Colabor Group Inc. (TSX: GCL) (“Colabor” or the “Corporation”)

today reported its results for the third quarter ended

September 8, 2018.

Third Quarter 2018 Highlights:

- Sales were $291.0 million compared with $319.3 million during

the equivalent period of 2017

- Sales growth of Broadline Distribution activities in Quebec,

from the hotel, restaurant and institutional market

- Improving gross margins as a percentage of sales

- Adjusted EBITDA of $7.6 million compared with $7.7 million

during the equivalent period of 2017

- Cash flow from operating activities growing to $12.0 million up

from $8.9 million in the equivalent period of 2017

- Total debt reduced to $115.4 million, from $122.4 million in

the second quarter of 2018, and from $118.9 million during the

equivalent period of 2017

- Extension of the terms of the credit facility and subordinated

debt for an additional period of one year and six-months

respectively

| Financial highlights |

Quarters

ended |

Nine-month periods

ended |

|

(thousands of dollars except per-share data) |

September 8,

2018 |

September 9,

2017 |

September 8, 2018 |

September 9,

2017 |

| |

84 days |

84 days |

252 days |

252 days |

|

Sales |

291,006 |

|

319,334 |

|

836,794 |

|

917,893 |

|

|

Adjusted EBITDA1 |

7,628 |

|

7,682 |

|

12,488 |

|

17,600 |

|

|

Charges not related to current operations2 |

(1,194 |

) |

6,961 |

|

(1,194 |

) |

8,297 |

|

|

Net earnings (loss) |

1,180 |

|

(18,753 |

) |

(2,483 |

) |

(19,101 |

) |

| Per share - basic and diluted ($) |

0.01 |

|

(0.18 |

) |

(0.02 |

) |

(0.19 |

) |

|

Cash flow from operating activities3 |

11,964 |

|

8,924 |

|

7,198 |

|

6,630 |

|

| Total debt |

115,396 |

|

118,887 |

|

115,396 |

|

118,887 |

|

| Weighted average number of shares

outstanding(basic, in thousands)4 |

101,139 |

|

102,074 |

|

101,195 |

|

102,074 |

|

1 Non-IFRS measure. Refer to the table of

reconciliation of Net Earnings to Adjusted EBITDA.2 The variation

in costs not related to current operations results from fees

related to the tobacco notice of $6.5 M in the third quarter of

2017 and from the reversal of provisions following the termination

of onerous contracts amounting to $1.2 M in the third quarter of

2018. Refer the MD&A for the third quarter of 2018, in section

5.1, in costs not related to current operations.3 After the net

change in working capital.4 The Company announced, on January 15,

2018, that it had reduced by less than 1% the number of shares

issued and outstanding following the ongoing liquidation and

dissolution of Colabor Investments Inc.

Structuring Changes to the Management Team:

- Mario Brin as Interim Senior Vice President and Chief Financial

Officer

- John Hemeon as Senior Vice President and General Manager of the

Summit Foods Division in Ontario

- Élisabeth Tremblay as Vice President, Human Resources and

Communications

- Daniel Valiquette as Vice President, Central Procurement and

Private Label

- Mathieu Dumulong as Vice President, Sales for Colabor

For additional information regarding these changes, please refer

to section 2.2 of the 2018 Third Quarter Management Discussion and

Analysis.

Lionel Ettedgui, President and Chief Executive

Officer of Colabor, said: “Measures implemented over the last few

quarters have allowed us to further improve our gross margins as a

percentage of sales, improve cash flow from operations and reduce

the level of debt. By improving how we manage our resources and

focusing on our most promising markets, we continue to deploy all

our efforts to further strengthen our competitiveness, create value

and reduce our level of debt.”

Third Quarter Results

Consolidated sales for the 84-day period ended

September 8, 2018 stood at $291.0 million, down from

$319.3 million for the 84-day period ended September 9, 2017,

representing a decrease of 8.9%.

The 9.2% decrease in sales in the Distribution

Segment came primarily from the loss of supply agreements for

Popeye's Louisiana Kitchen and Montana's BBQ & Bar restaurant

chains in Ontario (these contract were terminated effective

November 13, 2017 and April 1, 2018 respectively), a situation that

was mitigated by an improvement of sales from Broadline

Distribution activities in Quebec.

The 7.6% decrease in sales in the Wholesale

Segment is explained by the non-renewal of non-profitable

contracts.

Adjusted EBITDA was $7.6 million or 2.6% of

sales, compared to $7.7 million or 2.4% of sales in the third

quarter of 2017, resulting primarily from the reduction in the

volume of sales from the Distribution Segment in Ontario. This was

mitigated by gross margin improvements as a percentage of sales and

by the reduction of operating expenses, a portion of which comes

from the effect of the reversal of provisions mainly related to

favorable settlements, amounting to $0.7 M in the quarter.

Colabor concluded the third quarter of 2018 with

net earnings of $1.2 million, or $0.01 per share, compared to net

earnings of ($18.8) million, or ($0.18) per share in the equivalent

quarter of 2017. The loss in the volume of sales was mitigated by

gross margin improvements as a percentage of sales and by a

reduction of operating expenses. In addition, the reduction

of $14.1 M (or $12.6 M after income taxes) in asset impairment

losses, and of $8.2 M (or $7.7 M after income taxes) in costs not

related to current operation, also contributed to this

improvement.

Nine-Month Results

Consolidated sales were $836.8 million for the

252-day period ended September 8, 2018, down from $917.9

million for the nine-month period ended September 9, 2017.

