Fairfax Financial Holdings Limited (TSX: FFH and FFH.U) announces

net earnings of $1,250.0 million ($49.38 net earnings per diluted

share after payment of preferred share dividends) in the first

quarter of 2023 compared to net earnings of $588.7 million ($22.67

net earnings per diluted share after payment of preferred share

dividends) in the first quarter of 2022. Book value per basic share

at March 31, 2023 was $803.49 compared to $762.28 at

December 31, 2022 (an increase of 6.8% adjusted for the $10

per common share dividend paid in the first quarter of 2023).

"We got off to a great start in 2023, with our

property and casualty insurance and reinsurance operations

producing operating income of $1,309.3 million ($843.0 million

excluding discounting and risk adjustment on claims of $466.3

million) for the first quarter, reflecting increased interest and

dividends, increased share of profit of associates and strong

insurance service result. Our underwriting performance in the first

quarter of 2023 continued to produce favourable results, with

additional growth in gross premiums written of 7.2% and net

premiums written of 6.1%, primarily reflecting new business and

continued incremental rate increases in certain lines of business.

We achieved underwriting profit of $313.8 million on an

undiscounted basis and a consolidated combined ratio of 94.0% for

the quarter.

"On January 1, 2023 we were required to adopt

the new accounting standard for insurance contracts (IFRS 17) –

with the most significant changes being the discounting of our

insurance liabilities and a specific risk margin for uncertainty.

As we have stated before, this new reporting requirement will not

change the way management evaluates the business and we will

continue to be focused on underwriting profit on an undiscounted

basis with strong reserving. The effects of discounting and risk

adjustment in the quarter resulted in an increase to pre-tax

earnings of $309.6 million.

"Net gains on investments of $771.2 million in

the quarter were principally comprised of mark to market gains on

common stocks of $410.4 million and bonds of $319.0 million. The

pre-tax gain on the sale of Brit's MGA Ambridge of approximately

$255 million was not accounted for in the first quarter as the

transaction only closed on May 10, 2023. Also, on closing of the

Gulf Insurance transaction, the company expects it will record a

pre-tax gain of approximately $300 million when our equity interest

increases from 43.7% to a controlling interest of 90.0%.

"As we have previously said, we have increased

our interest and dividend annual run-rate to over $1.5 billion and

have locked it in at this level for the next three years. Our fixed

income portfolio is conservatively positioned with effectively 80%

of our fixed income portfolio in government bonds and only 14% in

primarily short-dated corporate bonds.

"We continue to focus on being soundly financed

and ended the quarter with approximately $1.0 billion in cash and

investments in the holding company, which does not include any

proceeds from the sale of Brit's MGA Ambridge that closed on May

10, 2023," said Prem Watsa, Chairman and Chief Executive

Officer.

The table below presents the sources of the

company's net earnings in a format which the company has

consistently used as it believes it assists in understanding

Fairfax:

| |

First quarter |

|

|

2023 |

|

|

2022 |

|

| |

($ millions) |

| Gross premiums written |

7,138.5 |

|

|

6,662.9 |

|

| Net premiums written |

5,663.1 |

|

|

5,342.7 |

|

| Net insurance revenue |

5,159.9 |

|

|

4,674.4 |

|

| |

|

|

|

| Sources of net

earnings |

|

|

|

| Operating income - Property

and Casualty Insurance and Reinsurance: |

|

|

|

|

Insurance service result: |

|

|

|

|

North American Insurers |

275.8 |

|

|

211.6 |

|

|

Global Insurers and Reinsurers |

625.3 |

|

|

399.1 |

|

|

International Insurers and Reinsurers |

76.6 |

|

|

51.2 |

|

|

Insurance service result |

977.7 |

|

|

661.9 |

|

|

Other insurance operating expenses |

(197.6 |

) |

|

(170.0 |

) |

|

|

780.1 |

|

|

491.9 |

|

|

Interest and dividends |

311.5 |

|

|

110.5 |

|

|

Share of profit of associates |

217.7 |

|

|

127.5 |

|

| Operating income - Property

and Casualty Insurance and Reinsurance |

1,309.3 |

|

|

729.9 |

|

| Operating income - Life

insurance and Run-off |

3.4 |

|

|

44.6 |

|

| Operating income (loss) -

Non-insurance companies |

(0.6 |

) |

|

27.1 |

|

| Net finance income (expense)

