FIRST MAJESTIC SILVER CORP. (AG: NYSE; FR: TSX)

(the "Company" or “First Majestic”) is pleased to announce the

consolidated financial results for the Company’s fourth quarter and

year ended December 31, 2020. The full version of the financial

statements and the management discussion and analysis can be viewed

on the Company's website at www.firstmajestic.com, on SEDAR at

www.sedar.com and EDGAR at www.sec.gov. All amounts are in U.S.

dollars unless stated otherwise.

2020 HIGHLIGHTS

- Generated robust revenues of $363.9

million primarily due to strong silver production and higher metal

prices in the second half of 2020 which helped to offset reduced

revenues in Q2 2020 due to Mexico’s national COVID-19

shutdown.

- Mine operating earnings of $105.1

million primarily due to higher silver and gold prices, as well as

shifting a greater portion of production to its larger and lower

cost operations.

- Operating cash flows before working

capital and taxes of $107.3 million or $0.50 per share.

- Net earnings of $23.1 million, or

basic earnings per share (“EPS”) of $0.11, representing a 157%

increase compared to 2019.

- Adjusted net earnings of $37.4

million, or $0.18 per share, after excluding non-cash or unusual

items.

- Cash costs of $5.09 per payable

silver ounce representing a 1% decrease compared to 2019 and

slightly above the revised guidance range of $3.95 to $4.59 per

ounce primarily due to lower than expected gold by-product credits

at Santa Elena and San Dimas in the second half of 2020.

- All-in sustaining costs (“AISC”) of

$13.92 per payable silver ounce representing a 10% increase

compared to 2019 and slightly above the revised guidance range of

$12.29 to $13.45 per ounce.

- Realized an average silver price of

$21.15 per payable silver ounce, representing a 29% increase

compared to 2019.

- Ended 2020 with record cash and

cash equivalents of $238.6 million, up from $169.0 million at the

end of 2019.

Q4 2020 HIGHLIGHTS

- Revenues totaled $117.1 million,

representing a 21% increase compared to Q4 2019.

- Mine operating earnings of $43.7

million, representing an 82% increase compared to $23.9 million in

Q4 2019.

- Operating cash flows before working

capital and taxes of $48.2 million, or $0.22 per share

(non-GAAP).

- Net earnings of $34.5 million, or

EPS of $0.16.

- Adjusted net earnings $24.2

million, or $0.11 per share, after excluding non-cash or unusual

items.

- Cash costs of $6.53 per payable

silver ounce, representing a 75% increase compared to Q4 2019.

- AISC of $15.92 per payable silver

ounce, representing a 30% increase compared to Q4 2019.

- Realized an average silver price of

$24.88 per payable silver ounce, representing a 43% increase

compared to Q4 2019.

CEO COMMENTS

“First Majestic finished 2020 with strong silver

production and solid financial results despite the early challenges

related to the COVID-19 global pandemic,” stated Keith Neumeyer,

President and CEO of First Majestic. “We generated 87% of our

$105.1 million in operating earnings in the second half of 2020

primarily due to higher silver production and an improved metal

price environment. This significant increase in profitability

helped to lift our cash balance to a record $238.6 million at the

end of the year. We also announced our inaugural dividend policy at

the end of 2020 which was a major milestone and something I am

particularly proud of as this has been a long-term objective of the

Company. Looking ahead, we continue to expect higher prices as

silver supplies tighten due to increases in investor demand and the

longer-term global transition to greener energy and electric

vehicle solutions.”

