Acadian Timber Corp. (“Acadian” or the “Company”) (TSX:ADN) today

reported financial and operating results1 for the three months

ended June 26, 2021 (the “second quarter”).

“With favourable operating conditions and steady

demand for our products, we were able to reduce our inventory and

recover the volume shortfall of the first quarter,” commented Erika

Reilly, Chief Executive Officer. “Acadian expects continued steady

demand for its key products for the remainder of the year.”

Acadian generated $2.9 million of Free Cash Flow

and declared dividends of $4.8 million to its shareholders during

the second quarter, reflecting the seasonality of the business.

Acadian’s balance sheet remains solid with $20.1 million of net

liquidity as at June 26, 2021, which includes funds available under

our credit facilities.

With health and safety continuing as a top

focus, Acadian experienced no recordable safety incidents among

employees and contractors during the second quarter.

1 This news release makes reference to

Adjusted EBITDA, Adjusted EBITDA margin, Free Cash Flow and Payout

Ratio which are key performance measures in evaluating Acadian’s

operations and are important in enhancing investors’ understanding

of Acadian’s operating performance. Adjusted EBITDA and Adjusted

EBITDA margin are used to evaluate operational performance. Free

Cash Flow is used to evaluate Acadian’s ability to generate

sustainable cash flows from its operations while the Payout Ratio

is used to evaluate Acadian’s ability to fund its distribution

using Free Cash Flow. Acadian’s management defines Adjusted EBITDA

as earnings before interest, taxes, fair value adjustments,

recovery of or impairment of land and roads, realized gain/loss on

sale of other fixed assets, unrealized exchange gain/loss on debt,

depreciation and amortization and Adjusted EBITDA margin as

Adjusted EBITDA as a percentage of its total revenue. Free Cash

Flow is defined as Adjusted EBITDA less interest paid, current

income tax expense, and capital expenditures plus net proceeds from

the sale of fixed assets (selling price less gains or losses

included in Adjusted EBITDA). Payout Ratio is defined as dividends

declared divided by Free Cash Flow. As these performance measures

do not have standardized meanings prescribed by International

Financial Reporting Standards (“IFRS”), they may not be comparable

to similar measures presented by other companies. As a result, we

have provided in this news release reconciliations of net income,

as determined in accordance with IFRS, to Adjusted EBITDA and Free

Cash Flow.

Review of Operations

Operating and Financial

Highlights

|

|

Three Months Ended |

Six Months Ended |

|

(CAD thousands, except per share information) |

June 26, 2021 |

June 27, 2020 |

June 26, 2021 |

June 27, 2020 |

|

Sales volume (000s m3) |

|

211.3 |

|

|

139.7 |

|

|

501.3 |

|

|

514.6 |

|

|

Sales |

$ |

18,414 |

|

$ |

11,458 |

|

$ |

44,306 |

|

$ |

42,866 |

|

|

Operating earnings |

|

3,763 |

|

|

1,283 |

|

|

10,503 |

|

|

9,546 |

|

|

Net income |

|

5,898 |

|

|

5,229 |

|

|

11,722 |

|

|

1,518 |

|

|

Adjusted EBITDA |

$ |

3,827 |

|

$ |

1,354 |

|

$ |

10,701 |

|

$ |

9,683 |

|

|

Adjusted EBITDA margin |

|

21% |

|

|

12% |

|

|

24% |

|

|

23% |

|

|

Free Cash Flow |

$ |

2,864 |

|

$ |

(208 |

) |

$ |

7,854 |

|

$ |

6,357 |

|

|

Dividends declared |

|

4,839 |

|

|

4,839 |

|

|

9,678 |

|

|

9,678 |

|

|

Payout Ratio |

|

n/a |

|

|

n/a |

|

|

123% |

|

|

152% |

|

|

Per share – basic and diluted |

|

|

|

|

|

Net income |

$ |

0.35 |

|

$ |

0.31 |

|

$ |

0.70 |

|

$ |

0.09 |

|

|

Free Cash Flow |

|

0.17 |

|

|

(0.01 |

) |

|

0.47 |

|

|

0.38 |

|

|

Dividends declared |

|

0.29 |

|

|

0.29 |

|

|

0.58 |

|

|

0.58 |

|

During the second quarter, Acadian generated

sales of $18.4 million, compared to $11.5 million in the prior year

period. Sales volume, excluding biomass, increased 55% over the

prior year period due to favourable operating conditions and stable

demand. Acadian recovered the volume shortfall of the first

quarter, benefiting from an earlier start following the spring thaw

and more operating days compared to the prior year period. Weighted

average selling price, excluding biomass, was flat year-over-year

as increased sawlog pricing was offset by weaker pulpwood pricing

and a stronger Canadian dollar.