from insurance contracts and reinsurance contract assets held |

(163.4 |

) |

|

419.0 |

|

| Net gains (losses) on

investments |

771.2 |

|

|

(195.2 |

) |

| Interest expense |

(124.3 |

) |

|

(103.9 |

) |

| Corporate overhead and other

expense |

(26.5 |

) |

|

(16.3 |

) |

| Earnings before income

taxes |

1,769.1 |

|

|

905.2 |

|

| Provision for income

taxes |

(365.1 |

) |

|

(206.4 |

) |

| Net

earnings |

1,404.0 |

|

|

698.8 |

|

| |

|

|

|

| Attributable to: |

|

|

|

| Shareholders of Fairfax |

1,250.0 |

|

|

588.7 |

|

| Non-controlling interests |

154.0 |

|

|

110.1 |

|

| |

1,404.0 |

|

|

698.8 |

|

The table below presents the insurance service

result for the property and casualty insurance and reinsurance

operations reconciled to underwriting profit, a key performance

measure used by the company and the property and casualty industry

in which it operates. The reconciling adjustments are (i) other

insurance operating expenses as presented on the consolidated

statement of earnings, and (ii) the effects of discounting of

losses and ceded losses on claims recorded in the period and the

effects of the risk adjustment and other, which are presented in

insurance service expenses and recoveries of insurance service

expenses.

| |

First Quarter |

|

|

2023 |

|

|

2022 |

|

| |

($ millions) |

| Insurance service

result |

977.7 |

|

|

661.9 |

|

|

Other insurance operating expenses |

(197.6 |

) |

|

(170.0 |

) |

|

Discounting of losses and ceded losses on claims recorded in the

period |

(422.4 |

) |

|

(175.7 |

) |

|

Changes in the risk adjustment and other |

(43.9 |

) |

|

8.2 |

|

| Underwriting

profit |

313.8 |

|

|

324.4 |

|

| Interest and dividends |

311.5 |

|

|

110.5 |

|

| Share of profit of

associates |

217.7 |

|

|

127.5 |

|

| Adjusted operating

income - Property and Casualty Insurance and

Reinsurance |

843.0 |

|

|

562.4 |

|

Adoption of IFRS 17

Insurance Contracts ("IFRS 17") on January

1, 2023

On January 1, 2023 Fairfax adopted the new

accounting standard for insurance contracts (IFRS 17).

- It resulted in

considerable changes to the recognition, measurement, presentation

and disclosure of the company’s insurance and reinsurance

operations – the most significant being the discounting of the

company's net insurance liabilities and a new risk adjustment for

uncertainty.

- This new

accounting standard has not changed the way management evaluates

the performance of its property and casualty insurance and

reinsurance operations. The company remains focused on underwriting

profit on an undiscounted basis with strong reserving with all of

the property and casualty insurance and reinsurance operations

continuing to use the traditional performance measures of gross

premiums written, net premiums written and combined ratios to

manage the business.

- The cumulative

effect of implementing IFRS 17 was $2.4 billion and was recognized

as an increase in common shareholders' equity at December 31,

2022 (an increase in book value per share of $104.60), primarily

reflecting the introduction of discounting net claims reserves of

$4.7 billion, partially offset by a risk adjustment of $1.6 billion

for uncertainty related to the timing and amount of cash flows from

non-financial risk and by the tax effect of the measurement changes

and other of $0.7 billion.

- The new standard

increased common shareholders' equity at December 31, 2022 to

$17.8 billion, a book value per share of $762.28.

Highlights for the first quarter of 2023 (with

comparisons to the first quarter of 2022 except as otherwise noted,

and excluding the effects of IFRS 17 when discussing the combined

ratio and adjusted operating income) include the following:

- Net premiums

written by the property and casualty insurance and reinsurance

operations increased 6.1% to $5,619.4 million from

$5,297.3 million, while gross premiums written increased by

7.2%.

- The consolidated

combined ratio of the property and casualty insurance and

reinsurance operations was 94.0%, producing an underwriting profit

of $313.8 million, compared to a combined ratio of 93.1% and

an underwriting profit of $324.4 million in 2022, driven by

continued growth in business volumes (net insurance revenue

increased by 10.6%) and prudent expense management, partially

offset by increased catastrophe losses of $191.9 million or

3.7 combined ratio points in the quarter.

