Allkem Limited (ASX: AKE, “

Allkem” or the

“

Company”) provides an update for its Mt Cattlin

operation in Western Australia.

KEY POINTS

- Mineral Resource

tonnage increased 21% to 13.3Mt @ 1.2% Li2O and 131 ppm Ta2O5 at a

cut-off grade of 0.4% Li2O, the increase principally reflecting the

impact of using a US$1,100/t pit shell at 6% Li2O concentrate grade

(c.f. US$900/t in 2021) and net of mining depletion

- Ore Reserve

tonnage decreased 28% to 5.8Mt @ 0.98% Li2O and 113 ppm Ta2O5 at

cut-off grade of 0.4% Li2O reflecting depletion from mining

activities within the current mine design between 31 March 2021 to

30 June 2022

- A major 147

hole, 32,685m drill programme commenced in April with the objective

of extending mine life through increasing resources and upgrading

resource categories. Drilling results will inform mining studies

and a revised Mineral Resource and Ore Reserve

- Delays in

planned pre-stripping activities have deferred exposure of main ore

sources in the 2NW pit which will limit Q1 FY23 production and

reduce FY23 guidance from 160-170kt to 140-150 kt of spodumene

concentrate SC6. Production volumes are expected to increase each

quarter throughout the year as pre-stripping is completed

- This deferred

production will be partially offset by the sale of 130ktpa of lower

grade spodumene concentrate to existing customers in the first half

of FY23

PRODUCTION GUIDANCE UPDATE

Recent results from Mt Cattlin mining

operations, as well impacts from on-going labour shortages in

Western Australia, have resulted in a review of production guidance

for FY23.

Many Western Australian mining operations

continue to suffer from a severe shortage and high turnover of

staff which is exacerbated by COVID-19 related absences. At Mt

Cattlin this has resulted in a further delay in pre-strip

activities at the new 2NW pit.

Previous production guidance assumed that a

small upper lens of mineralisation would provide ore for processing

while the main ore zones are being exposed. Unfortunately, the

mineralogy of this upper lens has not been amenable to processing

through the plant as currently configured due to its fine-grained

nature. This will lower production for the next 4-6 weeks while the

main orebody is exposed by pre-stripping operations, at which time

normal production levels will resume.

Consequently, Allkem currently anticipates that

FY23 annual production at Mt Cattlin will be approximately

140-150kt compared to the previous guidance of 160-170kt.

Production will be split approximately 15%, 20%, 30%, 35% across

each respective quarter and with FY23 costs expected to be

approximately US$900/t. As advised in the June Quarterly Report,

ore grades will increase from 0.93-0.94% in the current year to

1.17% in FY24 which will have a beneficial impact on costs and

production.

Mitigation actions at site are already well

underway and include the mobilisation of an additional mining

contractor, the replacement and upsizing of mining equipment with

the existing mining contractor, the installation of magnetic ore

sorters to allow the processing of low-grade stockpiles and

advanced metallurgical test work on the fine-grained ore.

So far this quarter Allkem has sold two trial

shipments for a total of 30,000 tonnes of low grade (~1.3%)

spodumene concentrate at an average realised price of between

US$500/t and US$600/t CIF. In order to offset the deferred delivery

of SC6 spodumene volumes, Allkem is currently in advanced

discussions with existing customers to substitute up to 100,000

tonnes of the lower grade material during the current half

year.

RESOURCE EXTENSION DRILLING

Allkem commenced a three-phase resource

extension program in mid-April that targets 147 holes for

approximately 32,685 metres of reverse circulation

(“RC”) drilling.

The first two phases will target the immediate

extension to mine-life at depth. The first phase aims to convert

~3.2Mt of resource from the inferred to indicated category. The

second phase will test two pegmatite lenses of approximately 4.2Mt

of existing inferred resource along strike and at depth in

conjunction with a study to evaluate either the opencut or

underground development of potential resource extensions.

As of this date of this announcement, 60 holes

and approximately 14,000m of drilling had been completed and an

update on results will be provided later in September. The current

drilling program is expected to be completed towards the end of

CY22 and results have not been incorporated in the 2022 Mineral

Resource estimate.