Operating costs and expenses were $14.7 million

during the second quarter, compared to $10.2 million in the prior

year period, reflecting higher sales volumes and timber services

activity. Weighted average variable costs, excluding biomass,

decreased 9%, as a result of lower processing costs and a stronger

Canadian dollar compared to the prior year period.

Adjusted EBITDA was $3.8 million during the

second quarter, compared to $1.4 million in the prior year period

while the Adjusted EBITDA margin for the quarter was 21%, compared

to 12% in the prior year period for the reasons discussed above.

Free Cash Flow was $2.9 million compared to $0.2 million of

negative Free Cash Flow in the same period in 2020.

Net income for the second quarter totaled $5.9

million, or $0.35 per share, compared to a net income of $5.2

million, or $0.31 per share in the same period in 2020. The

increase in net income from the prior year period is due to

increased operating earnings offset by a combination of lower

non-cash fair value adjustments and unrealized foreign exchange

gain on long-term debt in 2021 compared to 2020.

During the first half of 2021, Acadian sales of

$44.3 million increased 3% compared to the prior year period. The

weighted average selling price, excluding biomass, decreased 1%,

and the sales volume was flat year-over-year. Operating costs and

expenses of $33.8 million were also flat year-over-year. Strong

sawlogs prices, lower administrative costs, and increased timber

services revenues resulted in Adjusted EBITDA of $10.7 million

compared to $9.7 million during the first half of 2020. Adjusted

EBITDA margin improved to 24% from 23%.

For the six months ended June 26, 2021, net

income was $11.7 million, or $0.70 per share, which represents an

increase of $10.2 million compared to the prior period, primarily

as a result of a non-cash unrealized foreign exchange gain on long

term debt of $3.5 million this year compared to a loss of $5.2

million in 2020 combined with lower administrative costs and

interest expense.

Segment Performance

New Brunswick Timberlands

The table below summarizes operating and

financial results for New Brunswick Timberlands.