Adjusted EBITDA was $12.5 million compared with $17.6 million last

year. Finally, the net loss for the cumulative period ended

September 8, 2018, was $2.5 million, compared to a net

loss of $19.1 million for the cumulative period ended

September 9, 2017, primarily resulting from a reduction of

$13.7 M (or $12.3 M after income taxes) in asset impairment losses,

and of $9.5 M (or $9.0 M after income taxes) in costs not

related to current operations.

Cash Flow and Financial

Position

Cash flow from operating activities stood at

$12.0 million in the third quarter of 2018, compared to $8.9

million for the equivalent quarter of 2017. This is explained by an

improving working capital situation resulting from better

management of accounts receivable and inventories to reflect the

level of sales.

As at September 8, 2018, the Company’s

total debt including the convertible debentures and bank overdraft

amounted to $115.4 million, down from $122.4 M in the second

quarter of 2018, and $118.9 million during the equivalent period of

2017.

Outlook

“We are redoubling our efforts in order to

change the trend of recent years and are now seeing some positive

effects. As announced in the second quarter of 2018, we are

pursuing our reflection and are actively working to identify

strategic alternatives.” added Mr. Ettedgui.

Conference Call and Annual Meeting of

Shareholders

Colabor will hold a conference call to discuss

these results, today Thursday October 18, 2018, beginning at 10:30

a.m. Eastern time. Interested parties can join the call by dialing

647-788-4922 (from the Toronto area) or 1-877-223-4471 (from

elsewhere in North America). If you are unable to participate, you

can listen to a recording by dialing 1-800-585-8367 and entering

the code 1097427 on your telephone keypad. The recording will be

available from 13:30 p.m. on Thursday, October 18, 2018, to 11:59

p.m. on Thursday, November 1, 2018.

Those wishing to join the webcast and presentation can do so by

clicking on the following

link:http://www.colabor.com/en/investisseurs/evenements-et-presentations/

Non-IFRS Measures

The information provided in this release

includes non-IFRS performance measures, notably adjusted earnings

before financial expenses, income taxes, depreciation and

amortization (“EBITDA”) and cash flow. As these concepts are not

defined by IFRS, they may not be comparable to those of other

companies.

Table of reconciliation of Net Earnings (Loss)

to Adjusted EBITDA

| Reconciliation of Net Earnings (Loss)

to Adjusted EBITDA |

Quarters

ended |

Nine-month periods

ended |

|

(thousands of dollars except per-share data) |

September 8,

2018 |

September 9,

2017 |

September 8, 2018 |

September 9,

2017 |

| |

84 days |

84 days |

252 days |

252 days |

|

Net earnings (loss) |

1,180 |

|

(18,753 |

) |

(2,483 |

) |

(19,101 |

) |

| Income taxes expense (recovery) |

496 |

|

(1,271 |

) |

(702 |

) |

(992 |

) |

| Financial expenses |

1,769 |

|

1,751 |

|

5,466 |

|

5,322 |

|

| Impairment loss on the available-for-sale asset |

— |

|

— |

|

118 |

|

— |

|

| Depreciation and amortization |

3,008 |

|

2,554 |

|

8,499 |

|

7,634 |

|

| Impairment loss on goodwill, intangible assets and

property, plant and equipment |

2,369 |

|

16,440 |

|

2,784 |

|

16,440 |

|

|

EBITDA |

8,822 |

|

721 |

|

13,682 |

|

9,303 |

|

| Costs not related to current operations |

(1,194 |

) |

6,961 |

|

(1,194 |

) |

8,297 |

|

| Adjusted EBITDA |

7,628 |

|

7,682 |

|

12,488 |

|

17,600 |

|

Additional Information

The Management Discussion and Analysis and the

financial statements of the Corporation will also be available on

SEDAR (www.sedar.com) following publication of this release.

Additional information about Colabor Group Inc. can be found on

SEDAR and on the Corporation’s website at www.colabor.com.

Forward-Looking Statements

This news release contains certain statements

that may be deemed to be forward-looking statements reflecting the

opinions or current expectations of Colabor Group Inc. concerning

its performance, business operations and future events. Such

statements are subject to risks, uncertainties and assumptions and

the analysis of the debt structure and available alternatives, and

risks mentioned in the Corporation’s annual information form found

under its profile on SEDAR (www.sedar.com), such as the risk of

dilution for existing shareholders. As such, these statements are

not guarantees of future performance, and actual results, realities

or events may differ materially. Except as required by law, the

Corporation assumes no obligation to update these forward-looking

statements in the event that management’s beliefs, estimates or

opinions or other factors change.

About Colabor

Colabor is a distributor and wholesaler of food

and related products serving the hotel, restaurant and

institutional markets or "HRI" in Quebec, Ontario and in the

Atlantic provinces, as well as the retail market (grocery stores

and convenience stores). Within its two operating segments, Colabor

offers specialty food products such as meat, fresh fish and

seafood, as well as food and related products through its Broadline

activities.

Further information:

Colabor Group Inc.Mario Brin, MBA,

ICD.D.Interim Senior Vice President and Chief Financial

OfficerTel. : 450-449-0026, ext. 1308Fax :

450-449-6180mario.brin@colabor.com

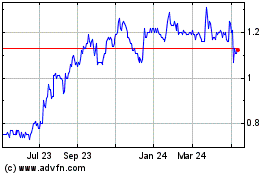

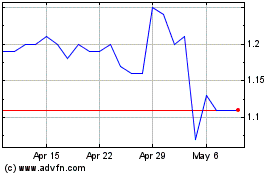

Colabor (TSX:GCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Colabor (TSX:GCL)

Historical Stock Chart

From Apr 2023 to Apr 2024