SAP To Pay $98 Million To SEC To Settle Bribery Charges

January 10 2024 - 1:25PM

Dow Jones News

By Ben Glickman

German software company SAP will pay nearly $100 million to

settle U.S. Securities and Exchange Commission charges related to

foreign bribery schemes.

The SEC on Wednesday said it found that SAP allegedly violated

the Foreign Corrupt Practices App when, from at least December 2014

to January 2022, the company hired intermediaries to pay government

officials to obtain public-sector business.

The SEC alleges the bribes occurred in South Africa, Malawi,

Kenya, Tanzania, Ghana, Indonesia and Azerbaijan and were recorded

as legitimate business expenses.

The charges are part of a coordinated global settlement which

includes the U.S. Department of Justice and authorities in South

Africa.

SAP consented to the SEC's order finding it violated

anti-bribery, recordkeeping and internal accounting controls

provisions in securities law. The company agreed to cease and

desist from the violations and to pay disgorgement of $85 million

plus prejudgement interest of more than $13.4 million.

SAP's payment to the SEC will be offset by up to $59 million to

the South African government in connection with a parallel

investigation.

SAP also will pay the DOJ a $118.8 million criminal fine and

agreed to a forfeiture of about $103 million, $85 million of which

will be satisfied by disgorgement payments to the SEC.

Write to Ben Glickman at ben.glickman@wsj.com

(END) Dow Jones Newswires

January 10, 2024 14:10 ET (19:10 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

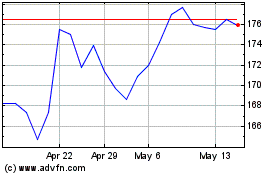

Sap (TG:SAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

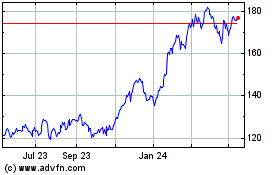

Sap (TG:SAP)

Historical Stock Chart

From Nov 2023 to Nov 2024