2020 ANNUAL AND FOURTH QUARTER

HIGHLIGHTS

|

|

|

|

Change |

|

|

|

Change |

|

Key Performance Metrics |

2020-Q4 |

2019-Q4 |

Q4 vs Q4 |

|

|

2020 |

|

2019 |

|

'20 vs '19 |

|

Operational |

|

|

|

|

|

|

|

|

|

|

Ore Processed / Tonnes Milled |

|

625,332 |

|

626,482 |

|

0% |

|

|

|

2,213,954 |

|

2,831,999 |

|

(22%) |

|

|

Silver Ounces Produced |

|

3,452,959 |

|

3,348,424 |

|

3% |

|

|

|

11,598,380 |

|

13,241,118 |

|

(12%) |

|

|

Silver Equivalent Ounces Produced |

|

5,477,492 |

|

6,233,412 |

|

(12%) |

|

|

|

20,379,010 |

|

25,554,288 |

|

(20%) |

|

|

Cash Costs per Ounce (1) |

$6.53 |

$3.73 |

|

75% |

|

|

$5.09 |

$5.16 |

|

(1%) |

|

|

All-in Sustaining Cost per Ounce (1) |

$15.92 |

$12.25 |

|

30% |

|

|

$13.92 |

$12.64 |

|

10% |

|

|

Total Production Cost per Tonne (1) |

$85.68 |

$78.62 |

|

9% |

|

|

$79.59 |

$75.05 |

|

6% |

|

|

Average Realized Silver Price per Ounce (1) |

$24.88 |

$17.46 |

|

43% |

|

|

$21.15 |

$16.40 |

|

29% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial (in $millions) |

|

|

|

|

|

|

|

|

|

|

Revenues |

$117.1 |

$96.5 |

|

21% |

|

|

$363.9 |

$363.9 |

|

0% |

|

|

Mine Operating Earnings (Loss) |

$43.7 |

$23.9 |

|

82% |

|

|

$105.1 |

$66.2 |

|

59% |

|

|

Net Earnings (Loss) |

$34.5 |

($39.9 |

) |

NM |

|

|

$23.1 |

($40.5 |

) |

157% |

|

|

Operating Cash Flows before Movements in Working Capital and

Taxes |

$48.2 |

$32.9 |

|

47% |

|

|

$107.3 |

$108.9 |

|

(1%) |

|

|

Cash and Cash Equivalents |

$238.6 |

$169.0 |

|

41% |

|

|

$238.6 |

$169.0 |

|

41% |

|

|

Working Capital (1) |

$254.4 |

$171.1 |

|

49% |

|

|

$254.4 |

$171.1 |

|

49% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders |

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) per Share ("EPS") - Basic |

$0.16 |

($0.19 |

) |

NM |

|

|

$0.11 |

($0.20 |

) |

154% |

|

|

Adjusted EPS (1) |

$0.11 |

$0.00 |

|

NM |

|

|

$0.18 |

$0.04 |

|

NM |

|

|

Cash Flow per Share (1) |

$0.22 |

$0.16 |

|

36% |

|

|

$0.50 |

$0.54 |

|

(7%) |

|

|

"NM" - Not meaningful |

|

|

|

|

|

|

|

|

|

(1) The Company reports non-GAAP measures

which include cash costs per ounce produced, all-in sustaining cost

per ounce, total production cost per tonne, average realized silver

price per ounce sold, working capital, adjusted EPS and cash flow

per share. These measures are widely used in the mining industry as

a benchmark for performance, but do not have a standardized meaning

and may differ from methods used by other companies with similar

descriptions.

2020 FINANCIAL RESULTS

Full year revenues totaled $363.9 million as

higher silver and gold prices were offset by reduced production

rates due to Mexico’s national COVID-19 suspensions and reduced

worker availability. The average realized silver price increased

29% to $21.15 per ounce during the year compared to $16.40 in 2019.

However, strong silver production from La Encantada and San Dimas

in the second half of 2020 helped to also offset some of the

production losses resulting from the COVID-19 shutdowns in the

second quarter of 2020. At the end of 2020, approximately 9% of the

Company's workforce at its three operating mines remained

vulnerable under Mexico’s national decree, an improvement from 18%

at the end of the second quarter.

Annual mine operating earnings totaled $105.1

million compared to $66.2 million in 2019. The increase in

mine operating earnings was primarily driven by higher silver and

gold prices, as well as shifting a greater proportion of the

Company's production to its larger and lower cost operations.

Cash flows before movements in working capital

and taxes during the year was $107.3 million ($0.50 per share)

compared to $108.9 million ($0.54 per share) in 2019.

Adjusted EPS (non-GAAP), normalized for non-cash

or unusual items such as impairment of non-current assets,

share-based payments and deferred income taxes for the year ended

December 31, 2020 was $0.18 compared to $0.04 in 2019.

The Company ended 2020 with $238.6 million in

cash and cash equivalents compared to $169.0 million at the end of

2019. In addition, the Company ended the year with

working capital of $254.4 million compared to $171.1 million at the

end of 2019. The increase in cash and cash equivalents was

primarily attributed to $79.7 million generated from its operating

activities, $126.1 million raised through prospectus offerings and

its “at-the-market distributions” equity financing program,

proceeds of $14.0 million from exercise of stock options, net of

$127.1 million spent on investing activities primarily

relating to mining interests and property, plant, and

equipment.

