FALSE000077686700007768672024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 7, 2024

Date of Report (Date of earliest event reported)

WHITE MOUNTAINS INSURANCE GROUP, LTD.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Bermuda (State or other jurisdiction of incorporation or organization) | 1-8993 (Commission file number) | 94-2708455 (I.R.S. Employer Identification No.) |

23 South Main Street, Suite 3B, Hanover, New Hampshire 03755

(Address of principal executive offices)

(603) 640-2200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares, par value $1.00 per share | | WTM | | New York Stock Exchange |

| | WTM.BH | | Bermuda Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On August 7, 2024, White Mountains Insurance Group, Ltd. issued a press release announcing its results for the three and six months ended June 30, 2024. The press release furnished herewith is attached as Exhibit 99.1 to this Form 8-K.

Certain information included in the press release constitutes non-GAAP financial measures (as defined in Regulation G of the Securities and Exchange Commission). Specifically, there are 13 non-GAAP financial measures: (i) adjusted book value per share, (ii) growth in adjusted book value per share excluding net realized and unrealized investment losses from White Mountains’s investment in MediaAlpha, (iii) Kudu’s EBITDA, (iv) Kudu’s adjusted EBITDA, (v) Kudu’s annualized adjusted EBITDA, (vi) Kudu’s annualized revenue, (vii) Kudu’s cash revenue yield, (viii) Bamboo’s MGA pre-tax income (loss), (ix) Bamboo’s MGA net income (loss), (x) Bamboo’s MGA EBITDA, (xi) Bamboo’s MGA adjusted EBITDA, (xii) total consolidated portfolio return excluding MediaAlpha and (xiii) total equity portfolio return excluding MediaAlpha. These non-GAAP financial measures have been reconciled from their most comparable GAAP financial measures.

Adjusted book value per share is a non-GAAP financial measure which is derived by adjusting (i) the GAAP book value per share numerator and (ii) the common shares outstanding denominator, as described below. The GAAP book value per share numerator is adjusted (i) to add back the unearned premium reserve, net of deferred acquisition costs, at HG Global and (ii) to include a discount for the time value of money arising from the modeled timing of cash payments of principal and interest on the BAM surplus notes. The value of HG Global’s unearned premium reserve, net of deferred acquisition costs, was $199 million, $196 million, $195 million and $182 million as of June 30, 2024, March 31, 2024, December 31, 2023 and June 30, 2023, respectively. Under GAAP, White Mountains is required to carry the BAM surplus notes, including accrued interest, at nominal value with no consideration for time value of money. Based on a debt service model that forecasts operating results for BAM through maturity of the surplus notes, the present value of the BAM surplus notes, including accrued interest and using an 8% discount rate, was estimated to be $87 million, $89 million, $91 million and $95 million less than the nominal GAAP carrying values as of June 30, 2024, March 31, 2024, December 31, 2023 and June 30, 2023, respectively. White Mountains believes these adjustments are useful to management and investors in analyzing the intrinsic value of HG Global, including the value of the in-force business at HG Re, HG Global’s reinsurance subsidiary, and the value of the BAM surplus notes. The denominator used in the calculation of adjusted book value per share equals the number of common shares outstanding adjusted to exclude unearned restricted common shares, the compensation cost of which, at the date of calculation, has yet to be amortized. Restricted common shares are earned on a straight-line basis over their vesting periods. The reconciliation of GAAP book value per share to adjusted book value per share is included on page 8 of Exhibit 99.1 to this Form 8-K.

The growth in adjusted book value per share excluding net realized and unrealized investment losses from White Mountains’s investment in MediaAlpha on page 1 is a non-GAAP financial measure. White Mountains believes this measure to be useful to management and investors by showing the underlying performance of White Mountains without regard to the impact of changes in MediaAlpha’s share price. A reconciliation from GAAP to the reported percentages is as follows:

| | | | | | | | |

| | Three Months Ended June 30, 2024 |

Growth in GAAP book value per share | | (1.2)% |

Adjustments to book value per share (see reconciliation on page 8) | | 0.1% |

Remove net realized and unrealized investment losses from White Mountains’s investment in MediaAlpha | | 3.0% |

Growth in adjusted book value per share excluding net realized and unrealized investment losses from White Mountains’s investment in MediaAlpha | | 1.9% |

Kudu’s EBITDA, adjusted EBITDA, annualized adjusted EBITDA, annualized revenue and cash revenue yield are non-GAAP financial measures. EBITDA is a non-GAAP financial measure that adds back interest expense on debt, income tax (expense) benefit, depreciation and amortization of other intangible assets to GAAP net income (loss). Adjusted EBITDA is a non-GAAP financial measure that excludes certain other items in GAAP net income (loss) in addition to those added back to calculate EBITDA. The items relate to (i) net realized and unrealized investment gains (losses) on Kudu’s revenue and earnings participation contracts, (ii) non-cash equity-based compensation expense and (iii) transaction expenses. A description of each item follows:

•Net realized and unrealized investment gains (losses) - Represents net unrealized investment gains and losses recorded on Kudu’s revenue and earnings participation contracts, which are recorded at fair value under GAAP, and realized investment gains and losses from participation contracts sold during the period.

•Non-cash equity-based compensation expense - Represents non-cash expenses related to Kudu’s management compensation that are settled with equity units in Kudu.

•Transaction expenses - Represents costs directly related to Kudu’s mergers and acquisitions activity, such as external lawyer, banker, consulting and placement agent fees, which are not capitalized and are expensed under GAAP.

Annualized adjusted EBITDA is a non-GAAP financial measure that (i) annualizes partial year revenues related to Kudu’s revenue and earnings participation contracts acquired during the previous 12-month period and (ii) removes partial year revenues related to revenue and earnings participation contracts sold during the previous 12-month period. Annualized revenue is a non-GAAP financial measure that adds the adjustments for annualized adjusted EBITDA to GAAP net investment income. Cash revenue yield is a non-GAAP financial measure that is derived using annualized revenue as a percentage of total net capital drawn and invested. White Mountains believes that these non-GAAP financial measures are useful to management and investors in evaluating Kudu’s performance. White Mountains also believes that annualized adjusted EBITDA is useful to management and investors in understanding the full earnings profile of Kudu’s business as of the end of any 12-month period. See page 19 of Exhibit 99.1 to this Form 8-K for the reconciliation of Kudu’s GAAP net income (loss) to EBITDA, adjusted EBITDA and annualized adjusted EBITDA, and the reconciliation of Kudu’s GAAP net investment income to annualized revenue.

Bamboo’s MGA pre-tax income (loss), MGA net income (loss), MGA EBITDA and MGA adjusted EBITDA are non-GAAP financial measures. MGA pre-tax income (loss) and MGA net income (loss) are non-GAAP financial measures that exclude the results of the Bamboo Captive, which is consolidated under GAAP, from Bamboo’s consolidated GAAP pre-tax income (loss) and net income (loss). The following table presents the reconciliation from Bamboo’s consolidated GAAP pre-tax income (loss) to MGA pre-tax income (loss):

| | | | | | | | | | | | | |

| Millions | | Three Months Ended June 30, 2024 | Six Months Ended

June 30, 2024 | | |

| Bamboo’s consolidated GAAP pre-tax income (loss) | | $ | 6.4 | | $ | 7.3 | | | |

| Remove pre-tax (income) loss, Bamboo Captive | | (.4) | | — | | | |

| MGA pre-tax income (loss) | | $ | 6.0 | | $ | 7.3 | | | |

MGA EBITDA is a non-GAAP financial measure that adds back interest expense on debt, income tax (expense) benefit, depreciation and amortization of other intangible assets to MGA net income (loss). MGA adjusted EBITDA is a non-GAAP financial measure that excludes certain other items in GAAP net income (loss) in addition to those added back to calculate MGA EBITDA. The items relate to (i) non-cash equity-based compensation expense, (ii) software implementation expenses and (iii) restructuring expenses. A description of each item follows:

•Non-cash equity-based compensation expense - Represents non-cash expenses related to Bamboo’s management compensation that are settled with equity units in Bamboo.

•Software implementation expenses - Represents costs directly related to Bamboo’s implementation of new software.

•Restructuring expenses - Represents costs directly related to Bamboo’s corporate restructuring and capital planning activities associated with the development of new markets.

White Mountains believes that these non-GAAP financial measures are useful to management and investors in evaluating Bamboo’s performance. See page 21 of Exhibit 99.1 to this Form 8-K for the reconciliation of Bamboo’s consolidated GAAP net income (loss) to MGA net income (loss), MGA EBITDA and MGA adjusted EBITDA.

Total consolidated portfolio return excluding MediaAlpha and total equity portfolio return excluding MediaAlpha are non-GAAP financial measures that remove the net investment income and net realized and unrealized investment gains (losses) from White Mountains’s investment in MediaAlpha. White Mountains believes these measures to be useful to management and investors by showing the underlying performance of White Mountains’s investment portfolio and equity portfolio without regard to White Mountains’s investment in MediaAlpha. The following tables present reconciliations from GAAP to the reported percentages:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Total consolidated portfolio return | | (0.1) | % | | 0.9 | % | | 4.5 | % | | 5.5 | % |

Remove MediaAlpha | | 2.3 | % | | 2.1 | % | | (1.0) | % | | 0.6 | % |

Total consolidated portfolio return excluding MediaAlpha | | 2.2 | % | | 3.0 | % | | 3.5 | % | | 6.1 | % |

| | | | | | | | | | |

| | Three Months Ended June 30, 2024 | | |

Total equity portfolio return | | (1.3) | % | | |

Remove MediaAlpha | | 5.2 | % | | |

Total equity portfolio return excluding MediaAlpha | | 3.9 | % | | |

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | WHITE MOUNTAINS INSURANCE GROUP, LTD. | |

| August 7, 2024 | | By: | /s/ MICHAELA J. HILDRETH Michaela J. Hildreth Managing Director and Chief Accounting Officer | |

| | | | | | | | |

| | CONTACT: Rob Seelig

(603) 640-2212 |

WHITE MOUNTAINS REPORTS SECOND QUARTER RESULTS

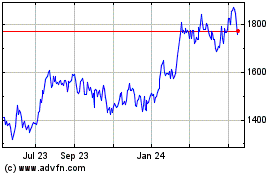

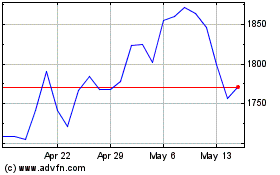

HAMILTON, Bermuda (August 7, 2024) - White Mountains Insurance Group, Ltd. (NYSE: WTM) reported book value per share of $1,722 and adjusted book value per share of $1,777 as of June 30, 2024. Book value per share and adjusted book value per share both decreased 1% in the second quarter of 2024 and increased 4% in the first six months of 2024, including dividends.