- Adjusted

operating income of the property and casualty insurance and

reinsurance operations increased by 49.9% to $843.0 million from

$562.4 million, principally due to increased interest and dividend

income and share of profit of associates.

- Net finance

expense from insurance contracts and reinsurance contract assets

held of $163.4 million reflected interest accretion as a result of

the unwinding of the effects of discounting recognized at higher

interest rates compared to net finance income from insurance

contracts and reinsurance contract assets held of $419.0 million in

the prior year that benefited from the significant increase in

discount rates during the quarter, the effects of which exceeded

the interest accretion.

- Consolidated

interest and dividends increased significantly in the quarter from

$168.9 million to $382.3 million. At March 31, 2023 the

company's insurance and reinsurance companies held portfolio

investments of $54.5 billion (excluding Fairfax India's portfolio

of $2.0 billion), of which approximately $7.5 billion was in cash

and short term investments representing approximately 13.7% of

those portfolio investments. During the first quarter of 2023 the

company used net proceeds from sales and maturities of short dated

U.S. treasuries to purchase $5.9 billion of U.S. treasuries with

maturities between 3 to 5 years, which will benefit interest and

dividend income in the remainder of 2023.

- Consolidated

share of profit of associates of $333.8 million principally

reflected share of profit of $94.6 million from Eurobank, $69.2

million from EXCO Resources Inc., $50.1 million from Poseidon

(formerly Atlas Corp.) and $28.7 million from Gulf Insurance.

- Net gains on investments of $771.2

million consisted of the following:

| |

First quarter of 2023 |

| |

($ millions) |

|

|

Realizedgains(losses) |

|

|

Unrealizedgains |

|

|

Netgains |

|

|

Net gains (losses) on: |

|

|

|

|

|

|

|

|

Equity exposures |

172.7 |

|

|

237.7 |

|

|

410.4 |

|

|

Bonds |

(331.9 |

) |

|

650.9 |

|

|

319.0 |

|

|

Other |

(63.1 |

) |

|

104.9 |

|

|

41.8 |

|

| |

(222.3 |

) |

|

993.5 |

|

|

771.2 |

|

Net gains on equity exposures of $410.4 million

was primarily comprised of unrealized gains on common stocks,

convertible bonds and preferred stocks and net gains on equity

derivatives. At March 31, 2023 the company continued to hold

equity total return swaps on 1,964,155 Fairfax subordinate voting

shares with an original notional amount of $732.5 million

(Cdn$935.0 million) or approximately $372.96 (Cdn$476.03) per

share, on which the company recorded $139.8 million of net gains in

the first quarter of 2023.

Net gains on bonds of $319.0 million included

net gains of $216.9 million on U.S. treasuries and net gains of

$55.8 million on corporate and other bonds (principally U.S. and

other corporate bonds).

- The

Non-insurance companies reporting segment had an operating loss of

$0.6 million in the first quarter of 2023 compared to operating

income of $27.1 million in the first quarter of 2022. Excluding

non-cash charges and adjustments and the operating loss at Grivalia

Hospitality (consolidated on July 5, 2022), which together totaled

$74.7 million in the first quarter of 2023, operating income

increased by $47.0 million to $74.1 million, principally reflecting

higher share of profit of associates and increased interest and

dividend income at Fairfax India and higher business volumes at

AGT.

- Interest expense

of $124.3 million (inclusive of $13.0 million on leases) was

principally comprised of $81.8 million incurred on borrowings by

the holding company and the insurance and reinsurance companies and

$29.5 million incurred on borrowings by the non-insurance companies

(which are non-recourse to the holding company).

- At

March 31, 2023 the excess of fair value over carrying value of

investments in non-insurance associates and consolidated

non-insurance subsidiaries was $439.1 million.

- The company's

total debt to total capital ratio, excluding non-insurance

companies, decreased to 22.9% at March 31, 2023 compared to

23.7% at December 31, 2022, principally reflecting increased

common shareholders' equity as a result of the strong net earnings

reported in the quarter.

