Computer Modelling Group Ltd. (“CMG” or the “Company”) announces

its financial results for the three months ended June 30, 2019.

Quarterly Performance

| |

Fiscal 2018(1) |

Fiscal 2019(1) |

Fiscal

2020 |

|

($ thousands, unless otherwise stated) |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

| |

|

|

|

|

|

|

|

|

|

Annuity/maintenance licenses |

16,341 |

16,158 |

15,664 |

14,715 |

15,111 |

17,240 |

16,734 |

15,756 |

|

Perpetual licenses |

290 |

743 |

2,053 |

326 |

1,172 |

611 |

2,891 |

1,159 |

|

Software licenses |

16,631 |

16,901 |

17,717 |

15,041 |

16,283 |

17,851 |

19,625 |

16,915 |

|

Professional services |

1,350 |

1,418 |

1,677 |

1,664 |

1,658 |

1,222 |

1,513 |

1,208 |

|

Total revenue |

17,981 |

18,319 |

19,394 |

16,705 |

17,941 |

19,073 |

21,138 |

18,123 |

|

Operating profit |

6,615 |

6,908 |

7,529 |

5,374 |

7,024 |

8,406 |

8,750 |

7,068 |

| Operating profit (%) |

37 |

38 |

39 |

32 |

39 |

44 |

41 |

39 |

| Profit before income and other

taxes |

6,253 |

7,151 |

8,547 |

5,980 |

7,104 |

9,406 |

8,400 |

6,439 |

| Income and other taxes |

1,647 |

2,054 |

2,401 |

1,722 |

2,048 |

2,559 |

2,426 |

1,997 |

| Net income for the period |

4,606 |

5,097 |

6,146 |

4,258 |

5,056 |

6,847 |

5,974 |

4,442 |

| EBITDA(2) |

7,090 |

7,400 |

8,090 |

5,837 |

7,505 |

8,915 |

9,250 |

8,118 |

| Cash dividends declared and

paid |

8,021 |

8,022 |

8,021 |

8,021 |

8,024 |

8,022 |

8,023 |

8,022 |

| Funds flow from

operations |

5,788 |

6,225 |

7,285 |

5,242 |

5,777 |

7,550 |

7,024 |

6,097 |

| Free

cash flow(2) |

5,372 |

5,595 |

6,904 |

4,909 |

5,697 |

7,297 |

6,948 |

5,707 |

| Per share amounts -

($/share) |

|

|

|

|

|

|

|

|

| Earnings per share -

basic |

0.06 |

0.06 |

0.08 |

0.05 |

0.06 |

0.09 |

0.07 |

0.06 |

| Earnings per share -

diluted |

0.06 |

0.06 |

0.08 |

0.05 |

0.06 |

0.09 |

0.07 |

0.06 |

|

Cash dividends declared and paid |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

0.10 |

|

Funds flow from operations per share - basic |

0.07 |

0.08 |

0.09 |

0.07 |

0.07 |

0.09 |

0.09 |

0.08 |

|

Free cash flow per share - basic(2) |

0.07 |

0.07 |

0.09 |

0.06 |

0.07 |

0.09 |

0.09 |

0.07 |

|

(1) |

On April 1,

2019, the Company adopted IFRS 16 Leases using the modified

retrospective approach, by adjusting opening retained earnings with

no restatement of comparative figures. As such, comparative

information continues to be reported under the previous lease

standard. |

| (2) |

Non-IFRS financial measures are defined in the “Non-IFRS

Financial Measures” section. |

Highlights

During the three months ended June 30, 2019, as compared to the

same period of the previous fiscal year, we:

- Increased annuity/maintenance license revenue by 7%;

- Increased software license revenue by 12%;

- Increased net income by 4% (without the negative impact of IFRS

16 adoption, net income increased by 9%);

- Increased EBITDA by 39% (without the positive impact of IFRS 16

adoption, EBITDA increased by 23%).

