Lumine Group Inc. (“Lumine Group”) in a joint release with

Constellation Software Inc. (TSX:CSU) (“Constellation”) today

announced financial results for Lumine Group (Holdings) Inc. (the

“Company”), an indirect wholly owned subsidiary of Constellation,

for the fourth quarter and year ended December 31, 2022. Please

note that all amounts referred to in this press release are in US

dollars unless otherwise stated.

The following press release should be read in

conjunction with the Company’s Annual Consolidated Financial

Statements for the year ended December 31, 2022, prepared in

accordance with International Financial Reporting Standards

(“IFRS”), and the Lumine Group’s annual Management’s Discussion and

Analysis for the year ended December 31, 2022, which can be found

on SEDAR at www.sedar.com and on Lumine Group’s website

www.luminegroup.com. Additional information about Lumine Group is

also available on SEDAR at www.sedar.com. The information presented

is based on the historical financial performance of the Company, as

predecessor to Lumine Group, and does not take into account the

transactions described under “Subsequent Events”.

Q4 2022 Headlines:

- Revenue grew

14% to $68.3 million compared to $59.7 million in Q4 2021

(including -2% organic growth after adjusting for foreign exchange

impacts).

- Net income

decreased to a loss of $1.1 million from income of $6.9 million in

Q4 2021.

- The acquisition

of WizTivi SAS was completed in Q4 2022 for aggregate cash

consideration of $33.3 million (which includes acquired cash).

Deferred payments associated with this acquisition have an

estimated value of $3.1 million resulting in total consideration of

$36.4 million.

- Cash flows from

operations (“CFO”) decreased $8.9 million to $9.8 million compared

to $18.7 million in Q4 2021 representing a decrease of 47%.

2022 Headlines:

- Revenue grew

12% to $255.7 million compared to $228.4 million in 2021 (including

-3% organic growth after adjusting for foreign exchange

impacts).

- Net income

stayed flat year-over-year at $27.4 million ($27.5 million in

2021).

- Two

acquisitions were completed in 2022 for aggregate cash

consideration of $113.2 million (which includes acquired cash).

Deferred payments associated with these acquisitions have an

estimated value of $6.4 million resulting in total consideration of

$119.6 million.

- CFO decreased

$51.4 million to $34.6 million compared to $86.0 million in 2021

representing a decrease of 60%.

Total revenue for the quarter ended December 31,

2022 was $68.3 million, an increase of 14%, or $8.6 million,

compared to $59.7 million for the comparable period in 2021. For

the 2022 fiscal year total revenues were $255.7 million, an

increase of 12%, or $27.4 million, compared to $228.4 million for

the 2021 fiscal year. The increase for both the three and twelve

month periods ended December 31, 2022 compared to the same periods

in the prior year is primarily attributable to growth from

acquisitions. The Company experienced negative organic growth of

-9% for both the three and twelve month periods ended December 31,

2022, or -2% and -3%, respectively, after adjusting for foreign

exchange impacts. Organic growth is not a standardized financial

measure and might not be comparable to measures disclosed by other

issuers.

Net loss for the quarter ended December 31, 2022

was ($1.1) million compared to net income of $6.9 million for the

same period in 2021. Net income decreased by $0.1 million to $27.4

million for the year ended December 31, 2022, compared to net

income of $27.5 million for the same period in 2021. The decrease

in net income for the three and twelve month periods ended December

31, 2022 compared to the same periods prior year is primarily

attributable to one-time fees incurred in 2022 related to the

corporate reorganization, public listing, and acquisition of

WideOrbit Inc. (“WideOrbit”), which are discussed further below

under Subsequent Events.

For the quarter ended December 31, 2022, CFO

decreased $8.9 million to $9.8 million compared to $18.7 million

for the same period in 2021 representing a decrease of 47%. The

decrease is mainly related to lower net income and higher income

taxes paid during Q4 2022. For the twelve months ended December 31,

2022, CFO decreased $51.4 million to $34.6 million compared to

$86.0 million for the same period in 2021 representing a decrease

of 60%. The primary reason for the decrease is that CFO includes

the impact of changes in non-cash operating assets and liabilities

exclusive of effects of business combinations or, changes in

non-cash operating working capital (“NCOWC”), and income taxes

paid. There are many reasons contributing to the NCOWC impact

variance for the Company, none of which are indicative of an

underlying concern with the overall NCOWC balance. Specifically,

there are no concerns with accounts receivable or unbilled revenue

aging.