Manning Rountree, CEO, commented, “ABVPS was down 1% in the quarter, due primarily to our investment in MediaAlpha. Excluding MediaAlpha, ABVPS was up 2%, driven by solid results at our operating companies and good investment returns. Ark produced an 89% combined ratio and $697 million of gross written premiums in the quarter, up 15% year-over-year. BAM generated $28 million of total gross written premiums and member surplus contributions in the quarter, up 7% year-over-year due to strong primary market volume. At Kudu, trailing 12 months adjusted EBITDA increased, while the value of the continuing portfolio grew 7%. Bamboo had another strong quarter, once again tripling managed premiums year-over-year and growing adjusted EBITDA. MediaAlpha’s share price declined 35% in the quarter, producing a $139 million loss. Excluding MediaAlpha, investment returns were good on an absolute and relative basis. Undeployed capital now stands at roughly $650 million.”

Comprehensive income (loss) attributable to common shareholders was $(55) million and $182 million in the second quarter and first six months of 2024 compared to $21 million and $201 million in the second quarter and first six months of 2023. Results in the second quarter and first six months of 2024 included $(139) million and $72 million of net realized and unrealized investment gains (losses) from White Mountains’s investment in MediaAlpha compared to $(77) million and $8 million of unrealized investment gains (losses) in the second quarter and first six months of 2023.

Ark/WM Outrigger

The Ark/WM Outrigger segment’s combined ratio was 87% and 89% in the second quarter and first six months of 2024 compared to 87% and 89% in the second quarter and first six months of 2023. Ark/WM Outrigger reported gross written premiums of $697 million and $1,569 million, net written premiums of $503 million and $1,101 million and net earned premiums of $318 million and $621 million in the second quarter and first six months of 2024 compared to gross written premiums of $606 million and $1,416 million, net written premiums of $461 million and $1,075 million and net earned premiums of $293 million and $548 million in the second quarter and first six months of 2023.

Ark’s combined ratio was 89% and 91% in the second quarter and first six months of 2024 compared to 89% and 91% in the second quarter and first six months of 2023. Ark’s combined ratio in the second quarter and first six months of 2024 included minimal catastrophe losses compared to five points and three points of catastrophe losses in the second quarter and first six months of 2023. Non-catastrophe losses in the second quarter of 2024 included $19 million related to a political risk claim, $14 million related to tornado damage in Oklahoma and $13 million related to two satellite losses, all on a net basis. Ark’s combined ratio in the second quarter and first six months of 2024 included two points and one point of net favorable prior year development, primarily due to property lines of business, compared to four points of net unfavorable prior year development in both the second quarter and first six months of 2023, primarily due to Winter Storm Elliott and three large claims in the property and marine & energy lines of business.

Ark reported gross written premiums of $697 million and $1,569 million, net written premiums of $464 million and $1,028 million and net earned premiums of $311 million and $603 million in the second quarter and first six months of 2024 compared to gross written premiums of $606 million and $1,416 million, net written premiums of $403 million and $973 million and net earned premiums of $284 million and $534 million in the second quarter and first six months of 2023.

Ark reported pre-tax income of $50 million and $83 million in the second quarter and first six months of 2024 compared to $42 million and $78 million in the second quarter and first six months of 2023. Ark’s results included net realized and unrealized investment gains of $20 million and $31 million in the second quarter and first six months of 2024 compared to $18 million and $43 million in the second quarter and first six months of 2023.

Ian Beaton, CEO of Ark, said, “We are off to a good start through the first half of 2024. Ark’s combined ratio was 89% for the second quarter and 91% year to date, both in line with prior year. Gross written premiums were up 15% over prior year in the quarter. Risk adjusted rate change was flat overall. We are seeing good growth in select lines of business, including Marine & Energy and Accident & Health, and in new product classes.”

WM Outrigger Re’s combined ratio was 27% and 30% in the second quarter and first six months of 2024 compared to 25% and 24% in the second quarter and first six months of 2023. Catastrophe losses were minimal in all periods. WM Outrigger Re reported gross and net written premiums of $39 million and $73 million and net earned premiums of $8 million and $18 million in the second quarter and first six months of 2024 compared to gross and net written premiums of $58 million and $102 million and net earned premiums of $10 million and $15 million in the second quarter and first six months of 2023. Gross and net written premiums decreased due to White Mountains’s lower capital commitment to WM Outrigger Re in 2024. WM Outrigger Re reported pre-tax income of $8 million and $18 million in the second quarter and first six months of 2024 compared to $10 million and $16 million in the second quarter and first six months of 2023.

HG Global/BAM

BAM’s gross written premiums and member surplus contributions (MSC) collected were $28 million and $50 million in the second quarter and first six months of 2024 compared to $26 million and $47 million in the second quarter and first six months of 2023. BAM insured municipal bonds with par value of $5.3 billion and $8.8 billion in the second quarter and first six months of 2024 compared to $3.4 billion and $6.3 billion in the second quarter and first six months of 2023. Total pricing was 54 and 57 basis points in the second quarter and first six months of 2024 compared to 77 and 75 basis points in the second quarter and first six months of 2023. BAM’s total claims paying resources were $1,525 million as of June 30, 2024 compared to $1,501 million as of December 31, 2023 and $1,451 million as of June 30, 2023. On May 29, 2024, S&P Global Ratings affirmed BAM’s AA rating and Stable outlook.

Seán McCarthy, CEO of BAM, said, “BAM had a solid quarter and first half. Primary market par insured totaled $7.9 billion for the first half, up 55% from 2023 and a record result. This included 18 transactions of $100 million or more, reflecting strong demand from retail and institutional buyers in the primary market. Total pricing decreased year-over-year, in part because of the volume of large, higher-credit issuance. Secondary market activity was up 20% year-over-year in the quarter, as heightened interest rate volatility created opportunities.”

HG Global reported pre-tax income of $11 million and $17 million in the second quarter and first six months of 2024 compared to $7 million and $24 million in the second quarter and first six months of 2023. HG Global’s results included net realized and unrealized investment gains (losses) of $(2) million and $(9) million in the second quarter and first six months of 2024 compared to $(6) million and $2 million in the second quarter and first six months of 2023, driven by the movement of interest rates.

White Mountains reported pre-tax loss related to BAM of $19 million and $40 million in the second quarter and first six months of 2024 compared to $20 million and $29 million in the second quarter and first six months of 2023. BAM’s results included net realized and unrealized investment gains (losses) of $(2) million and $(5) million in the second quarter and first six months of 2024 compared to $(4) million and $5 million in the second quarter and first six months of 2023, driven by the movement of interest rates.

BAM is a mutual insurance company that is owned by its members. BAM’s results are consolidated into White Mountains’s GAAP financial statements and attributed to noncontrolling interests.

Kudu

Kudu reported total revenues of $70 million, pre-tax income of $61 million and adjusted EBITDA of $12 million in the second quarter of 2024 compared to total revenues of $19 million, pre-tax income of $10 million and adjusted EBITDA of $12 million in the second quarter of 2023. Total revenues, pre-tax income and adjusted EBITDA included $16 million of net investment income in the second quarter of 2024 compared to $15 million in the second quarter of 2023. Total revenues and pre-tax income also included $55 million of net realized and unrealized investment gains in the second quarter of 2024 compared to $5 million in the second quarter of 2023.

Kudu reported total revenues of $81 million, pre-tax income of $63 million and adjusted EBITDA of $26 million in the first six months of 2024 compared to total revenues of $63 million, pre-tax income of $45 million and adjusted EBITDA of $23 million in the first six months of 2023. Total revenues, pre-tax income and adjusted EBITDA included $33 million of net investment income in the first six months of 2024 compared to $29 million in the first six months of 2023. Total revenues and pre-tax income also included $48 million of net realized and unrealized investment gains in the first six months of 2024 compared to $34 million in the first six months of 2023.

Rob Jakacki, CEO of Kudu, said, “We had a good quarter. Trailing 12 months adjusted EBITDA increased to $60 million, while the fair value of our continuing portfolio grew 7%. Kudu’s portfolio continues to perform well, and we have robust dry powder and deployment opportunities heading into the second half of 2024.”

Bamboo

Bamboo reported commission and fee revenues of $33 million and $55 million and pre-tax income of $6 million and $7 million for the second quarter and first six months of 2024. Bamboo reported MGA pre-tax income of $6 million and $7 million and MGA adjusted EBITDA of $12 million and $18 million for the second quarter and first six months of 2024.

Managed premiums, which represent the total premiums placed by Bamboo, were $120 million and $209 million for the second quarter and first six months of 2024 compared to $41 million and $69 million for the second quarter and first six months of 2023. The increase in managed premiums was driven primarily by growth in new business volume as well as a growing renewal book.

John Chu, CEO of Bamboo, said, “Bamboo delivered a strong second quarter, achieving new highs for managed premiums and earnings. Managed premiums tripled year-over-year to $120 million, and MGA Adjusted EBITDA increased to a record $12 million. Growth was driven by continued strong new business volume and an expanding renewal book. We see continuing opportunities to drive robust, profitable growth.”