During the three months ended June 30, 2019, we:

- Realized basic earnings per share of $0.06;

- Declared and paid a regular dividend of $0.10 per share.

Revenue

| Three months ended June

30, |

2019 |

|

2018 |

|

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

| |

|

|

|

|

|

Software license revenue |

16,915 |

|

15,041 |

|

1,874 |

|

12 |

% |

| Professional services |

1,208 |

|

1,664 |

|

(456 |

) |

-27 |

% |

|

Total revenue |

18,123 |

|

16,705 |

|

1,418 |

|

8 |

% |

| |

|

|

|

|

| Software license revenue as a

% of total revenue |

93 |

% |

90 |

% |

|

|

|

Professional services as a % of total revenue |

7 |

% |

10 |

% |

|

|

| |

|

|

|

|

CMG’s revenue is comprised of software license sales, which

provide the majority of the Company’s revenue, and fees for

professional services.

Total revenue for the three months ended June 30, 2019 increased

by 8% compared to the same period of the previous fiscal year, due

to an increase in software license revenue partially offset by a

decrease in professional services revenue.

Software License Revenue

|

Three months ended June 30, |

2019 |

|

2018 |

|

$ change |

% change |

|

| ($

thousands) |

|

| |

| Annuity/maintenance license

revenue |

15,756 |

|

14,715 |

|

1,041 |

7 |

% |

|

Perpetual license revenue |

1,159 |

|

326 |

|

833 |

256 |

% |

| Total

software license revenue |

16,915 |

|

15,041 |

|

1,874 |

12 |

% |

| |

| Annuity/maintenance as a % of

total software license revenue |

93 |

% |

98 |

% |

|

|

Perpetual as a % of total software license revenue |

7 |

% |

2 |

% |

|

| |

|

|

|

|

|

Total software license revenue for the three months ended June

30, 2019 increased by 12% compared to the same period of the

previous fiscal year, due to increases both in annuity/maintenance

license revenue and perpetual license revenue.

CMG’s annuity/maintenance license revenue increased by 7% during

the three months ended June 30, 2019, compared to the same period

of the previous fiscal year, due to increases in all geographic

regions, except Canada, due to increased licensing to both existing

and new customers. In addition, the movement in the CAD/USD

exchange rate had a positive impact on the quarterly

annuity/maintenance license revenue.

Perpetual license revenue increased from $0.3 million to $1.2

million, due to an increase in perpetual sales in the United States

and South America, partially offset by a decrease in the Eastern

Hemisphere. Software licensing under perpetual sales may fluctuate

significantly between periods due to the uncertainty associated

with the timing and the location where sales are generated. For

this reason, even though we expect to achieve a certain level of

aggregate perpetual sales on an annual basis, we expect to observe

fluctuations in the quarterly perpetual revenue amounts throughout

the fiscal year.