Figure 1: Mt Cattlin Mineral

Resource/Reserve and pit

shellshttps://www.globenewswire.com/NewsRoom/AttachmentNg/5d84292f-3b9e-4c1f-90fb-7849d34027bd

MINERAL RESOURCE

The Mineral Resource Estimate at 30 June 2022 is

presented in Table 1 and represents the combination of the 2018

Mineral Resource with a stand-alone 2021 2NW pit estimate, depleted

for mining activities from 31 March 2021 to 30 June 2022. As in

previous years the cut-off grade used was 0.4% Li2O whilst the pit

shell used within which to estimate the Mineral Resource was

generated at US$1,100/t at 6% Li2O concentrate grade (c.f. US$900/t

in 2021).

Table 1: Mt Cattlin Mineral Resource at

30 June 2022

|

Category |

|

Tonnage |

Grade |

Grade |

Contained Metal |

Contained metal |

Nett Variance to 2021 Statement |

|

|

|

Mt |

% Li2O |

ppm Ta2O5 |

(‘000) t Li2O |

lbs Ta2O5 |

% |

|

Measured |

In-situ |

- |

- |

- |

- |

- |

-100% |

|

Indicated |

In-situ |

4.5 |

1.3 |

135 |

59 |

1,339,000 |

-6% |

|

|

Stockpiles |

2.4 |

0.8 |

122 |

19 |

646,000 |

-20% |

|

Inferred |

In-situ |

6.4 |

1.3 |

131 |

83 |

1,850,000 |

121% |

|

Total Resource at 30 June 2022 |

|

13.3 |

1.2 |

131 |

161 |

3,835,000 |

21% |

|

Depletion |

|

|

|

|

|

|

Notes |

|

Measured |

|

-0.3 |

1.6 |

236 |

-5 |

-156,000 |

2NE Pit |

|

Indicated + Inferred |

|

-0.8 |

1.6 |

330 |

-13 |

-582,000 |

2NE Pit |

|

Stockpiles |

|

-0.6 |

0.8 |

122 |

-5 |

-161,000 |

Surface |

|

Addition |

|

|

|

|

|

|

Notes |

|

Measured |

|

- |

- |

- |

- |

- |

No GC drilling |

|

Indicated |

|

0.3 |

1.1 |

146 |

3 |

97,000 |

Change in RPEEE + 2SW deeps |

|

Inferred |

|

3.7 |

1.3 |

141 |

49 |

1,150,000 |

Change in RPEEE |

|

Stockpiles (Indicated) |

|

- |

- |

- |

- |

- |

Depleted as 2NW pre-strip developed |

|

Total Resource at 31 March 2021 |

|

11.0 |

1.2 |

151.0 |

131.8 |

3,674,000 |

- |

Notes: Reported at cut-off grade of 0.4% Li2O

contained within a pit shell generated at a spodumene price of

USD1,100 at 6% Li20. The preceding statements of Mineral Resources

conforms to the Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves (JORC Code) 2012

edition. All tonnages reported are dry metric tonnes. Excludes

mineralisation classified as oxide and transitional. Minor

discrepancies may occur due to rounding to appropriate significant

figures. RPEEE is defined as reasonable prospects for eventual

economic evaluation.

The FY2022 Mineral Resource estimate takes into

account both mining of resources from the current open pit mine and

depletion of stockpiles, and includes results from the 2021 infill

drilling results from the 2NW deposit. Remnant Mineral Resources

under the backfilled 2SW pit has also been included as potential

underground feed.

A description of the major factors that resulted

in changes from the 2021 Mineral Resource to the 2022 Mineral

Resource are as follows:

- Resource model

depletion of 1.4 Mt of material mined at a grade of 1.62%

Li2O;

- Stockpiles

depleted by approximately 510Kt;

- Decline in

Measured and Indicated grade due to the mining of higher-grade

material in H2 CY21 compared to the life of mine grade;

- Reclassification

of the RPEEE input revenue factor from USD 900 to 1,100 (at AUD/USD

0.70) for the generation of the pit shell within which the in-pit

resource is estimated –this development envelope is currently

subject to development drilling; and

- An updated,

depleted and integrated geological model in 2021.

The Mineral Resource estimate, mining depletion

and reporting was completed by Allkem staff. Allkem has assumed

responsibility for the logging, sampling, analytical and quality

assurance/quality control protocols currently in place for

estimates and depletions.