FULL YEAR 2020 OPERATIONAL

RESULTS

|

Annual Production Summary |

San Dimas |

Santa Elena |

La Encantada |

Consolidated |

|

Ore Processed / Tonnes Milled |

|

713,064 |

|

|

640,276 |

|

|

860,613 |

|

|

2,213,954 |

|

|

Silver Ounces Produced |

|

6,399,667 |

|

|

1,692,761 |

|

|

3,505,953 |

|

|

11,598,380 |

|

|

Gold Ounces Produced |

|

71,598 |

|

|

28,242 |

|

|

241 |

|

|

100,081 |

|

|

Silver Equivalent Ounces Produced |

|

12,670,526 |

|

|

4,181,708 |

|

|

3,526,776 |

|

|

20,379,010 |

|

|

Cash Costs per Ounce* |

$2.04 |

|

$5.81 |

|

$10.27 |

|

$5.09 |

|

|

All-in Sustaining Cost per Ounce* |

$8.75 |

|

$12.78 |

|

$12.43 |

|

$13.92 |

|

|

Total Production Cost per Tonne |

$127.91 |

|

$78.44 |

|

$40.37 |

|

$79.59 |

|

*Cash Cost per Ounce and All-in Sustaining Cost

per Ounce are calculated on a per payable silver ounce basis.

Total silver production reached 11.6 million

ounces achieving the top-end of the Company’s guidance of 11.0 to

11.7 million silver. Strong silver production from La

Encantada and San Dimas in the second half of 2020 helped to offset

some of the production losses during the Mexican national COVID-19

shutdowns in the second quarter of 2020. Total gold production

reached 100,081 ounces slightly below the Company’s guidance range

of producing between 106,000 to 112,000 ounces. The slight miss was

primarily due to lower production rates at Santa Elena and lower

gold grades at San Dimas in the second half of 2020. The La

Encantada mine achieved its highest annual silver production since

2014 with 3.5 million ounces of silver produced during the year,

representing a 14% increase from the prior year, and beating the

Company’s revised production guidance of 3.1 to 3.3 million silver

ounces.

Cash cost per ounce in the year was $5.09, a

slight decrease compared to the previous year. The decrease in cash

cost was primarily due to cost savings from the suspension of

higher cost mines in 2019 and a 12% weaker Mexican Peso, partially

offset by lower by-product credits and decrease in production

attributed to the COVID-19 suspensions, as well as higher mining

contractor costs and COVID-19 related costs.

AISC per ounce in 2020 was $13.92, compared to

$12.64 in the previous year. The increase in AISC per ounce was

primarily attributed to an increase in fixed overhead costs, such

as general and administration expenses and annual workers

participation benefits, being divided by 12% less silver ounces

produced due to the required COVID-19 suspensions.

The Company’s total capital expenditures in 2020

was $125.0 million consisting of $31.7 million for underground

development, $43.6 million in exploration and $28.5 million in

property, plant and equipment, and $21.2 million in innovation

projects. Total investments in 2020, on a mine-by-mine basis,

primarily consisted of $43.8 million at San Dimas, $33.7 million at

Santa Elena (including $14.6 million for the Ermitaño project),

$10.7 million at La Encantada, $2.8 million at La Parrilla,

$1.2 million at Del Toro and $0.3 million at San Martin.

Q4 2020 FINANCIAL RESULTS

Revenues generated in the fourth quarter of 2020

totaled $117.1 million, representing a 21% increase compared to the

fourth quarter of 2019, primarily due to a 43% increase in average

realized silver price compared to the same quarter of the prior

year, plus a 13% decrease in silver equivalent ounces sold compared

to the same quarter of 2019.

Mine operating earnings were $43.7 million,

representing an 82% increase compared the fourth quarter of 2019.

The increase in mine operating earnings in the quarter was

primarily attributed to higher metals prices.

The Company recorded net earnings of $34.5

million (EPS of $0.16) compared to net loss of $39.9 million (EPS

of ($0.19)) in the fourth quarter of 2019. The increase in net

earnings was primarily attributed to a $52.4 million after-tax

impairment loss taken in the fourth quarter of the prior year.

Cash flows before movements in working capital

and income taxes were $48.2 million ($0.22 per share), compared to

$32.9 million ($0.16 per share) in the fourth quarter of 2019.