MediaAlpha

On May 10, 2024, MediaAlpha completed a secondary offering of 7.6 million shares at $19.00 per share ($18.24 per share net of underwriting fees). In the secondary offering, White Mountains sold 5.0 million shares for net proceeds of $91 million. Following the completion of the offering, White Mountains owns 17.9 million shares of MediaAlpha, representing a 27% basic ownership interest (25% on a fully-diluted/fully-converted basis).

As of June 30, 2024, MediaAlpha’s share price was $13.17 per share, which decreased from $20.37 per share as of March 31, 2024. The carrying value of White Mountains’s investment in MediaAlpha was $235 million as of June 30, 2024 compared to $466 million at March 31, 2024. The $231 million decline in MediaAlpha’s carrying value resulted from $139 million of net realized and unrealized losses in the quarter and $91 million of net proceeds received from the secondary offering. At our current level of ownership, each $1.00 per share increase or decrease in the share price of MediaAlpha will result in an approximate $7.00 per share increase or decrease in White Mountains’s book value per share and adjusted book value per share. We encourage you to read MediaAlpha’s second quarter earnings release and related shareholder letter, which is available on MediaAlpha’s investor relations website at www.investors.mediaalpha.com.

Other Operations

White Mountains’s Other Operations reported pre-tax income (loss) of $(153) million and $49 million in the second quarter and first six months of 2024 compared to $(31) million and $82 million in the second quarter and first six months of 2023. Net realized and unrealized investment gains (losses) from White Mountains’s investment in MediaAlpha were $(139) million and $72 million in the second quarter and first six months of 2024 compared to $(77) million and $8 million in the second quarter and first six months of 2023. Excluding MediaAlpha, net realized and unrealized investment gains were $9 million and $31 million in the second quarter and first six months of 2024 compared to $76 million and $118 million in the second quarter and first six months of 2023. Net investment income was $8 million and $18 million in the second quarter and first six months of 2024 compared to $7 million and $14 million in the second quarter and first six months of 2023. White Mountains’s Other Operations reported general and administrative expenses of $43 million and $94 million in the second quarter and first six months of 2024 compared to $49 million and $89 million in the second quarter and first six months of 2023.

Investments

The total consolidated portfolio return was -0.1% in the second quarter of 2024. Excluding MediaAlpha, the total consolidated portfolio return was 2.2% in the second quarter of 2024. The total consolidated portfolio return was 0.9% in the second quarter of 2023. Excluding MediaAlpha, the total consolidated portfolio return was 3.0% in the second quarter of 2023.

The total consolidated portfolio return was 4.5% in the first six months of 2024. Excluding MediaAlpha, the total consolidated portfolio return was 3.5% in the first six months of 2024. The total consolidated portfolio return was 5.5% in the first six months of 2023. Excluding MediaAlpha, the total consolidated portfolio return was 6.1% in the first six months of 2023.

Mark Plourde, President of White Mountains Advisors, said, “Excluding MediaAlpha, the total portfolio was up 2.2% in the quarter, a good result on both an absolute and relative basis. Our short duration fixed income portfolio returned 1.0%, ahead of the BBIA Index return of 0.5%. The equity portfolio, excluding MediaAlpha, returned 3.9%, slightly behind the S&P 500 Index return of 4.3%.”

Share Repurchases

White Mountains did not repurchase any of its common shares in the second quarter of 2024. In the first six months of 2024, White Mountains repurchased and retired 5,269 of its common shares for $8 million at an average share price of $1,505.01, or 85% of White Mountains’s adjusted book value per share as of June 30, 2024.

In the second quarter of 2023, White Mountains repurchased and retired 5,542 of its common shares for $7 million at an average share price of $1,336.68, or 85% of White Mountains’s adjusted book value per share as of June 30, 2023. In the first six months of 2023, White Mountains repurchased and retired 24,165 of its common shares for $33 million at an average share price of $1,354.88, or 86% of White Mountains’s adjusted book value per share as of June 30, 2023.

Additional Information

White Mountains is a Bermuda-domiciled financial services holding company traded on the New York Stock Exchange under the symbol WTM and the Bermuda Stock Exchange under the symbol WTM.BH. Additional financial information and other items of interest are available at the Company’s website located at www.whitemountains.com. White Mountains expects to file its Form 10-Q today with the Securities and Exchange Commission and urges shareholders to refer to that document for more complete information concerning its financial results.

WHITE MOUNTAINS INSURANCE GROUP, LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 | | June 30, 2023 | | |

| Assets | | | | | | | | |

| P&C Insurance and Reinsurance (Ark/WM Outrigger) | | | | | | | | |

| Fixed maturity investments | | $ | 1,005.5 | | | $ | 866.8 | | | $ | 755.8 | | | |

| Common equity securities | | 422.3 | | | 400.6 | | | 382.6 | | | |

| Short-term investments | | 904.5 | | | 962.8 | | | 640.3 | | | |

| Other long-term investments | | 491.3 | | | 440.9 | | | 410.7 | | | |

| Total investments | | 2,823.6 | | | 2,671.1 | | | 2,189.4 | | | |

| Cash (restricted $3.6, $0.7, $2.1) | | 156.3 | | | 90.5 | | | 101.7 | | | |

| Reinsurance recoverables | | 863.8 | | | 442.0 | | | 669.7 | | | |

| Insurance premiums receivable | | 1,175.4 | | | 612.2 | | | 1,077.2 | | | |

| Deferred acquisition costs | | 245.3 | | | 145.3 | | | 232.1 | | | |

| | | | | | | | |

| Goodwill and other intangible assets | | 292.5 | | | 292.5 | | | 292.5 | | | |

| Other assets | | 147.0 | | | 125.0 | | | 69.4 | | | |

| Total P&C Insurance and Reinsurance assets | | 5,703.9 | | | 4,378.6 | | | 4,632.0 | | | |

| Financial Guarantee (HG Global/BAM) | | | | | | | | |

| Fixed maturity investments | | 1,039.4 | | | 1,012.3 | | | 932.9 | | | |

| Short-term investments | | 51.3 | | | 70.6 | | | 67.5 | | | |

| Total investments | | 1,090.7 | | | 1,082.9 | | | 1,000.4 | | | |

| Cash | | 5.0 | | | 6.7 | | | 2.9 | | | |

| Insurance premiums receivable | | 6.4 | | | 5.5 | | | 6.4 | | | |

| Deferred acquisition costs | | 41.7 | | | 40.1 | | | 37.4 | | | |

| | | | | | | | |

| Other assets | | 36.3 | | | 36.8 | | | 25.3 | | | |

| Total Financial Guarantee assets | | 1,180.1 | | | 1,172.0 | | | 1,072.4 | | | |

| Asset Management (Kudu) | | | | | | | | |

| Short-term investments | | 37.6 | | | 29.3 | | | 4.1 | | | |

| Other long-term investments | | 907.1 | | | 896.3 | | | 737.1 | | | |

| Total investments | | 944.7 | | | 925.6 | | | 741.2 | | | |

| Cash (restricted $0.0, $0.0, $13.4) | | 1.1 | | | 1.4 | | | 25.0 | | | |

| Accrued investment income | | 15.1 | | | 17.6 | | | 13.1 | | | |

| Goodwill and other intangible assets | | 8.1 | | | 8.3 | | | 8.4 | | | |

| Other assets | | 35.4 | | | 6.5 | | | 10.0 | | | |

| Total Asset Management assets | | 1,004.4 | | | 959.4 | | | 797.7 | | | |

| P&C Insurance Distribution (Bamboo) | | | | | | | | |

| Fixed maturity investments | | 33.2 | | | — | | | — | | | |

| Short-term investments | | 19.8 | | | — | | | — | | | |

| Total investments | | 53.0 | | | — | | | — | | | |

| Cash (restricted $60.5, $0.0, $0.0) | | 68.9 | | | — | | | — | | | |

| Premiums, commissions and fees receivable | | 58.0 | | | — | | | — | | | |

| Goodwill and other intangible assets | | 363.0 | | | — | | | — | | | |

| Other assets | | 18.8 | | | — | | | — | | | |

| Total P&C Insurance Distribution assets | | 561.7 | | | — | | | — | | | |

| Other Operations | | | | | | | | |

| Fixed maturity investments | | 266.7 | | | 230.2 | | | 252.0 | | | |

| Common equity securities | | 208.5 | | | 137.8 | | | 272.5 | | | |

| Investment in MediaAlpha | | 235.2 | | | 254.9 | | | 235.7 | | | |

| Short-term investments | | 192.3 | | | 425.2 | | | 274.2 | | | |

| Other long-term investments | | 624.0 | | | 661.0 | | | 667.2 | | | |

| Total investments | | 1,526.7 | | | 1,709.1 | | | 1,701.6 | | | |

| Cash | | 23.9 | | | 23.8 | | | 24.9 | | | |

| Insurance premiums receivable | | 21.7 | | | — | | | — | | | |

| Goodwill and other intangible assets | | 67.4 | | | 69.8 | | | 72.7 | | | |

| Other assets | | 77.1 | | | 73.2 | | | 75.0 | | | |

| Total Other Operations assets | | 1,716.8 | | | 1,875.9 | | | 1,874.2 | | | |

| Total assets | | $ | 10,166.9 | | | $ | 8,385.9 | | | $ | 8,376.3 | | | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS (CONTINUED)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 | | June 30, 2023 | | |

| Liabilities | | | | | | | | |

| P&C Insurance and Reinsurance (Ark/WM Outrigger) | | | | | | | | |

| Loss and loss adjustment expense reserves | | $ | 1,890.1 | | | $ | 1,605.1 | | | $ | 1,421.0 | | | |

