Acacia Mining Shares Drop on Prospect of Barrick Takeover to Solve Tax Dispute

May 22 2019 - 3:42AM

Dow Jones News

By Adam Clark

Acacia Mining PLC (ACA.LN) shares fell on Wednesday after its

board said it would consider a takeover proposal from former parent

Barrick Gold Corp. (GOLD), as a possible way to resolve its dispute

with the Tanzanian government.

Barrick, which still has a 64% stake in Acacia, said late

Tuesday that it had proposed acquiring the London-listed miner via

a stock swap of 0.153 Barrick share for each share of Acacia it

doesn't already own.

The deal implies a value for Acacia of $787 million and total

consideration to Acacia's minority shareholders of $285 million,

Barrick said.

Acacia shares at 0753 GMT traded down 4.6% at 152.10 pence,

valuing the company at 623.7 million pounds ($793.1 million).

Acacia has been locked in a tax dispute in Tanzania, which

canceled mining licenses for many companies, raised taxes and

royalty payments and accused the company of underreporting gold and

copper production. Barrick said Tuesday that the basis for a

settlement has been developed but the Tanzanian government has

refused to enter into a deal directly with Acacia.

The board of Acacia said it would seek clarification of the

Tanzanian government's position and advised shareholders to take no

action in the meantime.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

May 22, 2019 04:27 ET (08:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

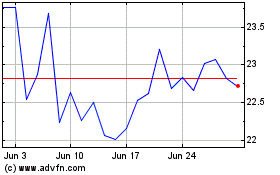

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Apr 2023 to Apr 2024