Subsequent Events

(a) Capital

Reorganization

On February 21, 2023, Lumine Group filed

articles of amendment and reorganized its share capital. Subsequent

to the reorganization, Lumine Group is authorized to issue one

super voting share (“Super Voting Share”), an unlimited number of

subordinate voting shares (“Subordinate Voting Shares”), an

unlimited number of preferred shares (“Preferred Shares”), and an

unlimited number of special shares (“Special Shares”). The

Preferred Shares are non-voting and are entitled to a cumulative

dividend of 5% per annum and are convertible into Subordinate

Voting Shares at a pre-determined ratio. The holders of the

Preferred Shares are entitled to redeem some or all of their shares

and receive an amount of cash equal to the initial equity value of

the Preferred Shares. The Special Shares carry voting rights

equivalent to Subordinate Voting Shares, with a cumulative dividend

entitlement of 5% per annum and can be converted to Subordinate

Voting Shares at a pre-determined ratio. The holders of the Special

Shares are entitled to redeem some or all of their shares and

receive an amount of cash equal to the initial equity value of the

Special Shares, plus one Subordinate Voting Share for each Special

Share redeemed.

Holders of Subordinate Voting Shares and the

Super Voting Share are entitled to attend and vote at meetings of

Lumine Group's shareholders except meetings at which only holders

of a particular class are entitled to vote. Holders of Subordinate

Voting Shares are entitled to one vote per share, and the holder of

the Super Voting Share is entitled to that number of votes that

equals 50.1% of the aggregate number of votes attached to all of

the outstanding Super Voting Shares, Subordinate Voting Shares and

Special Shares at such time. Other than in respect of voting

rights, the Subordinate Voting Shares and the Super Voting Share

have the same rights, are equal in all respects and are treated as

if they were one class of shares.

As a result of the share capital reorganization,

Lumine Group reclassified the one common share issued to Trapeze

Software ULC (“Trapeze”), a wholly owned indirect subsidiary of

Constellation, into one Super Voting Share.

(b) Acquisition of Lumine

Group (Holdings) Inc.

On February 22, 2023, Lumine Group acquired the

Company, a global portfolio of communications and media software

companies and a wholly owned subsidiary of Trapeze. As

consideration for the acquisition, Lumine Group issued 63,582,712

Subordinate Voting Shares and 55,233,745 Preferred Shares to

Trapeze.

Immediately following the completion of the

acquisition of the Company, Lumine Group amalgamated with the

Company, with the resulting entity being Lumine Group (the

“Amalgamation”). The Amalgamation is a business combination

involving entities under common control in which all of the

combining entities are ultimately controlled by Constellation, both

before and after the reorganization transactions were completed.

Business combinations involving entities under common control are

outside the scope of IFRS 3 Business Combinations. Lumine Group

will account for this common control transaction using book value

accounting, based on the book values recognized in the financial

statements of the underlying entities.

(c) Acquisition of

WideOrbit Inc.

On February 22, 2023, immediately following the

Amalgamation, Lumine Group completed the acquisition of 100% of the

shares of WideOrbit for a purchase price of $490.0 million which

was funded through a combination of cash, repayment of WideOrbit

debt, and the issuance of 10,204,294 Special Shares. WideOrbit is a

software business that primarily operates in the advertising market

for cable networks, local television stations and radio stations.

Lumine Group obtained the cash portion of the purchase price from

Trapeze, in exchange for issuing it a further 8,348,967 Preferred

Shares.