| Unearned insurance premiums | | 1,526.1 | | | 743.6 | | | 1,376.5 | | | |

| Debt | | 155.0 | | | 185.5 | | | 185.1 | | | |

| Reinsurance payable | | 367.3 | | | 81.1 | | | 247.0 | | | |

| Contingent consideration | | 107.3 | | | 94.0 | | | 45.1 | | | |

| Other liabilities | | 157.2 | | | 166.8 | | | 116.6 | | | |

| Total P&C Insurance and Reinsurance liabilities | | 4,203.0 | | | 2,876.1 | | | 3,391.3 | | | |

| Financial Guarantee (HG Global/BAM) | | | | | | | | |

| Unearned insurance premiums | | 333.2 | | | 325.8 | | | 303.7 | | | |

| Debt | | 147.2 | | | 146.9 | | | 146.7 | | | |

| Accrued incentive compensation | | 17.3 | | | 27.2 | | | 14.7 | | | |

| Other liabilities | | 34.8 | | | 31.8 | | | 34.6 | | | |

| Total Financial Guarantee liabilities | | 532.5 | | | 531.7 | | | 499.7 | | | |

| Asset Management (Kudu) | | | | | | | | |

| Debt | | 203.3 | | | 203.8 | | | 203.7 | | | |

| Other liabilities | | 67.9 | | | 71.6 | | | 51.0 | | | |

| Total Asset Management liabilities | | 271.2 | | | 275.4 | | | 254.7 | | | |

| P&C Insurance Distribution (Bamboo) | | | | | | | | |

| Loss and loss adjustment expense reserves | | 16.6 | | | — | | | — | | | |

| Unearned insurance premiums | | 23.6 | | | — | | | — | | | |

| Premiums and commissions payable | | 78.8 | | | — | | | — | | | |

| Other liabilities | | 28.2 | | | — | | | — | | | |

| Total P&C Insurance Distribution liabilities | | 147.2 | | | — | | | — | | | |

| Other Operations | | | | | | | | |

| Loss and loss adjustment expense reserves | | 3.9 | | | — | | | — | | | |

| Unearned insurance premiums | | 22.6 | | | — | | | — | | | |

| Debt | | 24.7 | | | 28.4 | | | 30.6 | | | |

| Accrued incentive compensation | | 58.5 | | | 87.7 | | | 51.0 | | | |

| Other liabilities | | 31.1 | | | 25.0 | | | 23.1 | | | |

| Total Other Operations liabilities | | 140.8 | | | 141.1 | | | 104.7 | | | |

| Total liabilities | | 5,294.7 | | | 3,824.3 | | | 4,250.4 | | | |

| | | | | | | | |

| Equity | | | | | | | | |

| White Mountains’s common shareholder’s equity | | | | | | | | |

| White Mountains’s common shares and paid-in surplus | | 561.3 | | | 551.3 | | | 543.2 | | | |

| Retained earnings | | 3,863.1 | | | 3,690.8 | | | 3,380.7 | | | |

| Accumulated other comprehensive income (loss), after tax: | | | | | | | | |

| Net unrealized gains (losses) from foreign currency translation | | (1.8) | | | (1.6) | | | (1.7) | | | |

| Total White Mountains’s common shareholders’ equity | | 4,422.6 | | | 4,240.5 | | | 3,922.2 | | | |

| Noncontrolling interests | | 449.6 | | | 321.1 | | | 203.7 | | | |

| Total equity | | 4,872.2 | | | 4,561.6 | | | 4,125.9 | | | |

| Total liabilities and equity | | $ | 10,166.9 | | | $ | 8,385.9 | | | $ | 8,376.3 | | | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

BOOK VALUE AND ADJUSTED BOOK VALUE PER SHARE

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | June 30, 2023 |

| Book value per share numerators (in millions): | | | | | | | | |

White Mountains’s common shareholders’ equity -

GAAP book value per share numerator | $ | 4,422.6 | | | $ | 4,470.4 | | | $ | 4,240.5 | | | $ | 3,922.2 | |

| | | | | | | | |

| | | | | | | | |

HG Global’s unearned premium reserve (1) | | 271.7 | | | 267.7 | | | 265.4 | | | 246.8 | |

HG Global’s net deferred acquisition costs (1) | | (78.5) | | | (77.3) | | | (76.5) | | | (70.7) | |

Time value of money discount on expected future payments on the BAM surplus notes (1) | | (84.7) | | | (86.3) | | | (87.9) | | | (91.8) | |

| Adjusted book value per share numerator | | $ | 4,531.1 | | | $ | 4,574.5 | | | $ | 4,341.5 | | | $ | 4,006.5 | |

| Book value per share denominators (in thousands of shares): | | | | | | | | |

Common shares outstanding - GAAP book value per share

denominator | | 2,568.3 | | | 2,565.7 | | | 2,560.5 | | | 2,560.5 | |

| Unearned restricted common shares | | (18.3) | | | (20.3) | | | (12.4) | | | (19.1) | |

| | | | | | | | |

| Adjusted book value per share denominator | | 2,550.0 | | | 2,545.4 | | | 2,548.1 | | | 2,541.4 | |

| GAAP book value per share | | $ | 1,722.02 | | | $ | 1,742.33 | | | $ | 1,656.14 | | | $ | 1,531.84 | |

| Adjusted book value per share | | $ | 1,776.89 | | | $ | 1,797.17 | | | $ | 1,703.82 | | | $ | 1,576.46 | |

|

(1) Amount reflects White Mountains's preferred share ownership in HG Global of 96.9%. |

| | | | | | | | |

| | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | June 30, 2023 |

Quarter-to-date change in GAAP book value per share,

including dividends: | | (1.2) | % | | 5.3 | % | | 7.4 | % | | 0.7 | % |

Quarter-to-date change in adjusted book value per share,

including dividends: | | (1.1) | % | | 5.5 | % | | 7.3 | % | | 0.6 | % |

Year-to-date change in GAAP book value per share,

including dividends: | | 4.0 | % | | 5.3 | % | | 13.8 | % | | 5.2 | % |

Year-to-date change in adjusted book value per share,

including dividends: | | 4.3 | % | | 5.5 | % | | 14.0 | % | | 5.5 | % |

| Year-to-date dividends per share | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2024 | | 2023 | | 2024 | | 2023 | |

| Revenues: | | | | | | | | | |

| P&C Insurance and Reinsurance (Ark/WM Outrigger) | | | | | | | | | |

| Earned insurance premiums | | $ | 318.3 | | | $ | 293.3 | | | $ | 621.1 | | | $ | 548.4 | | |

| Net investment income | | 22.3 | | | 13.7 | | | 42.2 | | | 24.3 | | |

| Net realized and unrealized investment gains (losses) | | 20.3 | | | 18.0 | | | 30.9 | | | 42.5 | | |

| Other revenues | | 2.4 | | | (2.0) | | | 5.9 | | | (4.7) | | |

| Total P&C Insurance and Reinsurance revenues | | 363.3 | | | 323.0 | | | 700.1 | | | 610.5 | | |

| Financial Guarantee (HG Global/BAM) | | | | | | | | | |

| Earned insurance premiums | | 9.0 | | | 7.7 | | | 16.8 | | | 15.4 | | |

| Net investment income | | 10.4 | | | 7.6 | | | 20.1 | | | 14.8 | | |

| Net realized and unrealized investment gains (losses) | | (4.3) | | | (9.9) | | | (14.4) | | | 7.1 | | |

| Other revenues | | .6 | | | .5 | | | 1.1 | | | 1.3 | | |

| Total Financial Guarantee revenues | | 15.7 | | | 5.9 | | | 23.6 | | | 38.6 | | |

| Asset Management (Kudu) | | | | | | | | | |

| Net investment income | | 15.7 | | | 14.7 | | | 32.9 | | | 28.9 | | |

| Net realized and unrealized investment gains (losses) | | 54.5 | | | 4.6 | | | 48.0 | | | 34.2 | | |

| Total Asset Management revenues | | 70.2 | | | 19.3 | | | 80.9 | | | 63.1 | | |

| P&C Insurance Distribution (Bamboo) | | | | | | | | | |

| Commission and fee revenues | | 32.7 | | | — | | | 54.6 | | | — | | |

| Earned insurance premiums | | 8.0 | | | — | | | 16.4 | | | — | | |

| | | | | | | | | |

| | | | | | | | | |

| Other revenues | | 1.3 | | | — | | | 2.1 | | | — | | |

| Total P&C Insurance Distribution revenues | | 42.0 | | | — | | | 73.1 | | | — | | |

| Other Operations | | | | | | | | | |

| Earned insurance premiums | | 8.6 | | | — | | | 8.6 | | | — | | |

| Net investment income | | 8.4 | | | 7.0 | | | 18.3 | | | 14.0 | | |

| Net realized and unrealized investment gains (losses) | | 8.5 | | | 76.0 | | | 30.7 | | | 117.8 | | |

