Plan's interest in Verizon Master Savings Trust | $ | 26,715 | |

| Net increase in Plan's interest in Bell Atlantic Master Trust | 17 | |

| Total investment income | 26,732 | |

| |

| Interest income on notes receivable from participants | 198 | |

| |

| Contributions | |

| Participant contributions | 4,142 | |

| Employer contributions | 1,775 | |

| Total contributions | 5,917 | |

| |

| Total additions | 32,847 | |

| |

| Deductions from net assets attributed to: | |

| Benefits paid to participants | 38,591 | |

| Administrative expenses | 730 | |

| Total deductions | 39,321 | |

| |

| Net decrease prior to asset transfers | (6,474) | |

| |

| Assets transferred into Plan from Bell Atlantic Master Trust (See Note 1) | 12 | |

| Net decrease | (6,462) | |

| |

| Net assets available for benefits | |

| Beginning of year | 401,201 | |

| End of year | $ | 394,739 | |

The accompanying notes are an integral part of these financial statements.

- 3 -

VERIZON SAVINGS AND SECURITY PLAN FOR WEST REGION HOURLY EMPLOYEES

Notes to Financial Statements

The following description of the Verizon Savings and Security Plan for West Region Hourly Employees (the “Plan”) provides only general information. Participants should refer to the Summary Plan Description and Plan Document for a complete description of the Plan’s provisions. The Plan is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”).

Eligibility

The Plan provides eligible employees, as defined by the Plan Document, of Verizon Communications Inc. (“Verizon” or “Plan Sponsor”) and certain of its subsidiaries (“Participating Affiliates”) with a convenient way to save for both short-term and long-term needs.

Covered employees are eligible to make before-tax or after-tax contributions or a combination of both to the Plan and to receive matching employer contributions upon completion of enrollment in the Plan as soon as practicable following the date of hire. Covered employees in certain bargaining groups who are not eligible to earn pension benefits and who are employed by Verizon or its Participating Affiliates on the last day of the year in a position subject to a collective bargaining agreement, may receive employer annual discretionary awards (“profit sharing contributions”) under the Plan. Beginning January 1, 2021, certain participants became eligible to make Roth 401(k) contributions to the Plan, and that feature has been extended to certain additional participants.

An individual’s active participation in the Plan shall terminate when the individual ceases to be an eligible employee; however, the individual shall remain a participant until the entire account balance under the Plan has been distributed or forfeited.

Participant Accounts

Each participant account is credited with the participant’s contributions, rollovers, employer-matching contributions, profit sharing contributions, and allocations of Plan income. Allocations of Plan income are based on participant account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are always vested in the value of their contributions and earnings thereon. A participant shall be fully vested in the employer-matching and profit sharing contributions allocated to his or her account or Employee Stock Ownership Plan (“ESOP”) account and any income thereon upon completing three years of vesting service or upon death, disability, retirement from Verizon or its Participating Affiliates, attainment of normal retirement age, or involuntary termination (other than for cause or in connection with a business transaction).

Forfeitures

Forfeited balances of terminated participants' non-vested accounts are used to pay administrative expenses and to reduce future employer-matching contributions and profit sharing contributions. Forfeitures used to pay certain administrative expenses and used to reduce employer-matching contributions totaled $227,915 for the year ended

December 31, 2021. At December 31, 2021 and 2020, forfeited non-vested accounts totaled $554,574 and $780,722, respectively.

Contributions

The Plan is funded by participant contributions up to a maximum of 25% of eligible compensation, by employer-matching contributions equal to a percentage of the first 6% of eligible compensation that the participant contributes to the Plan and by profit sharing contributions. The matching contribution percentage is specified by the Plan or the participant’s collective bargaining agreement, as applicable, and different percentages may apply to participants in certain bargaining groups who are not eligible to earn pension benefits. Participants attaining the age of 50 or older can elect to make additional catch-up contributions to the Plan. Contributions are subject to certain IRS limitations.

Effective January 1, 2021, the Plan includes an auto-enrollment provision whereby certain newly eligible employees are automatically enrolled in the Plan at a contribution rate of 6% of eligible compensation unless they affirmatively elect not to participate in the Plan or elect to contribute at a different rate. Contributions for an automatically enrolled participant are invested in the Long-Term Growth Strategy Portfolio, the qualified default investment alternative designated by the Plan administrator, until changed by the participant. Automatic enrollment applies to eligible employees who are covered by a specified bargaining agreement that approves the feature and who are hired on or after the effective date specified in the bargaining agreement.