- During the first

quarter of 2023 the company purchased 156,685 of its subordinate

voting shares for cancellation at an aggregate cost of $100.0

million.

- Transactions closing or closed

subsequent to March 31, 2023:

- On May 10, 2023

Brit completed the sale of Ambridge Group ("Ambridge"), its

Managing General Underwriter operations, to Amynta Group. In the

second quarter of 2023 Brit will deconsolidate the assets and

liabilities of Ambridge and will record a pre-tax gain of

approximately $255 million (prior to ascribing any fair value to

the potential additional receivable).

- On April 19, 2023 the company

entered into an agreement to acquire all shares of Gulf Insurance

Group K.S.C.P. (“Gulf Insurance”) under the control of KIPCO and

certain of its affiliates, representing 46.3% of the equity of Gulf

Insurance. On closing of the transaction, which is expected to be

in the second half of 2023, the company's equity interest in Gulf

Insurance will increase from 43.7% to a controlling interest of

90.0%. The company anticipates that upon closing it will

consolidate the assets and liabilities of Gulf Insurance and will

record a pre-tax gain of approximately $300 million, with changes

in the company's carrying value of its equity accounted investment

in Gulf Insurance up until the date of closing impacting the

pre-tax gain.

There were 23.3 million and 23.8 million

weighted average common shares effectively outstanding during the

first quarters of 2023 and 2022 respectively. At March 31,

2023 there were 23,228,539 common shares effectively

outstanding.

Consolidated balance sheet, earnings and

comprehensive income information, together with segmented premium

and combined ratio information, follow and form part of this news

release.

As previously announced, Fairfax will hold a

conference call to discuss its first quarter 2023 results at 8:30

a.m. Eastern time on Friday May 12, 2023. The call, consisting

of a presentation by the company followed by a question period, may

be accessed at 1 (888) 390-0867 (Canada or U.S.) or 1 (212)

547-0141 (International) with the passcode “FAIRFAX”. A replay of

the call will be available from shortly after the termination of

the call until 5:00 p.m. Eastern time on Friday, May 26, 2023.

The replay may be accessed at 1 (800) 814-6746 (Canada or U.S.) or

1 (203) 369-3827 (International).

Fairfax Financial Holdings Limited is a holding

company which, through its subsidiaries, is primarily engaged in

property and casualty insurance and reinsurance and the associated

investment management.

|

For further information, contact: |

John VarnellVice President, Corporate Development(416)

367-4941 |

|

|

|

CONSOLIDATED BALANCE SHEETSas at March 31,

2023, December 31, 2022 and January 1, 2022 (US$ millions

except per share amounts)

| |

|

March 31,2023 |

|

December 31,2022 |

|

January 1,2022 |

| |

|

|

|

|

Restated(1) |

|

Restated(1) |

| Assets |

|

|

|

|

|

|

|

|

|

Holding company cash and investments (including assets pledged for

derivative obligations – $208.9; December 31, 2022 – $104.6;

January 1, 2022 – $111.0) |

|

971.6 |

|

|

1,345.8 |

|

|

1,478.3 |

|

| Insurance contract

receivables |

|

613.9 |

|

|

648.9 |

|

|

650.1 |

|

| |

|

|

|

|

|

|

|

|

| Portfolio investments |

|

|

|

|

|

|

|

|

| Subsidiary cash and short term

investments (including restricted cash and cash equivalents –

$731.0; December 31, 2022 – $854.4; January 1, 2022 –

$1,246.4) |

|

7,455.7 |

|

|

9,368.2 |

|

|

21,799.5 |

|

| Bonds (cost $32,271.3;

December 31, 2022 – $29,534.4; January 1, 2022 – $13,836.3) |

|

32,054.0 |

|

|

28,578.5 |

|

|

14,091.2 |

|

| Preferred stocks (cost $777.7;

December 31, 2022 – $808.3; January 1, 2022 – $576.6) |

|

2,324.4 |

|

|

2,338.0 |

|

|

2,405.9 |

|

| Common stocks (cost $5,600.0;