ORE RESERVE

Allkem has reviewed and updated the Mt Cattlin

Ore Reserve, incorporating 2021 infill drilling results from the

2NW deposit, the depletion of the 2NE pit and evaluation of remnant

deeper resource under the 2SW pit. Within this review, depleted

mined material and site stockpiles at 30 June 2022 and material to

be mined after this date are presented in accordance with JORC

(2012) Ore Reserve Reporting.

Mt Cattlin’s Ore Reserve at 30 June 2022 is

presented in Table 3 and is based on the remaining Ore Reserves

with the current mine design utilising the model from the 2021

Mineral Resource estimate with the application of modifying

factors.

Like the 2021 annual review, modifying factors

and mining reconciliation were reviewed by the Competent Person and

reflect Allkem’s continued strategy to utilise front-end optical

sorters to upgrade and process low-grade stockpiled ore. A dilution

factor of 17% applied to the Ore Reserve and a mining recovery of

93% of diluted material reflects the current practice of mining to

horizontal flitches and benches.

At 30 June, 2022 the 2NW pit pre-strip had

advanced such that first ore had daylighted in the pit floor in

blasted stocks, approximately 70Kt of ore has been depleted at the

period end.

Table 3: Mt Cattlin Ore Reserve as at 30

June 2022

|

Category |

TonnageMt |

Grade% Li2O |

Gradeppm Ta2O5 |

Contained metal(‘000) t Li2O |

Contained metallbs Ta2O5 |

Variance to 2021% |

|

Proven |

- |

- |

- |

- |

- |

% |

-100% |

|

Probable |

2NW only |

3.3 |

1.12 |

105 |

37.0 |

764,000 |

-30% |

|

|

Stockpiles |

2.4 |

0.80 |

122 |

19.0 |

646,000 |

-20% |

|

Total |

5.8 |

0.98 |

113 |

56.0 |

1,410,000 |

-28% |

Notes: Reported at cut-off grade of 0.4 % Li2O

within current mine design. The preceding statements of Ore

Reserves conforms to the Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

2012 edition. All tonnages reported are dry metric tonnes. Reported

with 17% dilution and 93% mining recovery. Revenue factor

US$650/tonne applied. Minor discrepancies may occur due to rounding

to appropriate significant figures.

Table 4: Mt Cattlin Ore Reserve as at 31

March 2021

|

Category |

TonnageMt |

Grade% Li2O |

Gradeppm Ta2O5 |

Contained metal(‘000) t Li2O |

Contained metallbs Ta2O5 |

|

Proven |

In-situ |

0.3 |

1.36 |

198 |

4.1 |

131,000 |

|

Probable |

In-situ |

4.7 |

1.19 |

146 |

55.9 |

1,512,000 |

|

|

Stockpiles |

3.0 |

0.80 |

122 |

24.0 |

807,000 |

|

Total |

8.0 |

1.04 |

139 |

84.0 |

2,449,000 |

Notes: Reported at cut-off grade of 0.4 % Li2O

within current mine design. The preceding statements of Ore

Reserves conforms to the Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

2012 edition. All tonnages reported are dry metric tonnes. Reported

with 17% dilution and 93% mining recovery. Revenue factor

US$650/tonne applied. Minor discrepancies may occur due to rounding

to appropriate significant figures.

A description of the major factors that resulted

in changes from the 2021 Ore Reserve to the 2022 Ore Reserve is as

follows:

- Resource model

depleted for ore extracted from the completed 2NE pit;

- An updated 2021

Mineral Resource Estimate and supporting Ore Reserve Study;

- Decrease in Ore

Reserves due to open pit mining and stockpile processing;

- Decline in grade

is due to the mining of higher-grade material in H2 CY21 compared

to the life of mine grade; and

- Reconciliation

indicates the now depleted 2NE pit delivered 1.4Mt @1.62%

Li2O.

The Ore Reserve does not take into account the

infill drilling results from the 2NW deposit and the mine design

has not been changed to take into account increase in Mineral

Resources due to changes in pit shell. A revised mine design based

on an updated Mineral Resource will be undertaken after the

completion of the current major drilling programme.

Appropriate assessments and studies have been

carried out and include consideration of and modification by

realistically assumed mining, metallurgical, economic, marketing,

legal, environmental, social and governmental factors. These

assessments demonstrate at the time of reporting that extraction

could reasonably be justified.