Participant contributions may be made on a before-tax or after-tax basis or a combination of both or, for certain eligible employees, on a Roth 401(k) basis. The participants eligible to make elective contributions on a Roth 401(k) basis are eligible employees who are covered by a specified bargaining agreement that approves the feature and who are hired on or after the effective date specified in the bargaining agreement. Participants direct their contributions into various investment options offered by the Plan.

Employer-matching contributions and profit sharing contributions made in cash are directed into the same investment options as the participant contributions. Profit sharing contributions may also be provided in Verizon shares, as determined by Verizon. The Verizon shares are held by the Plan in a unitized fund, which means participants do not actually own shares of Verizon common stock but rather own an interest in the fund. There was no profit sharing contribution made for 2021.

Notes Receivable from Participants

The Plan includes an employee loan provision authorizing participants to borrow an aggregate amount generally not exceeding the lesser of (1) $50,000 or (2) 50% of their vested account balance in the Plan, subject to certain limitations. Loans are generally repaid by payroll deductions. The general term of repayment for loans is a minimum of six months and a maximum of five years (and generally fifteen years for a loan to purchase a principal residence). Each new loan will bear interest at a rate based upon the prime rate as of the last business day of the calendar quarter immediately preceding the calendar quarter in which the loan is made. Interest rates for loans outstanding at December 31, 2021 and 2020 were between 3.25% to 9.50%.

Payment of Benefits

Benefits are payable in a lump sum cash payment or a retired participant can elect, once per year, to take a partial withdrawal. A participant can also elect one of the following optional forms of benefit payment: (1) payment in Verizon shares for investments in the Verizon Company Stock Fund or the ESOP Shares Fund, with the balance in cash; (2) in annual, semiannual, quarterly, or monthly installments in cash of approximately equal amounts to be paid out for a period of 2 to 20 years, as selected by the participant; or (3) for those participants eligible to

receive their distribution in installments as described in (2) above, a pro rata portion of each installment payment in Verizon shares for investments in the Verizon Company Stock Fund or the ESOP Shares Fund, with the balance of each installment in cash.

Administrative Expenses

Plan administrative expenses may include legal, accounting, trustee, recordkeeping, and other administrative fees and expenses associated with maintaining the Plan. The cost of administering the Plan is paid by participants through a combination of fees allocated to each participant’s account and fees that are paid as part of the investment fees that are allocated to the Plan’s investment options. Plan administrative fees may be paid from forfeitures and may be reduced by credits provided by the Plan trustee/recordkeeper for the net float income it earns with respect to the Plan.

Master Trusts and Trustees

The Plan holds interests in the net assets of the Verizon Master Savings Trust (“VMST”) and the net assets of the defined contribution accounts in the Bell Atlantic Master Trust ("BAMT"), referred to collectively as the “Master Trusts”.

Fidelity Management Trust Company (“Fidelity”) has been designated as the trustee and record keeper of the VMST and is responsible for the control and disbursement of the funds and portfolios of the Plan. Fidelity is also responsible for the investment and reinvestment of the funds and portfolios of the Plan, except to the extent that it is directed by Verizon Investment Management Corp. (“VIMCO”) or by third-party investment managers appointed by VIMCO.

The BAMT holds specific defined benefit assets and specific defined contribution assets, as well as one account which is pooled between defined benefit plans and defined contribution plans. For the pooled account, there may be transfers of ownership interest in the account between the defined benefit plans and the defined contribution plans within the BAMT. The transfer of ownership interest is shown on the Statement of Changes in Net Assets Available for Benefits as either Assets transferred into the Plan from the BAMT or Assets transferred out of the Plan to the BAMT. All such transfers are made at the net asset value as calculated by The Bank of New York Mellon (“BNY Mellon”) as the trustee of the BAMT.

Plan Modification and Plan Termination

The Board of Directors of Verizon may amend, terminate or partially terminate the Plan at any time. The most senior Human Resources officer of Verizon also has the right to modify, alter or amend the Plan at any time subject to collective bargaining requirements. The chief legal counsel to the Verizon Employee Benefits Committee may amend the Plan for changes required by the Internal Revenue Service (“IRS”) in connection with a determination letter or voluntary compliance application or for changes that result from an agreement between Verizon and a collective bargaining agent representing eligible employees. No amendment may permit any of the assets held pursuant to the Plan to be used for any purpose other than for the exclusive benefit of Plan participants and their beneficiaries or for paying reasonable expenses of administering the Plan. In the event the Plan terminates, participants will become fully vested in their accounts.

| | |

2. Summary of Accounting Policies |

Basis of Accounting

The financial statements of the Plan have been prepared on the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein. Actual results could differ from those estimates.

