HEXO Corp. (TSX: HEXO; NASDAQ: HEXO) ("HEXO" or the "Company")

today reported its financial results for the fourth quarter

(“Q4’21”) and fiscal year ended July 31, 2021 ("F’21"). All amounts

are expressed in Canadian dollars unless otherwise noted.

"I am honoured and humbled to join the team as

HEXO's President & CEO," said Scott Cooper. “I look forward to

continuing to build on HEXO's strong foundation with an immediate

priority of continuing to integrate our recent acquisitions and

reviewing our financial position, with the ultimate goal of driving

growth and profitability through the commercialization of cannabis

consumer packaged goods products."

"As we review our last fiscal year, I would like

to highlight some key achievements. Last fiscal, HEXO

achieved its highest net revenue in the Company’s history, leads

the Canadian cannabis market in four categories and completed three

acquisitions, including the transformative Redecan acquisition,

propelling the Company to the number one market share position in

Canadian adult-use recreational cannabis sales," commented

Cooper.

Business Update

M&A

Key Highlights to July 31, 2021

- Closed the Zenabis acquisition on June 1, 2021, offering

diversified cultivation facilities, including a state-of-the-art

indoor grow facility in Atholville, NB.

- Zenabis contributed $6.8 million in net revenue for the two

months ended July 31, 2021.

Subsequent Events

- The Company completed the acquisitions of Redecan and 48North

Cannabis Corp. (“48North”). Through the integration progress, HEXO

is focused on ensuring that it implements the strengths of each

acquired company across the organization, identifies and resolves

any weaknesses, and obtains synergistic value for the overall

organization.

- HEXO believes these acquisitions will increase its market

share, accelerate its path to profitability, and create accretive

synergies.

Operations

Key Highlights to July 31, 2021

- Committed to ESG leadership, by offsetting 100% of its 2020

operational carbon emissions and personal emissions for all

employees1. The Company also committed to offsetting the

plastic used in its pouch packaging.

Subsequent Events

- The Company undertook a strategic reorganization, announcing

the departure of its Co-Founder and CEO, Sebastien St-Louis and the

appointment of Scott Cooper as HEXO's new President & CEO.

- Scott joins HEXO from Truss Beverage Co., a joint venture

between Molson-Coors Canada and HEXO which holds the number one

market share in cannabis infused beverages in Canada, where he held

the position of President & CEO. For a period of not more than

six months, Scott will simultaneously remain in this role.

- HEXO also announced the appointment of Valerie Malone as Chief

Commercial Officer and Guillaume Jouet as Chief People &

Culture Officer. Both executives bring significant

consumer-packaged good experience to the organization.

Canadian cannabis market

Key Highlights to July 31, 2021

- Net revenue increased 71% quarter-over-quarter and 43% from

Q4’20, marking HEXO's highest quarter of revenue to date.

- Total Q4’21 net revenue increased to $38.7 million from $22.6

million in Q3’21

- Total net revenue for FY21 grew to $123.5 million from $80.6

million in FY20.

- Increased market share in several Canadian provinces, including

Ontario, Alberta and British Colombia, and maintained a top two

market share in Quebec.

- Adult-use net revenues, exclusive of beverages, increased 28%

quarter-over-quarter.

- Cannabis beverage net revenues increased 70%

quarter-over-quarter and 161% from fiscal 2020.

Maintained leading market position relative to peers as market

share continues to diversify.

HEXO USA

Key Highlights to July 31, 2021

- On June 28, 2021, HEXO announced the closing of the acquisition

of a 50,000 sq. ft. facility in Colorado providing the Company with

the necessary infrastructure to execute on its U.S. expansion

plans. The facility is zoned for producing a full range of cannabis

products and offers a variety of operational capabilities.

Subsequent Events

- Truss CBD USA announced the expansion of Veryvell,

a line of hemp-derived CBD and adaptogen beverages, to 17

states following a successful Colorado launch in 2020. Truss CBD

USA is a joint venture by Molson Coors Beverage Company and

HEXO USA Inc, a subsidiary of HEXO poised to capture the

US cannabis infused beverage market.

Financial Update

| In

000’s |

For the three months ended |

For the twelve months ended |

|

Income Statement Snapshot |

July 31, 2021 |

|

April 30, 2021 |

|

July 31, 2020 |

|

July 31, 2021 |

|

July 31, 2020 |

|

| |

$ |

|

$ |

|

$ |

|

$ |

|

$ |

|

| Revenue from sale of goods |

53,022 |

|

33,082 |

|

36,140 |

|

173,081 |

|

110,149 |

|

| Excise taxes |

(14,365 |

) |

(10,482 |

) |

(9,082 |

) |

(49,583 |

) |

(29,598 |

) |

| Net revenue from sale of goods |

38,657 |

|

22,600 |

|

27,058 |

|

123,498 |

|

80,551 |

|

| Ancillary revenue |

103 |

|

60 |

|

87 |

|

271 |

|

233 |

|

| Total revenue |

38,760 |

|

22,660 |

|

27,145 |

|

123,769 |

|

80,784 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Gross profit before adjustments2 |

