Black Diamond Group Limited ("Black Diamond", the "Company" or

"we"), (TSX:BDI), a leading provider of space rental and workforce

accommodation solutions, today announced its operating and

financial results for the three months ended March 31, 2019

(the "Quarter") compared with the three months ended March 31,

2018 (the "Comparative Quarter"). All financial figures are

expressed in Canadian dollars.

- Revenue for the Quarter was $45.4

million, up 11% or $4.5 million from the Comparative Quarter due to

an increase in custom sales in Modular Space Solutions

("MSS").

- MSS revenue increased to $22.5

million, a 60% increase from the Comparative Quarter, and

represented 50% of consolidated revenue for the Quarter.

- Adjusted EBITDA (see "Non-GAAP

Measures") for the Quarter was $8.1 million, a decrease of 6% or

$0.5 million from the Comparative Quarter primarily due a change in

revenue mix. Included in Adjusted EBITDA is a positive $1.0

million impact from the adoption of the IFRS 16 Leases accounting

standard.

- The Company's leverage position

remains substantially unchanged from December 31, 2018, as net debt

increased slightly to $88.0 million from $86.9 million at year-end.

The Company exited the Quarter with a Funded Debt to EBITDA ratio

of 2.84 (December 31, 2018 - 2.95) and a Funded Debt to Tangible

Book Value ratio of 0.44 (December 31, 2018 - 0.44).

- Subsequent to the Quarter, Black

Diamond announced a $20 million rental contract for the Company's

U.S. WFS business unit.

"We believe our first Quarter results are

indicative of Black Diamond's continued focus to diversify our

business as the MSS segment continues to show growth in rental

revenue supported by sequential quarter-over-quarter fleet growth

and healthy markets throughout our North American footprint," said

Trevor Haynes, CEO of Black Diamond Group. "Our MSS fleet is

expected to show growth of 10% as we continue to invest in the

fleet. The Workforce Solutions business remains well

positioned to capitalize on an improvement in sector activity

levels in Canada, with improving backlog and healthy bid logs being

seen throughout the system. Outside of Canada, the Workforce

Solutions business in Australia and the United States are strong

and expect to see modest capital investment this year. We

remain excited with respect to our LodgeLink platform and are

expecting to roll out an upgrade to the digital marketplace in the

coming months, which will support the ongoing growth of both

supply, customers and room night bookings."

Black Diamond's consolidated revenue in the

Quarter increased 11% to $45.4 million from $40.9 million in the

Comparative Quarter. Despite higher revenues, Adjusted EBITDA

decreased to $8.1 million from $8.6 million in the Comparative

Quarter, due primarily to lower margins. Lower margins for

the quarter were driven by an increase in contribution from sales

and non-rental revenue which generate lower margins compared to

rental revenue. Operating margins were also lower

year-over-year due to comparably strong sales margin performance in

the Comparative Quarter. Revenue derived from outside of western

Canadian energy sources increased to 63% in the Quarter, compared

to 45% in the Comparative Quarter.

In the MSS segment, revenue in the Quarter

increased to $22.5 million, up 60% from $14.1 million in the

Comparative Quarter. MSS utilization averaged 73% in the Quarter,

up from 66% in the Comparative Quarter, while average rental rates

remained consistent with the Comparative Quarter. MSS Adjusted

EBITDA of $4.9 million was higher than Adjusted EBITDA in the

Comparative Quarter of $3.8 million due to increased rental and

non-rental revenue. Adjusted EBITDA was also positively impacted by

IFRS 16 in the amount of approximately $0.6 million.

The Company's Workforce Solutions ("WFS")

segment generated revenue in the Quarter of $22.9 million, down 15%

from $26.8 million in the Comparative Quarter. WFS Adjusted EBITDA

in the Quarter declined to $6.0 million from $7.1 million in the

Comparative Quarter due to lower used-fleet sales in the Quarter,

offset by $0.4 million from the positive impact of adopting IFRS

16. Lodging occupancy in the Quarter was consistent at 33%.

Outlook

In our MSS business, we expect continued growth

in regions such as British Columbia, southern Ontario and the

United States ("U.S."); supported by a healthy economy and strong

activity levels in construction and infrastructure. The Company

continues to focus on MSS fleet growth of 10% this year, supported

by $25 to $30 million of capital investment in this segment

throughout 2019. We expect cash flow generation to out-pace fleet

growth due to continued increase in scale and additional product

offerings through Value Added Products and Services ("VAPS").

