Tobacco company is in talks with cannabis company and e-cig

startup Juul

By Jennifer Maloney

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 5, 2018).

Marlboro maker Altria Group Inc. is eyeing cannabis and

e-cigarettes, searching for growth outside its traditional

business, as the long decline of U.S. cigarette sales

accelerates.

The tobacco giant is in separate talks to make investments in

Canadian cannabis company Cronos Group Inc. and in San Francisco

e-cigarette startup Juul Labs Inc., according to Cronos and people

familiar with the Juul matter. The two companies would give Altria

access to new customers and overseas markets, but a deal with

either isn't imminent.

Altria is the U.S. cigarette market leader, but its share of the

fast-growing e-cigarette market is eclipsed by Juul, whose sales

represent three-quarters of the domestic vaping industry. Cronos is

the fourth most valuable publicly listed marijuana company with a

total valuation of about $1.9 billion.

Talks with both companies could be derailed by the baggage that

Big Tobacco brings.

Some Juul staff are upset after The Wall Street Journal reported

last week that the startup is entertaining selling a significant

stake to the tobacco company, a move they feel betrays Juul's

stated mission of helping addicted cigarette smokers switch to less

harmful products, according to current and former employees.

And Cronos might be reluctant to do a deal because it could

preclude other potential partnerships the cannabis startup might

forge with pharmaceutical, food or beverage companies. Cronos on

Monday confirmed that it was in early discussions with Altria,

noting that "there can be no assurance such discussions will lead

to an investment."

Altria and Juul declined to comment Tuesday.

Toronto-based Cronos Group grows and sells medical and

recreational marijuana products in Canada, with smaller medical

growing and distribution operations in such countries as Germany

and Australia. Canada legalized recreational pot sales in October

and a number of other countries have legalized medical marijuana

sales.

A deal would give Altria an opportunity to capitalize on those

overseas markets, as cigarette sales slow in the U.S. But it is

unlikely that the company would sell marijuana products in the U.S.

before cannabis is legalized nationwide. While recreational or

medical marijuana is legal in many U.S. states, it remains illegal

at the federal level.

Cronos in September unveiled a research project with

Boston-based Ginkgo Bioworks Inc. to study new techniques for

producing medical marijuana. One process under consideration is

creating CBD and other cannabinoids through a yeast fermentation

process that eliminates the need to grow plants.

Cronos's stock price jumped by nearly 16% this week after

Reuters reported on the Altria talks.

Closely held Juul, a three-year-old company with more than 1,000

employees, was valued at $16 billion in a funding round this

summer. Juul's sales have surged over the past year, even as it

contends with a crackdown by the Food and Drug Administration aimed

at curbing widespread use of its products by teens.

Altria represents 46% of the U.S. market for combustible

cigarettes. Its stock has declined more than 20% over the past

year, as the company has been buffeted by declines in traditional

smokers and a potential U.S. ban on menthols. The tobacco giant

still has a market value of more than $100 billion.

The U.S. cigarette industry has for years used price increases

to boost revenue and profits despite falling cigarette volumes. But

that decline has sped up in recent months to a level that some

analysts see as unsustainable. Altria's long-term cigarette volume

forecast had been a decline of between 3% and 4%. For the year

ended Nov. 17, its cigarette volumes fell 4.5%, a rate that has

steepened to 7.6% in the most recent four weeks, according to a

Wells Fargo analysis of Nielsen data.

Altria CEO Howard Willard in October on a conference call with

analysts acknowledged the sharpening decline, attributing it to

higher gas prices, which reduce discretionary spending, and the

growing popularity of e-cigarettes.

"It's hard to tell how long it's going to persist," he said of

the slide. "I think we're going to have to wait and see what

happens with both gas prices...and whether or not the growth rate

of e-vapor slows down."

Mr. Willard confirmed that the company was exploring

opportunities in the cannabis industry. "We acknowledge that it is

currently federally illegal in the U.S., but I think we think it's

worth exploring the category because that might change in the

future," he said.

With these two investments, Altria could buy itself out of a

bind, Cowen analyst Vivien Azer said, noting that it will become

more difficult to use price increases to offset falling cigarette

sales.

Altria has long had an interest in cannabis. An internal

document in 1970 said that the Justice Department had asked the

tobacco company to perform a chemical analysis of marijuana smoke,

and the company viewed the request as an opportunity to explore a

controversial product that was increasingly popular among young

people.

"We are in the business of relaxing people who are tense and

providing a pickup for people who are bored or depressed," the

document said, explaining the decision to grant the DOJ's request.

"The human needs that our product fills will not go away. Thus, the

only real threat to our business is that society will find other

means of satisfying these needs."

Jacquie McNish contributed to this article.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

December 05, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

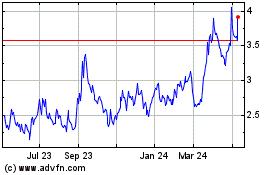

Cronos (TSX:CRON)

Historical Stock Chart

From Mar 2024 to Apr 2024

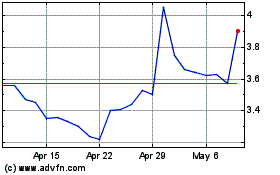

Cronos (TSX:CRON)

Historical Stock Chart

From Apr 2023 to Apr 2024