Adjusted net earnings for the fourth quarter was

$24.2 million (Adjusted EPS of $0.11) compared to

adjusted net earnings of $0.3 million (Adjusted EPS of $0.00) in

the fourth quarter of 2019, after excluding non-cash or

non-recurring items.

Q4 2020 OPERATIONAL RESULTS

|

Fourth Quarter Production Summary |

San Dimas |

Santa Elena |

La Encantada |

Consolidated |

|

Ore Processed / Tonnes Milled |

|

208,648 |

|

|

168,276 |

|

|

248,408 |

|

|

625,332 |

|

|

Silver Ounces Produced |

|

1,941,286 |

|

|

418,153 |

|

|

1,093,521 |

|

|

3,452,959 |

|

|

Gold Ounces Produced |

|

19,980 |

|

|

6,294 |

|

|

69 |

|

|

26,343 |

|

|

Silver Equivalent Ounces Produced |

|

3,477,061 |

|

|

901,630 |

|

|

1,098,800 |

|

|

5,477,492 |

|

|

Cash Costs per Ounce* |

$3.23 |

|

$11.69 |

|

$10.39 |

|

$6.53 |

|

|

All-in Sustaining Cost per Ounce* |

$10.09 |

|

$23.02 |

|

$12.37 |

|

$15.92 |

|

|

Total Production Cost per Tonne |

$135.13 |

|

$86.32 |

|

$43.72 |

|

$85.68 |

|

*Cash Cost per Ounce and All-in Sustaining Cost

per Ounce are calculated on a per payable silver ounce basis.

Total production in the fourth quarter of 2020

reached 5.5 million silver equivalent ounces, consisting of 3.5

million ounces of silver and 26,343 ounces of gold. Quarterly

silver and gold production increased 9% and 2%, respectively,

compared to the prior quarter.

Cash cost per ounce for the quarter was $6.53

per payable silver ounce, compared to $2.49 per ounce in the

previous quarter. The increase in cash cost was primarily due to

higher gold by-product credits realized in the third quarter

attributed to inventory that rolled over from the second quarter,

which contributed an additional $7.4 million or $2.34 per ounce in

by-product credits in the previous quarter, a 6% stronger Mexican

Peso against the U.S. Dollar compared to the previous quarter, as

well as higher COVID-19 related expenses.

AISC per ounce in the fourth quarter was $15.92

per ounce compared to $9.94 per ounce in the previous quarter. The

increase in AISC per ounce was primarily attributed to increase in

cash cost per ounce, higher sustaining development and capital

expenditure activities as the mines ramp up operations after the

COVID-19 suspensions.

Capital expenditures in the fourth quarter were

$43.7 million, an increase of 24% compared to the prior quarter,

primarily consisting of $14.1 million at San Dimas, $13.8 million

at Santa Elena (including $6.6 million for the Ermitaño project),

$3.6 million at La Encantada, $0.9 million at La Parrilla, $0.4

million at Del Toro and $11.0 million for innovation projects.

ELECTION OF DIRECTOR

The Board of Directors have appointed Mr. Thomas

Fudge as a Director of the Company effective February 17, 2021.

Mr. Fudge brings over 42 years of professional

mining experience having previously worked with companies including

Tahoe Resources, Alexco Resources, Hecla Mining, and Sunshine

Precious Metals. Mr. Fudge holds a Bachelor of Science degree in

Mining Engineering from Michigan Technological University and has

overseen numerous major mining construction projects in the United

States, Mexico, Venezuela, Yukon Territory, Guatemala, and

Peru.

“On behalf of the Board of Directors, I am

pleased to welcome Thomas to the First Majestic team,” said Keith

Neumeyer, President & CEO. “Thomas’s wealth of mining and

construction experience will make him a valuable contributor to the

Board as we work towards our goal of becoming a 30 million ounce

producer.”

INAUGURAL DIVIDEND POLICY

As previously announced on December 7, 2020, the

Board of Directors had adopted a dividend policy under which the

Company intends to pay quarterly dividends of 1% of net revenues

commencing after the completion of the first quarter of 2021. The

initial quarterly payment for the first quarter of 2021 is expected

to be paid in May. In accordance with the rules of the Toronto

Stock Exchange the Company will issue a press release at the time

each quarterly dividend is declared. This dividend is an eligible

dividend for the purposes of the Income Tax Act

(Canada).

ABOUT THE COMPANY

First Majestic is a publicly traded mining

company focused on silver production in Mexico and is aggressively

pursuing the development of its existing mineral property assets.