December 31, 2022 – $5,162.6; January 1, 2022 – $4,717.2) |

|

5,823.6 |

|

|

5,124.3 |

|

|

5,468.9 |

|

| Investments in associates

(fair value $7,139.4; December 31, 2022 – $6,772.9; January 1, 2022

– $5,671.9) |

|

6,035.4 |

|

|

6,093.1 |

|

|

4,749.2 |

|

| Derivatives and other invested

assets (cost $872.3; December 31, 2022 – $869.8; January 1, 2022 –

$888.2) |

|

849.4 |

|

|

828.5 |

|

|

991.2 |

|

| Assets pledged for derivative

obligations (cost $111.9; December 31, 2022 – $52.4; January 1,

2022 – $119.6) |

|

113.4 |

|

|

51.3 |

|

|

119.6 |

|

| Fairfax India cash, portfolio

investments and associates (fair value $3,079.1; December 31, 2022

– $3,079.6; January 1, 2022 – $3,336.4) |

|

1,982.6 |

|

|

1,942.8 |

|

|

2,066.0 |

|

| |

|

56,638.5 |

|

|

54,324.7 |

|

|

51,691.5 |

|

| |

|

|

|

|

|

|

|

|

| Reinsurance contract assets

held |

|

9,891.6 |

|

|

9,691.5 |

|

|

9,893.1 |

|

| Deferred income tax

assets |

|

132.9 |

|

|

137.3 |

|

|

449.1 |

|

| Goodwill and intangible

assets |

|

5,737.2 |

|

|

5,689.0 |

|

|

5,928.2 |

|

| Other assets |

|

7,183.6 |

|

|

6,981.3 |

|

|

6,034.1 |

|

| Total assets |

|

81,169.3 |

|

|

78,818.5 |

|

|

76,124.4 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

|

4,918.8 |

|

|

4,806.6 |

|

|

4,587.6 |

|

| Derivative obligations |

|

301.3 |

|

|

191.0 |

|

|

152.9 |

|

| Deferred income tax

liabilities |

|

1,071.0 |

|

|

868.0 |

|

|

586.5 |

|

| Insurance contract

payables |

|

1,440.0 |

|

|

1,402.7 |

|

|

1,826.0 |

|

| Insurance contract

liabilities |

|

40,691.4 |

|

|

39,906.6 |

|

|

39,742.2 |

|

| Borrowings – holding company

and insurance and reinsurance companies |

|

6,631.7 |

|

|

6,621.0 |

|

|

6,129.3 |

|

| Borrowings – non-insurance

companies |

|

2,086.6 |

|

|

2,003.9 |

|

|

1,623.7 |

|

| Total liabilities |

|

57,140.8 |

|

|

55,799.8 |

|

|

54,648.2 |

|

| |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Common shareholders’

equity |

|

18,663.8 |

|

|

17,780.3 |

|

|

15,199.8 |

|

| Preferred stock |

|

1,335.5 |

|

|

1,335.5 |

|

|

1,335.5 |

|

| Shareholders’ equity

attributable to shareholders of Fairfax |

|

19,999.3 |

|

|

19,115.8 |

|

|

16,535.3 |

|

| Non-controlling interests |

|

4,029.2 |

|

|

3,902.9 |

|

|

4,940.9 |

|

| Total equity |

|

24,028.5 |

|

|

23,018.7 |

|

|

21,476.2 |

|

| |

|

81,169.3 |

|

|

78,818.5 |

|

|

76,124.4 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Book value per basic

share |

|

803.49 |

|

|

762.28 |

|

|

636.89 |

|

| |

|

|

|

|

|

|

|

|

|

(1) Restated for the transition to IFRS 17.

CONSOLIDATED STATEMENTS OF EARNINGSfor the

three months ended March 31, 2023 and 2022(US$ millions except per

share amounts)

