Wells Fargo Foundation Expands Free Virtual Financial Coaching to Help with COVID-19 Hardships

June 10 2020 - 9:05AM

Business Wire

Grants support nonprofits offering financial recovery resources

for people of color, people with disabilities, and other vulnerable

populations hit hardest by the pandemic

With record numbers of U.S. adults filing for unemployment, and

many people facing a lower income amid COVID-19, the Wells Fargo

Foundation is supporting national nonprofits in expanding virtual

financial coaching services, cost-free, to help the public adapt in

these challenging times. These efforts are part of the Wells

Foundation’s $175 million commitment to help vulnerable populations

navigate through the pandemic, with more than 3,000 grants awarded

since March to address public health needs, small business,

housing, and financial stability challenges.

“COVID-19 is having an acute impact on millions of people who

have lost income and are facing immediate and evolving concerns

about their financial security. The situation is changing rapidly

and the path for accessing government benefits and other assistance

can be confusing and stressful,” said Darlene Goins, head of

Financial Health Philanthropy for the Wells Fargo Foundation. “We

want all people to know that financial coaches and counselors

provided by nonprofit organizations can assist them with applying

for public benefits, figuring out which bills to pay first and

where to go for help with rent and other household expenses, and

start planning for recovery in a manner that respects their

personal situation and preserves financial dignity.”

The following nonprofits, with grant support from Wells Fargo,

are now offering independent, personalized, and confidential

financial coaching and counseling sessions by phone, live chat or

video nationwide:

- Association for Financial Counseling and Planning Education®

(AFCPE®): Individuals or families struggling to pay for rent,

groceries and basic needs, worried about debt, or facing other

financial hardships, can sign up to meet virtually with an

AFCPE-certified financial coach or counselor for free at

www.yellowribbonnetwork.org/afcpecovid19.

- Cities for Financial Empowerment Fund: Offering remote,

bilingual, professional financial counseling as a free public

service for underserved residents in cities across the U.S. to help

people open bank accounts, pay down debt, and address other

financial challenges. Visit www.fecpublic.org/about for a list of

locations.

- National Disability Institute: For the 100 million people with

disabilities and chronic health conditions in the U.S., visit the

Financial Resilience Center for accessible emergency resources,

financial wellness guidance in partnership with LifeCents, and free

financial counseling with an AFCPE-certified financial coach with

disability-related expertise.

- National Foundation for Credit Counseling (NFCC): Visit the

Coronavirus Financial Toolkit for resources and assistance with

managing creditors or debt. Call 1-844-865-1971 or visit

https://www.nfcc.org/locator/ to connect free with a NFCC-certified

financial counselor in English or Spanish.

Six ways nonprofit financial coaches can help

Here are a few examples of ways that financial coaches and

counselors can help people cope during COVID-19. Individuals and

families can reach out to one or more nonprofits to assess whether

the assistance offered is right for their specific needs.

- Finding local resources for food, clothing, shelter and other

basic needs

- Creating a household budget to maximize current funds and

prepare for future emergencies

- Prioritizing bills and expenses to cover daily necessities and

plan for the future

- Applying for unemployment benefits, SNAP benefits, and other

financial recovery resources

- Opening bank accounts and using digital tools to manage money

and pay bills remotely

- Building and protecting credit, including options for managing

debt

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a diversified,

community-based financial services company with $1.98 trillion in

assets. Wells Fargo’s vision is to satisfy our customers’ financial

needs and help them succeed financially. Founded in 1852 and

headquartered in San Francisco, Wells Fargo provides banking,

investment and mortgage products and services, as well as consumer

and commercial finance, through 7,400 locations, more than 13,000

ATMs, the internet (wellsfargo.com) and mobile banking, and has

offices in 31 countries and territories to support customers who

conduct business in the global economy. With approximately 263,000

team members, Wells Fargo serves one in three households in the

United States. Wells Fargo & Company was ranked No. 30 on

Fortune’s 2020 rankings of America’s largest corporations. News,

insights and perspectives from Wells Fargo are also available at

Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com |

Twitter: @WellsFargo.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200610005114/en/

Media Melissa Murray Melissa.k.murray@wellsfargo.com

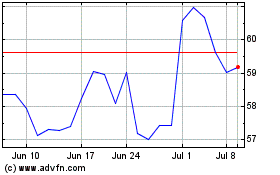

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

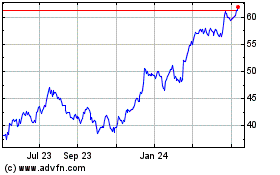

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024