|

|

Three Months

Ended June 26, 2021 |

|

Three Months Ended June 27, 2020 |

|

|

|

Harvest (000s

m3) |

Sales (000s

m3) |

Sales Mix |

|

|

Results ($000) |

|

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

|

|

Results ($000s) |

|

|

Softwood |

41.0 |

54.9 |

33% |

|

$ |

3,464 |

|

42.3 |

48.3 |

40% |

|

$ |

2,506 |

|

|

Hardwood |

78.8 |

88.9 |

54% |

|

|

6,476 |

|

32.0 |

53.6 |

45% |

|

|

4,248 |

|

|

Biomass |

21.4 |

21.4 |

13% |

|

|

878 |

|

17.7 |

17.7 |

15% |

|

|

631 |

|

|

|

141.2 |

165.2 |

100% |

|

|

10,818 |

|

92.0 |

119.6 |

100% |

|

|

7,385 |

|

|

Timber services and other |

|

|

|

4,056 |

|

|

|

|

|

2,097 |

|

|

Sales |

|

|

|

$ |

14,874 |

|

|

|

|

$ |

9,482 |

|

|

Adjusted EBITDA |

|

|

|

$ |

3,839 |

|

|

|

|

$ |

1,781 |

|

|

Adjusted EBITDA margin |

|

|

|

26% |

|

|

|

|

|

19% |

|

|

|

Six Months

Ended June 26, 2021 |

|

Six Months Ended June 27, 2020 |

|

|

|

Harvest (000s

m3) |

Sales (000s

m3) |

Sales Mix |

|

|

Results ($000) |

|

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

|

Results ($000s) |

|

|

Softwood |

139.2 |

141.4 |

40% |

|

$ |

9,031 |

|

158.8 |

161.7 |

43% |

|

$ |

9,138 |

|

|

Hardwood |

159.8 |

163.0 |

46% |

|

|

12,287 |

|

135.8 |

149.6 |

40% |

|

|

12,013 |

|

|

Biomass |

51.0 |

51.0 |

14% |

|

|

2,087 |

|

62.5 |

62.5 |

17% |

|

|

2,124 |

|

|

|

350.0 |

355.4 |

100% |

|

|

23,405 |

|

357.1 |

373.8 |

100% |

|

|

23,275 |

|

|

Timber services and other |

|

|

|

9,790 |

|

|

|

|

|

7,904 |

|

|

Sales |

|

|

|

$ |

33,195 |

|

|

|

|

$ |

31,179 |

|

|

Adjusted EBITDA |

|

|

|

$ |

8,198 |

|

|

|

|

$ |

7,660 |

|

|

Adjusted EBITDA margin |

|

|

|

27% |

|

|

|

|

|

25% |

|

Sales for New Brunswick Timberlands were $14.9

million during the second quarter, compared to $9.5 million during

the prior year period. Sales volume, excluding biomass, increased

41% relative to the same period in 2020, mainly due to higher

softwood sawlogs and hardwood pulpwood sales. During the second

quarter, New Brunswick’s operations benefited from favourable

operating conditions and recovered the volume shortfall of the

first quarter, except for softwood pulpwood, for which demand

remained weak. Biomass sales volume increased 21% due to strong

deliveries to export markets. The weighted average selling price,

excluding biomass, for the second quarter was $69.13 per m3, or 4%

higher than the prior year period, reflecting strong sawlog prices

and a favourable product mix. Biomass pricing was up 15%

year-over-year reflecting the higher average hauling distance to

market driven by the customer mix.

Operating costs and expenses were $11.1 million

during the second quarter, compared to $7.7 million in the prior

year period due to higher harvesting and timber services activity.

Favourable operating conditions during the quarter, resulted in

more operating days than in the prior year period. Weighted average

variable costs, excluding biomass, decreased by 7% due to lower log

processing costs compared to the prior year period.

Adjusted EBITDA for the quarter was $3.8 million

compared to $1.8 million during the prior year period and Adjusted

EBITDA margin increased to 26% from 19% in the prior year period.

Adjusted EBITDA increase was driven by higher sales volumes and

additional revenues from timber services.

During the first half of 2021, New Brunswick

Timberlands’ sales of $33.2 million increased 6% compared to the

prior year period. The weighted average selling price, excluding

biomass, increased 3%, however the sales volume, excluding biomass,

decreased 2% year-over-year. The volume decrease reflects the lower

softwood pulpwood deliveries due to the increased availability of

sawmill residuals in the region. Operating costs and expenses of

$24.4 million during the first half of 2021 were $0.8 million

higher than the prior year period due to higher timber services

activity. As a result of higher sales and lower administration

costs, Adjusted EBITDA increased to $8.9 million from $7.7 million

during the first half of 2020, and Adjusted EBITDA margin improved

to 27% from 25%.

There were no recordable safety incidents

amongst employees or contractors during the second quarter of

2021.

Maine Timberlands

The table below summarizes operating and

financial results for Maine Timberlands.