RESOURCE AND RESERVE CONTROLS &

GOVERNANCE

Allkem ensures that quoted Mineral Resource and

Ore Reserve estimates are subject to internal controls and external

review at both project and corporate levels. Mineral Resource and

Ore Reserves are estimated and reported in accordance with the 2012

edition of the JORC Code.

Allkem stores and collects exploration data

using industry standard software that contains internal validation

checks. Exploration samples from drilling have certified reference

material standards introduced to the sample stream at set ratios,

typically 1 per 25 samples. These are reported as necessary to the

relevant Competent Persons to assess both accuracy and precision of

the assay data applied to resource estimates. In resource

modelling, block models are validated by checking the input drill

hole composites against the block model grades by domain.

Allkem engages independent, qualified experts on

a commercial fee for service basis, to undertake Mineral Resource

and Ore Reserve audits. Allkem internally reconciles the resource

outcomes to validate both the process and the outcome. RPEEE has

been tested against a Whittle Optimisation with only the revenue

factor changed from USD 900 to 1,100.

The Company has developed its internal systems

and controls to maintain JORC compliance in all external reporting,

including the preparation of all reported data by Competent Persons

who are members of the Australasian Institute of Mining and

Metallurgy or a ‘Recognised Professional Organisation’. As set out

above, the Mineral Resource and Ore Reserve statements included in

this announcement were reviewed by suitably qualified Competent

Persons (below) prior to their inclusion, in the form and context

announced.

This release was authorised by Mr Martin Perez

de Solay, CEO and Managing Director of Allkem Limited.

|

Allkem LimitedABN 31 112 589 910 Level 35, 71

Eagle StBrisbane, QLD 4000 |

Investor Relations & Media EnquiriesAndrew

Barber M: +61 418 783 701 E:

Andrew.Barber@allkem.coPhoebe LeeP: +61 7 3064

3600 E: Phoebe.Lee@allkem.co |

Connect info@allkem.co+61 7 3064

3600www.allkem.co |

IMPORTANT NOTICES

This investor ASX/TSX release

(Release) has been prepared by Allkem Limited (ACN

112 589 910) (the Company or

Allkem). It contains general information about the

Company as at the date of this Release. The information in this

Release should not be considered to be comprehensive or to comprise

all of the material which a shareholder or potential investor in

the Company may require in order to determine whether to deal in

Shares of Allkem. The information in this Release is of a general

nature only and does not purport to be complete. It should be read

in conjunction with the Company’s periodic and continuous

disclosure announcements which are available at allkem.co and with

the Australian Securities Exchange (ASX)

announcements, which are available at www.asx.com.au.

This Release does not take into account the

financial situation, investment objectives, tax situation or

particular needs of any person and nothing contained in this

Release constitutes investment, legal, tax, accounting or other

advice, nor does it contain all the information which would be

required in a disclosure document or prospectus prepared in

accordance with the requirements of the Corporations Act 2001 (Cth)

(Corporations Act). Readers or recipients of this

Release should, before making any decisions in relation to their

investment or potential investment in the Company, consider the

appropriateness of the information having regard to their own

individual investment objectives and financial situation and seek

their own professional investment, legal, taxation and accounting

advice appropriate to their particular circumstances.

This Release does not constitute or form part of

any offer, invitation, solicitation or recommendation to acquire,

purchase, subscribe for, sell or otherwise dispose of, or issue,

any Shares or any other financial product. Further, this Release

does not constitute financial product, investment advice (nor tax,

accounting or legal advice) or recommendation, nor shall it or any

part of it or the fact of its distribution form the basis of, or be

relied on in connection with, any contract or investment

decision.

The distribution of this Release in other

jurisdictions outside Australia may also be restricted by law and

any restrictions should be observed. Any failure to comply with

such restrictions may constitute a violation of applicable

securities laws.

Past performance information given in this

Release is given for illustrative purposes only and should not be

relied upon as (and is not) an indication of future

performance.