7,988 |

|

5,006 |

|

8,104 |

|

34,175 |

|

26,953 |

|

| Gross profit/(loss) before fair value adjustments |

1,499 |

|

4,379 |

|

(36,012 |

) |

29,066 |

|

(46,421 |

) |

| Gross profit/(loss)2 |

3,234 |

|

8,816 |

|

(34,690 |

) |

48,798 |

|

(57,975 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

(63,116 |

) |

(24,906 |

) |

(71,509 |

) |

(134,293 |

) |

(418,576 |

) |

| Loss from operations |

(59,882 |

) |

(16,090 |

) |

(106,199 |

) |

(85,495 |

) |

(476,551 |

) |

| Other expenses and

losses |

(9,630 |

) |

(4,621 |

) |

(63,333 |

) |

(29,664 |

) |

(75,961 |

) |

| Loss and comprehensive loss before tax |

(69,512 |

) |

(20,711 |

) |

(169,532 |

) |

(115,159 |

) |

(552,512 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Current and deferred tax recovery |

397 |

|

– |

|

– |

|

397 |

|

6,023 |

|

| Other comprehensive

income |

1,156 |

|

3 |

|

– |

|

1,152 |

|

– |

|

| Total Net loss and

comprehensive loss |

(67,959 |

) |

(20,708 |

) |

(169,532 |

) |

(113,610 |

) |

(546,489 |

) |

|

1 |

The Company has adjusted the presentation of gross profit before

fair value adjustments by removing inventory and biological asset

write offs and impairment losses. |

|

2 |

See section ‘Cost of Sales, Excise Taxes and Fair Value

Adjustments’ for reconciliation of gross profits |

Operating Expenses

| In 000’s |

For the three months ended |

For the years ended |

|

|

July 31, 2021 |

April 30, 2021 |

|

July 31, 2020 |

|

July 31, 2021 |

July 31, 2020 |

| |

$ |

$ |

|

$ |

|

$ |

$ |

| Selling, general and administration1 |

19,160 |

11,178 |

|

12,436 |

|

54,543 |

52,793 |

| Marketing and promotion |

3,665 |

2,452 |

|

2,375 |

|

10,348 |

12,474 |

| Share-based compensation |

827 |

2,715 |

|

4,373 |

|

11,731 |

25,790 |

| Research and development |

934 |

730 |

|

677 |

|

3,835 |

4,639 |

| Depreciation of property, plant and equipment |

1,728 |

1,612 |

|

1,179 |

|

6,097 |

6,072 |

| Amortization of intangible assets |

1,002 |

371 |

|

249 |

|

2,050 |

3,939 |

| Restructuring costs |

1,562 |

336 |

|

(79 |

) |

3,283 |

4,767 |

| Impairment of property, plant and equipment |

19,350 |

16 |

|

46,414 |

|

20,230 |

79,418 |

| Impairment of intangible assets |

– |

– |

|

2,000 |

|

– |

108,189 |

| Impairment of goodwill |

– |

– |

|

– |

|

– |

111,877 |

| Realization of onerous contract |

– |

– |

|

1,763 |

|

– |

4,763 |

| Disposal of long-lived assets |

– |

– |

|

122 |

|

1,294 |

3,855 |

| Loss/(gain) on disposal of

property, plant and equipment |

19 |

(19 |

) |

– |

|

64 |

– |

| Acquisition transaction

costs |

14,869 |

1,871 |

|

– |

|

17,174 |

– |

| Health Canada Recovery

Fee’s1 |

– |

3,644 |

|

– |

|

3,644 |

– |

|

Total |

63,116 |

24,906 |

|

71,509 |

|

134,293 |

418,576 |

|

1 |

The Company has adjusted the presentation of the Selling, General

and Administrative expenses to breakdown the Health Canada Recovery

Fee’s for ease of user review and identification. This presentation

differs from that of the Company’s interim financial statement for

the year ended July 31, 2021. |

Other Matters

Gross margins

Quarter-over-quarter, the Company's total gross

margin declined to 20% from 22% in Q3’21. Net adult-use revenue

(exclusive of beverages) gross margin declined to 12% from 28% due

to; increases to sales in higher excise tax burdened markets,

decreases to average selling prices, and the crystallization of

fair value adjustments upon the business acquisition of

Zenabis.

Normalizing for the impact of the

crystallization, the Company’s total gross margin would improve to

26% in Q4’21. Strong margined international sales grew

significantly in period to net revenues of $6.8 million and a gross

margin contribution of 65%. Wholesales were also impacted by the

crystallization of fair value adjustments on the purchase price

accounting of Zenabis, normalized for this, margins would otherwise

have been 35% versus reported gross margin of (65%).