Net realized and unrealized investment gains (losses) from

investment in MediaAlpha | | (139.2) | | | (77.3) | | | 71.5 | | | 7.9 | | |

| Commission and fee revenues | | 3.4 | | | 3.2 | | | 7.0 | | | 6.5 | | |

| Other revenues | | 14.5 | | | 21.3 | | | 28.9 | | | 51.9 | | |

| Total Other Operations revenues | | (95.8) | | | 30.2 | | | 165.0 | | | 198.1 | | |

| Total revenues | | $ | 395.4 | | | $ | 378.4 | | | $ | 1,042.7 | | | $ | 910.3 | | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (CONTINUED)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | 2024 | | 2023 | | 2024 | | 2023 | |

| Expenses: | | | | | | | | | |

| P&C Insurance and Reinsurance (Ark/WM Outrigger) | | | | | | | | | |

| Loss and loss adjustment expenses | | $ | 175.7 | | | $ | 167.5 | | | $ | 355.7 | | | $ | 315.3 | | |

| Acquisition expenses | | 68.2 | | | 61.4 | | | 134.5 | | | 121.2 | | |

| General and administrative expenses | | 42.9 | | | 34.9 | | | 85.1 | | | 70.1 | | |

| Change in fair value of contingent consideration | | 13.3 | | | 2.2 | | | 13.3 | | | (.2) | | |

| Interest expense | | 4.7 | | | 5.2 | | | 10.1 | | | 10.2 | | |

| Total P&C Insurance and Reinsurance expenses | | 304.8 | | | 271.2 | | | 598.7 | | | 516.6 | | |

| Financial Guarantee (HG Global/BAM) | | | | | | | | | |

| Acquisition expenses | | 2.2 | | | 1.5 | | | 4.4 | | | 4.2 | | |

| General and administrative expenses | | 17.2 | | | 14.9 | | | 34.5 | | | 32.2 | | |

| Interest expense | | 4.1 | | | 2.5 | | | 7.6 | | | 7.0 | | |

| Total Financial Guarantee expenses | | 23.5 | | | 18.9 | | | 46.5 | | | 43.4 | | |

| Asset Management (Kudu) | | | | | | | | | |

| General and administrative expenses | | 3.5 | | | 4.0 | | | 6.9 | | | 7.8 | | |

| Interest expense | | 5.4 | | | 5.3 | | | 11.0 | | | 10.0 | | |

| Total Asset Management expenses | | 8.9 | | | 9.3 | | | 17.9 | | | 17.8 | | |

| P&C Insurance Distribution (Bamboo) | | | | | | | | | |

| Broker commission expenses | | 12.7 | | | — | | | 22.0 | | | — | | |

| Loss and loss adjustment expenses | | 4.3 | | | — | | | 10.1 | | | — | | |

| Acquisition expenses | | 2.9 | | | — | | | 6.0 | | | — | | |

| General and administrative expenses | | 15.7 | | | — | | | 27.7 | | | — | | |

| Total P&C Insurance Distribution expenses | | 35.6 | | | — | | | 65.8 | | | — | | |

| Other Operations | | | | | | | | | |

| Loss and loss adjustment expenses | | 3.9 | | | — | | | 3.9 | | | — | | |

| Acquisition expenses | | 2.6 | | | — | | | 2.6 | | | — | | |

| Cost of sales | | 7.0 | | | 11.6 | | | 14.6 | | | 25.5 | | |

| General and administrative expenses | | 43.2 | | | 48.8 | | | 93.5 | | | 88.5 | | |

| Interest expense | | .6 | | | 1.2 | | | 1.3 | | | 2.0 | | |

| Total Other Operations expenses | | 57.3 | | | 61.6 | | | 115.9 | | | 116.0 | | |

| Total expenses | | 430.1 | | | 361.0 | | | 844.8 | | | 693.8 | | |

| Pre-tax income (loss) | | (34.7) | | | 17.4 | | | 197.9 | | | 216.5 | | |

| Income tax (expense) benefit | | (6.5) | | | (.2) | | | (17.3) | | | (12.1) | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) | | (41.2) | | | 17.2 | | | 180.6 | | | 204.4 | | |

| Net (income) loss attributable to noncontrolling interests | | (13.4) | | | 2.4 | | | 1.2 | | | (5.3) | | |

Net income (loss) attributable to White Mountains’s

common shareholders | | $ | (54.6) | | | $ | 19.6 | | | $ | 181.8 | | | $ | 199.1 | | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) attributable to White Mountains’s

common shareholders | | $ | (54.6) | | | $ | 19.6 | | | $ | 181.8 | | | $ | 199.1 | |

| Other comprehensive income (loss), net of tax | | .1 | | | 1.4 | | | (.2) | | | 2.6 | |

| | | | | | | | |

| | | | | | | | |

| Comprehensive income (loss) | | (54.5) | | | 21.0 | | | 181.6 | | | 201.7 | |

Other comprehensive (income) loss attributable to

noncontrolling interests | | (.1) | | | (.4) | | | — | | | (.8) | |

Comprehensive income (loss) attributable to White Mountains’s

common shareholders | $ | (54.6) | | | $ | 20.6 | | | $ | 181.6 | | | $ | 200.9 | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

EARNINGS PER SHARE

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Earnings (loss) per share attributable to White Mountains’s

common shareholders | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Basic earnings (loss) per share | | | | | | | | |

| Continuing operations | | $ | (21.24) | | | $ | 7.65 | | | $ | 70.93 | | | $ | 77.57 | |

| Discontinued operations | | — | | | — | | | — | | | — | |

| Total consolidated operations | | $ | (21.24) | | | $ | 7.65 | | | $ | 70.93 | | | $ | 77.57 | |

| | | | | | | | |

| Diluted earnings (loss) per share | | | | | | | | |

| Continuing operations | | $ | (21.24) | | | $ | 7.65 | | | $ | 70.93 | | | $ | 77.57 | |

| Discontinued operations | | — | | | — | | | — | | | — | |

| Total consolidated operations | | $ | (21.24) | | | $ | 7.65 | | | $ | 70.93 | | | $ | 77.57 | |

| Dividends declared per White Mountains’s common share | | $ | — | | | $ | — | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

QTD SEGMENT STATEMENTS OF PRE-TAX INCOME (LOSS)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, 2024 | | Ark/WM Outrigger | | HG Global/BAM | | | | | | | | |

| | Ark | | WM Outrigger Re | | HG Global | | BAM | | Kudu | | Bamboo | | Other Operations | | Total |

| Revenues: | | | | | | | | | | | | | | | | |

| Earned insurance premiums | | $ | 310.8 | | | $ | 7.5 | | | $ | 7.5 | | | $ | 1.5 | | | $ | — | | | $ | 8.0 | | | $ | 8.6 | | | $ | 343.9 | |

Net investment income (1) | | 19.3 | | | 3.0 | | | 5.9 | | | 4.5 | | | 15.7 | | | .6 | | | 8.4 | | | 57.4 | |

Net investment income (expense) - BAM surplus note interest | | — | | | — | | | 6.6 | | | (6.6) | | | — | | | — | | | — | | | — | |

Net realized and unrealized investment gains (losses) (1) | | 20.3 | | | — | | | (2.0) | | | (2.3) | | | 54.5 | | | — | | | 8.5 | | | 79.0 | |

| Net realized and unrealized investment gains (losses) from investment in MediaAlpha | | — | | | — | | | — | | | — | | | — | | | — | | | (139.2) | | | (139.2) | |

| Commission and fee revenues | | — | | | — | | | — | | | — | | | — | | | 32.7 | | | 3.4 | | | 36.1 | |

| Other revenues | | 2.4 | | | — | | | — | | | .6 | | | — | | | .7 | | | 14.5 | | | 18.2 | |

| Total revenues | | 352.8 | | | 10.5 | | | 18.0 | | | (2.3) | | | 70.2 | | | 42.0 | | | (95.8) | | | 395.4 | |

| Expenses: | | | | | | | | | | | | | | | | |

| Loss and loss adjustment expenses | | 176.0 | | | (.3) | | | — | | | — | | | — | | | 4.3 | | | 3.9 | | | 183.9 | |

| Acquisition expenses | | 65.9 | | | 2.3 | | | 2.2 | | | — | | | — | | | 2.9 | | | 2.6 | | | 75.9 | |

| Cost of sales | | — | | | — | | | — | | | — | | | — | | | — | | | 7.0 | | | 7.0 | |

| Broker commission expenses | | — | | | — | | | — | | | — | | | — | | | 12.7 | | | — | | | 12.7 | |

| General and administrative expenses | | 42.8 | | | .1 | | | .6 | | | 16.6 | | | 3.5 | | | 15.7 | | | 43.2 | | | 122.5 | |

Change in fair value of contingent

consideration | | 13.3 | | | — | | | — | | | — | | | — | | | — | | | — | | | 13.3 | |

| Interest expense | | 4.7 | | | — | | | 4.1 | | | — | | | 5.4 | | | — | | | .6 | | | 14.8 | |

| Total expenses | | 302.7 | | | 2.1 | | | 6.9 | | | 16.6 | | | 8.9 | | | 35.6 | | | 57.3 | | | 430.1 | |

| Pre-tax income (loss) | | $ | 50.1 | | | $ | 8.4 | | | $ | 11.1 | | | $ | (18.9) | | | $ | 61.3 | | | $ | 6.4 | | | $ | (153.1) | | | $ | (34.7) | |

(1) Bamboo’s net investment income and net realized and unrealized investment gains (losses) are included in other revenues in the consolidated statement of operations.

WHITE MOUNTAINS INSURANCE GROUP, LTD.