Longer term, over the next five years, the Company's goal is to

double the MSS fleet.

Within our WFS segment, we expect activity

levels in the U.S. and Australian markets to remain robust, and the

Canadian market has performed relatively in line with year-ago

levels. However, we are optimistic that the Canadian market

will show improved WFS performance into the second half of the

year. This optimism is supported by previously announced

contract wins related to a 908-bed turnkey project ("Sukunka") for

the Coastal Gas Link project and a separate, smaller rental project

in Kitimat, British Columbia. Install and transportation of

the 908-bed Sukunka camp has begun in the second quarter with rent

expected to begin in the third quarter. The smaller Kitimat rental

project was installed in late March and is currently on rent.

Our large WFS asset base continues to provide meaningful operating

leverage to a recovery in activity levels. Our ability to move

these WFS assets into diversified markets outside of the western

Canadian energy sector is evidenced by our recently-announced $20

million rental contract to supply 1,584 beds to support the

reconstruction of Paradise, California. Given our healthy bid log,

we believe the market for private dormitory assets could tighten

relatively quickly should a handful of infrastructure projects move

forward over the next several quarters. Amongst this

backdrop, we will remain disciplined with our pricing and capital

allocation decisions while continuing to optimize our fleet by

selling down underutilized assets.

LodgeLink, the Company's digital marketplace for

workforce accommodation, continued to gain traction with customers

and suppliers during the Quarter. LodgeLink now has over 520

properties listed, representing over 61,000 rooms of capacity

across North America. We've begun expanding into the U.S. in 2019,

with an increase in customers and listed properties. Our first U.S.

bookings were completed recently, and we continue to expect growth

in both customer and supplier volumes throughout the year.

Black Diamond exited the Quarter with net debt

of $88.0 million, up slightly from $86.9 million at the end of

2018. Black Diamond's capital budget for 2019 remains

unchanged. The Company expects to invest approximately $35

million of capital on a gross basis, which is expected to be funded

with internally generated cash flow. Any excess cash flows is

expected to be directed towards further debt repayment.

First Quarter 2019 Financial Highlights

| |

Three months ended March 31, |

| (in millions, except as noted) |

2019 |

|

2018 |

|

Change |

|

|

$ |

|

$ |

|

|

| Revenue |

|

|

|

| Modular Space Solutions |

22.5 |

|

14.1 |

|

60 |

% |

| Workforce Solutions |

22.9 |

|

26.8 |

|

(15 |

)% |

| Total

Revenue |

45.4 |

|

40.9 |

|

11 |

% |

| |

|

|

|

| Total Adjusted

EBITDA |

8.1 |

|

8.6 |

|

(6 |

)% |

| |

|

|

|

| Funds from Operations |

8.8 |

|

10.9 |

|

(19 |

)% |

| Per share ($) |

0.16 |

|

0.20 |

|

(20 |

)% |

| |

|

|

|

| Loss |

(2.7 |

) |

(1.9 |

) |

42 |

% |

| Loss per share - Basic and

diluted |

(0.05 |

) |

(0.03 |

) |

67 |

% |

| |

|

|

|

| Capital expenditures |

8.3 |

|

1.3 |

|

538 |

% |

| |

|

|

|

| Property & equipment

(NBV) |

336.6 |

|

362.2 |

|

(7 |

)% |

| Total assets |

418.2 |

|

416.0 |

|

1 |

% |

| Long-term

debt |

88.3 |

|

107.5 |

|

(18 |

)% |

Additional Information

A copy of the Company's unaudited interim

condensed consolidated financial statements for the three months

ended March 31, 2019 and 2018 and related management's discussion

and analysis have been filed with the Canadian securities

regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com) and www.blackdiamondgroup.com.

