Doman Building Materials Group Ltd. (“Doman” or “the Company”)

(TSX:DBM) announced today its third quarter 2024 financial

results(1) for the period ended September 30, 2024.

For the three-month period ended September 30,

2024(1), consolidated revenues increased 3.0% to $663.1 million,

compared to $643.9 million in 2023. The increase in revenues was

largely due to the impact of the results from the Southeast

Acquisition, acquired late in the first quarter of 2024. The

Company’s sales by product group in the period were made up of 74%

construction materials, compared to 72% last year, with the

remaining balance resulting from specialty and allied products of

21%, and other of 5%.

Gross margin dollars increased to $103.0 million

in the three-month period, versus $102.8 million in the comparative

period in 2023. Gross margin percentage was 15.5% during the third

quarter of 2024, a decrease from the 16.0% achieved in the same

quarter of 2023.

EBITDA(3) and Adjusted EBITDA(2) for the third

quarter of 2024 amounted to $46.3 million and $47.4 million,

respectively, compared to EBITDA of $52.0 million during the same

period in 2023. Adjusted EBITDA in the third quarter of 2024

excluded $1.2 million in non-recurring acquisition related costs.

Net earnings for the three-month period ended September 30, 2024,

were $14.6 million versus $21.2 million in the comparative period

of 2023.

The Company declared a $0.14 per share(4)

dividend during the third quarter, which was paid on October 15,

2024, to shareholders of record at the close of business on

September 27, 2024.

For the nine-month period ended September 30,

2024(1), the Company generated EBITDA and Adjusted EBITDA of $141.3

million and $143.6 million, respectively, on revenues of $1.96

billion. Gross margin and gross margin percentage during the period

amounted to $311.5 million and 15.9%, respectively. This compares

to 2023 EBITDA of $162.9 million, on revenues of $1.96 billion.

Gross margin and gross margin percentage during the 2023 period

amounted to $322.2 million and 16.4%. Net earnings for the

nine-month period ended September 30, 2024, were $45.9 million

versus $65.3 million in the comparative period of 2023.

“The third quarter reflected a continuation of

the market conditions we experienced in the previous quarter with

volatility in general activity, and lower average pricing when

compared to the third quarter of last year," commented Amar S.

Doman, Chairman of the Board. "As we approach the end of the year,

we are encouraged by some positive indicators with pricing firming

up, and steadier activity in our key markets. We believe that with

our recent acquisition of Tucker Lumber(5) and housing fundamentals

in North America, we are well positioned to serve our growing

business footprint in North America.”

Reconciliation of Net Earnings to Earnings before

Interest, Tax, Depreciation and Amortization (EBITDA):

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

|

2024 |

2023 |

2024 |

2023 |

|

(in thousands of dollars) |

$ |

$ |

$ |

$ |

|

Net earnings |

14,567 |

21,158 |

45,923 |

65,261 |

|

Provision for income taxes |

1,920 |

3,889 |

6,984 |

15,160 |

| Finance

costs |

11,783 |

10,131 |

35,202 |

31,191 |

|

Depreciation and amortization |

18,008 |

16,837 |

53,146 |

51,245 |

|

EBITDA |

46,278 |

52,015 |

141,255 |

162,857 |

|

Acquisition costs |

1,161 |

- |

2,349 |

- |

|

Adjusted EBITDA |

47,439 |

52,015 |

143,604 |

162,857 |

About Doman Building Materials Group

Ltd.

Founded in 1989, Doman is headquartered in

Vancouver, British Columbia, and trades on the Toronto

Stock Exchange under the symbol DBM.

As Canada’s only fully integrated national

distributor in the building materials and related products sector,

Doman operates several distinct divisions with multiple

treating plants, planing and specialty facilities and distribution

centres coast-to-coast in all major cities across Canada and

coast-to-coast across the United States.

Strategically located across Canada,

Doman Building Materials Canada operates

distribution centres coast-to-coast, and Doman Treated Wood

Canada operates multiple treating plants near major

cities. In the United States; headquartered in Dallas, Texas,

Doman Lumber operates 21 treating plants, two

specialty planing mills and five specialty sawmills located in nine

states, distributing, producing and treating lumber, fencing and

building material servicing the central U.S.; Doman Tucker

Lumber operates three treating plants, specialty

sawmilling operations and a captive trucking fleet serving the U.S.

east coast; Doman Building Materials USA and

Doman Treated Wood USA serve the U.S. west coast

with multiple locations in California and Oregon; and in the

state of Hawaii the Honsador Building Products

Group services 15 locations across all the islands.