Software Revenue by Geographic Segment

|

Three months ended June 30, |

2019 |

2018 |

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

Annuity/maintenance license

revenue |

|

|

|

|

|

Canada |

3,776 |

3,867 |

(91 |

) |

-2 |

% |

|

United States |

4,934 |

4,553 |

381 |

|

8 |

% |

|

South America |

1,945 |

1,681 |

264 |

|

16 |

% |

|

Eastern Hemisphere(1) |

5,101 |

4,614 |

487 |

|

11 |

% |

|

|

15,756 |

14,715 |

1,041 |

|

7 |

% |

| Perpetual

license revenue |

|

|

|

|

|

Canada |

- |

- |

- |

|

0 |

% |

|

United States |

298 |

- |

298 |

|

100 |

% |

|

South America |

769 |

- |

769 |

|

100 |

% |

|

Eastern Hemisphere |

92 |

326 |

(234 |

) |

-72 |

% |

|

|

1,159 |

326 |

833 |

|

256 |

% |

| Total

software license revenue |

|

|

|

|

|

Canada |

3,776 |

3,867 |

(91 |

) |

-2 |

% |

|

United States |

5,232 |

4,553 |

679 |

|

15 |

% |

|

South America |

2,714 |

1,681 |

1,033 |

|

61 |

% |

|

Eastern Hemisphere |

5,193 |

4,940 |

253 |

|

5 |

% |

|

|

16,915 |

15,041 |

1,874 |

|

12 |

% |

| |

|

|

|

|

| (1) |

Includes

Europe, Africa, Asia and Australia. |

During the three months ended June 30, 2019, all regions, with

the exception of Canada, experienced an increase in total software

license revenue, as compared to the same period of the previous

fiscal year.

The Canadian market (representing 22% of year-to-date software

license revenue) experienced a slight 2% decrease in

annuity/maintenance license revenue during the three months ended

June 30, 2019, compared to the same period of the previous fiscal

year, due to a reduction in licensing by some customers, most of

which relates to short-term licenses.

The United States market (representing 31% of year-to-date

software license revenue) experienced an 8% increase in

annuity/maintenance license revenue during the three months ended

June 30, 2019, compared to the same period of the previous fiscal

year, due to increased licensing by both existing and new

customers. Almost half of the increase is a result of increased

usage of our cloud-based offerings, as the number of customers who

access our software on a cloud has been growing over the last year.

Perpetual revenue increased in the current period, as there were no

perpetual sales recognized in the comparative period.

South America (representing 16% of year-to-date software license

revenue) experienced a 16% increase in annuity/maintenance license

revenue during the three months ended June 30, 2019, compared to

the same period of the previous fiscal year, mainly due to

increased licensing by existing customers. Perpetual revenue

increased in the current period, as there were no perpetual sales

recognized in the comparative period.

The Eastern Hemisphere (representing 31% of year-to-date

software license revenue) experienced an 11% increase in

annuity/maintenance license revenue during the three months ended

June 30, 2019, due to a combination of increased licensing from

existing customers and addition of new customers. Modest perpetual

sales were realized in the Eastern Hemisphere during the three

months ended June 30, 2019, resulting in a 72% decrease compared to

the same period of the previous fiscal year.

Deferred Revenue

| |

Fiscal |

|

Fiscal |

|

Fiscal |

|

|

|

|

($ thousands) |

2020 |

|

2019 |

|

2018 |

|

$ change |

|

% change |

|

| Deferred revenue at: |

|

|

|

|

|

|

|

|

| Q1 (June 30) |

29,266 |

|

29,350 |

(3) |

|

|

(84 |

) |

0 |

% |

| Q2 (September 30) |

|

|

23,222 |

(4) |

23,686 |

(1) |

(464 |

) |

-2 |

% |

| Q3 (December 31) |

|

|

13,782 |

|

17,785 |

|

(4,003 |

) |

-23 |

% |

| Q4

(March 31) |

|

|

35,015 |

(5) |

34,362 |

(2) |

653 |

|

2 |

% |

| |

|

|

|

|

|

|

|

|

| (1) |

Includes current deferred revenue of $23.0 million and

long-term deferred revenue of $0.6 million. |

| (2) |

Includes current deferred revenue of $33.4 million and

long-term deferred revenue of $1.0 million. |

| (3) |

Includes current deferred revenue of $28.8 million and

long-term deferred revenue of $0.6 million. |

| (4) |

Includes current deferred revenue of $22.9 million and

long-term deferred revenue of $0.3 million. |

| (5) |

Includes current deferred revenue of $34.7 million and

long-term deferred revenue of $0.3 million. |

CMG’s deferred revenue consists primarily of amounts for

pre-sold licenses. With the exception of certain term-based

software licenses that are recognized at the start of the license

period, our annuity/maintenance revenue is deferred and recognized

ratably over the license period, which is generally one year or

less. Amounts are deferred for licenses that have been provided and

revenue recognition reflects the passage of time.