The gross purchase price is subject to customary

adjustments, as a result of, but not limited to, minimum cash

requirements of $10.0 million, target net indebtedness of $86.7

million, and claims under the representations and warranties of the

acquisition agreement. Lumine Group has the ability to reduce the

cash portion of the purchase consideration by $10.0 million for net

indebtedness up to $96.7 million. If net indebtedness is greater

than $96.7 million, excess repayment would be funded by Lumine

Group and added to the gross purchase price. Pursuant to the terms

of the acquisition agreement, eligible shareholders of WideOrbit

elected to rollover a portion of their WideOrbit common shares into

Special Shares of Lumine Group.

As of the date hereof, Lumine Group has not yet

completed the initial accounting for the WideOrbit acquisition,

including the fair value assessment of the assets acquired and

liabilities assumed, due to the proximity of the date of

acquisition to the date hereof.

(d) Spinout of Lumine

Group

On February 23, 2023, Trapeze declared and paid

a dividend-in-kind and distributed its 63,582,712 Subordinate

Voting Shares of Lumine Group to its parent, Volaris Group Inc.,

who further distributed these shares to its parent Constellation.

Constellation then distributed 63,582,706 Subordinate Voting Shares

to its shareholders pursuant to a dividend-in-kind, resulting in

Lumine Group's Subordinate Voting Shares being issued to public

shareholders of Constellation.

(e) New Bank

Facility

On March 2, 2023, WideOrbit entered into a

revolving financing facility with a syndicate of Canadian and US

financial institutions amounting to $185.0 million, to provide

long-term financing in connection with the acquisition of

WideOrbit. Covenants associated with this facility are monitored

and reported based on the financial position and financial

performance of WideOrbit. The covenants include a leverage ratio

and a fixed charge coverage ratio. The loan has a maturity date of

March 2, 2028 and bears an interest rate of SOFR plus applicable

spreads ranging from 1.75% to 3%, based on the leverage ratio.

Lumine Group does not guarantee this debt, nor are there any

cross-guarantees between other subsidiaries. The credit facility is

collateralized by substantially all of the assets of WideOrbit.

(f) Acquisition of

Titanium Software Holdings Inc

On March 8, 2023, Lumine Group acquired 100% of

the outstanding shares of Titanium Software Holdings Inc

(“Titanium”) for aggregate cash consideration of $31.4 million on

closing plus cash holdbacks of $14.4 million and contingent

consideration with an estimated acquisition date fair value of $4.1

million for total consideration of $49.9 million. Titanium is a

software company catering to the communications and media market,

which is a software business similar to existing businesses

operated by Lumine Group. For this arrangement, which includes a

maximum, or capped, contingent consideration amount, the contingent

consideration is not expected to exceed $10.0 million. The cash

holdbacks are payable over a two-year period and are adjusted, as

necessary, for such items as working capital or net tangible asset

assessments, as defined in the agreements, and claims under the

respective representations and warranties of the purchase and sale

agreements.

As of the date hereof, Lumine Group had not yet

completed the initial accounting for the acquisition, including the

fair value assessment of the assets acquired and liabilities

assumed, due to the proximity of the date of acquisition to the

date hereof.

Forward-Looking Statements

Certain statements herein may be

“forward-looking” statements that involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of Lumine Group or the industry to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements involve significant risks

and uncertainties, should not be read as guarantees of future

performance or results, and will not necessarily be accurate

indications of whether or not such results will be achieved. A

number of factors could cause actual results to vary significantly

from the results discussed in the forward-looking statements. These

forward-looking statements reflect current assumptions and

expectations regarding future events and operating performance and

are made as of the date hereof and Lumine Group assumes no

obligation, except as required by law, to update any

forward-looking statements to reflect new events or

circumstances.

About Lumine Group Inc.

Lumine Group acquires, strengthens, and grows,

vertical market software businesses in the communications and media

industry. Learn more at www.luminegroup.com.

About Constellation Software

Inc.

Constellation's common shares are listed on the

Toronto Stock Exchange under the symbol "CSU". Constellation

acquires, manages and builds vertical market software

businesses.