|

|

Three Months Ended June 26, 2021 |

|

Three Months Ended June 27, 2020 |

|

|

|

Harvest (000s

m3) |

Sales (000s

m3) |

Sales Mix |

|

Results ($000s) |

|

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

|

Results ($000s) |

|

|

Softwood |

27.6 |

27.5 |

60% |

|

$ |

1,855 |

|

10.4 |

10.2 |

51% |

|

$ |

810 |

|

|

Hardwood |

10.0 |

18.3 |

40% |

|

|

1,552 |

|

7.3 |

9.8 |

49% |

|

|

1,025 |

|

|

Biomass |

0.3 |

0.3 |

0% |

|

|

3 |

|

0.1 |

0.1 |

0% |

|

|

— |

|

|

|

37.9 |

46.1 |

100% |

|

|

3,410 |

|

17.8 |

20.1 |

100% |

|

|

1,835 |

|

|

Timber services and other |

|

|

|

130 |

|

|

|

|

|

141 |

|

|

Sales |

|

|

|

$ |

3,540 |

|

|

|

|

$ |

1,976 |

|

|

Adjusted EBITDA |

|

|

|

$ |

424 |

|

|

|

|

$ |

117 |

|

|

Adjusted EBITDA margin |

|

|

|

12% |

|

|

|

|

|

6% |

|

|

|

Six Months Ended June 26, 2021 |

|

Six Months Ended June 27, 2020 |

|

|

|

Harvest (000s

m3) |

Sales (000s

m3) |

Sales Mix |

|

Results ($000s) |

|

Harvest (000s m3) |

Sales (000s m3) |

Sales Mix |

|

Results ($000s) |

|

|

Softwood |

103.6 |

103.5 |

71% |

|

$ |

7,573 |

|

102.4 |

102.4 |

73% |

|

$ |

8,065 |

|

|

Hardwood |

36.9 |

41.8 |

29% |

|

|

3,305 |

|

37.7 |

38.2 |

27% |

|

|

3,360 |

|

|

Biomass |

0.6 |

0.6 |

0% |

|

|

8 |

|

0.2 |

0.2 |

0% |

|

|

2 |

|

|

|

141.1 |

145.9 |

100% |

|

|

10,886 |

|

140.3 |

140.8 |

100% |

|

|

11,427 |

|

|

Timber services and other |

|

|

|

225 |

|

|

|

|

|

260 |

|

|

Sales |

|

|

|

$ |

11,111 |

|

|

|

|

$ |

11,687 |

|

|

Adjusted EBITDA |

|

|

|

$ |

2,452 |

|

|

|

|

$ |

3,166 |

|

|

Adjusted EBITDA margin |

|

|

|

22% |

|

|

|

|

|

27% |

|

Sales for Maine Timberlands during the second

quarter totaled $3.5 million, compared to $2.0 million for the same

period last year. Sales volume, excluding biomass, increased by

129% as a result of favourable operating conditions and stable

demand.

The weighted average selling price, excluding

biomass, in Canadian dollar terms was $74.26 per m3, compared to

$91.45 per m3 in 2020. In U.S. dollar terms, the weighted average

selling price, excluding biomass, was $60.38 per m3, compared to

$65.16 per m3 in 2020 with higher sawlog prices offset by lower

hardwood pulpwood prices. The 19% price decrease in Canadian dollar

terms is mainly due to changes in the foreign exchange rate

compared to the prior year period.

Operating costs and expenses for the second

quarter were $3.1 million, compared to $1.9 million during the same

period in 2020 as a result of higher sales volumes. Weighted

average variable costs, excluding biomass, decreased 17%,

benefiting from a stronger Canadian dollar and lower softwood

sawlogs costs related to a higher proportion of roadside sales.

Adjusted EBITDA for the quarter was $0.4 million

compared to $0.1 million during the prior year period and Adjusted

EBITDA margin was 12% compared to 6% in the prior year period.

Adjusted EBITDA was impacted by higher volumes partially offset by

the stronger Canadian dollar.

During the first half of 2021, Maine

Timberlands’ sales were $11.1 million compared to $11.7 million in

the prior year period. Maine Timberlands’ weighted average selling

price, excluding biomass, decreased 8% in Canadian dollar terms,

and 1% in U.S. dollar terms, however the sales volume, excluding

biomass, increased 3% year-over-year. Operating costs and expenses

of $8.8 million during the first half of 2021 were flat

year-over-year. Adjusted EBITDA was $2.5 million compared to $3.2

million during the first half of 2020 while Adjusted EBITDA margin

was 22% compared to 27% in 2020.

There were no recordable safety incidents

amongst employees or contractors during the second quarter of

2021.

Carbon Credit Project

Over the past 18 months, Acadian has explored

opportunities to participate in both compliance and voluntary

carbon credit markets. During the quarter, Acadian executed its

first carbon development and marketing agreement to develop

voluntary carbon credits on the portion of its Maine Timberlands

that is subject to a working forest conservation easement. This

project commits Acadian to balancing harvest and growth, and

requires long term planning, annual reporting, periodic carbon

inventory verification, and maintenance of the existing sustainable

forestry certification.

While this project is relatively small, and

expected to contribute modestly to cash flow and have little impact

on operations, it forms a foundation for further carbon credit

development. As it takes about 12-18 months to develop and sell

carbon credits, Acadian expects to begin receiving proceeds from

sales in mid to late 2022.

Market Outlook

The following contains forward-looking

information about Acadian Timber Corp.’s market outlook for the

remainder of fiscal 2021. Reference should be made to the section

entitled “Cautionary Statement Regarding Forward-Looking

Information and Statements” section of this news release. For a

description of material factors that could cause actual results to

differ materially from the forward-looking statements in the

following, please see the Risk Factors section of our Management’s

Discussion and Analysis of Acadian’s most recent Annual Report and

Annual Information Form available on our website at

www.acadiantimber.com or filed with SEDAR at www.sedar.com.