About Black Diamond Group

Black Diamond Group rents and sells space rental

solutions and modular workforce accommodations to business

customers in Canada, the United States and Australia. The Company

also provides specialized field rentals to the oil and gas

industries of Canada and the United States. In addition, Black

Diamond Group provides turnkey lodging services, as well as a host

of related services that include transportation, installation,

dismantling, repairs, maintenance and ancillary field equipment

rentals. From twenty-two locations, the Company serves multiple

sectors including oil and gas, mining, power, construction,

engineering, military, government and education.

Black Diamond Group has two core business units:

Modular Space Solutions and Workforce Solutions. Learn more at

www.blackdiamondgroup.com.

For investor inquiries please contact Jason

Zhang at 403-206-4739 or investor@blackdiamondgroup.com

Reader Advisory

Forward-Looking

StatementsCertain information set forth in this news

release contains forward-looking statements including, but not

limited to, the amount of funds that will be expended on the 2019

capital plan, how such capital will be expended, expectations for

asset sales, management's assessment of Black Diamond's future

operations and what may have an impact on them, financial

performance, business prospects and opportunities, changing

operating environment including increased activity levels, amount

of revenue anticipated to be derived from current contracts,

anticipated debt levels, economic life of the Company's assets,

future growth and profitability of the Company and realization of

the anticipated benefits of acquisitions and sales. With respect to

the forward-looking statements in the news release, Black Diamond

has made assumptions regarding, among other things: future

commodity prices, that Black Diamond will continue to conduct its

operations in a manner consistent with past operations, that

counter-parties to contracts will perform the contracts as written

and that there will be no unforeseen material delays in contracted

projects. Although Black Diamond believes that the expectations

reflected in the forward-looking statements contained in this news

release, and the assumptions on which such forward-looking

statements are made, are reasonable, there can be no assurances

that such expectations or assumptions will prove to be correct.

Readers are cautioned that assumptions used in the preparation of

such statements may prove to be incorrect. Events or circumstances

may cause actual results to differ materially from those predicted,

as a result of numerous known and unknown risks, uncertainties and

other factors, many of which are beyond the control of Black

Diamond. These risks include, but are not limited to: the impact of

general economic conditions, industry conditions, fluctuation of

commodity prices, the Company's ability to attract new customers,

failure of counterparties to perform on contracts, industry

competition, availability of qualified personnel and management,

timely and cost effective access to sufficient capital from

internal and external sources, political conditions, dependence on

suppliers and stock market volatility. The risks outlined above

should not be construed as exhaustive. Additional information on

these and other factors that could affect Black Diamond's

operations and financial results are included in Black Diamond's

annual information form for the year ended December 31, 2018 and

other reports on file with the Canadian Securities Regulatory

Authorities which can be accessed on SEDAR. Readers are cautioned

not to place undue reliance on these forward-looking statements.

Furthermore, the forward-looking statements contained in this news

release are made as at the date of this news release and Black

Diamond does not undertake any obligation to update or revise any

of the forward-looking statements, except as may be required by

applicable securities laws.

Non-GAAP MeasuresIn this news

release, the following terms have been referenced: Adjusted EBITDA,

Net Debt, Funded Debt, Tangible Book Value and Funds from

Operations. Readers are cautioned that these measures are not

defined under International Financial Reporting Standards ("IFRS").

Readers are cautioned that these non-GAAP measures are not

alternatives to measures under IFRS and should not, on their own,

be construed as an indicator of the Company's performance or cash

flows, a measure of liquidity or as a measure of actual return on

the common shares of the Company. These Non-GAAP measures should

only be used in conjunction with the consolidated financial

statements of the Company. A reconciliation between these

measures and measures defined under IFRS is included in

management's discussion and analysis for the three month period

ended March 31, 2019 filed on SEDAR.

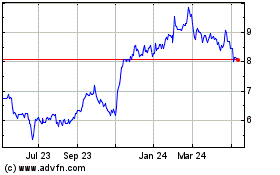

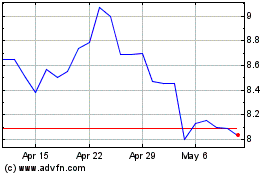

Black Diamond (TSX:BDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Black Diamond (TSX:BDI)

Historical Stock Chart

From Apr 2023 to Apr 2024