Barrick Gold Corporation (NYSE:GOLD) (TSX:ABX) – Since Kibali went

into production 10 years ago it has not only grown into Africa’s

largest gold mine, it has also opened a new mining frontier in the

DRC and stimulated the development of a thriving regional economy

in the country’s North-East province, says Mark Bristow, Barrick

president and chief executive.

Speaking at a media visit to Kibali today,

Bristow said the mutually beneficial partnership between the

company and its local stakeholders, notably the government,

contractors, service providers, employees and the community, had

demonstrated that it was possible to build and operate a

successful, world-class mine, run by host country nationals in one

of Africa’s remotest corners.

In the 13 years since the acquisition of the

property which became Kibali, it has invested more than $4.6

billion in the DRC, with payments to: local contractors and

suppliers alone amounting to almost $2.4 billion; $1.4 billion

going to the government in the form of royalties, taxes and

permits; salaries amounting to $621 million; and the investment of

$196 million in infrastructure development and community

support.

“Kibali has multiple partnerships with local

businesses, many of which we have actively mentored, such as the

all-Congolese team that built the mine’s Azambi hydropower

station,” Bristow said.

“Kibali’s three continuously upgraded hydropower

stations and their battery back-up system have put it in the lead

of the Barrick group’s green energy drive. At present,

approximately 80% of the mine’s power requirement is provided by

renewable energy sources and this will rise when the planned new

solar plant is commissioned in 2025, further reducing Kibali’s

carbon footprint as well as its costs.”

For the fourth successive year, exploration more

than replaced the gold that Kibali mined in 2022, extending the

mine’s Tier One1 production profile to 2033 and growing reserves to

a level equivalent that in the original 2010 feasibility study,

despite producing more than 6.4 million ounces of gold since

commissioning2. It continues to explore for additional reserves to

replace depletion at Kibali and for new growth opportunities

elsewhere in the DRC.

The mine also continues to invest in the

recruitment and training of Congolese nationals, who already

account for 95% of its workforce and 76% of its leadership, with

special emphasis on the skills development of potential managers

and technicians.

The Barrick group is an industry leader in

sustainability with a strategy that holistically links the

management of challenges related to climate change, poverty and

biodiversity loss. Kibali has a particular interest in the future

of Africa’s biodiversity and will write a new chapter in its long

support for the DRC’s Garamba National Park with the introduction

of a sustainable population of white rhinos in partnership with

African Parks and the DRC people.

Enquiries:

|

DRC country managerCyrille Mutombo+243 812 532 441 |

Investor and Media RelationsKathy du Plessis+44 20 7557

7738Email:barrick@dpapr.com |

Website: www.barrick.com

Endnote 1

A Tier One Gold Asset is an asset with a reserve

potential to deliver a minimum 10-year life, annual production of

at least 500,000 ounces of gold and total cash costs per ounce over

the mine life that are in the lower half of the industry cost

curve.

Endnote 2

On a 100% basis. Refer to the Technical Report

on the Kibali Mine, Democratic Republic of the Congo, dated March

18, 2022, and filed on SEDAR at www.sedar.com and EDGAR at

www.sec.gov on March 18, 2022.