Acadian expects continued steady demand for its

softwood and hardwood sawlogs, hardwood pulpwood, and biomass.

While North American softwood lumber prices are

moderating as supply and demand come into balance, demand for

softwood lumber is expected to remain strong given the continued

positive outlook for U.S. home construction and improvements,

supported by low interest rates, income and job growth, aging and

underbuilt housing stock, and favorable home buying demographics.

Consensus forecast for U.S. housing starts is 1.55 million for 2021

and 1.52 million for 2022.

Accordingly, softwood sawmills are running

steady in our operating regions, and Acadian is continuing to

experience steady demand for its softwood sawlogs.

Demand for hardwood sawlogs has been strong as

both appearance and industrial grade lumber is in high demand and

roundwood inventories at hardwood sawmills are low. Acadian expects

strong demand and pricing for its hardwood sawlogs for the

remainder of this year.

Regional hardwood pulpwood demand is expected to

remain stable as the economy improves, while softwood pulpwood

demand is expected to remain weak with continued high roundwood

inventories regionally and significant competition from sawmill

residuals that limit prospects for near term

improvement.

Demand for biomass from Acadian’s New Brunswick

operation is expected to remain stable to positive, with steady

demand from the regional market supplemented by the return of

export markets.

Appointment of Director

Concurrent with his appointment to President and

Chief Executive Officer, Adam Sheparski has been appointed to the

Board of Directors.

Quarterly Dividend

Acadian is pleased to announce a dividend of

$0.29 per share, payable on October 15, 2021 to shareholders of

record on September 30, 2021.

Acadian Timber Corp.

(“Acadian”, the “Company” or “we”) is one of the largest timberland

owners in Eastern Canada and the Northeastern U.S. and has a total

of approximately 2.4 million acres of land under management.

Acadian owns and manages approximately 761,000 acres of freehold

timberlands in New Brunswick (“New Brunswick Timberlands” or “NB

Timberlands”), approximately 300,000 acres of freehold timberlands

in Maine (“Maine Timberlands”) and provides timber services

relating to approximately 1.3 million acres of Crown licensed

timberlands in New Brunswick. Acadian’s products include softwood

and hardwood sawlogs, pulpwood and biomass by-products, sold to

approximately 90 regional customers.

Acadian’s business strategy is to maximize cash

flows from its existing timberland assets through sustainable

forest management and other land use activities while growing its

business by acquiring assets on a value basis and actively managing

these assets to drive improved performance.

Acadian’s shares are listed for trading on the

Toronto Stock Exchange under the symbol ADN.

For further information, please visit our

website at www.acadiantimber.com or contact:

Adam SheparskiChief Financial OfficerTel:

506-737-2345 Email: ir@acadiantimber.com

Cautionary Statement Regarding

Forward-Looking Information and Statements

This News Release contains forward-looking

information and statements within the meaning of applicable

Canadian securities laws that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Acadian Timber Corp. and its

subsidiaries (collectively, “Acadian”), or industry results, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. When used in this News Release, such forward-looking

statements may contain such words as “may,” “will,” “intend,”

“should,” “suggest,” “expect,” “believe,” “outlook,” “forecast,”

“predict,” “remain,” “anticipate,” “estimate,” “potential,”

“continue,” “plan,” “could,” “might,” “project,” “targeting” or the

negative of these terms or other similar terminology.

Forward-looking information is included in this News Release and

includes statements made in this News Release in sections entitled

“Dividend Policy of the Company,” “Liquidity and Capital

Resources,” and “Market Outlook” and without limitation other

statements regarding management’s beliefs, intentions, results,

performance, goals, achievements, future events, plans and

objectives, business strategy, growth strategy and prospects,

access to capital, liquidity and trading volumes, dividends, taxes,

capital expenditures, projected costs, market trends and similar

statements concerning anticipated future events, results,

achievements, circumstances, performance or expectations that are

not historical facts. These statements, which reflect management’s

current expectations regarding future events and operating

performance, are based on information currently available to

management and speak only as of the date of this News Release. All

forward-looking statements in this News Release are qualified by

these cautionary statements. Forward-looking statements involve

significant risks and uncertainties, should not be read as

guarantees of future performance or results, should not be unduly

relied upon, and will not necessarily be accurate indications of

whether or not such results will be achieved. Factors that could

cause actual results to differ materially from the results

discussed in the forward-looking statements include, but are not

limited to: general economic and market conditions; changes in U.S.

