United States Steel Corporation (NYSE: X) today provided third

quarter 2024 adjusted net earnings per diluted share guidance of

$0.44 to $0.48. Third quarter 2024 adjusted EBITDA is expected to

be approximately $300 million.

Commenting on third quarter guidance, President and Chief

Executive Officer David B. Burritt said, “Adjusted EBITDA guidance

of $300 million is in-line with our prior third quarter outlook and

reflects resilient domestic flat-rolled steel demand amid a

bottoming steel pricing environment. Challenging pricing dynamics

are being offset in part by the benefits of our balanced and

diverse order books in the North American Flat-Rolled segment. In

Europe, we are experiencing a softening demand environment,

resulting in Blast Furnace #1 remaining temporarily idled following

a planned 30-day outage as customer demand continues to be tepid.

The Tubular segment continues to face pressure from a weak pricing

environment.”

Commenting on the Company’s strategic initiatives, Burritt

continued, “We are approaching the planned start-up of Big River 2

in the fourth quarter of 2024. For the third quarter result, we

expect approximately $40 million of related start-up and one-time

construction costs, which are included in our third quarter

adjusted EBITDA guidance for the Mini Mill segment. Meanwhile, we

are steadily advancing the ramp-up and delivery of products from

our non-grain oriented (NGO) electrical steel line and the new dual

Galvalume® / Galvanized (CGL2) coating line. We look forward to the

completion of approximately $4 billion of capital investments

designed to generate stakeholder value by providing the sustainable

steels our customers demand, and the beginning of a more resilient

and higher free cash flow generative future at U. S. Steel.”

Burritt concluded, “We continue to progress through the U.S.

regulatory reviews of the pending transaction with Nippon Steel,

and are confident in our ability to achieve these approvals. We

continue to work towards closing the transaction by the end of the

year. Earlier this quarter, Nippon Steel disclosed further

information about its intended post-closing governance structure

and additional investment commitments of at least $1 billion to

modernize the hot strip mill and other facilities at Mon Valley

Works and approximately $300 million to revamp Blast Furnace #14 at

Gary Works. We are heartened by the outpouring of support from our

employees and communities who see their futures benefitting from

the transaction and maintain the view that this deal is the BEST

deal for American steel, and steel communities.”

Third Quarter Adjusted EBITDA Commentary

The Flat-Rolled segment’s adjusted EBITDA is expected to be

lower than the second quarter as a result of softer selling prices.

However, a diverse commercial portfolio and strong focus on

operations and costs continue to drive resilient financial

performance.

The Mini Mill segment’s adjusted EBITDA is expected to be lower

than the second quarter. Average selling prices are expected to be

sequentially lower, reflecting the segment’s market-based monthly

contract and spot price exposure. Pricing headwinds are expected to

be partially offset by lower metallics costs. Separately, as

mentioned above, approximately $40 million of anticipated start-up

and one-time construction costs are included in the segment's

adjusted results. These costs largely reflect the new Big River 2

mini mill, expected to start-up in the fourth quarter of 2024.

The European segment’s adjusted EBITDA is expected to be higher

than the second quarter, despite the challenging market

environment, largely due to a favorable adjustment for CO2

allowances.

The Tubular segment’s adjusted EBITDA is expected to be lower

than the second quarter, primarily due to lower selling prices.

UNITED STATES STEEL

CORPORATION

NON-GAAP FINANCIAL MEASURES

RECONCILIATION OF ADJUSTED EBITDA

GUIDANCE

(Dollars in millions)

Reconciliation to Projected Adjusted

EBITDA Included in Guidance

Q3 2024

Projected net earnings attributable to

United States Steel Corporation included in guidance

$

90

Estimated income tax provision

(5)

Estimated net interest and other financial

costs (income)

(55)