The above table illustrates the normal trend in the deferred

revenue balance from the beginning of the calendar year (which

corresponds with Q4 of our fiscal year), when most renewals occur,

to the end of the calendar year (which corresponds with Q3 of our

fiscal year). Our fourth quarter corresponds with the beginning of

the fiscal year for most oil and gas companies, representing a time

when they enter a new budget year and sign/renew their

contracts.

Deferred revenue as at Q1 of fiscal 2020 remained consistent

compared to Q1 of fiscal 2019.

Expenses

|

Three months ended June 30, ($ thousands, except per share

data) |

Previousleasestandard 2019 |

IFRS 16 impact |

|

IFRS 16 2019 |

2018 |

$ change |

|

% change |

|

| |

|

|

|

|

|

|

|

Sales, marketing and professional services |

4,696 |

(66 |

) |

4,630 |

4,987 |

(357 |

) |

-7 |

% |

|

Research and development |

4,980 |

(229 |

) |

4,751 |

4,775 |

(24 |

) |

-1 |

% |

|

General and administrative |

1,729 |

(55 |

) |

1,674 |

1,569 |

105 |

|

7 |

% |

|

Total operating expenses |

11,405 |

(350 |

) |

11,055 |

11,331 |

(276 |

) |

-2 |

% |

|

|

|

|

|

|

|

|

|

Direct employee costs(1) |

8,664 |

- |

|

8,664 |

8,715 |

(51 |

) |

-1 |

% |

| Other

corporate costs |

2,741 |

(350 |

) |

2,391 |

2,616 |

(225 |

) |

-9 |

% |

|

|

11,405 |

(350 |

) |

11,055 |

11,331 |

(276 |

) |

-2 |

% |

| |

|

|

|

|

|

|

|

|

|

| (1) |

Includes salaries, bonuses, stock-based compensation, benefits,

commissions, and professional development. See “Non-IFRS Financial

Measures”. |

Prior to applying IFRS 16, total operating expenses increased by

1% for the three months ended June 30, 2019 compared to the same

period of the previous fiscal year, due to an increase in other

corporate costs, partially offset by a decrease in direct employee

costs.

IFRS 16 resulted in a net decrease of $0.4 million to total

operating expenses. This net decrease of $0.4 million is a

combination of $1.0 million lower rent expense (because under IFRS

16 rent payments are classified as finance costs and repayment of

lease liability), partially offset by $0.6 million higher

depreciation expense on the recognition of right-of-use assets.

Prior to IFRS 16 adoption, other corporate costs increased by 5%

during the three months ended June 30, 2019 compared to the same

period of the previous fiscal year, primarily due to an operating

cost refund included in the comparative period.

Outlook

During the first quarter of fiscal 2020, annuity and maintenance

license revenue increased by 7% compared to the first quarter of

the previous fiscal year. The US region increased by 8%, supported

by the growing use of our public cloud solution. South America and

the Eastern Hemisphere showed double-digit increases – 16% and 11%,

respectively – due to increased licensing by existing customers as

well as the addition of new customers. The weakening of the

Canadian dollar relative to the USD had a positive impact on

revenue in these regions. Annuity and maintenance revenue from

Canada remained relatively consistent for the second consecutive

quarter, with a slight decrease of only 2% compared to the first

quarter of the previous fiscal year. While we view this as an

indication of an improved operating environment in Canada compared

to previous years, we continue to monitor consolidation activity in

the industry and any impact it might have on our contract renewals

in the latter part of the year. We continue to demonstrate to our

Canadian customers that our simulation tools are instrumental in

achieving long-term sustainability though optimizing production and

increasing operational efficiency.

Perpetual license revenue increased more than threefold compared

to the first quarter of the previous fiscal year, due to several

sales realized in South America and the US. Total revenue increased

by 8%, supported by the increases in annuity and maintenance and

perpetual revenue, partially offset by lower professional services

revenue.