Payment of Benefits

Benefits are recorded when paid.

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. A participant loan is in default if loan repayments are delinquent beyond the end of the Plan’s grace period. Defaulted loans are treated as an offset distribution or deemed distribution for tax purposes and become taxable income to the participant in the year in which the default occurs. In the case of an offset distribution, the participant loan balance is reduced and a distribution is recorded on the participant’s account.

Recently Adopted Accounting Standards

In August 2018, the Financial Accounting Standards Board issued the Accounting Standards Update (“ASU”) No. 2018-13, “Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement”. This ASU removes the requirements to disclose the amount of and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, the policy for timing of level transfers, and the valuation processes for Level 3 fair value measurements. This ASU requires entities that calculate net asset value ("NAV") to disclose the timing of liquidation of an investee’s assets and the date when redemption restrictions might lapse, only if the timing was communicated to the entity or publicly announced, and disclose information on measurement uncertainty as of the reporting date. In addition, this ASU requires entities to present the changes in unrealized gains and losses for recurring Level 3 fair value measurements, as well as the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, based on materiality. The amendments in this ASU are effective for fiscal years beginning after December 15, 2019. The Plan Sponsor adopted this accounting standard update in 2020 on a prospective basis, with the exception of the enhancements to the Level 3 disclosures which were applied on a retrospective basis, where applicable, to conform to disclosure requirements.

Investment Valuation and Income Recognition

The Plan’s interests in the Master Trusts are reported at fair value (except for Fully Benefit-Responsive Investment Contracts (“FBRICs”), which are reported at contract value). The investment in the Master Trusts represents the Plan's interest in the net assets of the Master Trusts. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The Statement of Changes in Net Assets Available for Benefits reflects the net increase/(decrease) in the Plan’s interest in the Master Trusts which consists of the realized gains or losses and the unrealized appreciation/ (depreciation) in fair value, or contract value of those investments, as well as interest and dividends earned.

Purchases and sales of securities are recorded on a trade-date basis. Realized gains and losses on sales of investments are determined on the basis of average cost. Dividend income is recorded on the ex-dividend date.

Interest earned on investments is recorded on the accrual basis. Net appreciation/(depreciation) includes gains and losses on investments bought and sold, as well as held during the year.

| | |

3. Investments in Master Trusts |

The Plan’s investments are held in the VMST and in the BAMT. The Plan’s participating interests in the investment funds of the Master Trusts are based on account balances of the participants and their elected investment funds. The net assets of the Master Trusts at December 31, 2021 and 2020, respectively, which may include receivables and payables from unsettled trades, are allocated by assigning to each plan participating in the Master Trusts those transactions that can be specifically identified as related to the plan, such as contributions, benefit payments, and plan-specific expenses. The income and expenses resulting from the collective investments of the Master Trusts’ assets are allocated in proportion to the fair value of the assets assigned to such plan.

On a monthly basis, investments, investment income and expenses are allocated to the Plan in accordance with its specific interests in the Master Trusts. Investment fees are charged against the earnings of the funds and portfolios.

The defined contribution net investments in the BAMT are held in a unitized commingled account measured at NAV per share, as a practical expedient. The net investments are reflected as a component of “Investments measured at NAV” presented in the fair value hierarchy table.

The Plan’s interest in the investments in the Master Trusts are reported as “Plan interest in Verizon Master Savings Trust” and “Plan interest in Bell Atlantic Master Trust” in the Statements of Net Assets Available for Benefits. The related investment gains (losses) are reported within “Net increase/(decrease) in Plan's interest in Verizon Master Savings Trust” and “Net increase/(decrease) in Plan's interest in Bell Atlantic Master Trust” in the Statement of Changes in Net Assets Available for Benefits.

Cash receipts and payments derived from investment trades involving foreign currency denominated investments are translated into U.S. dollars at the prevailing exchange rate on the respective transaction date. Net realized gains and losses on foreign currency transactions, upon disposition of foreign currency denominated investments, arise as a result of fluctuations in foreign exchange rates between the trade and settlement dates and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received.

The foreign exchange effect on foreign currency denominated investments is not segregated from the impact of changes in market prices in the Statement of Changes in Net Assets Available for Benefits.