| |

|

First quarter |

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

Restated(1) |

|

|

Insurance |

|

|

|

|

|

Insurance revenue |

|

6,279.9 |

|

|

5,638.2 |

|

|

Insurance service expenses |

|

(5,177.4 |

) |

|

(4,697.8 |

) |

|

Net insurance result |

|

1,102.5 |

|

|

940.4 |

|

|

Cost of reinsurance |

|

(1,120.0 |

) |

|

(963.8 |

) |

|

Recoveries of insurance service expenses |

|

1,004.3 |

|

|

691.1 |

|

|

Net reinsurance result |

|

(115.7 |

) |

|

(272.7 |

) |

|

Insurance service result |

|

986.8 |

|

|

667.7 |

|

|

Other insurance operating expenses |

|

(246.1 |

) |

|

(144.4 |

) |

|

Net finance income (expense) from insurance contracts |

|

(225.8 |

) |

|

513.6 |

|

|

Net finance income (expense) from reinsurance contract assets

held |

|

62.4 |

|

|

(94.6 |

) |

|

|

|

577.3 |

|

|

942.3 |

|

| Investment

income |

|

|

|

|

|

Interest and dividends |

|

382.3 |

|

|

168.9 |

|

|

Share of profit of associates |

|

333.8 |

|

|

180.6 |

|

|

Net gains (losses) on investments |

|

771.2 |

|

|

(195.2 |

) |

|

|

|

1,487.3 |

|

|

154.3 |

|

| Other revenue and

expenses |

|

|

|

|

|

Non-insurance revenue |

|

1,558.4 |

|

|

1,066.3 |

|

|

Non-insurance expenses |

|

(1,623.1 |

) |

|

(1,075.0 |

) |

|

Interest expense |

|

(124.3 |

) |

|

(103.9 |

) |

|

Corporate and other expenses |

|

(106.5 |

) |

|

(78.8 |

) |

| |

|

(295.5 |

) |

|

(191.4 |

) |

| Earnings before income

taxes |

|

1,769.1 |

|

|

905.2 |

|

| Provision for income

taxes |

|

(365.1 |

) |

|

(206.4 |

) |

| Net

earnings |

|

1,404.0 |

|

|

698.8 |

|

| |

|

|

|

|

| Attributable

to: |

|

|

|

|

|

Shareholders of Fairfax |

|

1,250.0 |

|

|

588.7 |

|

|

Non-controlling interests |

|

154.0 |

|

|

110.1 |

|

| |

|

1,404.0 |

|

|

698.8 |

|

| |

|

|

|

|

| Net earnings per

share |

|

53.17 |

|

|

24.23 |

|

| Net earnings per

diluted share |

|

49.38 |

|

|

22.67 |

|

| Cash dividends paid

per share |

|

10.00 |

|

|

10.00 |

|

| Shares outstanding

(000) (weighted average) |

|

23,282 |

|

|

23,838 |

|

| |

|

|

|

|

|

|

(1) Restated for the transition to IFRS 17.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

for the three months ended March 31, 2023 and 2022(US$

millions)

| |

|

First quarter |

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

Restated(1) |

|

| |

|

|

|

|

| Net

earnings |

|

1,404.0 |

|

|

698.8 |

|

| |

|

|

|

|

| Other comprehensive

income (loss), net of income taxes |

|

|

|

|

| |

|

|

|

|

|

Items that may be reclassified to net

earnings |

|

|

|

|

|

Net unrealized foreign currency translation gains (losses) on

foreign subsidiaries |

|

60.6 |

|

|

(18.1 |

) |

|

Losses on hedge of net investment in Canadian subsidiaries |

|

(2.4 |

) |

|

(24.9 |

) |

|

Gains (losses) on hedge of net investment in European

operations |

|

(14.3 |

) |

|

18.2 |

|

|

Share of other comprehensive income (loss) of associates, excluding

net gains (losses) on defined benefit plans |

|

2.2 |

|

|

(47.0 |

) |

|

Other |

|

(3.3 |

) |

|

— |

|

| |

|

42.8 |

|

|

(71.8 |

) |

|

Net unrealized foreign currency translation gains on associates

reclassified to net earnings |

|

(4.8 |

) |

|

— |

|

| |

|

38.0 |

|

|

(71.8 |

) |

|

Items that will not be reclassified to net

earnings |

|

|

|

|

|

Net gains (losses) on defined benefit plans |

|

(10.3 |

) |

|

50.1 |

|

|

Share of net gains on defined benefit plans of associates |

|

0.3 |

|

|

5.8 |

|

| |

|

(10.0 |

) |

|

55.9 |

|

| |

|

|

|

|

| Other comprehensive

income (loss), net of income taxes |

|

28.0 |

|

|

(15.9 |

) |

| Comprehensive

income |

|

1,432.0 |

|

|

682.9 |

|

| |

|

|

|

|

| Attributable

to: |

|

|

|

|

| Shareholders of Fairfax |

|

1,264.9 |

|

|

600.7 |

|

| Non-controlling interests |

|

167.1 |

|

|

82.2 |

|

| |

|

1,432.0 |

|

|

682.9 |

|

| |

|

|

|

|

|

|

(1) Restated for the transition to IFRS 17.