Kibali Historical Total Mineral

Reserves

|

|

|

|

|

Proven |

|

Probable |

|

Total |

|

100% Basis |

|

Tonnes |

Grade |

Containedozs |

|

Tonnes |

Grade |

Containedozs |

|

Tonnes |

Grade |

Containedozs |

|

Year |

Gold PriceAssumption |

Project |

|

(Mt) |

(gm/t) |

(Moz) |

|

(Mt) |

(gm/t) |

(Moz) |

|

(Mt) |

(gm/t) |

(Moz) |

|

2009 |

$700/oz |

Kibali |

|

- |

- |

- |

|

42 |

4.03 |

5.5 |

|

42 |

4.03 |

5.5 |

|

2010 |

$800/oz |

Kibali |

|

- |

- |

- |

|

74 |

4.21 |

10.1 |

|

74 |

4.21 |

10.1 |

|

2011 |

$1,000/oz |

Kibali |

|

- |

- |

- |

|

79 |

4.04 |

10.2 |

|

79 |

4.04 |

10.2 |

|

2012 |

$1,000/oz |

Kibali |

|

3.6 |

3.24 |

0.4 |

|

79 |

4.14 |

10.5 |

|

83 |

4.10 |

10.9 |

|

2013 |

$1,000/oz |

Kibali |

|

5.5 |

2.28 |

0.4 |

|

84 |

4.15 |

11.2 |

|

89 |

4.04 |

11.6 |

|

2014 |

$1,000/oz |

Kibali |

|

5.4 |

1.76 |

0.3 |

|

78 |

4.28 |

10.7 |

|

83 |

4.12 |

11.0 |

|

2015 |

$1,000/oz |

Kibali |

|

4.0 |

1.84 |

0.2 |

|

76 |

4.25 |

10.4 |

|

80 |

4.13 |

10.6 |

|

2016 |

$1,000/oz |

Kibali |

|

4 |

1.90 |

0.3 |

|

66 |

4.17 |

8.9 |

|

71 |

4.03 |

9.2 |

|

2017 |

$1,000/oz |

Kibali |

|

19 |

4.07 |

2.5 |

|

47 |

4.10 |

6.2 |

|

66 |

4.09 |

8.7 |

|

2018 |

$1,000/oz |

Kibali |

|

20 |

4.15 |

2.7 |

|

42 |

4.12 |

5.6 |

|

63 |

4.13 |

8.3 |

|

2019 |

$1,200/oz |

Kibali |

|

21 |

4.13 |

2.7 |

|

48 |

4.23 |

6.5 |

|

68 |

4.20 |

9.2 |

|

2020 |

$1,200/oz |

Kibali |

|

20 |

4.34 |

2.8 |

|

56 |

3.66 |

6.6 |

|

76 |

3.84 |

9.4 |

|

2021 |

$1,200/oz |

Kibali |

|

32 |

3.76 |

3.9 |

|

51 |

3.50 |

5.8 |

|

83 |

3.60 |

9.6 |

|

2022 |

$1,300/oz |

Kibali |

|

32 |

3.47 |

3.6 |

|

65 |

3.15 |

6.6 |

|

97 |

3.26 |

10.2 |

As of January 1, 2019, Barrick owns 45% of

Kibali as the operator, with AngloGold Ashanti owning 45% and

Congolese parastatal Société Miniere de Kilo-Moto SA UNISARL

(SOKIMO) held by the Minister of Portfolio of DRC owning 10%.

For 2019 onwards, estimated in accordance with

National Instrument 43-101 as required by Canadian securities

regulatory authorities. Complete mineral reserve and resource data,

including tonnes, grades, and ounces, as well as the assumptions on

which the mineral reserves and resources for Barrick are reported

(on an attributable basis), can be found on pages 37-46 of

Barrick’s 2022 Annual Information Form / Form 40-F on file with the

Canadian provincial securities regulators on SEDAR at www.sedar.com

and the Securities and Exchange Commission on EDGAR at www.sec.gov.

Historical reserves for years prior to 2019 were estimated by

Randgold Resources in accordance with the Australian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves (the “JORC Code”). The JORC Code reporting standards are

functionally equivalent to National Instrument 43-101.

Kibali Historical

Production

|

100% Basis |

|

Year |

Tonnes Milled(kt) |

Head Grade(g/t) |

Gold Produced(oz) |

Recovery(%) |

|

2013 |

808 |

3.87 |

88,199 |

91.5 |

|

2014 |

5,546 |

3.81 |

526,627 |

79.0 |

|

2015 |

6,833 |

3.55 |

642,720 |

83.8 |

|

2016 |

7,299 |

3.10 |

586,530 |

79.8 |

|

2017 |

7,621 |

2.87 |

596,226 |

83.6 |

|

2018 |

8,218 |

3.45 |

807,251 |

88.6 |

|

2019 |

7,513 |

3.80 |

814,027 |

88.7 |

|

2020 |

7,632 |

3.68 |

808,134 |

89.4 |

|

2021 |

7,783 |

3.62 |

812,152 |

89.8 |

|

2022 |

7,815 |

3.39 |

749,589 |

88.4 |

|

Total |

67,068 |

3.41 |

6,431,455 |

86.0 |

As of January 1, 2019, Barrick owns 45% of

Kibali as the operator, with AngloGold Ashanti owning 45% and

Congolese parastatal Société Miniere de Kilo-Moto SA UNISARL

(SOKIMO) held by the Minister of Portfolio of DRC owning 10%.