QTD SEGMENT STATEMENTS OF PRE-TAX INCOME (LOSS) (CONTINUED)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, 2023 | | Ark/WM Outrigger | | HG Global/BAM | | | | | | |

| | Ark | | WM Outrigger Re | | HG Global | | BAM | | Kudu | | Other Operations | | Total |

| Revenues: | | | | | | | | | | | | | | |

| Earned insurance premiums | | $ | 283.7 | | | $ | 9.6 | | | $ | 6.4 | | | $ | 1.3 | | | $ | — | | | $ | — | | | $ | 301.0 | |

| Net investment income | | 11.2 | | | 2.5 | | | 4.1 | | | 3.5 | | | 14.7 | | | 7.0 | | | 43.0 | |

Net investment income (expense) - BAM surplus note interest | | — | | | — | | | 6.5 | | | (6.5) | | | — | | | — | | | — | |

Net realized and unrealized

investment gains (losses) | | 18.0 | | | — | | | (5.7) | | | (4.2) | | | 4.6 | | | 76.0 | | | 88.7 | |

Net realized and unrealized investment gains (losses) from investment in MediaAlpha | | — | | | — | | | — | | | — | | | — | | | (77.3) | | | (77.3) | |

| Commission and fee revenues | | — | | | — | | | — | | | — | | | — | | | 3.2 | | | 3.2 | |

| Other revenues | | (2.0) | | | — | | | — | | | .5 | | | — | | | 21.3 | | | 19.8 | |

| Total revenues | | 310.9 | | | 12.1 | | | 11.3 | | | (5.4) | | | 19.3 | | | 30.2 | | | 378.4 | |

| Expenses: | | | | | | | | | | | | | | |

| Loss and loss adjustment expenses | | 167.1 | | .4 | | | — | | | — | | | — | | | — | | | 167.5 | |

| Acquisition expenses | | 59.4 | | | 2.0 | | | 1.8 | | | (.3) | | | — | | | — | | | 62.9 | |

| Cost of sales | | — | | | — | | | — | | | — | | | — | | | 11.6 | | | 11.6 | |

| General and administrative expenses | | 34.9 | | | — | | | .3 | | | 14.6 | | | 4.0 | | | 48.8 | | | 102.6 | |

| Change in fair value of contingent consideration | | 2.2 | | | — | | | — | | | — | | | — | | | — | | | 2.2 | |

| Interest expense | | 5.2 | | | — | | | 2.5 | | | — | | | 5.3 | | | 1.2 | | | 14.2 | |

| Total expenses | | 268.8 | | | 2.4 | | | 4.6 | | | 14.3 | | | 9.3 | | | 61.6 | | | 361.0 | |

| Pre-tax income (loss) | | $ | 42.1 | | | $ | 9.7 | | | $ | 6.7 | | | $ | (19.7) | | | $ | 10.0 | | | $ | (31.4) | | | $ | 17.4 | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

YTD SEGMENT STATEMENTS OF PRE-TAX INCOME (LOSS)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Six Months Ended June 30, 2024 | | Ark/WM Outrigger | | HG Global/BAM | | | | | | | | |

| | Ark | | WM Outrigger Re | | HG Global | | BAM | | Kudu | | Bamboo | | Other Operations | | Total |

| Revenues: | | | | | | | | | | | | | | | | |

| Earned insurance premiums | | $ | 603.3 | | | $ | 17.8 | | | $ | 14.0 | | | $ | 2.8 | | | $ | — | | | $ | 16.4 | | | $ | 8.6 | | | $ | 662.9 | |

Net investment income (1) | | 36.3 | | | 5.9 | | | 11.3 | | | 8.8 | | | 32.9 | | | .9 | | | 18.3 | | | 114.4 | |

Net investment income (expense) - BAM surplus note interest | | — | | | — | | | 13.2 | | | (13.2) | | | — | | | — | | | — | | | — | |

Net realized and unrealized investment gains (losses) (1) | | 30.9 | | | — | | | (9.3) | | | (5.1) | | | 48.0 | | | (.1) | | | 30.7 | | | 95.1 | |

Net realized and unrealized investment gains

(losses) from investment in MediaAlpha | | — | | | — | | | — | | | — | | | — | | | — | | | 71.5 | | | 71.5 | |

| Commission and fee revenues | | — | | | — | | | — | | | — | | | — | | | 54.6 | | | 7.0 | | | 61.6 | |

| Other revenues | | 5.9 | | | — | | | — | | | 1.1 | | | — | | | 1.3 | | | 28.9 | | | 37.2 | |

| Total revenues | | 676.4 | | | 23.7 | | | 29.2 | | | (5.6) | | | 80.9 | | | 73.1 | | | 165.0 | | | 1,042.7 | |

| Expenses: | | | | | | | | | | | | | | | | |

| Loss and loss adjustment expenses | | 355.3 | | | .4 | | | — | | | — | | | — | | | 10.1 | | | 3.9 | | | 369.7 | |

| Acquisition expenses | | 129.6 | | | 4.9 | | | 4.0 | | | .4 | | | — | | | 6.0 | | | 2.6 | | | 147.5 | |

| Cost of sales | | — | | | — | | | — | | | — | | | — | | | — | | | 14.6 | | | 14.6 | |

| Broker commission expenses | | — | | | — | | | — | | | — | | | — | | | 22.0 | | | — | | | 22.0 | |

| General and administrative expenses | | 85.0 | | | .1 | | | 1.0 | | | 33.5 | | | 6.9 | | | 27.7 | | | 93.5 | | | 247.7 | |

Change in fair value of contingent

consideration | | 13.3 | | | — | | | — | | | — | | | — | | | — | | | — | | | 13.3 | |

| Interest expense | | 10.1 | | | — | | | 7.6 | | | — | | | 11.0 | | | — | | | 1.3 | | | 30.0 | |

| Total expenses | | 593.3 | | | 5.4 | | | 12.6 | | | 33.9 | | | 17.9 | | | 65.8 | | | 115.9 | | | 844.8 | |

| Pre-tax income (loss) | | $ | 83.1 | | | $ | 18.3 | | | $ | 16.6 | | | $ | (39.5) | | | $ | 63.0 | | | $ | 7.3 | | | $ | 49.1 | | | $ | 197.9 | |

(1) Bamboo’s net investment income and net realized and unrealized investment gains (losses) are included in other revenues in the consolidated statement of operations.

WHITE MOUNTAINS INSURANCE GROUP, LTD.

YTD SEGMENT STATEMENTS OF PRE-TAX INCOME (LOSS) (CONTINUED)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Six Months Ended June 30, 2023 | | Ark/WM Outrigger | | HG Global/BAM | | | | | | |

| | Ark | | WM Outrigger Re | | HG Global | | BAM | | Kudu | | Other Operations | | Total |

| Revenues: | | | | | | | | | | | | | | |

| Earned insurance premiums | | $ | 533.6 | | | $ | 14.8 | | | $ | 12.8 | | | $ | 2.6 | | | $ | — | | | $ | — | | | $ | 563.8 | |

| Net investment income | | 19.6 | | | 4.7 | | | 8.1 | | | 6.7 | | | 28.9 | | | 14.0 | | | 82.0 | |

Net investment income (expense) - BAM surplus note interest | | — | | | — | | | 13.1 | | | (13.1) | | | — | | | — | | | — | |

Net realized and unrealized investment gains

(losses) | | 42.5 | | | — | | | 2.2 | | | 4.9 | | | 34.2 | | | 117.8 | | | 201.6 | |

Net realized and unrealized investment gains

(losses) from investment in MediaAlpha | | — | | | — | | | — | | | — | | | — | | | 7.9 | | | 7.9 | |

| Commission and fee revenues | | — | | | — | | | — | | | — | | | — | | | 6.5 | | | 6.5 | |

| Other revenues | | (4.7) | | | — | | | — | | | 1.3 | | | — | | | 51.9 | | | 48.5 | |

| Total revenues | | 591.0 | | | 19.5 | | | 36.2 | | | 2.4 | | | 63.1 | | | 198.1 | | | 910.3 | |

| Expenses: | | | | | | | | | | | | | | |

| Loss and loss adjustment expenses | | 314.7 | | | .6 | | | — | | | — | | | — | | | — | | | 315.3 | |

| Acquisition expenses | | 118.3 | | | 2.9 | | | 3.6 | | | .6 | | | — | | | — | | | 125.4 | |

| Cost of sales | | — | | | — | | | — | | | — | | | — | | | 25.5 | | | 25.5 | |

| General and administrative expenses | | 70.0 | | | .1 | | | 1.4 | | | 30.8 | | | 7.8 | | | 88.5 | | | 198.6 | |

Change in fair value of contingent consideration | | (.2) | | | — | | | — | | | — | | | — | | | — | | | (.2) | |

| Interest expense | | 10.2 | | | — | | | 7.0 | | | — | | | 10.0 | | | 2.0 | | | 29.2 | |

| Total expenses | | 513.0 | | | 3.6 | | | 12.0 | | | 31.4 | | | 17.8 | | | 116.0 | | | 693.8 | |

| Pre-tax income (loss) | | $ | 78.0 | | | $ | 15.9 | | | $ | 24.2 | | | $ | (29.0) | | | $ | 45.3 | | | $ | 82.1 | | | $ | 216.5 | |

| | | | | | | | | | | | | | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

SELECTED FINANCIAL DATA

($ in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ark/WM Outrigger | | Three Months Ended June 30, 2024 |

| | Ark | | WM

Outrigger Re | | Elimination | | Total |

| Insurance premiums: | | | | | | | | |

| Gross written premiums | | $ | 697.0 | | | $ | 38.9 | | | $ | (38.9) | | | $ | 697.0 | |

| Net written premiums | | $ | 463.9 | | | $ | 38.9 | | | $ | — | | | $ | 502.8 | |

| Net earned premiums | | $ | 310.8 | | | $ | 7.5 | | | $ | — | | | $ | 318.3 | |

| | | | | | | | |

| Insurance expenses: | | | | | | | | |

| Loss and loss adjustment expenses | | $ | 176.0 | | | $ | (.3) | | | $ | — | | | $ | 175.7 | |

| Acquisition expenses | | 65.9 | | | 2.3 | | | — | | | 68.2 | |

Other underwriting expenses (1) | | 33.1 | | | — | | | — | | | 33.1 | |

| Total insurance expenses | | $ | 275.0 | | | $ | 2.0 | | | $ | — | | | $ | 277.0 | |

| | | | | | | | |

| Insurance ratios: | | | | | | | | |

| Loss and loss adjustment expense | | 56.6 | % | | (4.0) | % | | — | % | | 55.2 | % |

| Acquisition expense | | 21.2 | | | 30.7 | | | — | | | 21.4 | |

| Other underwriting expense | | 10.7 | | | — | | | — | | | 10.4 | |

| Combined Ratio | | 88.5 | % | | 26.7 | % | | — | % | | 87.0 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) Included within general and administrative expenses in the consolidated statement of operations.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ark/WM Outrigger | | Three Months Ended June 30, 2023 |