housing starts; product demand; concentration of customers;

commodity pricing; interest rate and foreign currency fluctuations;

seasonality; weather and natural conditions; regulatory, trade or

environmental policy changes; changes in Canadian or U.S. income

tax law; the economic situation of key customers; disease outbreak;

Acadian’s ability to source and secure potential investment

opportunities; the availability of potential acquisitions that suit

Acadian’s growth profile; and other risks and factors discussed

under the heading “Risk Factors” in the Annual Report dated

February 10, 2021, the Annual Information Form dated March 26,

2021,and other filings of Acadian made with securities regulatory

authorities, which are available on SEDAR at www.sedar.com.

Forward-looking information is based on various material factors or

assumptions, which are based on information currently available to

Acadian. Material factors or assumptions that were applied in

drawing a conclusion or making an estimate set out in the

forward-looking information may include, but are not limited to:

forecasts in the housing market; anticipated financial performance;

anticipated market conditions; business prospects; the economic

situation of key customers; strategies; regulatory developments;

exchange rates; the sufficiency of budgeted capital expenditures in

carrying out planned activities; the availability and cost of

labour and services; and the ability to obtain financing on

acceptable terms. Readers are cautioned that the preceding list of

material factors or assumptions is not exhaustive. Although the

forward-looking statements contained in this News Release are based

upon what management believes are reasonable assumptions, Acadian

cannot assure readers that actual results will be consistent with

these forward-looking statements. The forward-looking statements in

this News Release are made as of the date of this News Release and

should not be relied upon as representing Acadian’s views as of any

date subsequent to the date of this News Release. Acadian assumes

no obligation to update or revise these forward-looking statements

to reflect new information, events, circumstances or otherwise,

except as may be required by applicable law.

Acadian Timber

Corp.Interim Condensed Consolidated Statements of

Net Income(unaudited)

|

|

|

Three Months Ended |

Six Months Ended |

|

(CAD thousands, except per share data) |

|

June 26, 2021 |

June 27, 2020 |

June 26, 2021 |

June 27, 2020 |

|

Sales |

|

$ |

18,414 |

|

$ |

11,458 |

|

$ |

44,306 |

|

$ |

42,866 |

|

|

Operating costs and expenses |

|

|

|

|

|

|

Cost of sales |

|

|

12,269 |

|

|

7,768 |

|

|

29,716 |

|

|

28,629 |

|

|

Selling, administration and other |

|

|

2,058 |

|

|

2,086 |

|

|

3,698 |

|

|

4,303 |

|

|

Silviculture |

|

|

260 |

|

|

250 |

|

|

263 |

|

|

251 |

|

|

Depreciation and amortization |

|

|

64 |

|

|

71 |

|

|

126 |

|

|

137 |

|

|

|

|

|

14,651 |

|

|

10,175 |

|

|

33,803 |

|

|

33,320 |

|

|

Operating earnings |

|

|

3,763 |

|

|

1,283 |

|

|

10,503 |

|

|

9,546 |

|

|

Interest expense, net |

|

|

(727 |

) |

|

(1,172 |

) |

|

(1,482 |

) |

|

(2,463 |

) |

|

Other items |

|

|

|

|

|

|

Fair value adjustments and other |

|

|

2,055 |

|

|

4,237 |

|

|

2,480 |

|

|

3,218 |

|

|

Unrealized exchange gain / (loss) on long-term debt |

|

2,288 |

|

|

3,030 |

|

|

3,504 |

|

|

(5,180 |

) |

|

Gain on sale of timberlands |

|

— |

|

|

— |

|

|

72 |

|

|

— |

|

|

Earnings before income taxes |

|

|

7,379 |

|

|

7,378 |

|

|

15,077 |

|

|

5,121 |

|

|

Current income tax expense |

|

|

(179 |

) |

|

(656 |

) |

|

(1,285 |

) |

|

(1,558 |

) |

|

Deferred income tax expense |

|

|

(1,302 |

) |

|

(1,493 |

) |

|

(2,070 |

) |

|

(2,045 |

) |

|

Net income |

|

$ |

5,898 |

|

$ |

5,229 |

|

$ |

11,722 |

|

$ |

1,518 |

|

|

Net income per share – basic and diluted |

|

$ |

0.35 |

|

$ |

0.31 |

|

$ |

0.70 |

|

$ |

0.09 |

|

Acadian Timber

Corp.Interim Condensed Consolidated Statements of

Comprehensive Income(unaudited)