On April 1, 2019, CMG adopted IFRS 16 Leases. The new standard

essentially moved most of the Company’s office leases to the

balance sheet, eliminating rent expense and replacing it with

interest expense and repayment of lease liability, as well as

depreciation of the right-of-use assets. The adoption of IFRS 16

resulted in a decrease to total operating expenses and an increase

to finance costs, for a total negative impact of $0.2 million on

the Company’s net income.

Despite the negative impact of the IFRS 16 adoption, the

Company’s net income increased by 4% because of the solid revenue

achievement (without the negative impact of IFRS 16 adoption, net

income increased by 9%). EBITDA increased by 39% to reach 45% of

revenue, which is an impressive measure of the Company’s

performance (without the positive impact of IFRS 16 adoption,

EBITDA increased by 23% or to 40% of revenue).

As messaged in our fiscal 2019 Financial Report, in the current

quarter we signed two agreements with two new customers for

short-term use of CoFlow, our newest integrated asset modelling

product, on specific projects. Subsequent to quarter-end, CMG and

Shell signed an amendment to our CoFlow development agreement. In

order to achieve specific development targets and deployments

across a broader range of Shell’s assets, CMG will allocate more

resources to CoFlow over the next two years, while Shell will

increase its financial contribution accordingly. The costs of

additional resources allocated to CoFlow are expected to be in the

range of $4.5 – $6.5 million on an annualized basis by the end of

fiscal 2020.

We continue pursuing our goal of increasing software license

sales, particularly internationally, with the support of various

R&D initiatives (such as our public cloud offering, CoFlow

development, product feature and functionality enhancements, etc.),

while exercising fiscal prudence.

We ended the first quarter of 2020 with a strong balance sheet,

no borrowings and $50.8 million in cash. Subsequent to quarter end,

CMG’s Board of Directors declared a quarterly dividend of $0.10 per

share.

ADDITIONAL IFRS MEASURE

Funds flow from operations is an additional IFRS measure that

the Company presents in its consolidated statements of cash flows.

Funds flow from operations is calculated as cash flows provided by

operating activities adjusted for changes in non-cash working

capital. Management believes that this measure provides useful

supplemental information about operating performance and liquidity,

as it represents cash generated during the period, regardless of

the timing of collection of receivables and payment of payables,

which may reduce comparability between periods.

NON-IFRS FINANCIAL MEASURES

Certain financial measures in this press release – namely,

direct employee costs, other corporate costs, EBITDA and free cash

flow – do not have a standard meaning prescribed by IFRS and,

accordingly, may not be comparable to measures used by other

companies. Management believes that these indicators nevertheless

provide useful measures in evaluating the Company’s

performance.

Direct employee costs include salaries, bonuses, stock-based

compensation, benefits, commission expenses, and professional

development. Other corporate costs include facility-related

expenses, corporate reporting, professional services, marketing and

promotion, computer expenses, travel, and other office-related

expenses. Direct employee costs and other corporate costs should

not be considered an alternative to total operating expenses as

determined in accordance with IFRS. People-related costs represent

the Company’s largest area of expenditure; hence, management

considers highlighting separately corporate and people-related

costs to be important in evaluating the quantitative impact of cost

management of these two major expenditure pools. See “Expenses”

heading for a reconciliation of direct employee costs and other

corporate costs to total operating expenses.

EBITDA refers to net income before adjusting for depreciation

expense, finance income, finance costs, and income and other taxes.

EBITDA should not be construed as an alternative to net income as

determined by IFRS. The Company believes that EBITDA is useful

supplemental information as it provides an indication of the

results generated by the Company’s main business activities prior

to consideration of how those activities are amortized, financed or

taxed.

Free cash flow is a non-IFRS financial measure that is

calculated as funds flow from operations less capital expenditures

and repayment of lease liabilities. Management uses free cash flow

to help measure the capacity of the Company to pay dividends and

invest in business growth opportunities.