Estimated depreciation, depletion, and

amortization

230

Projected EBITDA included in guidance

$

260

Estimated adjustments

40

Projected adjusted EBITDA included in

guidance

$

300

UNITED STATES STEEL

CORPORATION

NON-GAAP FINANCIAL MEASURES

RECONCILIATION OF ADJUSTED NET

EARNINGS GUIDANCE

(Dollars in millions, except per share

amounts)

Reconciliation to Projected Adjusted Net Earnings Attributable

to U. S. Steel Included in Guidance

Q3 2024

Projected net earnings attributable to United States Steel

Corporation included in guidance

$

90

Estimated adjustments

25

Projected adjusted net earnings attributable to United States Steel

Corporation included in guidance

$

115

Reconciliation to Projected Adjusted

Net Earnings Per Diluted Share Included in Guidance Q3 2024

Q3 2024

Projected net earnings per diluted share

included in guidance (mid-point of guidance)

$

0.36

Estimated adjustments

0.10

Projected adjusted net earnings per

diluted share included in guidance (mid-point of guidance)

$

0.46

Note: This reconciliation excludes the impact of the Company’s

quarterly adjustment related to the surplus VEBA assets. See Note

18 in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, for an explanation of the surplus VEBA assets.

This excluded item is not expected to impact adjusted EBITDA.

Cautionary Note Regarding Forward-Looking Statements

This press release contains information regarding the Company

that may constitute “forward-looking statements,” as that term is

defined under the Private Securities Litigation Reform Act of 1995

and other securities laws, that are subject to risks and

uncertainties. We intend the forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements in those sections. Generally, we have identified such

forward-looking statements by using the words “believe,” “expect,”

“intend,” “estimate,” “anticipate,” “project,” “target,”

“forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,”

“may” and similar expressions or by using future dates in

connection with any discussion of, among other things, statements

expressing general views about future operating or financial

results, operating or financial performance, trends, events or

developments that we expect or anticipate will occur in the future,

anticipated cost savings, potential capital and operational cash

improvements and changes in the global economic environment,

anticipated capital expenditures, the construction or operation of

new or existing facilities or capabilities and the costs associated

with such matters, statements regarding our greenhouse gas

emissions reduction goals, as well as statements regarding the

proposed transaction between the Company and Nippon Steel

Corporation. However, the absence of these words or similar

expressions does not mean that a statement is not forward-looking.

Forward-looking statements include all statements that are not

historical facts, but instead represent only the Company’s beliefs

regarding future goals, plans and expectations about our prospects

for the future and other events, many of which, by their nature,

are inherently uncertain and outside of the Company’s control. It

is possible that the Company’s actual results and financial

condition may differ, possibly materially, from the anticipated

results and financial condition indicated in these forward-looking

statements. Management of the Company believes that these

forward-looking statements are reasonable as of the time made.

However, caution should be taken not to place undue reliance on any

such forward-looking statements because such statements speak only

as of the date when made. In addition, forward looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ materially from the Company’s historical

experience and our present expectations or projections. Risks and

uncertainties include without limitation: the ability of the

parties to consummate the proposed transaction between the Company

and Nippon Steel Corporation, on a timely basis or at all; the

timing, receipt and terms and conditions of any required

governmental and regulatory approvals of the proposed transaction;

the occurrence of any event, change or other circumstances that

could give rise to the termination of the definitive agreement and

plan of merger relating to the proposed transaction (the “Merger

Agreement”); the risk that the parties to the Merger Agreement may

not be able to satisfy the conditions to the proposed transaction

in a timely manner or at all; risks related to disruption of

management time from ongoing business operations due to the

proposed transaction; certain restrictions during the pendency of

the proposed transaction that may impact the Company’s ability to

pursue certain business opportunities or strategic transactions;

the risk that any announcements relating to the proposed

transaction could have adverse effects on the market price of the

Company’s common stock; the risk of any unexpected costs or

expenses resulting from the proposed transaction; the risk of any

litigation relating to the proposed transaction; the risk that the

proposed transaction and its announcement could have an adverse

effect on the ability of the Company to retain customers and retain

and hire key personnel and maintain relationships with customers,

suppliers, employees, stockholders and other business relationships

and on its operating results and business generally; and the risk

the pending proposed transaction could distract management of the

Company. The Company directs readers to its Form 10-K for the year

ended December 31, 2023 and Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024, and the other documents it files with