|

|

Three Months Ended |

Six Months Ended |

|

(CAD thousands) |

June 26, 2021 |

June 27, 2020 |

June 26, 2021 |

June 27, 2020 |

|

Net income |

$ |

5,898 |

|

$ |

5,229 |

|

$ |

11,722 |

|

$ |

1,518 |

|

Other comprehensive (loss) / income |

|

|

|

|

|

Items that may be reclassified subsequently to net income: |

|

|

|

|

|

Unrealized foreign currency translation (loss) / gain |

|

(3,185 |

) |

|

(4,169 |

) |

|

(4,618 |

) |

|

7,455 |

|

Comprehensive income |

$ |

2,713 |

|

$ |

1,060 |

|

$ |

7,104 |

|

$ |

8,973 |

Acadian Timber

Corp.Interim Condensed Consolidated Balance

Sheets(unaudited)

|

As at(CAD thousands) |

|

June 26, 2021 |

December 31, 2020 |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash |

|

$ |

7,853 |

$ |

10,258 |

|

Accounts receivable and other assets |

|

|

6,744 |

|

7,731 |

|

Current income taxes receivable |

|

|

— |

|

415 |

|

Inventory |

|

|

614 |

|

957 |

|

|

|

|

15,211 |

|

19,361 |

|

Timber |

|

|

386,375 |

|

388,005 |

|

Land, roads, and other fixed assets |

|

|

98,286 |

|

99,892 |

|

Intangible asset |

|

|

6,140 |

|

6,140 |

|

Total assets |

|

$ |

506,012 |

$ |

513,398 |

|

Liabilities and shareholders’ equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

6,237 |

$ |

8,640 |

|

Current income taxes payable |

|

|

338 |

|

— |

|

Dividends payable to shareholders |

|

|

4,839 |

|

4,839 |

|

|

|

|

11,414 |

|

13,479 |

|

Long-term debt |

|

|

97,755 |

|

101,185 |

|

Deferred income tax liabilities |

|

|

106,176 |

|

105,493 |

|

Shareholders’ equity |

|

|

290,667 |

|

293,241 |

|

Total liabilities and shareholders’ equity |

|

$ |

506,012 |

$ |

513,398 |

Acadian Timber

Corp.Interim Condensed Consolidated Statements of

Cash Flows(unaudited)