The Company’s Canadian operations also include ownership and

management of private timberlands and forest licenses, and

agricultural post-peeling and pressure treating through

its Doman Timber operations.

For additional information on Doman Building

Materials Group Ltd., please refer to the Company’s filings on

SEDAR+ and the Company’s website www.domanbm.com

For further information regarding Doman please

contact:

Ali MahdaviInvestor Relations416-962-3300

ali.mahdavi@domanbm.com

Certain statements in this press release may

constitute “forward-looking” statements. When used in this press

release, forward-looking statements often but not always, can be

identified by the use of forward-looking words such as, including

but not limited to, “may”, “will”, “intend”, “should”, “expect”,

“believe”, “outlook”, “predict”, “remain”, “anticipate”,

“estimate”, “potential”, “continue”, “plan”, “could”, “might”,

“project”, “targeting” or the inverse or negative of these terms or

other similar terminology. Forward-looking information in the Q3

2024 Reporting Documents includes, without limitation, statements

regarding funding requirements, dividends, commodity pricing, debt

repayment, interest rates, economic conditions data and housing

starts. Additionally, the ultimate impact of COVID-19 on the

Company’s results is difficult to quantify, as it will depend on,

inter alia, the ongoing duration and impact of the pandemic, the

impact of government policies, and the pace of economic recovery.

These statements are based on management’s current expectations

regarding future events and operating performance, and on

information currently available to management, speak only as of the

date of the Q3 2024 Reporting Documents and are subject to risks

which are described in the Company’s current Annual Information

Form dated March 28, 2024 (“AIF”) and the Company’s public filings

on the Canadian Securities Administrators’ website at

www.sedarplus.com (“SEDAR”) and as updated from time to time, and

would include, but are not limited to, dependence on market

economic conditions, risks related to the impact of geopolitical

conflicts, local, national, and international health concerns,

including but not limited to COVID-19 or other viruses, epidemics

or pandemics, sales and margin risk, acquisition and integration

risks and operational risks related thereto, competition,

information system risks, technology risks, cybersecurity risks,

availability of supply of products, interest rate risks, inflation

risks, risks associated with the introduction of new product lines,

product design risk, product liability risk, modern slavery and

supply chain risks, environmental risks, climate change risks,

volatility of commodity prices, inventory risks, customer and

vendor risks, contract performance risk, availability of credit,

credit risks, performance bond risk, currency risks, insurance

risks, tax risks, risks of legislative or regulatory changes,

international trade and tariff risks, operational and safety risks,

resource industry risks, resource extraction risks, risks relating

to remote operations, forestry management and silviculture, fire

and natural disaster risks, key executive risk and litigation

risks. These risks and uncertainties may cause actual results to

differ materially from those contained in the statements. Such

statements reflect management’s current views and are based on

certain assumptions. Some of the key assumptions include, but are

not limited to, assumptions regarding the performance of the

Canadian and the United States (“US”) economies, the impact of

COVID-19, other viruses, epidemics, pandemics or health risks,

interest rates, exchange rates, inflation, capital and loan

availability, commodity pricing, the Canadian and the US housing

and building materials markets; international trade matters;

post-acquisition operation of a business; the amount of the

Company’s cash flow from operations; tax laws; laws and regulations

relating to the protection of the environment, including the

impacts of climate change, and natural resources; and the extent of

the Company’s future acquisitions and capital spending requirements

or planning in respect thereto, including but not limited to the

performance of any such business and its operation; availability or

more limited availability of access to equity and debt capital

markets to fund, at acceptable costs, the Company’s future growth

plans, the implementation and success of the integration of

acquisitions, the ability of the Company to refinance its debts as

they mature; the direct and indirect effect of the US housing

market and economy; exchange rate fluctuations between the Canadian

and US dollar; retention of key personnel; the Company’s ability to

sustain its level of sales and earnings margins; the Company’s

ability to grow its business long-term and to manage its growth;

the Company’s management information systems upon which it is

dependent are not impaired, ransomed or unavailable; the Company’s

insurance is sufficient to cover losses that may occur as a result

of its operations as well as the general level of economic

activity, in Canada and the US, and abroad, discretionary spending

and unemployment levels; the effect of general economic conditions;

market demand for the Company’s products, and prices for such

products; the effect of forestry, land use, environmental and other

governmental regulations; and the risk of losses from fires, floods

and other natural disasters and unemployment levels. They are, by

necessity, only estimates of future developments and actual

developments may differ materially from these statements due to a

number of known and unknown factors. Investors are cautioned not to

place undue reliance on these forward-looking statements. All

forward-looking information in the Q3 2024 Reporting Documents is

qualified by these cautionary statements. Although the

forward-looking information contained in the Q3 2024 Reporting

Documents is based on what management believes are reasonable

assumptions, there can be no assurance that actual results will be

consistent with these forward-looking statements. Certain

statements included in the Q3 2024 Reporting Documents may be

considered “financial outlook” for purposes of applicable

securities laws, and such financial outlook may not be appropriate

for purposes other than the Q3 2024 Reporting Documents.

In addition, there are numerous risks associated

with an investment in the Company’s common shares and senior

unsecured notes, which are also further described in the “Risks and

Uncertainties” section in these Q3 2024 Reporting Documents and

include but are not limited to the factors and risks described in

the periodic and other reports filed by Doman with Canadian

securities commissions and available on SEDAR in the “Risk Factors”

sections of Doman’s annual information form dated March 28, 2024,

as may be updated from time to time. These forward-looking

statements speak only as of the date of this press release. We

caution that the foregoing factors that may affect future results

are not exhaustive. When relying on our forward-looking statements

to make decisions with respect to Doman, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events.

Neither Doman nor any of its associates or

directors, officers, partners, affiliates, or advisers, provides

any representation, assurance or guarantee that the occurrence of

the events expressed or implied in any forward-looking statements

in these communications will actually occur. You are cautioned not

to place undue reliance on these forward-looking statements. Except

as required by applicable securities laws and legal or regulatory

obligations, Doman is not under any obligation, and expressly

disclaims any intention or obligation, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

(1) Please refer to our Q3 2024 MD&A and

Financial Statements for further information. Our Q3 2024 Financial

Statements filings are reported under International Financial

Reporting Standards (“IFRS”).

(2) In the discussion, reference is made to

Adjusted EBITDA, which is EBITDA as defined above, before certain

non-recurring or unusual items. This is not a generally accepted

earnings measure under IFRS and does not have a standardized

meaning under IFRS. The measure as calculated by Doman may not be

comparable to similarly-titled measures reported by other

companies. Adjusted EBITDA is presented as we believe it is a

useful indicator of Doman’s ability to meet debt service and

capital expenditure requirements from its regular business before

non-recurring items. Adjusted EBITDA should not be considered by an

investor as an alternative to net earnings or cash flows as

determined in accordance with IFRS. For a reconciliation from

Adjusted EBITDA to the most directly comparable measures calculated

in accordance with IFRS refer to “Reconciliation of Net Earnings to

Earnings before Interest, Tax, Depreciation and Amortization

(EBITDA) and Adjusted EBITDA”.

(3) In the discussion, reference is made to

EBITDA, which represents earnings from continuing operations before

interest, including amortization of deferred financing costs,

provision for income taxes, depreciation, and amortization. This is

not a generally accepted earnings measure under IFRS and does not

have a standardized meaning under IFRS, and therefore the measure

as calculated by Doman may not be comparable to similarly titled

measures reported by other companies. EBITDA is presented as we

believe it is a useful indicator of a company’s ability to meet

debt service and capital expenditure requirements and because we

interpret trends in EBITDA as an indicator of relative operating

performance. EBITDA should not be considered by an investor as an

alternative to net earnings or cash flows as determined in

accordance with IFRS. For a reconciliation of EBITDA to the most

directly comparable measures calculated in accordance with IFRS

refer to “Reconciliation of Net Earnings to Earnings before

Interest, Tax, Depreciation and Amortization (EBITDA) and Adjusted

EBITDA”.

(4) On September 13, 2024, Doman declared a

quarterly dividend of $0.14 per share, which was paid on October

15, 2024, to shareholders of record on September 27, 2024. Please

refer to our Q3 2024 MD&A and Financial Statements for more

information.

(5) On October 1, 2024 Doman announced the

acquisition of the assets of CM Tucker Lumber Companies, LLC.

Please see our press release of such date for further

information.

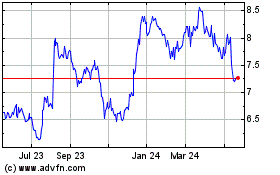

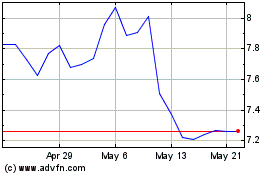

Doman Building Materials (TSX:DBM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Doman Building Materials (TSX:DBM)

Historical Stock Chart

From Nov 2023 to Nov 2024