For further information:

Jamal BakshChief Financial OfficerConstellation

Software Inc.jbaksh@csisoftware.com

David NylandChief Executive OfficerLumine

Groupdavid.nyland@luminegroup.com

|

Lumine Group (Holdings) Inc. |

|

Consolidated Statements of Financial Position |

|

(In thousands of USD. Due to rounding, numbers presented may not

foot.) |

|

|

|

|

December 31, 2022 |

|

December 31, 2021 |

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

Cash |

$ |

67,085 |

|

$ |

27,110 |

|

Accounts receivable |

|

63,677 |

|

|

45,109 |

|

Due from related parties, net |

|

- |

|

|

111,629 |

|

Unbilled revenue |

|

9,965 |

|

|

7,219 |

|

Inventories |

|

60 |

|

|

26 |

|

Other assets |

|

22,967 |

|

|

16,679 |

|

|

|

163,754 |

|

|

207,772 |

|

|

|

|

|

Non-current assets: |

|

|

|

Property and equipment |

|

3,138 |

|

|

2,517 |

|

Right of use assets |

|

5,349 |

|

|

4,503 |

|

Deferred income taxes |

|

2,931 |

|

|

3,580 |

|

Other assets |

|

8,492 |

|

|

6,785 |

|

Intangible assets and goodwill |

|

216,797 |

|

|

103,249 |

|

|

|

236,707 |

|

|

120,634 |

|

|

|

|

|

Total assets |

$ |

400,461 |

|

$ |

328,406 |

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

Accounts payable and accrued liabilities |

$ |

63,879 |

|

$ |

51,169 |

|

Due to related parties, net |

|

35,466 |

|

|

- |

|

Current portion of bank debt |

|

975 |

|

|

- |

|

Deferred revenue |

|

62,449 |

|

|

63,991 |

|

Provisions |

|

22 |

|

|

27 |

|

Acquisition holdback payables |

|

3,121 |

|

|

2,976 |

|

Lease obligations |

|

2,069 |

|

|

2,365 |

|

Income taxes payable |

|

9,464 |

|

|

5,690 |

|

|

|

177,445 |

|

|

126,218 |

|

|

|

|

|

Non-current liabilities: |

|

|

|

Deferred income taxes |

|

36,366 |

|

|

16,628 |

|

Bank debt |

|

18,138 |

|

|

- |

|

Lease obligations |

|

4,719 |

|

|

2,250 |

|

Other liabilities |

|

10,013 |

|

|

10,160 |

|

|

|

69,236 |

|

|

29,038 |

|

|

|

|

|

Total liabilities |

|

246,681 |

|

|

155,257 |

|

|

|

|

|

Equity: |

|

|

|

Capital stock |

|

- |

|

|

- |

|

Net parent investment |

|

- |

|

|

169,920 |

|

Contributed surplus |

|

162,692 |

|

|

- |

|

Accumulated other comprehensive income (loss) |

|

(8,912) |

|

|

3,229 |

|

Retained earnings (deficit) |

|

- |

|

|

- |

|

|

|

153,780 |

|

|

173,149 |

|

|

|

|

|

Subsequent events |

|

|

|

|

|

|

|

Total liabilities and equity |

$ |

400,461 |

|

$ |

328,406 |

|

Lumine Group (Holdings) Inc. |

|

Consolidated Statements of Income (Loss) |

|

(In thousands of USD, except per share amounts. Due to rounding,

numbers presented may not foot.) |

|

|

|

|

Years ended December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

Revenue |

|

|

|

License |

$ |

38,731 |

|

$ |

36,745 |

|

|

Professional services |

|

49,771 |

|

|

49,836 |

|

|

Hardware and other |

|

7,273 |

|

|

8,969 |

|

|

Maintenance and other recurring |

|

159,970 |

|

|

132,806 |

|

|

|

|

255,745 |

|

|

228,355 |

|

|

Expenses |

|

|

|

Staff |

|

134,316 |

|

|

120,092 |

|

|

Hardware |

|

4,617 |

|

|

5,166 |

|

|

Third party license, maintenance and professional services |

|

11,040 |

|

|

10,344 |

|

|

Occupancy |

|

2,936 |

|

|

2,102 |

|

|

Travel, telecommunications, supplies, software and equipment |

|

11,610 |

|

|

8,002 |

|

|

Professional fees |

|

12,289 |

|

|

3,203 |

|

|

