JPMorgan, Palantir, Blackberry: What to Watch When the Stock Market Opens Today

January 15 2021 - 8:24AM

Dow Jones News

By James Willhite

Here's what we're watching ahead of Friday's opening bell.

-- U.S. stock futures edged lower as some investors grew

concerned that President-elect Joe Biden's $1.9 trillion Covid-19

relief plan could lead to higher taxes.

Futures tied to the S&P 500 fell 0.4%, putting the benchmark

on course to decline for a second day. Contracts tied to the

Nasdaq-100 were flat and those linked to the Dow Jones Industrial

Average slipped 0.6%. Read our full market wrap here.

Retail sales declined 0.7% in December, as holiday shoppers

avoided stores during a rise in Covid-19 cases.

What's Coming Up

-- A preliminary reading of consumer sentiment, due at 10 a.m.,

is expected to register a small drop.

Market Movers to Watch

-- Corporate earnings season kicked into high gear with updates

before the bell from JPMorgan Chase, Citigroup and Wells Fargo.

Shares of JPMorgan slipped 2% after its profit jumped 42% during

the recent quarter. Wells Fargo dropped 4.1% after revenue fell

more than forecast but profit broke a streak of misses. Citigroup

shed 1.5% after its profit beat forecasts.

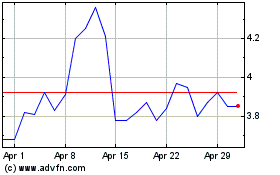

-- Shares of Blackberry jumped more than 20% premarket. The rise

comes after the maker of the eponymous device from technology days

of yore, now a security software and services company, saw its

stock climb more than 20% on Thursday. Earlier this week Canada's

the Globe and Mail reported the company had sold 90 patents to

Huawei. No word on whether " Blackberry thumb" is going to become a

thing again.

-- After surging for two days, GameStop shares are taking a

break, falling 4.5% premarket. Some investors had pointed to a

short squeeze as behind the recent jump.

-- Online resale marketplace Poshmark's shares fell 3.5%

premarket, but held on to most of the prior day's gains, when its

stock soared more than 140% in its trading debut.

-- Shares of Palantir Technologies are up more than 5%

premarket, as investors appear unmoved by yesterday's downgrade of

the stock from Citibank.

-- Energy giant Exxon Mobil's shares lost 3.5% before the open.

The SEC launched an investigation after an employee filed a

whistleblower complaint last fall alleging it overvalued one of its

most important oil and gas properties.

-- Business-application software firm Progress Software reported

higher-than-expected adjusted earnings and revenue for its most

recent quarter. Its shares slipped 1.5% premarket.

Market Fact

Smartphone giant Xiaomi's Hong Kong-listed shares fell almost

14% Friday before closing 10% lower, after the company became the

latest Chinese technology group to be targeted by the Trump

administration, with its surprise addition to an investment

blacklist.

Chart of the Day

The world's fastest Covid-19 vaccination rollout is drawing

investors to Israel, making its stock market one of the top

performers in 2021.

Must Reads Since You Went to Bed

When Some Investors Look at Stocks They See Dollars, Not

Shares

Fannie, Freddie Taxpayer Stake Won't Be Restructured Under

Trump

U.S. Blacklists Xiaomi, Spares Alibaba, Tencent and Baidu

James Simons Steps Down as Renaissance Chairman

Derby's Take: Lots of Life Left in Fed's Bond Buying, Central

Bank Officials Say

(END) Dow Jones Newswires

January 15, 2021 09:09 ET (14:09 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

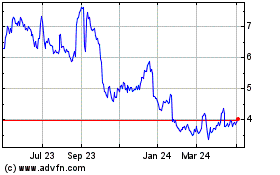

BlackBerry (TSX:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlackBerry (TSX:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024