Equinox Gold Corp. (TSX: EQX, NYSE American: EQX)

(“Equinox Gold” or the “Company”) has issued 24,761,905 common

shares of the Company (the “Common Shares”) to Ninety Fourth

Investment Company LLC (“Ninety Fourth”), an affiliate of MDC

Industry Holding Company LLC (“MDC”) on conversion of a US$130

million convertible note (the “Note”) held by MDC.

Further, Equinox Gold and Ninety Fourth have

entered into an agreement with BMO Capital Markets to complete a

secondary offering (the “Offering”) of the Common Shares issued on

conversion of the Note. Pursuant to the agreement, BMO Capital

Markets has agreed to purchase, on a bought deal basis, 24,761,905

Common Shares from Ninety Fourth at a price of US$5.65 per Common

Share, for total gross proceeds of approximately US$140

million.

Net proceeds of the Offering will be paid

directly to Ninety Fourth and Equinox Gold will not receive any

proceeds from the sale of Ninety Fourth’s Common Shares.

Greg Smith, Equinox Gold’s President and CEO,

commented: “Conversion of the US$130 million convertible note

reduces our current debt and meaningfully enhances our liquidity.

As a key partner in our growth, we are pleased to see MDC partially

capitalize on their long-term investment in the Company through the

Offering, and we look forward to continuing to work together.”

MDC’s US$130 million Note was issued in 2019

with a US$5.25 per share conversion price. Following completion of

the Offering, MDC will continue to hold a second US$130 million

principal amount convertible note of Equinox Gold with a September

10, 2025 maturity date and a US$6.50 per share conversion price,

which represents approximately 4.22% of the issued and outstanding

Common Shares on an as-converted basis.

The Offering is expected to close on or about

October 9, 2024, subject to customary closing conditions.

The Offering will be made in each of the

provinces and territories of Canada, except Quebec, by way of a

prospectus supplement (the “Prospectus Supplement”) to the

Company’s short form base shelf prospectus dated October 1, 2024

(the “Base Shelf Prospectus”). The Company has filed a registration

statement on Form F-10 (the “Registration Statement”) (including

the Base Shelf Prospectus) and will file the Prospectus Supplement

with the United States Securities and Exchange Commission (the

“SEC”) in accordance with the multijurisdictional disclosure system

established between Canada and the United States for the Offering.

The Offering may also be made on a private placement basis in other

international jurisdictions in reliance on applicable private

placement exemptions. Before investing, prospective investors

should read the Base Shelf Prospectus, the Prospectus Supplement,

when available, the documents incorporated by reference therein,

the Registration Statement containing such documents and other

documents the Company has filed with the SEC for more complete

information about the Company and the Offering.

When available, these documents may be accessed

for free on the System for Electronic Data Analysis and Retrieval +

(“SEDAR+”) at www.sedarplus.ca and on the SEC’s Electronic Data

Gathering, Analysis and Retrieval system (“EDGAR”) at

www.sec.gov.

Access to the Prospectus Supplement, the Base

Shelf Prospectus and any amendments thereto are provided in Canada

in accordance with securities legislation relating to the

procedures for providing access to a shelf prospectus supplement, a

base shelf prospectus and any amendment to such documents. The Base

Shelf Prospectus is, and the Prospectus Supplement will be (within

two business days from the date hereof), accessible through SEDAR+.

An electronic or paper copy of these documents, when available, may

be obtained, without charge, in Canada from BMO Capital Markets,

Brampton Distribution Centre c/o The Data Group of Companies, 9195

Torbram Road, Brampton, Ontario, L6S 6H2 by telephone at

905-791-3151 Ext. 4312 or by email at

torbramwarehouse@datagroup.ca, and in the United States from BMO

Capital Markets Corp., Attn: Equity Syndicate Department, 3 Times

Square, 25th Floor, New York, NY 10036 (Attn: Equity Syndicate) by

providing BMO Capital Markets with an email address or mailing

address, as applicable.

No securities regulatory authority has either

approved or disapproved the contents of this press release. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any province, state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

province, state or jurisdiction.

About Equinox Gold

Equinox Gold is a growth-focused Canadian mining

company operating entirely in the Americas, with eight producing

gold mines and a clear path to achieve more than one million ounces

of annual gold production from a pipeline of expansion projects.

Equinox Gold’s common shares are listed on the TSX and the NYSE

American under the trading symbol EQX.

Equinox Gold Contacts

Greg Smith, Chief Executive OfficerRhylin Bailie, Vice

President, Investor RelationsTel: +1 604-558-0560Email:

ir@equinoxgold.com

Forward-looking Statements

This news release contains certain

forward-looking information and forward-looking statements within

the meaning of applicable securities legislation (collectively,

“Forward-looking Information”). Forward-looking Information in this

news release relates to, among other things: completion of the

Offering, including the receipt of regulatory approvals, the

strategic vision for the Company and expectations regarding

exploration potential, production capabilities, growth potential,

and future financial or operating performance. Forward-looking

Information can be identified by the use of words such as “will”,

clear path”, “look forward”, “continuing”, and similar expressions

and phrases or statements that certain actions, events or results

“may”, “could”, “would” or “should” occur, or the negative

connotation of such terms. Although the Company believes that the

expectations reflected in such Forward-looking Information are

reasonable, undue reliance should not be placed on Forward-looking

Information since the Company can give no assurance that such

expectations will prove to be correct. The Company has based

Forward-looking Information in this news release on the Company’s

current assumptions, expectations and projections about future

events. While the Company considers these to be reasonable based on

information currently available, they may prove to be incorrect.

Accordingly, readers are cautioned not to put undue reliance on

Forward-looking Information contained in this news release.

Forward-looking Information is subject to known

and unknown risks, uncertainties and other factors that may cause

actual results and developments to differ materially from those

expressed or implied by such Forward-looking Information. Such

factors include, without limitation: fluctuations in gold prices;

fluctuations in prices for energy inputs, labour, materials,

supplies and services; fluctuations in currency markets;

operational risks and hazards inherent with the business of mining

(including environmental accidents and hazards, geotechnical

failures, industrial accidents, equipment breakdown, unusual or

unexpected geological or structural formations, cave-ins, flooding,

fire and severe weather); inadequate insurance, or inability to

obtain insurance to cover these risks and hazards; employee

relations; relationships with, and claims by, local communities and

indigenous populations; changes in laws, regulations and government

practices; legal restrictions relating to mining; and those factors

identified in the Company’s Management’s Discussion and Analysis

for the year ended December 31, 2023 and its most recently filed

Annual Information Form, copies of which are available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov. Except as required by

applicable law, the Company assumes no obligation to update or

publicly announce the results of any change to any Forward-looking

Information contained or incorporated by reference into this news

release to reflect actual results, future events or developments,

changes in assumptions or changes in other factors affecting the

Forward-looking Information. If the Company updates any

Forward-looking Information, no inference should be made that the

Company will make additional updates with respect to that or other

Forward-looking Information. All Forward-looking Information

contained in this news release is expressly qualified in its

entirety by this cautionary statement.

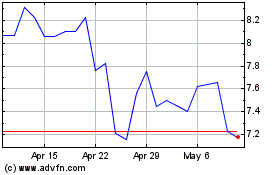

Equinox Gold (TSX:EQX)

Historical Stock Chart

From Oct 2024 to Nov 2024

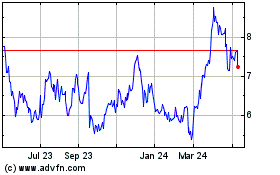

Equinox Gold (TSX:EQX)

Historical Stock Chart

From Nov 2023 to Nov 2024