Cautionary Statement on Forward-Looking

Information

Certain information contained or incorporated by

reference in this press release, including any information as to

our strategy, projects, plans, or future financial or operating

performance, constitutes “forward-looking statements”. All

statements, other than statements of historical fact, are

forward-looking statements. The words “pioneer”, “continue”,

“growth”, “opportunities”, “will”, and similar expressions identify

forward-looking statements. In particular, this press release

contains forward-looking statements including, without limitation,

with respect to: Kibali’s potential to continue to replace reserves

net of depletion; production guidance and performance, including

the extension of Kibali’s production profile to 2033; opportunities

for further growth at Kibali including potential new exploration

targets for the Kibali underground; the potential to grow the

mine’s mineral resource base; Kibali’s renewable power strategy and

the timeline for the completion of a new solar plant and

anticipated benefits from those initiatives; the anticipated

benefits from Kibali’s local recruitment and training initiatives,

including the development of local managers and technicians;

Barrick’s sustainability strategy and investment in Africa’s

biodiversity including through the reintroduction of white rhinos

to the Garamba national park; and Barrick’s commitment to the DRC

and potential further growth opportunities.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by the Company as at the date of

this press release in light of management’s experience and

perception of current conditions and expected developments, are

inherently subject to significant business, economic, and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information. Such

factors include, but are not limited to: fluctuations in the spot

and forward price of gold, copper, or certain other commodities

(such as silver, diesel fuel, natural gas, and electricity); the

speculative nature of mineral exploration and development; changes

in mineral production performance, exploitation, and exploration

successes; the possibility that future exploration results will not

be consistent with the Company’s expectations; risks that

exploration data may be incomplete and considerable additional work

may be required to complete further evaluation, including but not

limited to drilling, engineering and socioeconomic studies and

investment; disruption of supply routes which may cause delays in

construction and mining activities, including disruptions in the

supply of key mining inputs due to the invasion of Ukraine by

Russia; risk of loss due to acts of war, terrorism, sabotage and

civil disturbances; steps required prior to the distribution of

cash and equivalents held at Kibali in banks in the Democratic

Republic of Congo; risks associated with projects in the early

stages of evaluation, and for which additional engineering and

other analysis is required; failure to comply with environmental

and health and safety laws and regulations; timing of receipt of,

or failure to comply with, necessary permits and approvals;

uncertainty whether some or all of Barrick’s targeted investments

and projects will meet the Company’s capital allocation objectives

and internal hurdle rate; changes in national and local government

legislation, taxation, controls or regulations and/ or changes in

the administration of laws, policies and practices, expropriation

or nationalization of property and political or economic

developments in the DRC and other jurisdictions in which the

Company or its affiliates do or may carry on business in the

future; damage to the Company’s reputation due to the actual or

perceived occurrence of any number of events, including negative

publicity with respect to the Company’s handling of environmental

matters or dealings with community groups, whether true or not;

risks associated with new diseases, epidemics and pandemics,

including the effects and potential effects of the global Covid-19

pandemic; litigation and legal and administrative proceedings; the

impact of inflation, including global inflationary pressures driven

by supply chain disruptions caused by the ongoing Covid-19 pandemic

and global energy cost increases following the invasion of Ukraine

by Russia; employee relations including loss of key employees;

increased costs and physical risks, including extreme weather

events and resource shortages, related to climate change; and

availability and increased costs associated with mining inputs and

labor. Barrick also cautions that its guidance may be impacted by

the ongoing business and social disruption caused by the spread of

Covid-19. In addition, there are risks and hazards associated with

the business of mineral exploration, development and mining,

including environmental hazards, industrial accidents, unusual or

unexpected formations, pressures, cave-ins, flooding and gold

bullion, copper cathode or gold or copper concentrate losses (and

the risk of inadequate insurance, or inability to obtain insurance,

to cover these risks).

Many of these uncertainties and contingencies

can affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

Barrick disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as required

by applicable law.

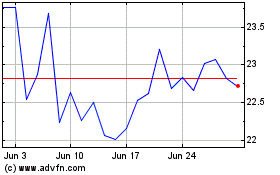

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Apr 2023 to Apr 2024