Forward-looking

Information

Certain information included in this press release is

forward-looking. Forward-looking information includes statements

that are not statements of historical fact and which address

activities, events or developments that the Company expects or

anticipates will or may occur in the future, including such things

as investment objectives and strategy, the development plans and

status of the Company’s software development projects, the

Company’s intentions, results of operations, levels of activity,

future capital and other expenditures (including the amount, nature

and sources of funding thereof), business prospects and

opportunities, research and development timetable, and future

growth and performance. When used in this press release, statements

to the effect that the Company or its management “believes”,

“expects”, “expected”, “plans”, “may”, “will”, “projects”,

“anticipates”, “estimates”, “would”, “could”, “should”,

“endeavours”, “seeks”, “predicts” or “intends” or similar

statements, including “potential”, “opportunity”, “target” or other

variations thereof that are not statements of historical fact

should be construed as forward-looking information. These

statements reflect management’s current beliefs with respect to

future events and are based on information currently available to

management of the Company. The Company believes that the

expectations reflected in such forward-looking information are

reasonable, but no assurance can be given that these expectations

will prove to be correct and such forward-looking information

should not be unduly relied upon.

Corporate Profile

CMG is a computer software technology company serving the oil

and gas industry. The Company is a leading supplier of advanced

process reservoir modelling software with a blue chip customer base

of international oil companies and technology centers in

approximately 60 countries. The Company also provides professional

services consisting of highly specialized support, consulting,

training, and contract research activities. CMG has sales and

technical support services based in Calgary, Houston, London,

Dubai, Bogota and Kuala Lumpur. CMG’s Common Shares are listed on

the Toronto Stock Exchange (“TSX”) and trade under the symbol

“CMG”.

