Fairfax Financial to Acquire Additional 46.32% Interest in Gulf Insurance Group from KIPCO

April 19 2023 - 6:00AM

Fairfax Financial Holdings Limited ("

FFHL")

(TSX:FFH and TSX:FFH.U) and Kuwait Projects Company (Holding)

K.S.C.P. (“

KIPCO”) (KW: KPRO) are pleased to

announce that they have entered into an agreement (the

"

Agreement") pursuant to which certain affiliates

of FFHL (collectively, “

Fairfax”) will acquire all

of the shares of Gulf Insurance Group K.S.C.P.

(“

GIG”) (KW: GINS) under the control of KIPCO and

certain of its affiliates (the “

KIPCO Sellers”),

representing approximately 46.32% of the equity of GIG. Under the

terms of the Agreement, the KIPCO Sellers’ shares in GIG will be

acquired by Fairfax for aggregate proceeds to KIPCO of 263,653,200

Kuwaiti Dinar (approximately $860 million), representing a price

per share of 2.00 Kuwaiti Dinar (approximately $6.53) per share,

subject to a reduction by the amount of any dividends received by

the KIPCO Sellers after January 1, 2023 (the

“

Transaction”). Following the closing of the

Transaction, Fairfax’s equity interest in GIG will increase from

43.69% to 90.01%.

In accordance with applicable Kuwaiti regulatory

requirements and the rules of the Boursa Kuwait, the exchange on

which GIG’s shares are traded, the purchase price payable to the

KIPCO Sellers in connection with the Transaction will be paid by

Fairfax in full in Kuwaiti Dinar on closing. Pursuant to the terms

of the Agreement, immediately following the settlement of the

Transaction, the KIPCO Sellers shall return to Fairfax in cash the

full purchase price less an amount of Kuwaiti Dinar equal to $200

million, together with a cash payment equal to all dividends

received by the KIPCO Sellers from GIG after January 1, 2023, and

Fairfax will deliver to KIPCO a payment deed requiring Fairfax to

make four equal annual payments of $165 million to KIPCO beginning

on the first anniversary of closing of the Transaction.

“We are excited to increase our ownership

interest in GIG,” said Prem Watsa, Chairman and CEO of Fairfax.

“GIG is among the largest and most diversified insurance groups in

the Middle East and North Africa region, with operations in 13

different countries and a market-leading presence in each of

Kuwait, Jordan, Bahrain and Egypt. Since our first investment in

2010, GIG has proven to be a great company. It has provided stellar

results over the long term and is run by an experienced and

talented management team led by Khaled Saoud Al Hasan. We are

thankful to our partners at KIPCO for giving us this opportunity to

expand our insurance operations in the rapidly growing Middle East

and North Africa market.”

“Our partnership with Fairfax is one that we

greatly value,” said Sheikha Dana Naser Sabah Al Ahmad Al Sabah,

KIPCO’s Group CEO. “Together we have grown Gulf Insurance Group

into a leading player in the MENA insurance market. As a holding

investment company, KIPCO’s strategy is to acquire, scale and exit

companies when the time is opportune. Our journey has been one of

success, and we believe that GIG will continue to grow under

Fairfax and remain a leading player in the market.”

“KIPCO has been our strategic investor since

1997 and when Fairfax became a shareholder in 2010, it was the

start of a successful long-term partnership,” said Khaled Saoud al

Hasan, Group CEO of Gulf Insurance Group. “I want to warmly thank

KIPCO for believing in us. The exponential growth of the GIG Group

from KIPCO’s initial investment is a testament to the success

achieved over the course of our partnership. Fairfax strongly

believes in the continued growth potential of the GIG Group and the

region. With this transaction Fairfax is showing its long-term

commitment to the GCC markets and to the GIG Group that has

recently posted a net profit of $124.7 million for the financial

year 2022. We will continue to work with our decentralized

operating model that allows all subsidiaries to operate

independently, while benefitting from Fairfax’s knowledge and

collective experience in over 40 markets around the world. In the

coming months, we will work closely with each of the regulators of

the GIG Group entities to make this transaction seamless and

beneficial for all parties.”

“GIG Gulf and GIG Saudi have been proudly part

of the GIG Group since the acquisition from AXA in 2021, and the

collaboration with our new shareholders, both KIPCO and Fairfax,

has been extremely smooth and positive,” said Paul Adamson, Chief

Executive Officer of GIG Gulf. “I am convinced that Fairfax, with

almost 40 years of experience in insurance, reinsurance and

investment management is well placed to ensure that GIG continues

with its plan to be a leading regional insurer and to pursue our

growth path. For all GIG entities, the opportunity to become part

of a global Insurance brand such as Fairfax is truly unique and

will allow us to further leverage each other’s and Fairfax’s

expertise.”

The Transaction is subject to the receipt of all

necessary approvals from applicable regulators, including merger

control, capital markets, stock exchange and insurance regulators

in each relevant jurisdiction in which GIG operates, and the

satisfaction of other customary closing conditions, including a

condition that the volume-weighted average price of the

publicly-traded shares of GIG in the six month period prior to

closing must not exceed the price per share to be paid to the KIPCO

Sellers (being 2.00 Kuwaiti Dinar, as adjusted to account for any

dividends received by the KIPCO Sellers after January 1, 2023).

Closing of the Transaction is currently expected to occur in the

second half of 2023.

In accordance with regulations of the Capital

Markets Authority of Kuwait, the closing of the Transaction between

KIPCO and Fairfax will require Fairfax to initiate a mandatory

tender offer to all other holders of GIG shares. Fairfax expects

the launch of the mandatory tender offer to occur shortly after the

closing of the Transaction, and in any event within thirty days

thereafter.

Fairfax Financial Holdings Limited is a holding

company which, through its subsidiaries, is primarily engaged in

property and casualty insurance and reinsurance and the associated

investment management.

For further information contact: John Varnell,

Vice President, Corporate Development at (416) 367-4941.

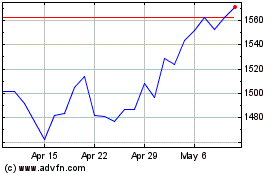

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

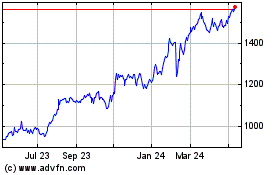

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Apr 2023 to Apr 2024