SEGMENTED INFORMATION (US$ millions)

Third party gross premiums written, net premiums

written and combined ratios, on an undiscounted basis, for the

property and casualty insurance and reinsurance operations

(excluding Life insurance and Run-off) in the first quarters ended

March 31, 2023 and 2022 were as follows:

Gross Premiums Written

| |

|

First quarter |

% changeyear-over-year |

| |

|

2023 |

|

|

2022 |

|

|

|

Northbridge |

|

506.3 |

|

|

474.7 |

|

|

6.7 |

% |

|

Crum & Forster |

|

1,155.6 |

|

|

1,036.6 |

|

|

11.5 |

% |

|

Zenith National |

|

257.3 |

|

|

259.0 |

|

|

(0.7 |

)% |

| North

American Insurers |

|

1,919.2 |

|

|

1,770.3 |

|

|

8.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Allied World |

|

1,883.6 |

|

|

1,751.8 |

|

|

7.5 |

% |

|

Odyssey Group |

|

1,508.8 |

|

|

1,417.1 |

|

|

6.5 |

% |

|

Brit(1) |

|

895.1 |

|

|

885.4 |

|

|

1.1 |

% |

| Global

Insurers and Reinsurers |

|

4,287.5 |

|

|

4,054.3 |

|

|

5.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

International Insurers and Reinsurers |

|

886.3 |

|

|

791.2 |

|

|

12.0 |

% |

| |

|

|

|

|

|

|

|

|

|

| Property

and casualty insurance and reinsurance |

|

7,093.0 |

|

|

6,615.8 |

|

|

7.2 |

% |

Net Premiums Written

| |

|

First quarter |

% changeyear-over-year |

| |

|

2023 |

|

|

2022 |

|

|

|

Northbridge |

|

443.1 |

|

|

431.1 |

|

|

2.8 |

% |

|

Crum & Forster |

|

855.3 |

|

|

833.3 |

|

|

2.6 |

% |

|

Zenith National |

|

259.8 |

|

|

257.5 |

|

|

0.9 |

% |

| North American

Insurers |

|

1,558.2 |

|

|

1,521.9 |

|

|

2.4 |

% |

| |

|

|

|

|

|

|

|

|

|

Allied World |

|

1,460.8 |

|

|

1,334.3 |

|

|

9.5 |

% |

|

Odyssey Group |

|

1,409.6 |

|

|

1,320.0 |

|

|

6.8 |

% |

|

Brit(1) |

|

644.0 |

|

|

630.2 |

|

|

2.2 |

% |

| Global Insurers and

Reinsurers |

|

3,514.4 |

|

|

3,284.5 |

|

|

7.0 |

% |

| |

|

|

|

|

|

|

|

|

| International Insurers

and Reinsurers |

|

546.8 |

|

|

490.9 |

|

|

11.4 |

% |

| |

|

|

|

|

|

|

|

|

| Property and casualty

insurance and reinsurance |

|

5,619.4 |

|

|

5,297.3 |

|

|

6.1 |

% |

Combined Ratios

| |

|

First quarter |

|

|

|

2023 |

|

|

2022 |

|

|

Northbridge |

|

91.1 |

% |

|

87.3 |

% |

|

Crum & Forster |

|

94.7 |

% |

|

94.8 |

% |

|

Zenith National |

|

99.3 |

% |

|

95.4 |

% |

| North American

Insurers |

|

94.1 |

% |

|

92.5 |

% |

| |

|

|

|

|

|

Allied World |

|

91.7 |

% |

|

92.1 |

% |

|

Odyssey Group |

|

96.4 |

% |

|

93.7 |

% |

|

Brit(1) |

|

90.8 |

% |

|

91.8 |

% |

| Global Insurers and

Reinsurers |

|

93.5 |

% |

|

92.8 |

% |

| |

|

|

|

|

| International Insurers

and Reinsurers |

|

96.4 |

% |

|

97.5 |

% |

| |

|

|

|

|

| Property and casualty

insurance and reinsurance |

|

94.0 |

% |

|

93.1 |

% |

| |

|

|

|

|

|

|

(1) Excluding Ki Insurance,

gross premiums written decreased by 4.8% and net premiums written

decreased by 2.2% in the first quarter of 2023. Excluding Ki

Insurance, the combined ratios were 90.5% and 92.2% in the first

quarter of 2023 and 2022.