| | Ark | | WM

Outrigger Re | | Elimination | | Total |

| Insurance premiums: | | | | | | | | |

| Gross written premiums | | $ | 606.1 | | | $ | 58.3 | | | $ | (58.3) | | | $ | 606.1 | |

| Net written premiums | | $ | 402.9 | | | $ | 58.3 | | | $ | — | | | $ | 461.2 | |

| Net earned premiums | | $ | 283.7 | | | $ | 9.6 | | | $ | — | | | $ | 293.3 | |

| | | | | | | | |

| Insurance expenses: | | | | | | | | |

| Loss and loss adjustment expenses | | $ | 167.1 | | | $ | .4 | | | $ | — | | | $ | 167.5 | |

| Acquisition expenses | | 59.4 | | | 2.0 | | | — | | | 61.4 | |

Other underwriting expenses (1) | | 25.5 | | | — | | | — | | | 25.5 | |

| Total insurance expenses | | $ | 252.0 | | | $ | 2.4 | | | $ | — | | | $ | 254.4 | |

| | | | | | | | |

| Insurance ratios: | | | | | | | | |

| Loss and loss adjustment expense | | 58.9 | % | | 4.2 | % | | — | % | | 57.1 | % |

| Acquisition expense | | 20.9 | | | 20.8 | | | — | | | 20.9 | |

| Other underwriting expense | | 9.0 | | | — | | | — | | | 8.7 | |

| Combined Ratio | | 88.8 | % | | 25.0 | % | | — | % | | 86.7 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) Included within general and administrative expenses in the consolidated statement of operations.

WHITE MOUNTAINS INSURANCE GROUP, LTD.

SELECTED FINANCIAL DATA (CONTINUED)

($ in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ark/WM Outrigger | | Six Months Ended June 30, 2024 |

| | Ark | | WM

Outrigger Re | | Elimination | | Total |

| Insurance premiums: | | | | | | | | |

| Gross written premiums | | $ | 1,569.1 | | | $ | 73.2 | | | $ | (73.2) | | | $ | 1,569.1 | |

| Net written premiums | | $ | 1,027.6 | | | $ | 73.2 | | | $ | — | | | $ | 1,100.8 | |

| Net earned premiums | | $ | 603.3 | | | $ | 17.8 | | | $ | — | | | $ | 621.1 | |

| | | | | | | | |

| Insurance expenses: | | | | | | | | |

| Loss and loss adjustment expenses | | $ | 355.3 | | | $ | .4 | | | $ | — | | | $ | 355.7 | |

| Acquisition expenses | | 129.6 | | | 4.9 | | | — | | | 134.5 | |

Other underwriting expenses (1) | | 63.6 | | | — | | | — | | | 63.6 | |

| Total insurance expenses | | $ | 548.5 | | | $ | 5.3 | | | $ | — | | | $ | 553.8 | |

| | | | | | | | |

| Insurance ratios: | | | | | | | | |

| Loss and loss adjustment expense | | 58.9 | % | | 2.3 | % | | — | % | | 57.3 | % |

| Acquisition expense | | 21.5 | | | 27.5 | | | — | | | 21.7 | |

| Other underwriting expense | | 10.5 | | | — | | | — | | | 10.2 | |

| Combined Ratio | | 90.9 | % | | 29.8 | % | | — | % | | 89.2 | % |

(1) Included within general and administrative expenses in the consolidated statement of operations.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ark/WM Outrigger | | Six Months Ended June 30, 2023 |

| | Ark | | WM

Outrigger Re | | Elimination | | Total |

| Insurance premiums: | | | | | | | | |

| Gross written premiums | | $ | 1,415.5 | | | $ | 102.4 | | | $ | (102.4) | | | $ | 1,415.5 | |

| Net written premiums | | $ | 973.0 | | | $ | 102.4 | | | $ | — | | | $ | 1,075.4 | |

| Net earned premiums | | $ | 533.6 | | | $ | 14.8 | | | $ | — | | | $ | 548.4 | |

| | | | | | | | |

| Insurance expenses: | | | | | | | | |

| Loss and loss adjustment expenses | | $ | 314.7 | | | $ | .6 | | | $ | — | | | $ | 315.3 | |

| Acquisition expenses | | 118.3 | | | 2.9 | | | — | | | 121.2 | |

Other underwriting expenses (1) | | 53.0 | | | — | | | — | | | 53.0 | |

| Total insurance expenses | | $ | 486.0 | | | $ | 3.5 | | | $ | — | | | $ | 489.5 | |

| | | | | | | | |

| Insurance ratios: | | | | | | | | |

| Loss and loss adjustment expense | | 59.0 | % | | 4.1 | % | | — | % | | 57.5 | % |

| Acquisition expense | | 22.2 | | | 19.6 | | | — | | | 22.1 | |

| Other underwriting expense | | 9.9 | | | — | | | — | | | 9.7 | |

| Combined Ratio | | 91.1 | % | | 23.7 | % | | — | % | | 89.3 | % |

(1) Included within general and administrative expenses in the consolidated statement of operations.

WHITE MOUNTAINS INSURANCE GROUP, LTD.

SELECTED FINANCIAL DATA (CONTINUED)

($ in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| BAM | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Gross par value of primary market policies issued | | $ | 4,656.8 | | | $ | 2,890.2 | | | $ | 7,866.1 | | | $ | 5,075.6 | |

| Gross par value of secondary market policies issued | | 602.6 | | | 500.3 | | | 965.6 | | | 1,204.5 | |

| | | | | | | | |

| Total gross par value of market policies issued | | $ | 5,259.4 | | | $ | 3,390.5 | | | $ | 8,831.7 | | | $ | 6,280.1 | |

| Gross written premiums | | $ | 13.6 | | | $ | 11.6 | | | $ | 24.1 | | | $ | 20.8 | |

MSC collected | | 14.6 | | | 14.7 | | | 26.0 | | | 26.5 | |

| Total gross written premiums and MSC collected | | $ | 28.2 | | | $ | 26.3 | | | $ | 50.1 | | | $ | 47.3 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total pricing | | 54 bps | | 77 bps | | 57 bps | | 75 bps |

| | | | | | | | | | | | | | | | | | | | | | | | |

| BAM | | As of

June 30, 2024 | | | | As of

December 31, 2023 | | As of

June 30, 2023 | | |

| Policyholders’ surplus | | $ | 253.3 | | | | | $ | 269.3 | | | $ | 281.5 | | | |

| Contingency reserve | | 145.8 | | | | | 136.2 | | | 126.9 | | | |

| Qualified statutory capital | | 399.1 | | | | | 405.5 | | | 408.4 | | | |

| Statutory net unearned premiums | | 62.1 | | | | | 60.7 | | | 56.9 | | | |

| Present value of future installment premiums and MSC | | 12.6 | | | | | 10.9 | | | 12.5 | | | |

| HG Re, Ltd collateral trusts at statutory value | | 651.0 | | | | | 623.5 | | | 573.4 | | | |

| Fidus Re, Ltd collateral trust at statutory value | | 400.0 | | | | | 400.0 | | | 400.0 | | | |

| Claims paying resources | | $ | 1,524.8 | | | | | $ | 1,500.6 | | | $ | 1,451.2 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| HG Global | | 2024 | | 2023 | | 2024 | | 2023 |

| Net written premiums | | $ | 11.6 | | | $ | 10.0 | | | $ | 20.5 | | | $ | 17.7 | |

| Earned premiums | | $ | 7.5 | | | $ | 6.4 | | | $ | 14.0 | | | $ | 12.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HG Global | | As of

June 30, 2024 | | | | | | | | As of

December 31, 2023 | | As of

June 30, 2023 | | | |

| Unearned premiums | | $ | 280.4 | | | | | | | | | $ | 273.9 | | | $ | 254.7 | | | | |

| Deferred acquisition costs | | $ | 81.0 | | | | | | | | | $ | 79.0 | | | $ | 72.9 | | | | |

| | | | | | | | | | | | | | | |

WHITE MOUNTAINS INSURANCE GROUP, LTD.

SELECTED FINANCIAL DATA (CONTINUED)

($ in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kudu | | Three Months Ended June 30, 2023 | | Three Months Ended June 30, 2024 | | Six Months Ended June 30, 2023 | | Six Months Ended June 30, 2024 | | | | Twelve Months Ended June 30, 2024 | | |

Net investment income (1) | | $ | 14.7 | | | $ | 15.7 | | | $ | 28.9 | | | $ | 32.9 | | | | | $ | 75.0 | | | |

| Net realized and unrealized investment gains (losses) | | 4.6 | | | 54.5 | | | 34.2 | | | 48.0 | | | | | 119.9 | | | |

| | | | | | | | | | | | | | |

| Total revenues | | 19.3 | | | 70.2 | | | 63.1 | | | 80.9 | | | | | 194.9 | | | |

| General and administrative expenses | | 4.0 | | | 3.5 | | | 7.8 | | | 6.9 | | | | | 18.5 | | | |

| Interest expense | | 5.3 | | | 5.4 | | | 10.0 | | | 11.0 | | | | | 22.2 | | | |

| Total expenses | | 9.3 | | | 8.9 | | | 17.8 | | | 17.9 | | | | | 40.7 | | | |

| GAAP pre-tax income (loss) | | 10.0 | | | 61.3 | | | 45.3 | | | 63.0 | | | | | 154.2 | | | |

| Income tax (expense) benefit | | (1.8) | | | (9.9) | | | (9.3) | | | (9.1) | | | | | (31.7) | | | |

| GAAP net income (loss) | | 8.2 | | | 51.4 | | | 36.0 | | | 53.9 | | | | | 122.5 | | | |

| | | | | | | | | | | | | | |

| Add back: | | | | | | | | | | | | | | |

| Interest expense | | 5.3 | | | 5.4 | | | 10.0 | | | 11.0 | | | | | 22.2 | | | |