Condensed Consolidated Statements of Financial

Position

|

UNAUDITED (thousands of Canadian $) |

June 30, 2019 |

|

March 31, 2019* |

|

| |

|

|

| Assets |

|

|

| Current assets: |

|

|

|

Cash |

50,753 |

|

54,290 |

|

|

Trade and other receivables |

12,650 |

|

19,220 |

|

|

Prepaid expenses |

1,180 |

|

1,332 |

|

|

Prepaid income taxes |

666 |

|

367 |

|

|

|

65,249 |

|

75,209 |

|

| Property and equipment |

14,142 |

|

14,501 |

|

| Right-of-use assets |

39,172 |

|

- |

|

| Deferred tax asset |

1,139 |

|

595 |

|

|

Total assets |

119,702 |

|

90,305 |

|

| |

|

|

| Liabilities

and shareholders’ equity |

|

|

| Current liabilities: |

|

|

|

Trade payables and accrued liabilities |

4,884 |

|

6,162 |

|

|

Income taxes payable |

- |

|

60 |

|

|

Deferred revenue |

29,266 |

|

34,653 |

|

|

Lease liability |

1,209 |

|

- |

|

|

|

35,359 |

|

40,875 |

|

|

Deferred revenue |

- |

|

362 |

|

| Lease liability |

41,591 |

|

- |

|

|

Deferred rent liability |

- |

|

1,813 |

|

| Total

liabilities |

76,950 |

|

43,050 |

|

| |

|

|

| Shareholders’ equity: |

|

|

|

Share capital |

79,711 |

|

79,711 |

|

|

Contributed surplus |

13,024 |

|

12,808 |

|

|

Deficit |

(49,983 |

) |

(45,264 |

) |

|

Total shareholders' equity |

42,752 |

|

47,255 |

|

| Total

liabilities and shareholders' equity |

119,702 |

|

90,305 |

|

|

|

|

|

Condensed Consolidated Statements of Operations

and Comprehensive Income

| |

|

|

|

Three months ended June 30, |

2019 |

|

2018* |

|

UNAUDITED (thousands of Canadian $ except per share amounts) |

|

|

| |

|

|

|

Revenue |

18,123 |

|

16,705 |

| |

|

|

| Operating

expenses |

|

|

|

Sales, marketing and professional services |

4,630 |

|

4,987 |

|

Research and development |

4,751 |

|

4,775 |

|

General and administrative |

1,674 |

|

1,569 |

|

|

11,055 |

|

11,331 |

| Operating

profit |

7,068 |

|

5,374 |

| |

|

|

| Finance income |

323 |

|

606 |

| Finance costs |

(952 |

) |

- |

|

Profit before income and other

taxes |

6,439 |

|

5,980 |

| Income

and other taxes |

1,997 |

|

1,722 |

| |

|

|

|

Net and total comprehensive

income |

4,442 |

|

4,258 |

| |

|

|

| Earnings

Per Share |

|

|

| Basic |

0.06 |

|

0.05 |

|

Diluted |

0.06 |

|

0.05 |

| |

|

|

|

Condensed Consolidated Statements of Cash

Flows

|

Three months ended June 30, |

2019 |

|

2018* |

|

|

UNAUDITED (thousands of Canadian $) |

|

|

| |

|

|

| Operating

activities |

|

|

| Net income |

4,442 |

|

4,258 |

|

| Adjustments for: |

|

|

|

Depreciation |

1,050 |

|

463 |

|

|

Deferred income tax recovery |

(160 |

) |

(346 |

) |

|

Stock-based compensation |

765 |

|

761 |

|

|

Deferred rent |

- |

|

106 |

|

|

Funds flow from operations |

6,097 |

|

5,242 |

|

| Movement in non-cash working

capital: |

|

|

|

Trade and other receivables |

6,570 |

|

5,766 |

|

|

Trade payables and accrued liabilities |

(1,734 |

) |

(1,770 |

) |

|

Prepaid expenses |

50 |

|

128 |

|

|

Income taxes payable |

(359 |

) |

(323 |

) |

|

Deferred revenue |

(5,749 |

) |

(4,327 |

) |

| Decrease in non-cash working

capital |

(1,222 |

) |

(526 |

) |

|

Net cash provided by operating

activities |

4,875 |

|

4,716 |

|

| |

|

|

| Financing

activities |

|

|

| Repayment of lease

liability |

(282 |

) |

- |

|

| Dividends paid |

(8,022 |

) |

(8,021 |

) |

|

Net cash used in financing

activities |

(8,304 |

) |

(8,021 |

) |

| |

|

|

| Investing

activities |

|

|

| Property and equipment

additions |

(108 |

) |

(333 |

) |

|

Decrease in cash |

(3,537 |

) |

(3,638 |

) |

| Cash,

beginning of period |

54,290 |

|

63,719 |

|

|

Cash, end of period |

50,753 |

|

60,081 |

|

| |

|

|

|

Supplementary cash flow

information |

|

|

| Interest received |

333 |

|

302 |

|

| Interest paid |

534 |

|

- |

|

| Income

taxes paid |

(2,074 |

) |

(1,981 |

) |

| |

|

|

|

|

* The Company adopted IFRS 16 Leases effective April 1, 2019

using the modified retrospective approach. Under this method,

comparative information is not restated.

See accompanying notes to condensed consolidated interim

financial statements.

For further information, contact:

| Ryan N. SchneiderPresident &

CEO(403) 531-1300ryan.schneider@cmgl.cawww.cmgl.ca |

or |

Sandra BalicVice President,

Finance & CFO(403) 531-1300sandra.balic@cmgl.ca |

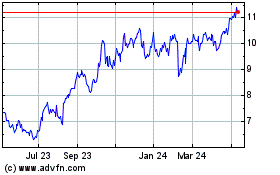

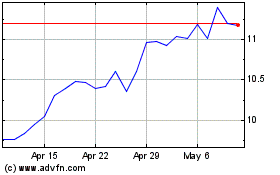

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Apr 2023 to Apr 2024