Wells Fargo, Apple, Walt Disney: Stocks That Defined the Week

June 26 2020 - 6:49PM

Dow Jones News

By Francesca Fontana

Wells Fargo & Co.

The Federal Reserve is keeping the nation's biggest banks on a

tight leash. The regulator on Thursday ordered banks to cap

dividends and suspend buybacks as a way of ensuring they stay

healthy during the recession. The Fed said its annual stress tests

showed that a prolonged downturn could saddle them with up to $700

billion in loan losses. Wells Fargo shares lost 7.4% Friday.

Apple Inc.

Apple is getting more serious about making its own chips. The

tech giant said Monday it plans to ship Macs later this year with

custom chips, ending a 15-year technology partnership with Intel

Corp. Custom components have cut costs, boosted performance and

increased Apple's control over future releases. But the shift has

roiled chip-makers shares and forced some suppliers to sell or exit

businesses. Apple said the transition from Intel to its own

processors would occur over the next two years; the first Macs with

custom-designed chips would ship by year-end. Apple shares rose

2.6% Monday.

Simon Property Group Inc.

The biggest shopping-center owner is eyeing the purchase of one

of its anchor tenants: J.C. Penney Co. Simon Property Group is

joining Brookfield Property Partners in exploring a bid for the

bankrupt department-store chain, The Wall Street Journal reported

Tuesday. Analysts said the trend of buying distressed tenants to

maintain occupancy isn't sustainable and is a worrying sign that

property owners' rent-collection business model is under siege. The

purchase would be Simon's third tenant acquisition in four years

and its third partnering with Brookfield. The two property owners,

in a consortium, previously bought Forever 21 Inc. and Aéropostale

Inc. Simon Property Group shares added 2.3% Tuesday.

Facebook Inc.

Facebook is trying to halt an expanding advertising boycott with

new rules governing its content. Chief Executive Mark Zuckerberg on

Friday unveiled policies designed to combat voter suppression and

better protect minorities on the platform. The company will begin

labeling posts that violate its policies but are deemed newsworthy

-- giving Facebook the option of labeling President Trump's posts.

The announcement came soon after consumer-goods giant Unilever PLC

said it would halt U.S. advertising on Facebook and Twitter Inc.

for at least the remainder of the year, joining a growing list of

companies that have vowed to boycott Facebook due to its issues

with hate speech and misinformation. Facebook shares lost 8.3%

Friday.

Walt Disney Co.

The Magic Kingdom has decided not to let anyone into one of its

key territories. Disney on Wednesday said that it would postpone

the scheduled reopening of its Disneyland Resort in Anaheim, Calif.

The park, which had been scheduled to reopen on July 17, will now

stay closed until an unspecified date. The company has faced

pressure to delay reopenings as coronavirus cases reach new highs.

Union officials representing workers sought help from the

California governor's office, and members of the public have signed

online petitions. Disney shares fell 0.6% Thursday.

Microsoft Corp.

Microsoft is giving up on bricks-and-mortar retail. The tech

giant has decided to permanently close its stores that shut in late

March as a result of the coronavirus pandemic. Microsoft said its

retail staff will serve customers from corporate facilities and

remotely, providing sales, training and support. Microsoft had more

than 80 Microsoft Store locations, most of which were in the U.S.,

which the company had used to promote its growing hardware

business. It opened its first location more than a decade ago.

Microsoft shares fell 2% Friday.

Gap Inc.

Can Kanye West save Gap? The casual-clothing retailer is teaming

up with Mr. West's fashion brand Yeezy on a collection called Yeezy

Gap that will debut next year. The rapper and fashion designer has

talked about wanting to partner with Gap in the past, and worked in

a Gap store while growing up in Chicago. T-shirts, jeans and a

version of the Yeezy hoodie will be available for men, women and

children at Gap stores and on its website beginning next year.

Prices will be in line with Gap's other offerings. Gap, which also

owns the Old Navy and Banana Republic brands, has been in a

yearslong slump, exacerbated by widespread store closures due to

the pandemic. Gap shares soared 19% Friday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

June 26, 2020 19:34 ET (23:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

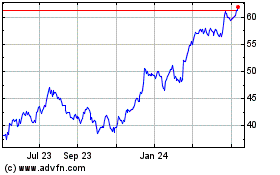

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

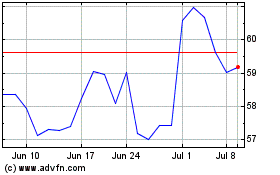

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024