|

|

Three Months Ended |

Six Months Ended |

|

(CAD thousands) |

June 26, 2021 |

June 27, 2020 |

June 26, 2021 |

June 27, 2020 |

|

Cash provided by (used for): |

|

|

|

|

|

Operating activities |

|

|

|

|

|

Net income |

$ |

5,898 |

|

$ |

5,229 |

|

$ |

11,722 |

|

$ |

1,518 |

|

|

Adjustments to net income: |

|

|

|

|

|

Income tax expense |

|

1,481 |

|

|

2,149 |

|

|

3,355 |

|

|

3,603 |

|

|

Depreciation and amortization |

|

64 |

|

|

71 |

|

|

126 |

|

|

137 |

|

|

Fair value adjustments and other |

|

(2,055 |

) |

|

(4,237 |

) |

|

(2,480 |

) |

|

(3,218 |

) |

|

Unrealized exchange (gain) / loss on long-term debt |

|

(2,288 |

) |

|

(3,030 |

) |

|

(3,504 |

) |

|

5,180 |

|

|

Gain on sale of timberlands |

|

— |

|

|

— |

|

|

(72 |

) |

|

— |

|

|

Income taxes paid |

|

(2,118 |

) |

|

— |

|

|

(532 |

) |

|

— |

|

|

Net change in non-cash working capital balances and other |

|

596 |

|

|

3,664 |

|

|

(1,260 |

) |

|

3,358 |

|

|

|

|

1,578 |

|

|

3,846 |

|

|

7,355 |

|

|

10,578 |

|

|

Financing activities |

|

|

|

|

|

Repayment of short-term debt |

|

— |

|

|

(1,156 |

) |

|

— |

|

|

(8,169 |

) |

|

Issuance of long-term debt |

|

— |

|

|

— |

|

|

— |

|

|

19,795 |

|

|

Repayment of long-term debt |

|

— |

|

|

— |

|

|

— |

|

|

(9,729 |

) |

|

Deferred financing costs |

|

— |

|

|

(17 |

) |

|

— |

|

|

(527 |

) |

|

Dividends paid to shareholders |

|

(4,839 |

) |

|

(4,839 |

) |

|

(9,678 |

) |

|

(9,678 |

) |

|

|

|

(4,839 |

) |

|

(6,012 |

) |

|

(9,678 |

) |

|

(8,308 |

) |

|

Investing activities |

|

|

|

|

|

Additions to timber, land, roads, and other fixed assets |

|

(88 |

) |

|

(87 |

) |

|

(157 |

) |

|

(95 |

) |

|

Proceeds from sale of timberlands |

|

— |

|

|

— |

|

|

75 |

|

|

— |

|

|

|

|

(88 |

) |

|

(87 |

) |

|

(82 |

) |

|

(95 |

) |

|

(Decrease) increase in cash during the period |

|

(3,349 |

) |

|

(2,253 |

) |

|

(2,405 |

) |

|

2,175 |

|

|

Cash, beginning of period |

|

11,202 |

|

|

12,029 |

|

|

10,258 |

|

|

7,601 |

|

|

Cash, end of period |

$ |

7,853 |

|

$ |

9,776 |

|

$ |

7,853 |

|

|

9,776 |

|

Acadian Timber

Corp.Reconciliations to Adjusted EBITDA and Free

Cash Flow

|

|

Three Months Ended |

Six Months Ended |

|

(CAD thousands) |

June 26, 2021 |

June 27, 2020 |

June 26, 2021 |

June 27, 2020 |

|

Net income |

$ |

5,898 |

|

$ |

5,229 |

|

$ |

11,722 |

|

$ |

1,518 |

|

|

Add (deduct): |

|

|

|

|

|

Interest expense, net |

|

727 |

|

|

1,172 |

|

|

1,482 |

|

|

2,463 |

|

|

Current income tax expense |

|

179 |

|

|

656 |

|

|

1,285 |

|

|

1,558 |

|

|

Deferred income tax expense |

|

1,302 |

|

|

1,493 |

|

|

2,070 |

|

|

2,045 |

|

|

Depreciation and amortization |

|

64 |

|

|

71 |

|

|

126 |

|

|

137 |

|

|

Fair value adjustments and other |

|

(2,055 |

) |

|

(4,237 |

) |

|

(2,480 |

) |

|

(3,218 |

) |

|

Unrealized exchange (gain) / loss on long-term debt |

|

(2,288 |

) |

|

(3,030 |

) |

|

(3,504 |

) |

|

5,180 |

|

|

Adjusted EBITDA |

$ |

3,827 |

|

$ |

1,354 |

|

$ |

10,701 |

|

$ |

9,683 |

|

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid on debt, net |

|

(696 |

) |

|

(819 |

) |

|

(1,408 |

) |

|

(1,673 |

) |

|

Additions to timber, land, roads, and other fixed assets |

|

(88 |

) |

|

(87 |

) |

|

(157 |

) |

|

(95 |

) |

|

Gain on sale of timberlands |

|

— |

|

|

— |

|

|

(72 |

) |

|

— |

|

|

Proceeds from sale of timberlands |

|

— |

|

|

— |

|

|

75 |

|

|

— |

|

|

Current income tax expense |

|

(179 |

) |

|

(656 |

) |

|

(1,285 |

) |

|

(1,558 |

) |

|

Free Cash Flow |

$ |

2,864 |

|

$ |

(208 |

) |

$ |

7,854 |

|

$ |

6,357 |

|

|

Dividends declared |

$ |

4,839 |

|

$ |

4,839 |

|

$ |

9,678 |

|

$ |

9,678 |

|

|

Payout Ratio |

|

n/a |

|

|

n/a |

|

|

123 |

% |

|

152 |

% |

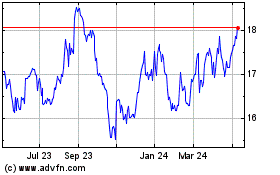

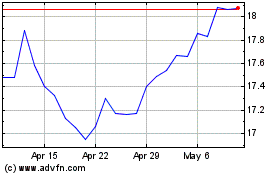

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acadian Timber (TSX:ADN)

Historical Stock Chart

From Apr 2023 to Apr 2024