The following table presents the net assets of the Master Trusts and the Plan’s interests in the Master Trusts as of December 31, 2021 and 2020 (in thousands), respectively:

| | | | | | | | | | | | | | |

| December 31, 2021 | December 31, 2020 |

| Master Trusts Balances | Plan's Interest in Master Trusts Balances | Master Trusts Balances | Plan's Interest in Master Trusts Balances |

| Cash and cash equivalents | $ | 1,629,948 | | $ | 15,514 | | $ | 2,022,284 | | $ | 20,769 | |

| U.S. government securities | 2,002,923 | | 19,064 | | 2,020,006 | | 20,746 | |

| Preferred debt securities | 880,792 | | 8,383 | | 936,486 | | 9,618 | |

| Other debt securities | 1,272,597 | | 12,113 | | 1,322,434 | | 13,581 | |

| Preferred stock | 17,951 | | 171 | | 22,690 | | 233 | |

| Common stock | 12,470,168 | | 118,691 | | 10,668,319 | | 109,565 | |

| Verizon common stock | 5,496,466 | | 52,315 | | 6,488,997 | | 66,643 | |

| Common/collective trusts | 14,182,882 | | 134,993 | | 12,427,515 | | 127,632 | |

| Pooled separate accounts | 813,391 | | 7,742 | | 708,917 | | 7,281 | |

| Mutual funds | 1,210,024 | | 11,517 | | 1,121,673 | | 11,520 | |

| Other | 608,208 | | 5,789 | | 421,449 | | 6,582 | |

| Total investments in the Verizon Master Savings Trust at fair value | $ | 40,585,350 | | $ | 386,292 | | $ | 38,160,770 | | $ | 394,170 | |

| Receivables | 2,897,255 | | 8,049 | | 2,221,120 | | 715 | |

| Payables | (3,365,365) | | (31,946) | | (2,678,853) | | (27,512) | |

| Total net assets in Verizon Master Savings Trust at fair value | $ | 40,117,240 | | 362,395 | | $ | 37,703,037 | | $ | 367,373 | |

| | | | |

| Commingled account | 171,099 | | 249 | | 193,562 | | 220 | |

| Total investments in the Bell Atlantic Master Trust at NAV | $ | 171,099 | | $ | 249 | | $ | 193,562 | | $ | 220 | |

| | | | |

| Fully benefit-responsive investment contracts | 751,687 | | 27,993 | | 752,106 | | 29,344 | |

| Total investments in the Verizon Master Savings Trust at contract value | $ | 751,687 | | $ | 27,993 | | $ | 752,106 | | $ | 29,344 | |

| | | | |

| Total investments | $ | 41,040,026 | | $ | 390,637 | | $ | 38,648,705 | | $ | 396,937 | |

The total Master Trusts' net appreciation was $4.1 billion for the year ended December 31, 2021. Interest and dividend income for the Master Trusts was $677.9 million for the year ended December 31, 2021.

Reclassification of Prior Year Presentation

Certain prior year amounts presented in the table of net assets above have been reclassified to conform with the current year presentation.

| | | | | | | | | | | | | | |

| 4. Fair Value Measurements |

The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1) and the lowest priority to unobservable inputs (level 3). The three levels of the fair value hierarchy under FASB ASC 820 are described as follows:

Level 1 – Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets.

Level 2 – Inputs to the valuation methodology include

•quoted prices for similar assets or liabilities in active markets;

•quoted prices for identical or similar assets or liabilities in inactive markets;

•inputs other than quoted prices that are observable for the asset or liability;

•inputs that are derived principally from or corroborated by observable market data by correlation or other means.

If the asset or liability has a specific (contractual) term, the level2 input must be observable for substantially the full term of the asset or liability.

Level 3 – Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The asset or liability's fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques maximize the use of relevant observable inputs and minimize the use of unobservable inputs.

The following is a description of the valuation methodologies used for the investments measured at fair value:

Cash and cash equivalents include short-term investment funds, primarily in diversified portfolios of investment grade money market instruments, and are valued using quoted market prices or other valuation methods. The carrying value of cash equivalents approximates fair value due to the short-term nature of these investments.

Investments in securities traded on national and foreign securities exchanges are valued by the custodian at the last reported sale prices on the last business day of the year or, if no sales were reported on that date, at the last reported bid prices.

Government obligations, corporate bonds, international bonds and asset-backed securities are valued using matrix prices with input from independent third-party valuation sources. Over-the-counter securities are valued at the bid and ask prices or the average of the bid and ask prices on the last business day of the year from published sources or, if not available, from other sources considered reliable such as multiple broker quotes.

Commingled funds not traded on national exchanges are valued by the custodian or fund administrator at their NAV. Commingled funds held by third-party custodians appointed by the fund managers provide the fund managers with a NAV. The fund managers have the responsibility for providing this information to the custodian of the respective plan. Commingled funds for which fair value is measured using the NAV per share as a practical expedient are not leveled within the fair value hierarchy and are included as a component of the total investments in the Master Trusts.

