Brookfield Infrastructure Issues $200 Million Inaugural Green Preferred Units

September 21 2020 - 7:13PM

Brookfield Infrastructure Partners L.P. (

TSX:

BIP.UN; NYSE:

BIP) (“Brookfield Infrastructure”) today

closed the public issuance of 8,000,000 Class A Preferred Limited

Partnership Units, Series 13 (the “Series 13 Preferred Units”) for

gross proceeds of $200 million.

Holders of the Series 13 Preferred Units will be

entitled to receive a cumulative quarterly fixed distribution of

5.125% per annum. The Series 13 Preferred Units have been approved

for listing on the New York Stock Exchange under the symbol “BIP PR

A.”

“We are pleased to issue these inaugural green

preferred units and further enhance our commitment to sustainable

investment practices,” said Sam Pollock, Chief Executive Officer of

Brookfield Infrastructure Partners. “These practices are integrated

into all aspects of our business, and this issuance further

demonstrates the market’s support for our approach.”

Brookfield Infrastructure intends to use the net

proceeds of the offering to finance and/or refinance recently

completed and future Eligible Green Projects, including the

development and redevelopment of such projects. Pending the

allocation of an amount equal to the net proceeds of the offering,

the unallocated portion will be used to repay amounts drawn under

Brookfield Infrastructure’s unsecured revolving credit

facility.

Morgan Stanley & Co. LLC, BofA Securities,

Inc., J.P. Morgan Securities LLC, RBC Capital Markets, LLC and

Wells Fargo Securities, LLC acted as joint bookrunning managers for

the public offering. TD Securities (USA) LLC acted as co-manager

for the public offering.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy the securities in

any jurisdiction, nor shall there be any offer or sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

Brookfield Infrastructure

Partners

Brookfield Infrastructure Partners is a leading

global infrastructure company that owns and operates high-quality,

long-life assets in the utilities, transport, energy and data

infrastructure sectors across North and South America, Asia Pacific

and Europe. We are focused on assets that generate stable cash

flows and require minimal maintenance capital expenditures.

Investors can access its portfolio either through Brookfield

Infrastructure L.P. (NYSE: BIP, TSX: BIP.UN), a Bermuda-based

limited partnership, or Brookfield Infrastructure Corporation

(NYSE, TSX: BIPC), a Canadian corporation. Further information is

available at www.brookfield.com/infrastructure.

Brookfield Infrastructure is the flagship listed

infrastructure company of Brookfield Asset Management, a global

alternative asset manager with approximately $550 billion of assets

under management. For more information, go to

www.brookfield.com.

|

Contact information: |

|

|

Media: |

Investors: |

|

Claire Holland |

Kate White |

|

Senior Vice President - Communications |

Manager, Investor Relations |

|

(416) 369-8236 |

(416) 956-5183 |

|

claire.holland@brookfield.com |

kate.white@brookfield.com |

Cautionary Statement Regarding

Forward-looking Statements

Note: This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. The words "will", "intend" and "expect" or

derivations thereof and other expressions which are predictions of

or indicate future events, trends or prospects, and which do not

relate to historical matters, identify forward-looking statements.

Forward-looking statements in this news release include statements

regarding the offering and the use of proceeds therefrom. Although

Brookfield Infrastructure believes that these forward-looking

statements and information are based upon reasonable assumptions

and expectations, the reader should not place undue reliance on

them, or any other forward-looking statements or information in

this news release. The future performance and prospects of

Brookfield Infrastructure are subject to a number of known and

unknown risks and uncertainties. Factors that could cause actual

results of Brookfield Infrastructure to differ materially from

those contemplated or implied by the statements in this news

release are described in the documents filed by Brookfield

Infrastructure with the securities regulators in Canada and the

United States including under "Risk Factors" in Brookfield

Infrastructure's most recent Annual Report on Form 20-F and other

risks and factors that are described therein and in, or

incorporated by reference in, the Registration Statement and

prospectus supplement thereto. Except as required by law,

Brookfield Infrastructure undertakes no obligation to publicly

update or revise any forward-looking statements or information,

whether as a result of new information, future events or

otherwise.

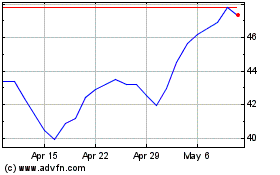

Brookfield Infrastructure (TSX:BIPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Infrastructure (TSX:BIPC)

Historical Stock Chart

From Apr 2023 to Apr 2024