Forward Looking Statements

Forward-looking statements are based on current

expectations and beliefs and, by their nature, are subject to a

number of known and unknown risks and uncertainties that could

cause the actual results, performances and achievements to differ

materially from any expected future results, performances or

achievements expressed or implied by such forward-looking

statements, including but not limited to, the risk of further

changes in government regulations, policies or legislation; the

risks associated with the continued implementation of the merger

between the Company and Galaxy Resources Ltd, risks that further

funding may be required, but unavailable, for the ongoing

development of the Company’s projects; fluctuations or decreases in

commodity prices; uncertainty in the estimation, economic

viability, recoverability and processing of mineral resources;

risks associated with development of the Company Projects;

unexpected capital or operating cost increases; uncertainty of

meeting anticipated program milestones at the Company’s Projects;

risks associated with investment in publicly listed companies, such

as the Company; and risks associated with general economic

conditions.

Subject to any continuing obligation under

applicable law or relevant listing rules of the ASX, the Company

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statements in this Release to

reflect any change in expectations in relation to any

forward-looking statements or any change in events, conditions or

circumstances on which any such statements are based. Nothing in

this Release shall under any circumstances (including by reason of

this Release remaining available and not being superseded or

replaced by any other Release or publication with respect to the

subject matter of this Release), create an implication that there

has been no change in the affairs of the Company since the date of

this Release.

Competent Person Statement

The information in this announcement that

relates to Exploration Results and Mineral Resources is based on

information compiled by Albert Thamm, B.Sc. (Hons)., M.Sc.

F.Aus.IMM, a Competent Person who is a Fellow of The Australasian

Institute of Mining and Metallurgy. Albert Thamm is a full-time

employee of Galaxy Resources Pty. Limited. Albert Thamm has

sufficient experience that is relevant to the style of

mineralization and type of deposit under consideration and to the

activity being undertaken to qualify as a Competent Person as

defined in the 2012 Edition of the ‘Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves’. Albert

Thamm consents to the inclusion in this announcement of the matters

based on his information in the form and context in which it

appears.

The information in this announcement that

relates to the 30 June 2022 Mt Cattlin Ore Reserve is based on

information compiled by Keith Muller, B. Eng. (Mining), M. Eng.

(Mining), F.Aus.IMM (CP Mining), a Competent Person who is a Fellow

of the Australasian Institute of Mining and Metallurgy. Keith

Muller is a full-time employee of Galaxy Resources Pty. Ltd. Keith

Muller has sufficient experience that is relevant to the style of

mineralization and type of deposit under consideration and to the

activity being undertaken to qualify as a Competent Person as

defined in the 2012 Edition of the ‘Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves’. Keith

Muller consents to the inclusion in this announcement of the

matters based on his information in the form and context in which

it appears.

The scientific and technical information

contained in this announcement has been reviewed and approved by

Albert Thamm, as it relates to geology, exploration, drilling,

sample preparation, data verification and the depleted Mineral

Resource and Keith Muller, BEng Mining, M. Eng. F.Aus.IMM (CP

Mining) as it relates to the Mineral Reserve, mining methods and

infrastructure; mineral processing, recovery methods, market

studies, permitting, environmental and social studies, capital and

operating cost estimates and economic analysis.

Not for

release or distribution

in the United States

This announcement has been prepared for

publication in Australia and may not be released to U.S. wire

services or distributed in the United States. This announcement

does not constitute an offer to sell, or a solicitation of an offer

to buy, securities in the United States or any other jurisdiction,

and neither this announcement or anything attached to this

announcement shall form the basis of any contract or commitment.

Any securities described in this announcement have not been, and

will not be, registered under the U.S. Securities Act of 1933 and

may not be offered or sold in the United States except in

transactions registered under the U.S. Securities Act of 1933 or

exempt from, or not subject to, the registration of the U.S.

Securities Act of 1933 and applicable U.S. state securities

laws.

Appendix 1 – JORC 2012 Table 1 Disclosure is

available at www.allkem.co

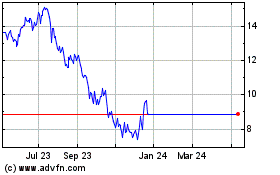

Alikem (TSX:AKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

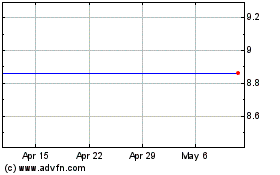

Alikem (TSX:AKE)

Historical Stock Chart

From Apr 2023 to Apr 2024