Canadian National Expected to Sweeten Kansas City Southern Bid -- Update

May 13 2021 - 2:10PM

Dow Jones News

By Dana Cimilluca and Cara Lombardo

Canadian National Railway Co. is expected to sweeten its

takeover bid for Kansas City Southern, according to people familiar

with the matter, as it seeks to outflank a rival and clinch a $30

billion deal for the railway operator.

The new proposal could include an agreement to cover the $700

million breakup fee Kansas City Southern would owe Canadian Pacific

Railway Ltd. should it walk away from their existing merger

agreement in favor of a deal with Canadian National, the people

said. It couldn't be learned what else a new proposal might

contain, including any adjustment to the consideration.

The move could pave the way for Kansas City Southern to switch

its allegiance to Canadian National, something it has indicated it

might do. Kansas City Southern's board is expected to convene soon

and could make a decision on the matter then, some of the people

said.

Kansas City Southern had asked Canadian National, which put in a

bid seeking to wrest the railroad operator from Canadian Pacific

last month, to make adjustments to its proposal, the people

said.

There's no guarantee Canadian National will submit a revised bid

or that Kansas City Southern would deem it superior. Should

Canadian National win Kansas City Southern's endorsement, Canadian

Pacific would have a five-day period to sweeten its offer or walk

away with the breakup fee.

The agreement with Canadian Pacific includes a $1 billion

reverse breakup fee, which Canadian Pacific would owe Kansas City

Southern if their deal is terminated for reasons including delays

tied to regulatory reviews. Canadian National had proposed the same

terms and Kansas City Southern has asked for more, but Canadian

National is leaning toward holding firm on that aspect of its bid,

some of the people said.

Canadian National had offered $325 for each Kansas City Southern

share, including $200 in cash and 1.059 Canadian National shares.

Kansas City Southern said late last month that it was entering into

discussions with Canadian National after determining its proposal

could "reasonably be expected" to lead to a better deal.

Canadian Pacific had agreed in March to pay $275 a share --

0.489 of its shares and $90 in cash -- or about $25 billion. Based

on the stock prices midday Thursday, Canadian National's bid was

worth around $319 a share and Canadian Pacific's, about $285.

Kansas City Southern shares were trading around $309, indicating

investors believe Canadian Pacific's current bid won't carry the

day.

Either deal would involve a two-step process. First, a voting

trust would acquire Kansas City Southern shares and, assuming

necessary approvals are received, the companies would then merge.

Both the use of a trust and the merger itself need approval from

the U.S. Surface Transportation Board, which requires major

railroad combinations to be in the public interest and enhance

competition.

The STB approved a voting trust proposed as part of the Canadian

Pacific deal last week, as was expected. While Canadian National

had asked STB to wait and rule on both voting trust proposals at

the same time, the STB decision didn't mention Canadian National's

request, which it is expected to rule on later. Should Kansas City

Southern switch its allegiance, it would signal a belief that the

STB would ultimately bless a trust for Canadian National too.

The bids by the Canadian railroads are the first major

transactions to be brought before the STB in more than two decades.

Whichever bid prevails, the expectation is that the merger itself

wouldn't be ruled on until well into next year.

Kansas City Southern, the smallest of the major freight

railroads in the U.S., plays a big role in U.S.-Mexico trade, with

a network stretching across both countries, which helps explain its

desirability as an acquisition target.

Ted Mann contributed to this article.

Write to Dana Cimilluca at dana.cimilluca@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

May 13, 2021 14:55 ET (18:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

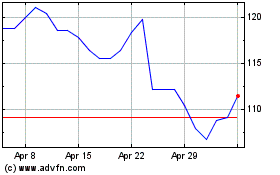

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024