Other, net |

|

6,334 |

|

|

10,484 |

|

|

Depreciation |

|

5,303 |

|

|

5,161 |

|

|

Amortization of intangible assets |

|

31,836 |

|

|

25,521 |

|

|

|

|

220,281 |

|

|

190,076 |

|

|

|

|

|

|

Finance and other expenses (income) |

|

(414) |

|

|

744 |

|

|

|

|

(414) |

|

|

744 |

|

|

|

|

|

|

Income (loss) before income taxes |

|

35,878 |

|

|

37,536 |

|

|

|

|

|

|

Current income tax expense (recovery) |

|

15,742 |

|

|

10,829 |

|

|

Deferred income tax expense (recovery) |

|

(7,266) |

|

|

(759) |

|

|

Income tax expense (recovery) |

|

8,476 |

|

|

10,070 |

|

|

|

|

|

|

Net income (loss) |

$ |

27,402 |

|

$ |

27,466 |

|

|

|

|

|

|

Earnings per share: |

|

|

|

Basic |

$ |

0.11 |

|

N/A |

|

Diluted |

$ |

0.11 |

|

N/A |

|

|

|

|

|

Lumine Group (Holdings) Inc. |

|

Consolidated Statements of Comprehensive Income

(Loss) |

|

(In thousands of USD. Due to rounding, numbers presented may not

foot.) |

|

|

|

|

Years ended December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

Net income (loss) |

$ |

27,402 |

|

$ |

27,466 |

|

|

|

|

|

|

Items that are or may be reclassified subsequently to net income

(loss): |

|

|

|

|

|

|

|

Foreign currency translation differences from foreign operations

and other |

|

(12,141) |

|

|

(2,410) |

|

|

|

|

|

|

Other comprehensive (loss) income for the year, net of income

tax |

|

(12,141) |

|

|

(2,410) |

|

|

|

|

|

|

Total comprehensive income (loss) for the year |

$ |

15,261 |

|

$ |

25,056 |

|

|

Lumine Group (Holdings) Inc. |

|

Consolidated Statement of Changes in Equity |

|

(In thousands of USD. Due to rounding, numbers presented may not

foot.) |

|

|

|

Year ended December 31, 2022 |

|

|

|

|

|

|

|

|

Capital stock |

Contributed surplus |

Accumulated other comprehensive (loss) income |

Retained earnings (deficit) |

Net parent investment |

Total equity |

|

|

|

|

|

|

|

|

|

Balance at January 1, 2022 |

- |

- |

3,229 |

|

- |

169,920 |

|

173,149 |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the year: |

|

|

|

|

|

|

|

Net income (loss) |

|

|

|

|

27,402 |

|

27,402 |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

Foreign currency translation differences from foreign operations

and other |

|

|

(12,141) |

|

|

|

(12,141) |

|

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss) for the

year |

- |

- |

(12,141) |

|

- |

27,402 |

|

15,261 |

|

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the

year |

- |

- |

(12,141) |

|

- |

27,402 |

|

15,261 |

|

|

|

|

|

|

|

|

|

|

Transactions with Parent, recorded directly in equity |

|

|

|

|

|

|

|

Capital contributions by Parent |

|

|

|

|

76,400 |

|

76,400 |

|

|

Dividends to Parent |

|

|

|

|

(111,030) |

|

(111,030) |

|

|

|

|

|

|

|

|

|

|

Acquisition of Lumine Portfolio entities |

|

162,692 |

|

|

(162,692) |

|

- |

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2022 |

- |

162,692 |

(8,912) |

|

- |

- |

|

153,780 |

|

|

Lumine Group (Holdings) Inc. |

|

Consolidated Statement of Changes in Equity |

|

(In thousands of USD. Due to rounding, numbers presented may not

foot.) |

|

|

|

Year ended December 31, 2021 |

|

|

|

|

|

|

|

Contributed surplus |

Accumulated other comprehensive (loss) income |

Retained earnings (deficit) |

Net parent investment |

Total equity |

|

|

|

|

|

|

|

|

Balance at January 1, 2021 |

- |