The accounting records of the Master Trusts are maintained in U.S. dollars. Foreign currency denominated assets and liabilities are translated into U.S. dollars at the prevailing rates of exchange at the end of each accounting period, with the impact of fluctuations in foreign exchange rates reflected as an unrealized gain or loss in the fair value of the investments.

The following table sets forth by level, within the fair value hierarchy, the Master Trusts’ assets measured at fair value as of December 31, 2021 (in thousands):

| | | | | | | | | | | | | | |

| Assets at Fair Value as of December 31, 2021 |

| Level 1 | Level 2 | Level 3 | Total |

| Investments | | | | |

| Cash and cash equivalents | $ | 2,543 | | $ | 285,543 | | $ | — | | $ | 288,086 | |

| Verizon common stock | 5,496,466 | | — | | — | | 5,496,466 | |

| Mutual funds | | | | |

| U.S. fixed income | 593,109 | | — | | — | | 593,109 | |

| | | | |

| U.S. small cap | 597,266 | | — | | — | | 597,266 | |

| International equity | 246,000 | | — | | — | | 246,000 | |

| Global fixed income | 212,433 | | — | | — | | 212,433 | |

| | | | |

| | | | |

| Equity | | | | |

| International equity | 3,683,086 | | 2,466 | | — | | 3,685,552 | |

| U.S. equity | 9,000,859 | | 1,748 | | — | | 9,002,607 | |

| Fixed income | | | | |

| U.S. bonds | 6,414 | | 1,319,872 | | — | | 1,326,286 | |

| U.S. treasuries and agencies | 1,638,632 | | 359,104 | | — | | 1,997,736 | |

| Asset-backed securities | — | | 146,036 | | — | | 146,036 | |

| International bonds | 1,656 | | 691,696 | | — | | 693,352 | |

| Convertible securities | 1,282 | | 23,028 | | — | | 24,310 | |

| Total investments in the fair value hierarchy | 21,479,746 | | 2,829,493 | | — | | 24,309,239 | |

| Investments measured at NAV | | | | 16,447,210 | |

| Total investments at fair value | $ | 21,479,746 | | $ | 2,829,493 | | $ | — | | $ | 40,756,449 | |

The Master Trusts' did not have any Level 3 assets for the year ended December 31, 2021.

The following table sets forth by level, within the fair value hierarchy, the Master Trusts’ assets measured at fair value as of December 31, 2020 (in thousands):

| | | | | | | | | | | | | | |

| | Assets at Fair Value as of December 31, 2020 |

| | Level 1 | Level 2 | Level 3 | Total |

| Investments | | | | |

| Cash and cash equivalents | $ | 2,297 | | $ | 96,969 | | $ | — | | $ | 99,266 | |

| Verizon common stock | 6,488,997 | | — | | — | | 6,488,997 | |

| Mutual funds | | | | |

| U.S. fixed income | 760,447 | | — | | — | | 760,447 | |

| | | | |

| U.S. small cap | 505,186 | | — | | — | | 505,186 | |

| International equity | 262,280 | | — | | — | | 262,280 | |

| Global fixed income | 220,210 | | — | | — | | 220,210 | |

| | | | |

| | | | |

| Equity | | | | |

| International equity | 3,481,594 | | 13,829 | | — | | 3,495,423 | |

| U.S. equity | 7,400,336 | | 1,519 | | — | | 7,401,855 | |

| Fixed income | | | | |

| U.S. bonds | 6,647 | | 1,460,390 | | — | | 1,467,037 | |

| U.S. treasuries and agencies | 1,438,149 | | 555,823 | | — | | 1,993,972 | |

| Asset-backed securities | — | | 181,177 | | — | | 181,177 | |

| International bonds | — | | 604,241 | | — | | 604,241 | |

| Convertible securities | 987 | | 25,809 | | — | | 26,796 | |

| Total investments in the fair value hierarchy | 20,567,130 | | 2,939,757 | | — | | 23,506,887 | |

| Investments measured at NAV | | | | 14,847,445 | |

| Total investments at fair value | $ | 20,567,130 | | $ | 2,939,757 | | $ | — | | $ | 38,354,332 | |

The following table states the change in fair value of the Master Trusts’ Level 3 assets for the year ended December 31, 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value January 1, 2020 | Transfer Out | | Transfer In | Acquisitions | Dispositions | Realized Gain | Change in Unrealized Gain/(Loss) | Fair Value December 31, 2020 |

| Fixed income | | | | | | | | | |

| U.S. bonds | $ | 6,879 | | $ | — | | | $ | 2 | | $ | — | | $ | (6,984) | | $ | 103 | | $ | — | | $ | — | |

| International bonds | 1,535 | | (1,320) | | (1) | — | | 281 | | (516) | | 20 | | — | | — | |

| Total investments | $ | 8,414 | | $ | (1,320) | | | $ | 2 | | $ | 281 | | $ | (7,500) | | $ | 123 | | $ | — | | $ | — | |

(1) Transferred from Level 3 to Level 2 because investments have observable market data.

