Kansas City Southern to Combine With Canadian National in Roughly $30 Billion Deal -- Update

May 21 2021 - 12:47PM

Dow Jones News

By Dave Sebastian

Kansas City Southern said it will combine with Canadian National

Railway Co. in a roughly $30 billion deal after deeming the offer

as superior to the agreement it had struck with Canadian Pacific

Railway Ltd.

The deal has an enterprise value of $33.6 billion, including the

assumption of about $3.8 billion in Kansas City Southern's debt,

the companies said Friday. The combination would create the first

freight-rail network linking the U.S., Mexico and Canada by

connecting ports in the three countries.

The Wall Street Journal on Thursday reported that Kansas City

Southern was expected to ditch the agreement with Canadian Pacific.

On Friday, Canadian Pacific said it remains ready to re-engage with

Kansas City Southern. Canadian Pacific had earlier decided to hold

firm on the terms of its agreed-upon deal with Kansas City

Southern.

Kansas City Southern shareholders will get $325 a share based on

Canadian National's May 13 offer, comprising $200 in cash and 1.129

shares of Canadian National stock for each Kansas City Southern

share, the companies said. The companies said Kansas City

Southern's preferred shareholders will get $37.50 in cash for each

preferred share. Kansas City Southern shareholders are expected to

own about 12.6% of the combined company, they added.

Kansas City Southern is the smallest of the major freight

railroads in the U.S. The company plays a big role in U.S.-Mexico

trade, with a network sprawling across both countries. Its trains

bring autos and other industrial products up from factories south

of the border into Texas and the Midwest and haul U.S. farm goods

back to Mexico. It also runs a rail link along the Panama

Canal.

Kansas City Southern and Canadian National said they are

confident in their ability to obtain regulatory approvals,

including from the U.S. Surface Transportation Board and the

Federal Economic Competition Commission and Federal

Telecommunications Institute in Mexico.

Canadian Pacific said it would proceed with its application with

STB to seek the board's authority to "control KCS and its U.S. rail

carrier subsidiaries." The company has already received preliminary

regulatory approval for the deal.

Canadian Pacific had agreed in March to pay what was then worth

$275 a share -- 0.489 of its shares and $90 in cash. (The exchange

ratio was set before Canadian Pacific's recent five-for-one stock

split.) The offer was worth about $25 billion when it was

unveiled.

In its sweetened proposal, Canadian National agreed to add more

stock and cover the $700 million breakup fee Kansas City Southern

would owe Canadian Pacific for walking away from their existing

agreement. If an agreement with Canadian National ultimately fails

to get approval from regulators, the Canadian company would also

owe Kansas City Southern a $1 billion reverse breakup fee.

While the STB already approved a voting trust as part of

Canadian Pacific's deal, it said this week that it was denying

Canadian National's request for now, without prejudice, since no

formal merger agreement had yet been filed at the time. An STB

spokesman on Friday said the board is reviewing the materials

submitted by Canadian National and Canadian Pacific.

Language in the STB's decision for Canadian National's request

suggested that the board will be more cautious about granting a

trust to Canadian National. Canadian Pacific is smaller and has

less overlap with Kansas City Southern, which could give it a leg

up in winning antitrust approval.

The deal would involve a two-step process. First, a voting trust

would acquire Kansas City Southern shares and, assuming necessary

approvals are obtained, the companies would then combine. Both the

use of a trust and the combination itself need approval from the

STB, which requires major railroad combinations to be in the public

interest and enhance competition.

Canadian National said it expects the transaction to boost its

adjusted earnings per share in the first full year after Canadian

National assumes control of Kansas City Southern.

Cara Lombardo contributed to this article.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

May 21, 2021 13:32 ET (17:32 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

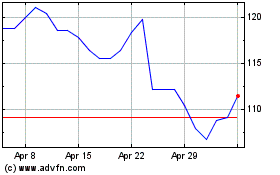

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024