Guardian Capital Launches Guardian Smart Infrastructure Management, a Direct Infrastructure Investment Business Focused on the Future

March 10 2022 - 3:00PM

Guardian Capital Group Limited (Guardian) (TSX:GCG) (TSX:GCG.A)

announced today that it has created and launched Guardian Smart

Infrastructure Management (GSIM), a Direct Private Infrastructure

Investment Business. GSIM will focus on investing in the growing

number of opportunities and projects to enhance the productivity of

new and existing global infrastructure assets by integrating

technological innovations.

Guardian is pleased to announce that experienced

infrastructure investors Robert Mah and Christopher Lee will lead

GSIM’s investment team. Both Mr. Mah and Mr. Lee bring decades-long

experience of the investment industry and, specifically, of the

infrastructure space. Their combined experience includes serving in

senior roles at a number of global investment banks, a large public

investment fund, General Partners of core infrastructure funds and,

most recently, as Partners of Smart Infrastructure

Managers. Mr. Mah and Mr. Lee have collectively managed

over US$ 15B of direct infrastructure investments globally, and

worked together for the last few years on developing the strategy

of Smart Infrastructure Managers.

“The launch of Guardian Smart Infrastructure

Management is an exciting development for Guardian as we bring on

board a very talented team whose leaders are steeped in the

knowledge and experience of investing in private infrastructure

assets,” said George Mavroudis, President and Chief Executive

Officer, Guardian. “We at Guardian have developed a reputation over

60 years for patient, long-term investing founded on deep-rooted

relationships. We plan to leverage this significant experience to

build the next frontier of infrastructure investing with our

partners.”

“Direct infrastructure investment has proven to

be an extremely popular asset class among large institutional

investors around the globe,” said Mr. Mah. “Our focus will be to

apply proven, value-enhancing technologies to existing

infrastructure and greenfield assets, thereby increasing

efficiencies and revenues. The demand for this type of

infrastructure investing is accelerating and we believe our focus

will garner the interest of both existing and prospective

investors. Guardian’s resources and relationships will enable us to

accelerate our Smart Infrastructure strategy alongside our

strategic partners, and allow us to pursue direct opportunities

globally in digital infrastructure assets and companies. The demand

for this type of infrastructure investing is becoming more relevant

for investors as the broader asset class matures.”

For further information, please contact:

Angela Shim(416) 947-8009

About Guardian Capital Group

Limited Guardian Capital Group Limited (Guardian) is a

diversified, global financial services company operating in two

main business segments: Asset Management and Wealth Management. As

at December 31, 2021, Guardian had C$56.3 billion of assets under

management and C$31.5 billion of assets under administration.

Guardian provides extensive institutional and private wealth

financial solutions to clients through its subsidiaries, while

offering comprehensive wealth management services to financial

advisors in its national mutual fund dealer, securities dealer and

insurance distribution network. It also maintains and manages a

proprietary investment portfolio with a fair market value of C$752

million as at December 31, 2021. Founded in 1962, Guardian’s

reputation for steady growth, long-term relationships and its core

values of trustworthiness, integrity and stability have been key to

its success over six decades. Its Common and Class A shares are

listed on the Toronto Stock Exchange as GCG and GCG.A,

respectively. To learn more about Guardian, visit

www.guardiancapital.com.

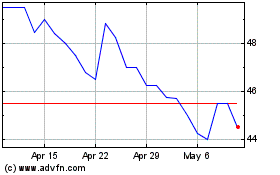

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardian Capital (TSX:GCG)

Historical Stock Chart

From Apr 2023 to Apr 2024