| Income tax expense (benefit) | | 1.8 | | | 9.9 | | | 9.3 | | | 9.1 | | | | | 31.7 | | | |

| Depreciation expense | | — | | | — | | | — | | | — | | | | | .1 | | | |

| Amortization of other intangible assets | | .2 | | | .1 | | | .2 | | | .2 | | | | | .3 | | | |

| EBITDA | | 15.5 | | | 66.8 | | | 55.5 | | | 74.2 | | | | | 176.8 | | | |

| | | | | | | | | | | | | | |

| Exclude: | | | | | | | | | | | | | | |

| Net realized and unrealized investment (gains) losses | | (4.6) | | | (54.5) | | | (34.2) | | | (48.0) | | | | | (119.9) | | | |

| Non-cash equity-based compensation expense | | — | | | — | | | — | | | — | | | | | 1.0 | | | |

| Transaction expenses | | .8 | | | .1 | | | 1.3 | | | .1 | | | | | 2.3 | | | |

| Adjusted EBITDA | | $ | 11.7 | | | $ | 12.4 | | | $ | 22.6 | | | $ | 26.3 | | | | | $ | 60.2 | | | |

| | | | | | | | | | | | | | |

| Adjustment to annualize partial year revenues from participation contracts acquired | 2.8 | | |

| Adjustment to remove partial year revenues from participation contracts sold | | (1.7) | | |

| Annualized adjusted EBITDA | | | | | | | | | | | | $ | 61.3 | | |

| | | | | | | | | | | | | | |

GAAP net investment income (1) | | | | | | | | | | | | $ | 75.0 | | |

| Adjustment to annualize partial year revenues from participation contracts acquired | 2.8 | | |

| Adjustment to remove partial year revenues from participation contracts sold | | (1.7) | | |

| Annualized revenue | | | | | | | | | | | | $ | 76.1 | | |

| | | | | | | | | | | | | | |

| Net equity capital drawn | | | | | | | | | | | | $ | 365.8 | | |

| Debt capital drawn | | | | | | | | | | | | 210.3 | | |

Total net capital drawn and invested (2) | | | | | | | | | | | | $ | 576.1 | | |

| | | | | | | | | | | | | | |

| GAAP net investment income revenue yield | | | | | | | | | | | | 13.0% | | |

| | | | | | | | | | | | | | |

| Cash revenue yield | | | | | | | | | | | | 13.2% | | |

| | | | | | | | | | | | | | |

(1) Net investment income includes revenues from participation contracts and income from short-term and other long-term investments.

(2) Total net capital drawn represents equity and debt capital drawn and invested less cumulative distributions.

WHITE MOUNTAINS INSURANCE GROUP, LTD.

SELECTED FINANCIAL DATA (CONTINUED)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | | |

| Kudu | | 2024 | | 2023 | | 2024 | | 2023 | | |

Beginning balance of Kudu’s participation contracts (1) | | $ | 884.2 | | | $ | 683.2 | | | $ | 890.5 | | | $ | 695.9 | | | |

Contributions to participation contracts (2) | | .2 | | | 50.7 | | | .2 | | | 117.4 | | | |

Proceeds from participation contracts sold (2)(3) | | (37.5) | | | (1.4) | | | (37.5) | | | (110.4) | | | |

Net realized and unrealized investment gains (losses) on participation contracts sold and pending sale (4) | | (3.2) | | | .9 | | | (6.3) | | | (1.2) | | | |

Net unrealized investment gains (losses) on participation contracts - all other (5) | | 57.6 | | | 3.7 | | | 54.4 | | | 35.4 | | | |

| | | | | | | | | | |

Ending balance of Kudu’s participation contracts (1) | | $ | 901.3 | | | $ | 737.1 | | | $ | 901.3 | | | $ | 737.1 | | | |

(1) As of January 1, 2024 and June 30, 2024, Kudu’s other long-term investments also includes $5.8 related to a private debt instrument.

(2) Includes $35.8 of non-cash contributions to (proceeds from) participation contracts for the six months ended June 30, 2023.

(3) Includes $28.1 of proceeds receivable from participation contracts sold during the three and six months ended June 30, 2024.

(4) Includes realized and unrealized investment gains (losses) recognized from participation contracts beginning in the quarter a contract is classified as pending sale.

(5) Includes unrealized investment gains (losses) recognized from (i) ongoing participation contracts and (ii) participation contracts prior to classification as pending sale.

WHITE MOUNTAINS INSURANCE GROUP, LTD.

SELECTED FINANCIAL DATA (CONTINUED)

(millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| Bamboo | | Three Months Ended June 30, 2024 | | | | Six Months Ended June 30, 2024 | | |

| Commission and fee revenues | | $ | 32.7 | | | | | $ | 54.6 | | | |

| Earned insurance premiums | | 8.0 | | | | | 16.4 | | | |

| | | | | | | | |

| | | | | | | | |

| Other revenues | | 1.3 | | | | | 2.1 | | | |

| Total revenues | | 42.0 | | | | | 73.1 | | | |

| Broker commission expenses | | 12.7 | | | | | 22.0 | | | |

| Loss and loss adjustment expenses | | 4.3 | | | | | 10.1 | | | |

| Acquisition expenses | | 2.9 | | | | | 6.0 | | | |

| General and administrative expenses | | 15.7 | | | | | 27.7 | | | |

| Total expenses | | 35.6 | | | | | 65.8 | | | |

| GAAP pre-tax income (loss) | | 6.4 | | | | | 7.3 | | | |

| Income tax (expense) benefit | | (2.2) | | | | | (1.5) | | | |

| GAAP net income (loss) | | 4.2 | | | | | 5.8 | | | |

| | | | | | | | |

| Exclude: | | | | | | | | |

| Net (income) loss, Bamboo Captive | | (.4) | | | | | — | | | |

| MGA net income (loss) | | 3.8 | | | | | 5.8 | | | |

| | | | | | | | |

| Add back: | | | | | | | | |

| | | | | | | | |

| Income tax expense (benefit) | | 2.2 | | | | | 1.5 | | | |

| | | | | | | | |

| Amortization of other intangible assets | | 4.3 | | | | | 8.5 | | | |

| MGA EBITDA | | 10.3 | | | | | 15.8 | | | |

| | | | | | | | |

| Exclude: | | | | | | | | |

| | | | | | | | |

| Non-cash equity-based compensation expense | | .3 | | | | | .6 | | | |

| Software implementation expenses | | .4 | | | | | .9 | | | |

| Restructuring expenses | | .5 | | | | | .6 | | | |

| | | | | | | | |

| MGA adjusted EBITDA | | $ | 11.5 | | | | | $ | 17.9 | | | |

Regulation G

This earnings release includes non-GAAP financial measures that have been reconciled from their most comparable GAAP financial measures.

•Adjusted book value per share is a non-GAAP financial measure which is derived by adjusting (i) the GAAP book value per share numerator and (ii) the common shares outstanding denominator, as described below.

The GAAP book value per share numerator is adjusted (i) to add back the unearned premium reserve, net of deferred acquisition costs, at HG Global and (ii) to include a discount for the time value of money arising from the modeled timing of cash payments of principal and interest on the BAM surplus notes.

The value of HG Global’s unearned premium reserve, net of deferred acquisition costs, was $199 million, $196 million, $195 million and $182 million as of June 30, 2024, March 31, 2024, December 31, 2023 and June 30, 2023, respectively.

Under GAAP, White Mountains is required to carry the BAM surplus notes, including accrued interest, at nominal value with no consideration for time value of money. Based on a debt service model that forecasts operating results for BAM through maturity of the surplus notes, the present value of the BAM surplus notes, including accrued interest and using an 8% discount rate, was estimated to be $87 million, $89 million, $91 million and $95 million less than the nominal GAAP carrying values as of June 30, 2024, March 31, 2024, December 31, 2023 and June 30, 2023, respectively.

White Mountains believes these adjustments are useful to management and investors in analyzing the intrinsic value of HG Global, including the value of the in-force business at HG Re, HG Global’s reinsurance subsidiary, and the value of the BAM surplus notes.

The denominator used in the calculation of adjusted book value per share equals the number of common shares outstanding adjusted to exclude unearned restricted common shares, the compensation cost of which, at the date of calculation, has yet to be amortized. Restricted common shares are earned on a straight-line basis over their vesting periods. The reconciliation of GAAP book value per share to adjusted book value per share is included on page 8.

•The growth in adjusted book value per share excluding net realized and unrealized investment losses from White Mountains’s investment in MediaAlpha on page 1 is a non-GAAP financial measure. White Mountains believes this measure to be useful to management and investors by showing the underlying performance of White Mountains without regard to the impact of changes in MediaAlpha’s share price. A reconciliation from GAAP to the reported percentages is as follows:

| | | | | | | | | | |

| | | | Three Months Ended June 30, 2024 |

Growth in GAAP book value per share | | | | (1.2)% |

Adjustments to book value per share (see reconciliation on page 8) | | | | 0.1% |

Remove net realized and unrealized investment losses from White Mountains’s investment in MediaAlpha | | | | 3.0% |

Growth in adjusted book value per share excluding net realized and unrealized investment losses from White Mountains’s investment in MediaAlpha | | | | 1.9% |

•Kudu’s EBITDA, adjusted EBITDA, annualized adjusted EBITDA, annualized revenue and cash revenue yield are non-GAAP financial measures.

EBITDA is a non-GAAP financial measure that adds back interest expense on debt, income tax (expense) benefit, depreciation and amortization of other intangible assets to GAAP net income (loss).

Adjusted EBITDA is a non-GAAP financial measure that excludes certain other items in GAAP net income (loss) in addition to those added back to calculate EBITDA. The items relate to (i) net realized and unrealized investment gains (losses) on Kudu’s revenue and earnings participation contracts, (ii) non-cash equity-based compensation expense and (iii) transaction expenses. A description of each item follows: