Enthusiast Gaming Holdings Inc. (“Enthusiast Gaming” or the

“Company”) (NASDAQ: EGLX; TSX: EGLX), an independent

gaming media and entertainment company, today announced financial

results for the three months ended March 31, 2023 (“Q1 2023”).

Q1 2023 Financial

Highlights

- Significant increase in high-margin

revenue streams compared to Q1 2022, including Brand Solutions

(formerly Direct Sales) up 92% to $10.0 million, and Subscriptions

up 19% to a record $4.0 million.

- Gross profit increased 24% to $16.8

million, compared to $13.5 million in Q1 2022, with margins

expanding 1,050 bps YoY to 39.1% from 28.6% in Q1

2022.

“The rapid transformation of Enthusiast Gaming

from a collection of entrepreneurial assets to an enterprise-scale

platform company built around a single technology stack is

underway,” commented Nick Brien, CEO of Enthusiast Gaming. “In the

10 weeks since I joined the company, we have begun to reorganize

around a unified vision, strategy, structure and processes that

will unlock the true potential of our diverse brands and highly

engaged audience. There is a tremendous opportunity in front of us

to increase the spend of our current advertisers, while attracting

new brands to the emergent gaming marketing sector.”

Continued Brien, “Our first quarter 2023 results

demonstrate the significant upside potential of our business. We

focused on delivering integrated marketing solutions to brands

(formerly direct sales) resulting in a near doubling of revenue to

$10 million, and we drove a 19% increase in Subscription revenue by

serving our communities of enthusiast gamers. The result was a 24%

increase in gross profit dollars and a 1,050 bps YoY increase in

gross margins to 39.1%, despite the digital ad market headwinds

which pressured our programmatic monetization.”

“We are transforming every aspect of our

business model at speed,” continued Mr. Brien. “The reorganization

of the leadership team and focus on the North American marketplace

is the first step in the strategic change process. We are

strengthening our product and content offerings to reinvent our

growth engine and create a more profitable revenue flywheel. Our

operations will be enhanced by increased automation and AI

application to ensure maximum efficiency and optimum yield

extraction of every dollar of revenue earned. We are focused on

developing smarter brand activation opportunities, not just selling

digital ads. Our company’s unique ability to create bespoke brand

experiences, increase site subscriptions, launch new products,

enable community commerce while building strategic partnerships

with major sports leagues like the NFL, all reinforce our unique

opportunity to create diversified revenue streams that deliver

value to shareholders.”

Q1 2023 Operational

Highlights

- Completion of the first season of

NFL Tuesday Night Gaming (NFL TNG), including the production and

broadcasting of 19 episodes, connecting fans with NFL stars and

gamers, and generating more than 73 million impressions across

livestream and social content since the debut in September 2022.

Recent NFL TNG media sponsors include Hulu + Live TV, Xbox,

Paramount+, Disney+, Puss In Boots: The Last Wish, Nickelodeon, the

FDA, TurboTax, Verizon, Campbell’s Chunky Soup, Hasbro, Sour Patch

Kids, and Carnival Cruise Line.

- Renewals or new business with key

notable advertisers including Coca-Cola, Paramount Pictures,

Universal Pictures, Toyota Canada, Hasbro, Hut8, LEGO, and the US

Navy. Renewals and additional business with existing customers

accounted for 59% of brand solutions in Q1 2023.

- A record of 2,600 attendees from

more than 1,200 companies participated in Pocket Gamer Connects

London in January.

- EV.IO, the Company’s browser-based

first-person shooter cross-chain blockchain game, won multiple

“Game of the Year” awards in the Esports and FPS categories in

January.

- Luminosity Gaming, the Company’s

esports division, won 9 championships and gained 35 million

impressions across all of its social channels in Q1 2023.

- The Company’s Tiktok network

achieved over 300 million views across 11 diverse channels in Q1

2023.

- The Company was ranked as the #1

gaming property for unique visitor traffic in the United States by

Comscore in January (Comscore Media Metrix®, Games, January 2023,

U.S.).

- Paid subscribers increased 5% to

275,000 at March 31, 2023 from 262,000 at December 31, 2022.

First Quarter 2023 Results

Comparison

Revenue was $42.9 million in Q1 2023 compared to

$47.2 million in Q1 2022. Brand solutions (included in revenue)

increased by 92% to $10.0 million, Esports & Entertainment

revenue increased 72% to $3.4 million, and Subscription revenue

increased 19% to $4.0 million. The decline in total revenue was

driven by Media & Content revenue which decreased 15% to $35.5

million, driven by: i) less video views due to a separation from a

number of non-profitable creator channels, ii) YouTube’s

introduction of stricter language moderation on monetized videos,

and iii) lower CPMs primarily due to the expansion of YouTube

Shorts which monetize at lower rates than long form video. Web page

views increased 4%.

Gross profit increased 24% to $16.8 million in

Q1 2023 compared to $13.5 million in Q1 2022, with margins

expanding 1,050 bps YoY to 39.1% from 28.6% in Q1 2022.

Net loss and comprehensive loss was $8.7 million

in Q1 2023, compared to $12.2 million in Q1 2022. Net loss per

basic and diluted share was $0.06 in Q1 2023 compared to $0.08 in

Q1 2022.

As of March 31, 2023, cash balance was $3.5

million compared to $7.4 million as of December 31, 2023. The $3.9

million decrease is primarily the result of a $2.6 million outflow

in cash from operations and $1.1 million of repayments on the

Company’s term credit.

In March, the Company received approval from its

lender to extend the maturity dates for the credit facility,

together with the Company’s $5 million operating facility, for an

additional year to December 31, 2024.

Conference Call

Management will host a conference call and

webcast on May 15, 2023, at 5 p.m. ET to review and discuss the

first quarter 2023 results. Conference call details:

- Toll Free Dial-in: 1-855-239-1101

(Conference ID: 10178677)

- Live webcast:

https://www.enthusiastgaming.com/investors

A replay of the webcast will be available on the

Investor Relations page of the Enthusiast Gaming website.

Supplemental Information

Certain information provided in this news

release is extracted from financial statements and management’s

discussion & analysis (“MD&A”) of the Company for the three

months ended March 31, 2023, and should be read in conjunction with

them. It is only in the context of the fulsome information and

disclosures contained in the financial statements and MD&A that

an investor can properly analyze this information. The financial

statements and MD&A have been published on the Company’s

profile on SEDAR and EDGAR. All amounts are in Canadian

dollars.

About Enthusiast Gaming

Enthusiast Gaming is an independent gaming media

and entertainment company, building the largest media and content

platform for video game players and esports fans to connect and

compete worldwide. Combining the elements of its five core pillars:

Communities, Content, Creators, Commerce and Experiences,

Enthusiast Gaming provides a unique opportunity for marketers to

create integrated brand solutions to connect with coveted GenZ and

Millennial audiences. Through its proprietary mix of digital media,

content and gaming assets, Enthusiast Gaming continues to grow its

network of communities, reflecting the diversity of gaming

enthusiasts today.

Investor Contacts

Enthusiast Gaming – Alex Macdonald, Chief Financial OfficerFNK

IR – Rob Fink / Matt Chesler, CFAinvestor@enthusiastgaming.com

Neither the Toronto Stock Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Statements

This news release contains certain statements

that may constitute forward-looking information under applicable

securities laws. All statements, other than those of historical

fact, which address activities, events, outcomes, results,

developments, performance or achievements that Enthusiast Gaming

anticipates or expects may or will occur in the future (in whole or

in part) should be considered forward-looking information. Often,

but not always, forward-looking information can be identified by

the use of words such as “plans”, “expects”, “is expected”,

“budget”, “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, or “believes” or variations (including negative

variations) of such words and phrases, or statements formed in the

future tense or indicating that certain actions, events or results

“may”, “could”, “would”, “might” or “will” (or other variations of

the forgoing) be taken, occur, be achieved, or come to pass.

Forward-looking statements in this news release include, but are

not limited to, statements regarding trends in certain financial

and operating metrics of the Company, and expectations relating to

the financial performance and the financial results of future

periods.

Forward-looking statements are based on

assumptions and analyses made by the Company in light of its

experience and its perception of historical trends, current

conditions and expected future developments, including, but not

limited to, expectations and assumptions concerning: interest and

foreign exchange rates; capital efficiencies, cost saving and

synergies; growth and growth rates; the success in the esports and

gaming media industry; the Company’s growth plan, and judgment

applied in the application of the Company’s accounting policies and

in the preparation of financial statements in accordance with

applicable financial reporting standards. While Enthusiast Gaming

considers these assumptions to be reasonable, based on information

currently available, they may prove to be incorrect. Readers are

cautioned not to place undue reliance on forward-looking

statements. In addition, forward-looking statements necessarily

involve known and unknown risks, including, without limitation,

risks associated with general economic conditions; adverse industry

events; and future legislative, tax and regulatory developments.

Readers are cautioned that the foregoing list is not exhaustive.

For more information on the risks, uncertainties and assumptions

that could cause anticipated opportunities and actual results to

differ materially, please refer to the public filings of Enthusiast

Gaming which are available on SEDAR at www.sedar.com. Readers are

further cautioned not to place undue reliance on forward-looking

statements as there can be no assurance that the plans, intentions

or expectations upon which they are placed will occur. Such

information, although considered reasonable by management at the

time of preparation, may prove to be incorrect and actual results

may differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement and reflect our expectations as of the

date hereof, and thus are subject to change thereafter. Enthusiast

Gaming disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

|

|

|

|

|

|

|

Enthusiast Gaming Holdings Inc. |

|

Condensed Consolidated Interim Statements of Financial

Position |

|

As of March 31, 2023 and December 31, 2022 |

|

(Unaudited - Expressed in Canadian Dollars) |

| |

|

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

| |

|

|

|

|

|

|

| |

ASSETS |

|

|

|

|

| |

Current |

|

|

|

|

| |

|

Cash |

$ |

3,466,909 |

|

$ |

7,415,516 |

|

| |

|

Trade and

other receivables |

|

31,965,982 |

|

|

37,868,107 |

|

| |

|

Investments |

|

124,939 |

|

|

125,000 |

|

| |

|

Loans

receivable |

|

- |

|

|

50,935 |

|

| |

|

Income tax

receivable |

|

159,807 |

|

|

367,092 |

|

| |

|

Prepaid expenses |

|

1,474,635 |

|

|

2,017,004 |

|

| |

Total current assets |

|

37,192,272 |

|

|

47,843,654 |

|

| |

Non-current |

|

|

|

|

| |

|

Property and

equipment |

|

178,176 |

|

|

180,621 |

|

| |

|

Right-of-use

assets |

|

1,868,052 |

|

|

2,099,996 |

|

| |

|

Investment

in associates and joint ventures |

|

2,277,584 |

|

|

2,450,031 |

|

| |

|

Long-term

portion of prepaid expenses |

|

279,586 |

|

|

279,814 |

|

| |

|

Intangible

assets |

|

113,916,348 |

|

|

116,967,438 |

|

| |

|

Goodwill |

|

171,642,377 |

|

|

171,615,991 |

|

| |

Total assets |

$ |

327,354,395 |

|

$ |

341,437,545 |

|

| |

|

|

|

|

|

|

| |

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| |

Current |

|

|

|

|

| |

|

Accounts

payable and accrued liabilities |

$ |

28,717,414 |

|

$ |

32,823,320 |

|

| |

|

Contract

liabilities |

|

4,735,649 |

|

|

5,380,378 |

|

| |

|

Income tax

payable |

|

246,201 |

|

|

129,485 |

|

| |

|

Current

portion of long-term debt |

|

4,352,940 |

|

|

17,431,625 |

|

| |

|

Current portion of deferred payment liability |

|

2,495,053 |

|

|

2,391,863 |

|

| |

|

Current

portion of lease liabilities |

|

839,390 |

|

|

872,429 |

|

| |

|

Current

portion of other long-term debt |

|

10,882 |

|

|

10,891 |

|

| |

Total current liabilities |

|

41,397,529 |

|

|

59,039,991 |

|

| |

Non-current |

|

|

|

|

| |

|

Long-term

debt |

|

11,985,100 |

|

|

- |

|

| |

|

Long-term portion of deferred payment liability |

|

1,314,363 |

|

|

1,451,939 |

|

| |

|

Long-term

lease liabilities |

|

1,268,678 |

|

|

1,478,438 |

|

| |

|

Other

long-term debt |

|

144,482 |

|

|

144,844 |

|

| |

|

Deferred tax

liability |

|

24,193,054 |

|

|

24,671,326 |

|

| |

Total liabilities |

$ |

80,303,206 |

|

$ |

86,786,538 |

|

| |

|

|

|

|

|

|

| |

Shareholders' Equity |

|

|

|

|

| |

|

Share

capital |

|

442,781,376 |

|

|

442,781,376 |

|

| |

|

Contributed

surplus |

|

31,533,073 |

|

|

30,402,742 |

|

| |

|

Accumulated

other comprehensive income |

|

8,636,399 |

|

|

8,629,848 |

|

| |

|

Deficit |

|

(235,899,659 |

) |

|

(227,162,959 |

) |

| |

Total shareholders' equity |

|

247,051,189 |

|

|

254,651,007 |

|

| |

Total liabilities and shareholders' equity |

$ |

327,354,395 |

|

$ |

341,437,545 |

|

|

Enthusiast Gaming Holdings Inc. |

|

Condensed Consolidated Interim Statements of Loss and

Comprehensive Loss |

|

For the three months ended March 31, 2023 and

2022 |

|

(Unaudited - Expressed in Canadian Dollars) |

| |

|

|

|

|

|

|

| |

|

|

|

March 31, 2023 |

|

|

March 31, 2022 |

|

| |

|

|

|

|

|

|

| |

Revenue |

$ |

42,879,966 |

|

$ |

47,167,538 |

|

| |

Cost of sales |

|

26,114,408 |

|

|

33,676,159 |

|

| |

Gross margin |

|

16,765,558 |

|

|

13,491,379 |

|

| |

Operating expenses |

|

|

|

|

| |

|

Professional fees |

|

453,336 |

|

|

924,821 |

|

| |

|

Consulting

fees |

|

1,308,484 |

|

|

1,478,174 |

|

| |

|

Advertising

and promotion |

|

1,456,111 |

|

|

327,447 |

|

| |

|

Office and

general |

|

2,291,783 |

|

|

2,262,905 |

|

| |

|

Salaries and

wages |

|

9,207,024 |

|

|

8,696,875 |

|

| |

|

Technology

support, web development and content |

|

5,296,024 |

|

|

3,458,868 |

|

| |

|

Esports

player, team and game expenses |

|

635,447 |

|

|

1,511,488 |

|

| |

|

Foreign

exchange loss |

|

114,557 |

|

|

8,587 |

|

| |

|

Share-based

compensation |

|

1,130,331 |

|

|

1,386,181 |

|

| |

|

Amortization

and depreciation |

|

3,338,023 |

|

|

4,767,024 |

|

| |

Total operating expenses |

|

25,231,120 |

|

|

24,822,370 |

|

| |

|

|

|

|

|

|

| |

Other expenses (income) |

|

|

|

|

| |

|

Share of net

loss (income) from investment in associates and joint ventures |

|

172,447 |

|

|

(296,041 |

) |

| |

|

Interest and

accretion |

|

610,340 |

|

|

1,430,669 |

|

| |

|

Gain on

revaluation of deferred payment liability |

|

(172,024 |

) |

|

(1,015,538 |

) |

| |

|

Interest income |

|

(61,207 |

) |

|

(1,401 |

) |

| |

Net loss before income taxes |

|

(9,015,118 |

) |

|

(11,448,680 |

) |

| |

|

|

|

|

|

|

| |

Income taxes |

|

|

|

|

| |

|

Current tax

expense |

|

203,492 |

|

|

110,529 |

|

| |

|

Deferred tax recovery |

|

(481,910 |

) |

|

(526,280 |

) |

| |

Net loss for the period |

|

(8,736,700 |

) |

|

(11,032,929 |

) |

| |

|

|

|

|

|

|

| |

Other comprehensive (loss) income |

|

|

|

|

| |

Items that may be reclassified to profit or loss |

|

|

|

|

| |

|

Foreign

currency translation adjustment |

|

6,551 |

|

|

(1,208,430 |

) |

| |

Net loss and comprehensive loss for the

period |

$ |

(8,730,149 |

) |

$ |

(12,241,359 |

) |

| |

|

|

|

|

|

|

| |

Net loss per share, basic and diluted |

$ |

(0.06 |

) |

$ |

(0.08 |

) |

| |

Weighted average number of common shares |

|

|

|

|

| |

|

outstanding, basic and diluted |

|

151,767,243 |

|

|

133,605,479 |

|

|

|

|

Enthusiast Gaming Holdings Inc. |

|

Condensed Consolidated Interim Statements of Cash

Flows |

|

For the three months ended March 31, 2023 and

2022 |

|

(Unaudited - Expressed in Canadian Dollars) |

| |

|

|

March 31, 2023 |

|

|

March 31, 2022 |

|

| |

|

|

|

|

|

| |

Cash

flows from operating activities |

|

|

|

|

| |

Net loss for

the period |

$ |

(8,736,700 |

) |

$ |

(11,032,929 |

) |

| |

Items not

affecting cash: |

|

|

|

|

| |

Amortization and depreciation |

|

3,338,023 |

|

|

4,767,024 |

|

| |

Share-based compensation |

|

1,130,331 |

|

|

1,386,181 |

|

| |

Interest and accretion |

|

83,480 |

|

|

1,227,562 |

|

| |

Deferred tax recovery |

|

(481,910 |

) |

|

(526,280 |

) |

| |

Share of net loss (income) from investment in associates and joint

ventures |

|

172,447 |

|

|

(296,041 |

) |

| |

Gain on revaluation of deferred payment liability |

|

(172,024 |

) |

|

(1,015,538 |

) |

| |

Foreign exchange gain |

|

(1,691 |

) |

|

13,456 |

|

| |

Shares for services |

|

- |

|

|

63,320 |

|

| |

Provisions |

|

159,250 |

|

|

- |

|

| |

Changes in

working capital: |

|

|

|

|

| |

Changes in trade and other receivables |

|

5,793,769 |

|

|

4,185,031 |

|

| |

Changes in prepaid expenses |

|

542,369 |

|

|

789,542 |

|

| |

Changes in loans receivable |

|

- |

|

|

125,995 |

|

| |

Changes in accounts payable and accrued liabilities |

|

(4,105,906 |

) |

|

(7,236,523 |

) |

| |

Changes in contract liabilities |

|

(644,729 |

) |

|

(22,668 |

) |

| |

Changes in income tax |

|

439,202 |

|

|

107,480 |

|

| |

Income tax paid |

|

(115,201 |

) |

|

(71,016 |

) |

| |

Net cash used in operating activities |

|

(2,599,290 |

) |

|

(7,535,404 |

) |

| |

|

|

|

|

|

| |

Cash

flows from investing activities |

|

|

|

|

| |

Acquisition

of intangible assets |

|

(27,488 |

) |

|

- |

|

| |

Acquisition

of property and equipment |

|

(18,531 |

) |

|

(1,757 |

) |

| |

Net cash provided by (used in) investing

activities |

|

(46,019 |

) |

|

(1,757 |

) |

| |

|

|

|

|

|

| |

Cash

flows from financing activities |

|

|

|

|

| |

Repayment of

long-term debt |

|

(1,088,235 |

) |

|

(500,000 |

) |

| |

Proceeds

from exercise of options |

|

- |

|

|

69,821 |

|

| |

Repayment of

other long-term debt |

|

(2,968 |

) |

|

(2,741 |

) |

| |

Lease

payments |

|

(265,523 |

) |

|

(240,001 |

) |

| |

Net cash provided by financing activities |

|

(1,356,726 |

) |

|

(672,921 |

) |

| |

|

|

|

|

|

| |

Foreign

exchange effect on cash |

|

53,428 |

|

|

(306,151 |

) |

| |

Net change

in cash |

|

(3,948,607 |

) |

|

(8,516,233 |

) |

| |

Cash, beginning of period |

|

7,415,516 |

|

|

22,654,262 |

|

| |

Cash, end of period |

$ |

3,466,909 |

|

$ |

14,138,029 |

|

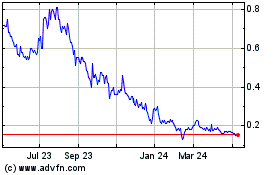

Enthusiast Gaming (TSX:EGLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

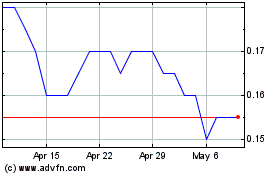

Enthusiast Gaming (TSX:EGLX)

Historical Stock Chart

From Apr 2023 to Apr 2024