Certain statements contained herein may

constitute forward-looking statements and are made pursuant to the

“safe harbour” provisions of the United States Private Securities

Litigation Reform Act of 1995 and any applicable Canadian

securities regulations. Such forward-looking statements are subject

to known and unknown risks, uncertainties and other factors which

may cause the actual results, performance or achievements of

Fairfax to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such factors include, but are not

limited to: a reduction in net earnings if our loss reserves are

insufficient; underwriting losses on the risks we insure that are

higher or lower than expected; the occurrence of catastrophic

events with a frequency or severity exceeding our estimates;

unfavourable changes in market variables, including interest rates,

foreign exchange rates, equity prices and credit spreads, which

could negatively affect our investment portfolio; the cycles of the

insurance market and general economic conditions, which can

substantially influence our and our competitors' premium rates and

capacity to write new business; insufficient reserves for asbestos,

environmental and other latent claims; exposure to credit risk in

the event our reinsurers fail to make payments to us under our

reinsurance arrangements; exposure to credit risk in the event our

insureds, insurance producers or reinsurance intermediaries fail to

remit premiums that are owed to us or failure by our insureds to

reimburse us for deductibles that are paid by us on their behalf;

our inability to maintain our long term debt ratings, the inability

of our subsidiaries to maintain financial or claims paying ability

ratings and the impact of a downgrade of such ratings on derivative

transactions that we or our subsidiaries have entered into; risks

associated with implementing our business strategies; the timing of

claims payments being sooner or the receipt of reinsurance

recoverables being later than anticipated by us; risks associated

with any use we may make of derivative instruments; the failure of

any hedging methods we may employ to achieve their desired risk

management objective; a decrease in the level of demand for

insurance or reinsurance products, or increased competition in the

insurance industry; the impact of emerging claim and coverage

issues or the failure of any of the loss limitation methods we

employ; our inability to access cash of our subsidiaries; our

inability to obtain required levels of capital on favourable terms,

if at all; the loss of key employees; our inability to obtain

reinsurance coverage in sufficient amounts, at reasonable prices or

on terms that adequately protect us; the passage of legislation

subjecting our businesses to additional adverse requirements,

supervision or regulation, including additional tax regulation, in

the United States, Canada or other jurisdictions in which we

operate; risks associated with government investigations of, and

litigation and negative publicity related to, insurance industry

practice or any other conduct; risks associated with political and

other developments in foreign jurisdictions in which we operate;

risks associated with legal or regulatory proceedings or

significant litigation; failures or security breaches of our

computer and data processing systems; the influence exercisable by

our significant shareholder; adverse fluctuations in foreign

currency exchange rates; our dependence on independent brokers over

whom we exercise little control; risks associated with IFRS 17;

impairment of the carrying value of our goodwill, indefinite-lived

intangible assets or investments in associates; our failure to

realize deferred income tax assets; technological or other change

which adversely impacts demand, or the premiums payable, for the

insurance coverages we offer; disruptions of our information

technology systems; assessments and shared market mechanisms which

may adversely affect our insurance subsidiaries; and risks

associated with the global pandemic caused by COVID-19 and the

conflict in Ukraine. Additional risks and uncertainties are

described in our most recently issued Annual Report which is

available at www.fairfax.ca and in our Base Shelf Prospectus (under

“Risk Factors”) filed with the securities regulatory authorities in

Canada, which is available on SEDAR at www.sedar.com. Fairfax

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

securities law.

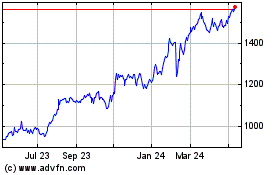

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

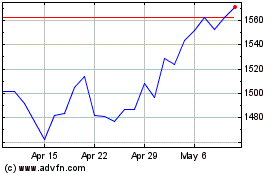

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Apr 2023 to Apr 2024