Assets are monitored to assess the appropriate levels assigned within the fair value hierarchy.

| | | | | | | | | | | | | | |

| 5. Redemption Restrictions |

The following table summarizes redemption restrictions for investments of the Master Trusts for which fair value is estimated using NAV per share as of December 31, 2021 (in thousands):

| | | | | | | | | | | | | | |

| Asset Type | Fair Value | Unfunded Commitments | Redemption Frequency | Redemption Notice |

| Commingled funds: | | | | |

| U.S. equity securities | $ | 10,296,346 | | N/A | Daily | Daily |

| International equity securities | 1,980,797 | | N/A | Daily | Daily |

| U.S. fixed income securities | 858,773 | | N/A | Daily | Daily |

| Cash equivalents | 2,497,903 | | N/A | Daily | Daily |

| Real estate | 813,391 | | N/A | Daily | Daily |

| Total | $ | 16,447,210 | | | | |

The following table summarizes redemption restrictions for investments of the Master Trusts for which fair value is estimated using NAV per share as of December 31, 2020 (in thousands):

| | | | | | | | | | | | | | |

| Asset Type | Fair Value | Unfunded Commitments | Redemption Frequency | Redemption Notice |

| Commingled funds: | | | | |

| U.S. equity securities | $ | 8,808,207 | | N/A | Daily | Daily |

| International equity securities | 1,811,553 | | N/A | Daily | Daily |

| U.S. fixed income securities | 921,102 | | N/A | Daily | Daily |

| Cash equivalents | 2,597,666 | | N/A | Daily | Daily |

| Real estate | 708,917 | | N/A | Daily | Daily |

| | | | |

| Total | $ | 14,847,445 | | | | |

For a portion of the real estate fund, redemption requests will be scheduled for payment on the next valuation date which is at least three months after receipt of a written request for redemption (last business day of the quarter). Redemption requests are subject to fund management discretion based on cash available to meet redemption requests. In the event total redemption requests exceed the total cash available to honor such requests, available cash will be prorated among the contract-holders eligible for redemption.

In the normal course of operations, the Master Trusts’ investments may include derivative financial instruments. Derivatives are synthetic instruments used to get various market exposures with limited margin requirements and therefore with leverage risk involved. The notional amounts disclosed in this footnote provide a measure of the Master Trusts’ involvement in such instruments but are not indicative of potential loss. The intent is to use derivative financial instruments to gain market exposure or as economic hedges to manage various risks associated with the Master Trusts’ investments or to express investment managers’ views of future market movements efficiently.

At December 31, 2021 and 2020, the Master Trusts utilized futures, swaps, options, and foreign currency forward contracts to manage risks such as price risk and foreign currency exchange rate risk. At December 31, 2021 and 2020, the gross notional value of the derivative instruments was $4.7 billion and $2.8 billion, respectively. At

December 31, 2021 and 2020, the fair value of the derivative assets was $50.8 million and $50.0 million, respectively. At December 31, 2021 and 2020, the fair value of derivative liabilities was $37.5 million and $31.7 million, respectively. The total losses for the year ended December 31, 2021 was $22.8 million.

The Master Trusts maintain Securities Lending Agreements (the “Agreements”) with the custodian, BNY Mellon (“Custodian”). The Agreements permit the Custodian to loan certain domestic and international securities held by the Master Trusts to borrowing counterparties who provide collateral for the loans. There is generally no stated repayment term for such loans and either party can terminate the loans at any time. Upon loan termination, the loan securities are returned to the Master Trusts and the collateral is paid back to the borrowing counterparty.

Risk of credit loss from securities lending is mitigated by obtaining sufficient collateral, transacting only with borrowing counterparties of high credit quality and being indemnified against borrowing counterparty default by the Custodian. During the years ended December 31, 2021 and 2020, the Master Trusts did not experience any losses arising from securities lending transactions.

The securities on loan may be sold at the Master Trusts' discretion, in which case the Custodian will reallocate or recall positions in order to satisfy sale delivery. Securities on loan may not be re-pledged by the Master Trusts.