The Company presently owns and operates the San Dimas Silver/Gold

Mine, the Santa Elena Silver/Gold Mine and the La Encantada Silver

Mine. Production from these mines are projected to be between 12.5

to 13.9 million silver ounces or 20.6 to 22.9 million silver

equivalent ounces in 2021.

FOR FURTHER INFORMATION contact

info@firstmajestic.com, visit our website at www.firstmajestic.com

or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking

Statements

This press release contains “forward‐looking

information” and "forward-looking statements” under applicable

Canadian and U.S. securities laws (collectively, “forward‐looking

statements”). These statements relate to future events or the

Company's future performance, business prospects or opportunities

that are based on forecasts of future results, estimates of amounts

not yet determinable and assumptions of management made in light of

management's experience and perception of historical trends,

current conditions and expected future developments.

Forward-looking statements include, but are not limited to,

statements with respect to: the Company’s business strategy; future

planning processes; commercial mining operations; cash flow;

budgets; capital expenditures; the timing and amount of estimated

future production; recovery rates; mine plans and mine life; the

future price of silver and other metals; costs; costs and timing of

the development of new deposits; capital projects and exploration

activities and the possible results thereof; completion of

technical reports and the timing of release. Assumptions may

prove to be incorrect and actual results may differ materially from

those anticipated. Consequently, guidance cannot be guaranteed. As

such, investors are cautioned not to place undue reliance upon

guidance and forward-looking statements as there can be no

assurance that the plans, assumptions or expectations upon which

they are placed will occur. All statements other than statements of

historical fact may be forward‐looking statements. Statements

concerning proven and probable mineral reserves and mineral

resource estimates may also be deemed to constitute forward‐looking

statements to the extent that they involve estimates of the

mineralization that will be encountered as and if the property is

developed, and in the case of measured and indicated mineral

resources or proven and probable mineral reserves, such statements

reflect the conclusion based on certain assumptions that the

mineral deposit can be economically exploited. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives or future

events or performance (often, but not always, using words or

phrases such as “seek”, “anticipate”, “plan”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “predict”,

“forecast”, “potential”, “target”, “intend”, “could”, “might”,

“should”, “believe” and similar expressions) are not statements of

historical fact and may be “forward‐looking statements”.

Actual results may vary from forward-looking

statements. Forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that may cause

actual results to materially differ from those expressed or implied

by such forward-looking statements, including but not limited to:

the duration and effects of the coronavirus and COVID-19, and any

other pandemics or public health crises on our operations and

workforce, and the effects on global economies and society, actual

results of exploration activities; conclusions of economic

evaluations; changes in project parameters as plans continue to be

refined; commodity prices; variations in ore reserves, grade or

recovery rates; actual performance of plant, equipment or processes

relative to specifications and expectations; accidents;

fluctuations in costs; labour relations; availability and

performance of contractors; relations with local communities;

changes in national or local governments; changes in applicable

legislation or application thereof; delays in obtaining approvals

or financing or in the completion of development or construction

activities; exchange rate fluctuations; requirements for additional

capital; government regulation; environmental risks; reclamation

expenses; outcomes of pending litigation including appeals of

judgments; resolutions of claims and arbitration proceedings;

negotiations and regulatory proceedings; limitations on insurance

coverage as well as those factors discussed in the section entitled

"Description of the Business - Risk Factors" in the Company's most

recent Annual Information Form, available on www.sedar.com, and

Form 40-F on file with the United States Securities and Exchange

Commission in Washington, D.C. Although First Majestic

has attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended.

The Company believes that the expectations

reflected in these forward‐looking statements are reasonable, but

no assurance can be given that these expectations will prove to be

correct and such forward‐looking statements included herein should

not be unduly relied upon. These statements speak only as of the

date hereof. The Company does not intend, and does not assume any

obligation, to update these forward-looking statements, except as

required by applicable laws.

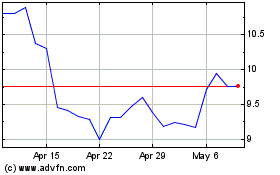

First Majestic Silver (TSX:FR)

Historical Stock Chart

From Oct 2024 to Nov 2024

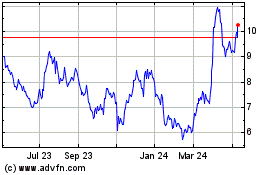

First Majestic Silver (TSX:FR)

Historical Stock Chart

From Nov 2023 to Nov 2024