the SEC for other risks associated with the Company’s future

performance. These documents contain and identify important factors

that could cause actual results to differ materially from those

contained in the forward-looking statements. All information in

this press release is as of the date above. The Company does not

undertake any duty to update any forward-looking statement to

conform the statement to actual results or changes in the Company’s

expectations whether as a result of new information, future events

or otherwise, except as required by law.

Note Regarding Non-GAAP Financial Measures

We present adjusted net earnings, adjusted net earnings per

diluted share, earnings before interest, income taxes, depreciation

and amortization (EBITDA) and adjusted EBITDA, which are non-GAAP

measures, as additional measurements to enhance the understanding

of our operating performance. We believe that EBITDA, considered

along with net earnings, is a relevant indicator of trends relating

to our operating performance and provides management and investors

with additional information for comparison of our operating results

to the operating results of other companies.

Adjusted net earnings, adjusted net earnings per diluted share

and adjusted EBITDA are non-GAAP measures that exclude certain

charges that are not part of the Company’s core operations such as

restructuring or asset impairments (Adjustment Items). We present

adjusted net earnings, adjusted net earnings per diluted share and

adjusted EBITDA to enhance the understanding of our ongoing

operating performance and established trends affecting our core

operations by excluding the effects of events that can obscure

underlying trends. U. S. Steel’s management considers adjusted net

earnings, adjusted net earnings per diluted share and adjusted

EBITDA as alternative measures of operating performance and not

alternative measures of the Company’s liquidity and believes these

measures are useful to investors by facilitating a comparison of

our operating performance to the operating performance of our

competitors. Additionally, the presentation of adjusted net

earnings, adjusted net earnings per diluted share and adjusted

EBITDA provides insight into management’s view and assessment of

the Company’s ongoing operating performance because management does

not consider the Adjustment Items when evaluating the Company’s

financial performance. Adjusted net earnings, adjusted net earnings

per diluted share and adjusted EBITDA should not be considered a

substitute for net earnings, earnings per diluted share or other

financial measures as computed in accordance with U.S. GAAP and are

not necessarily comparable to similarly titled measures used by

other companies.

###

Founded in 1901, United States Steel Corporation is a leading

steel producer. With an unwavering focus on safety, the company’s

customer-centric Best for All® strategy is advancing a more secure,

sustainable future for U. S. Steel and its stakeholders. With a

renewed emphasis on innovation, U. S. Steel serves the automotive,

construction, appliance, energy, containers, and packaging

industries with high value-added steel products such as U. S.

Steel’s proprietary XG3® advanced high-strength steel. The company

also maintains competitively advantaged iron ore production and has

an annual raw steelmaking capability of 22.4 million net tons. U.

S. Steel is headquartered in Pittsburgh, Pennsylvania, with

world-class operations across the United States and in Central

Europe. For more information, please visit www.ussteel.com.

©2024 U. S. Steel. All Rights Reserved

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240918101239/en/

Corporate Communications T – (412) 433-1300 E –

media@uss.com

Emily Chieng Investor Relations Officer T – (412) 618-9554 E –

ecchieng@uss.com

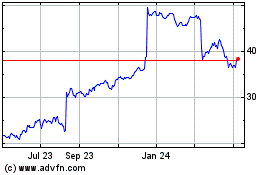

US Steel (NYSE:X)

Historical Stock Chart

From Oct 2024 to Nov 2024

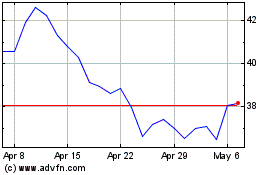

US Steel (NYSE:X)

Historical Stock Chart

From Nov 2023 to Nov 2024