Securities on loan continue to be recorded as assets in the Master Trusts. The Master Trusts recognize loan collateral, held in separate accounts managed by the Custodian, as an asset and also recognize an equal and offsetting liability, representing their obligation to return the collateral upon termination of the loan. The collateral and offsetting liability are not reflected in the Master Trust listing of investments. Loan collateral can be in the form of cash equivalents or non-cash assets. Collateral in cash equivalents can be invested and reinvested in approved investments by the Custodian according to guidelines set forth in the Agreements. Non-cash collateral is held in the form received and not subject to investing activities by the Custodian. Collateral received are not sold or pledged as loaned securities. Investment gains are shared amongst the Master Trusts, Custodian and borrowing counterparties based on an agreed allocation. Investment losses, if any, arising from such investing activities are borne by the Master Trusts.

The required collateral ranges from an amount equal to or greater than 102% to 105% of the fair value of the securities loaned for U.S. and non-U.S. securities, respectively. Additional collateral is required if the fair value of the borrowed securities increase.

The Master Trusts’ fees earned from these Agreements amounted to approximately $3.2 million for the year ended December 31, 2021. These earnings are included in the total investment income of the Master Trusts.

Total securities on loan were approximately $1.3 billion and $1.0 billion as of December 31, 2021 and 2020, respectively. Total collateral assets and liability to repay borrowing counterparties were each approximately $1.3 billion and $1.1 billion as of December 31, 2021 and 2020, respectively. The percentage of collateral was approximately 103% of the fair value of securities on loan as of December 31, 2021 and 2020, respectively. As of December 31, 2021 and 2020, total fair value of collateral included cash equivalents of $918.5 million and $690.4 million, of which $8.7 million and $6.9 million, respectively, represents the Plan’s estimated allocated interest. Cash equivalents collateral is generally held in U.S. and foreign currency denominations and non-cash collateral is generally held in U.S. and international fixed income securities. Cash equivalents collateral assets are classified as Level 2 fair value measurements.

| | | | | | | | | | | | | | |

8. Fully Benefit-Responsive Investment Contracts |

The Master Trusts hold a portfolio of synthetic investment contracts that meet the criteria of a FBRIC. The underlying investments of the FBRICs are included in the Master Trusts' assets at contract value, which as reported by the insurance companies and banks, was approximately $751.7 million and $752.1 million at December 31, 2021 and 2020, respectively.

The Plan’s share of the total contract value of the FBRICs was approximately $28.0 million and $29.3 million at December 31, 2021 and 2020, respectively, which is reflected in the Statements of Net Assets Available for Benefits. The contract value is the relevant measurement of the FBRICs because it represents the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. The contract value of the investment contracts represents contributions plus earnings, less participant withdrawals and administrative expenses.

The synthetic investment contracts held by the Master Trusts include wrapper contracts that provide a guarantee that the credit rate will not fall below zero percent. The wrap contracts are held with insurance companies and banks. In a typical wrap contract, the wrap issuer agrees to pay the fund the difference between the contract value and the fair value of the covered assets once the fair value has been totally exhausted. Though relatively unlikely, this could happen if the fund experiences significant redemptions during a time when the fair value of the fund’s covered assets is below their contract value and fair value is ultimately reduced to zero. As of December 31, 2021 and 2020, Standard & Poor's rated the issuers of these contracts and the contracts underlying the securities from AA- to A+.

Certain events limit the ability of the Plan to transact at contract value with the issuer. These events include the following: (1) substantive modification of the Plan, including complete or partial plan termination or merger with another plan; (2) any change in law, regulation, or administrative ruling that could have a material adverse effect on the fund’s cash flow; (3) the Plan’s failure to qualify under section 401(k) of the Code; (4) bankruptcy of the Plan Sponsor or other Plan Sponsor events which cause a significant withdrawal from the Plan; and (5) defaults in the debt securities that comprise the covered assets in excess of certain limits. The Plan administrator does not believe the occurrence of any such event is probable at this time.

In addition, certain events allow the issuer to terminate the contracts with the Plan and settle at an amount different from contract value. Those events may be different under each contract. Such events may include the following: (1) an uncured violation of the Plan’s investment guidelines; (2) a breach of material obligation under the contract; (3) a material misrepresentation; and (4) a material amendment to the agreements without the consent of the issuer.

| | |

| 9. Related-Party Transactions |

VIMCO, an indirect, wholly-owned subsidiary of Verizon, is the investment advisor for certain investment funds and, therefore, qualifies as a party-in-interest. VIMCO received no compensation from the Plan other than reimbursement of certain expenses directly attributable to its investment advisory and investment management services rendered to the Plan. In addition, certain investments held by the Master Trusts are managed by BNY Mellon, as trustee, and Fidelity, as trustee and record keeper. Therefore, these investments qualify as parties-in-interest transactions. The Plan also allows investment, through a unitized fund, in Verizon common stock, which is a party-in-interest transaction. All of these transactions are exempt from the prohibited transaction rules.

