Guardian Capital Announces November 2021 Distributions for Guardian Capital ETFs

November 17 2021 - 6:00AM

Guardian Capital LP announces the following regular cash

distributions for the period ending November 30, 2021, in respect

of the Guardian Capital ETFs listed below. In each case, the

distribution will be paid on November 30, 2021 to unitholders of

record on November 24, 2021. The ex-dividend date in each case is

November 23, 2021.

|

Exchange Traded Fund |

Series of ETF Units |

DistributionFrequency |

TradingSymbol |

Distribution Amount(per ETF

Unit) |

|

Guardian Directed Equity Path ETF |

Hedged |

Monthly |

GDEP |

$0.0685 |

|

Guardian Directed Equity Path ETF |

Unhedged |

Monthly |

GDEP.B |

$0.0652 |

|

Guardian Directed Premium Yield ETF |

Hedged |

Monthly |

GDPY |

$0.1076 |

|

Guardian Directed Premium Yield ETF |

Unhedged |

Monthly |

GDPY.B |

$0.1024 |

About Guardian Capital

LPGuardian Capital LP is the manager and portfolio manager

of the Guardian Capital Funds and Guardian Capital ETFs, with

capabilities that span a range of asset classes, geographic regions

and specialty mandates. Additionally, Guardian Capital LP manages

portfolios for institutional clients such as defined benefit and

defined contribution pension plans, insurance companies,

foundations, endowments and investment funds. Guardian Capital LP

is a wholly owned subsidiary of Guardian Capital Group Limited and

the successor to its original investment management business, which

was founded in 1962. For further information on Guardian Capital

LP, please call 416-350-8899 or visit www.guardiancapital.com.

About Guardian Capital Group

LimitedGuardian Capital Group Limited (Guardian) is a

diversified, global financial services company operating in two

main business segments: Asset Management and Wealth Management. As

at September 30, 2021, Guardian had C$53 billion of assets under

management and C$30 billion of assets under administration.

Guardian provides extensive institutional and private wealth

financial solutions to clients through its subsidiaries, while

offering comprehensive wealth management services to financial

advisors in its national mutual fund dealer, securities dealer and

insurance distribution network. It also maintains and manages a

proprietary investment portfolio with a fair market value of C$689

million as at September 30, 2021. Founded in 1962, Guardian’s

reputation for steady growth, long-term relationships and its core

values of trustworthiness, integrity and stability have been key to

its success over six decades. Its Common and Class A shares are

listed on the Toronto Stock Exchange as GCG and GCG.A,

respectively. To learn more about Guardian, visit

www.guardiancapital.com.

This communication is intended for informational

purposes only and does not constitute an offer to sell or the

solicitation of an offer to purchase Guardian Capital ETFs and is

not, and should not be construed as, investment, tax, legal or

accounting advice, and should not be relied upon in that regard.

Commissions, management fees and expenses all may be associated

with investments in exchange-traded funds (ETFs). Please read the

prospectus before investing. ETFs are not guaranteed, their values

change frequently and past performance may not be repeated. You

will usually pay brokerage fees to your dealer if you purchase or

sell units of an ETF on the TSX. If the units are purchased or sold

on the TSX, investors may pay more than the current net asset value

when buying units of the ETF and may receive less than the current

net asset value when selling them.

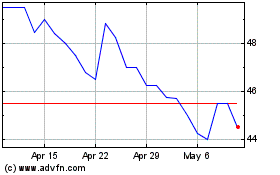

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Apr 2023 to Apr 2024