Going Concern & the Senior Secured

Convertible Note

The Company acknowledges the ongoing concern

with its senior secured convertible notes issued on May 27, 2021.

The Company has maintained a positive relationship with the holder,

with the holder having negotiated and agreed to two amendments

favorable to the Company. While there exists a risk that

significant cash outflows may be required over the next twelve

months under the terms of the Senior Secured Convertible Note, the

Company has been working with the Holder to renegotiate the terms

of the Senior Secured Convertible Note.

The Company has sufficient funding for ongoing

working capital requirements, however, current funds on hand,

combined with operational cash flows, are not sufficient to also

support funding potential cash requirements under the Senior

Secured Convertible Note, investments required to continue to

develop cultivation and distribution infrastructure, and the future

growth plans of the Company. Management is exploring several

options to secure the necessary financing, which could include the

issuance of new public or private equity or debt instruments,

supplemented with operating cash inflows from operations.

Nevertheless, there is risk that certain sources

of additional future funding will not be available to the Company

or will be available on terms which are acceptable to management.

In the meantime, Management continues to monitor and manage its

cash flow in relation to its strategic growth objectives and

working capital requirements.

Non-IFRS Measures

In this press release, reference is made to

gross profit before adjustment, profit/margin before fair value

adjustments, adjusted gross profit/margin, adjusted EBITDA, and

revenue per gram equivalent which are not measures of financial

performance under International Financial Reporting Standards

(IFRS). These metrics and measures are not recognized measures

under IFRS, do not have meanings prescribed under IFRS, and are

unlikely to be comparable to similar measures presented by other

companies. These measures are provided as information complementary

to those IFRS measures by providing a further understanding of our

operating results from the perspective of management. As such,

these measures should not be considered in isolation or in lieu of

a review of our financial information reported under IFRS.

Definitions and reconciliations for all terms above can be found in

the Company's Management's Discussion and Analysis for the fiscal

year ended July 31, 2021, filed under the Company's profile on

SEDAR at www.sedar.com and EDGAR at www.sec.gov respectively

Conference Call

The Company will hold a conference call, October

29, 2021 to discuss these results. Scott Cooper, President &

CEO, and Trent MacDonald, CFO, will host the call starting at 8:30

a.m. Eastern. Analysts' question and answer period will follow

management's presentation.

Date: October 29, 2021

Time: 8:30 a.m. ET

Webcast:

https://events.q4inc.com/attendee/987736433

For previous quarterly results and recent press

releases, see hexocorp.com.

About HEXO Corp

HEXO is an award-winning licensed producer of

innovative products for the global cannabis market. HEXO serves the

Canadian recreational market with a brand portfolio including HEXO,

Redecan, UP Cannabis, Namaste Original Stash, 48North, Trail Mix,

Bake Sale, REUP and Latitude brands, and the medical market in

Canada, Israel and Malta. The Company also serves the Colorado

market through its Powered by HEXO® strategy and Truss CBD USA, a

joint venture with Molson-Coors. With the completion of HEXO's

recent acquisitions of Redecan and 48North, HEXO is a leading

cannabis products company in Canada by recreational market share.

For more information, please visit www.HEXOcorp.com.

Forward-Looking Statements

This press release contains forward-looking

information and forward-looking statements within the meaning of

applicable securities laws ("forward-looking statements").

Forward-looking statements are based on certain expectations and

assumptions and are subject to known and unknown risks and

uncertainties and other factors that could cause actual events,

results, performance and achievements to differ materially from

those anticipated in these forward-looking statements.

Forward-looking statements should not be read as guarantees of

future performance or results. Forward-looking statements in this

press release include but are not limited to the Company's

statements with respect to management's belief that certain

expenses included in operating expenses are non-recurring and

related to significant changes in market conditions and the refocus

of its operations on becoming Adjusted EBITDA positive.

A more complete discussion of the risks and

uncertainties facing the Company appears in the Company's Annual

Information Form and other continuous disclosure filings, which are

available on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company disclaims any intention or obligation,

except to the extent required by law, to update or revise any

forward-looking statements as a result of new information or future

events, or for any other reason.

Investor Relations: invest@hexo.com

www.hexocorp.com

Media Relations: (819) 317-0526

media@hexo.com

1 Estimated personal emissions based on the average Canadian’s

emissions from heating and powering their homes, driving and food

consumption.

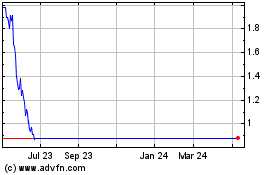

HEXO (TSX:HEXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

HEXO (TSX:HEXO)

Historical Stock Chart

From Dec 2023 to Dec 2024