Canadian Pacific Declines to Increase Offer for Kansas City Southern -- Update

May 20 2021 - 9:06AM

Dow Jones News

By Cara Lombardo

Canadian Pacific Railway Ltd. said Thursday it won't increase

its takeover offer for Kansas City Southern, betting recent

setbacks for a higher offer from a rival make sweetening the bid

unnecessary.

It is now up to Kansas City Southern to decide whether to go

with a roughly $30 billion offer from Canadian National Railway Co.

and abandon a $25 billion deal it already agreed to with Canadian

Pacific. While Canadian Pacific has already received a key early

nod from the Surface Transportation Board, the panel, which

regulates railroads in the U.S., indicated this week that it needs

more details before ruling on Canadian National's offer.

Canadian Pacific had until later Thursday to alter its bid or

hold steady after Canadian National took the lead in the race to

acquire Kansas City Southern last week, when the U.S. railroad

declared the higher bid was likely to lead to a better deal.

That declaration came after Canadian National agreed last week

to add more stock to its proposal and cover the $700 million

breakup fee Kansas City Southern would owe Canadian Pacific for

walking away from their existing merger agreement.

Either deal would involve a two-step process. First, a voting

trust would acquire Kansas City Southern shares and, assuming

necessary approvals are received, whichever companies would then

merge. Both the use of a trust and the merger itself need approval

from the STB, which requires major railroad combinations to be in

the public interest and enhance competition.

While the STB already approved a voting trust as part of

Canadian Pacific's deal, it said last week that it was denying

Canadian National's request for now, without prejudice, since no

formal merger agreement had yet been filed. But language in the

decision also suggested the board would be more cautious in

granting a trust to Canadian National.

Should Kansas City Southern ultimately spurn Canadian Pacific in

favor of Canadian National, it is expected Canadian National would

refile its request with the Surface Transportation Board.

In its announcement Thursday, Canadian Pacific pointed to

comments the Justice Department filed with the STB saying the CN

proposal raises competition concerns that should prohibit the

company from using a trust. And on Tuesday, TCI Fund Management

Ltd., which holds a roughly 3% Canadian National stake and more

than 8% of Canadian Pacific, urged CN to drop its bid to avoid the

risk of the trust not being approved. Canadian National's largest

shareholder, Cascade Investments LLC, has said it supports the

bid.

Canadian Pacific had agreed in March to pay $275 a share --

0.489 of its shares and $90 in cash -- or about $25 billion.

Canadian National's latest bid is worth $325 a share, with each

share of Kansas City Southern receiving $200 in cash and 1.129

shares of Canadian National stock.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

May 20, 2021 09:51 ET (13:51 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

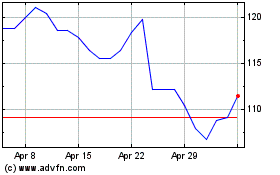

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024