Off-Hours Trading Surged at Peak of GameStop Frenzy

February 03 2021 - 12:58PM

Dow Jones News

By Alexander Osipovich

Data on the Reddit-fueled frenzy over GameStop Corp. stock shows

that an unusually large share of trading in the company's shares

took place outside of regular trading hours.

On two days--Jan. 27 and 28--more than 20% of daily trading

volume in GameStop took place in the pre-market or post-market

trading sessions, according to Dow Jones Market Data. That was up

from between 2% and 3% a week earlier, before frenetic trading in

GameStop by individual investors sent shares of the videogame

retailer skyrocketing. In December, off-hours trading accounted for

about 6% of daily volume on average.

Pre-market trading runs from 4 a.m. to 9:30 a.m. ET, while

post-market trading runs from 4 p.m. to 8 p.m. ET. The two

off-hours sessions are often marked by less liquidity than regular

trading hours, which can set the stage for sharp swings in stock

prices.

During the premarket session on Jan. 28, GameStop shares surged

as high as $504.99, after having closed at $347.51 the previous

day.

This item is part of a Wall Street Journal live coverage event.

The full stream can be found by searching P/WSJL (WSJ Live

Coverage).

(END) Dow Jones Newswires

February 03, 2021 13:43 ET (18:43 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

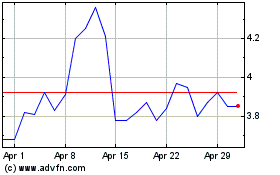

BlackBerry (TSX:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

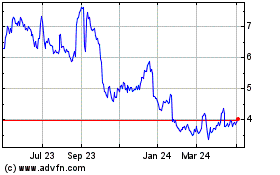

BlackBerry (TSX:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024