5,639 |

|

- |

141,472 |

|

147,111 |

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the year: |

|

|

|

|

|

|

Net income (loss) |

|

|

|

27,466 |

|

27,466 |

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

Foreign currency translation differences from foreign operations

and other |

|

(2,410) |

|

|

|

(2,410) |

|

|

|

|

|

|

|

|

|

Total other comprehensive income (loss) for the

year |

- |

(2,410) |

|

- |

27,466 |

|

25,056 |

|

|

|

|

|

|

|

|

|

Total comprehensive income (loss) for the

year |

- |

(2,410) |

|

- |

27,466 |

|

25,056 |

|

|

|

|

|

|

|

|

|

Transactions with Parent, recorded directly in equity |

|

|

|

|

|

|

Non-cash capital contributions for the transfer of acquired legal

entities |

|

|

|

14,148 |

|

14,148 |

|

|

Dividends to Parent |

|

|

|

(13,165) |

|

(13,165) |

|

|

|

|

|

|

|

|

|

Balance at December 31, 2021 |

- |

3,229 |

|

- |

169,920 |

|

173,149 |

|

|

Lumine Group (Holdings) Inc. |

|

Consolidated Statements of Cash Flows |

|

(In thousands of USD. Due to rounding, numbers presented may not

foot.) |

|

|

|

|

Years ended December 31, |

|

|

2022 |

|

2021 |

|

|

|

|

|

|

Cash flows from (used in) operating activities: |

|

|

|

Net income (loss) |

27,402 |

|

27,466 |

|

|

Adjustments for: |

|

|

|

Depreciation |

5,303 |

|

5,161 |

|

|

Amortization of intangible assets |

31,836 |

|

25,521 |

|

|

Contingent consideration adjustments |

(2,130) |

|

3,983 |

|

|

Finance and other expenses (income) |

(414) |

|

744 |

|

|

Income tax expense (recovery) |

8,476 |

|

10,070 |

|

|

Change in non-cash operating assets and liabilities exclusive of

effects of business combinations |

(26,755) |

|

17,265 |

|

|

Income taxes (paid) received |

(9,093) |

|

(4,182) |

|

|

Net cash flows from (used in) operating activities |

34,625 |

|

86,027 |

|

|

|

|

|

|

Cash flows from (used in) financing activities: |

|

|

|

Interest paid on lease obligations |

(204) |

|

(153) |

|

|

Interest paid on bank debt |

(192) |

|

- |

|

|

Cash transferred from (to) Parent |

104,871 |

|

(80,030) |

|

|

Cash obtained with businesses acquired by Parent |

- |

|

3,217 |

|

|

Proceeds from issuance of bank debt |

19,666 |

|

- |

|

|

Repayments of bank debt |

(244) |

|

- |

|

|

Transaction costs on bank debt |

(316) |

|

- |

|

|

Payments of lease obligations |

(2,781) |

|

(2,669) |

|

|

Net cash flows from (used in) in financing activities |

120,800 |

|

(79,635) |

|

|

|

|

|

|

Cash flows from (used in) investing activities: |

|

|

|

Acquisition of businesses |

(113,186) |

|

(15,926) |

|

|

Cash obtained with acquired businesses |

5,295 |

|

2,917 |

|

|

Post-acquisition settlement payments, net of receipts |

(6,669) |

|

(470) |

|

|

Property and equipment purchased |

(783) |

|

(700) |

|

|

Net cash flows from (used in) investing activities |

(115,343) |

|

(14,179) |

|

|

|

|

|

|

|

|

|

|

Effect of foreign currency on cash and cash equivalents |

(107) |

|

(247) |

|

|

|

|

|

|

Increase (decrease) in cash |

39,975 |

|

(8,034) |

|

|

|

|

|

|

Cash, beginning of period |

27,110 |

|

35,144 |

|

|

|

|

|

|

Cash, end of period |

67,085 |

|

27,110 |

|

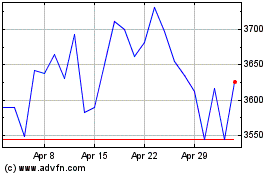

Constellation Software (TSX:CSU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Constellation Software (TSX:CSU)

Historical Stock Chart

From Apr 2023 to Apr 2024