The IRS has determined and informed the Company by a letter dated May 26, 2015, that the Plan and related trusts are designed in accordance with applicable sections of the Internal Revenue Code (the "IRC”). Although the Plan has been amended since receiving the determination letter, the Plan administrator believes the Plan is designed, and is currently being operated, in compliance with the applicable requirements of the IRC and, therefore, believes that the Plan is qualified, and the related trusts are tax exempt.

U.S. GAAP requires the Plan's management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021, there are no uncertain positions taken or expected to be taken. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan administrator believes the Plan is no longer subject to income tax examinations for years prior to 2018.

| | |

| 11. Risks and Uncertainties |

The Plan provides investment options for participants who can invest in combinations of stocks, fixed income securities, and other investment securities. Investment securities are exposed to various risks, such as interest rate, market, equity price, and credit risks. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in these financial statements.

In January 2020, the World Health Organization ("WHO") announced a global health emergency due to a new strain of coronavirus ("COVID-19") originating in Wuhan, China and the risk to the international community as the virus spread beyond its point of origin. In March 2020, the WHO classified COVID-19 as a pandemic, due to its rapid spread and severity.

Remaining impacts of the COVID-19 pandemic on market conditions are difficult to predict. Because the values of the Plan’s individual investments have and will fluctuate in response to changing market conditions, the ultimate impact of the pandemic on the Plan’s net assets available for benefits, and changes in net assets available for benefits are uncertain.

In response to the COVID-19 pandemic, in March 2020, the Coronavirus Aid, Relief and Economic Security (“CARES”) Act was enacted and signed into law. For the calendar year 2020, certain provisions of the CARES Act allowed defined contribution plans to waive mandatory distributions otherwise required to be paid in calendar year 2020. The CARES Act also permitted tax-advantaged withdrawals and the suspension of certain loan repayments by certain participants affected by COVID-19. The Plan had been administered to permit such withdrawals and loan repayment suspensions.

| | |

| 12. Reconciliation of Financial Statements to Form 5500 |

The following is a reconciliation of net assets available for benefits per the financial statements at December 31, 2021 and 2020, to Form 5500 (in thousands):

| | | | | | | | |

| | 2021 | 2020 |

| Net assets available for benefits per the financial statements | $ | 394,739 | | $ | 401,201 | |

| Deemed distributions of participant loans | (961) | | (903) | |

| Net assets available for benefits per Form 5500 | $ | 393,778 | | $ | 400,298 | |

The following is a reconciliation of total deductions per the financial statements for the year ended December 31, 2021, to Form 5500 (in thousands):

| | | | | |

| | 2021 |

| Total deductions per the financial statements | $ | 39,321 | |

| Add: deemed distributions of participant loans at December 31, 2021 | 961 | |

| Less: deemed distributions of participant loans at December 31, 2020 | (903) | |

| Total deductions per Form 5500 | $ | 39,379 | |

VERIZON SAVINGS AND SECURITY PLAN FOR WEST REGION HOURLY EMPLOYEES

EIN: 23-2259884 Plan # 105

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

As of December 31, 2021

(in thousands of dollars)

| | | | | | | | | | | | | | |

Identity of Issue,

Borrower, Lessor, or Similar

Party | | Description of Investment,

Including Maturity Date, Rate of

Interest, Collateral, Par, or

Maturity Value | | Current Value |

| | | | |

| Notes receivable from participants* | | 0 - 15 years maturity at 3.25% - 9.50% | | $ | 4,102 | |

* Party-in-interest

Cost information is not required because investments are participant-directed.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Verizon Employee Benefits Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

VERIZON SAVINGS AND SECURITY PLAN FOR WEST REGION HOURLY EMPLOYEES

| | | | | | | | |

| By: | /s/ Samantha Hammock | |

| Samantha Hammock | |

| Executive Vice President and Chief Human Resources Officer |

Date: June 27, 2022

Exhibit Index

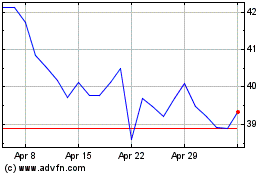

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024