HEXO Corp. (TSX: HEXO; NASDAQ: HEXO) ("HEXO" or the “Company"), a

leading producer of high-quality cannabis products, today

announced that the Company has taken a significant step in

executing on its strategic plan -The Path Forward - by finalizing a

strategic partnership with Tilray Brands, Inc. (“Tilray Brands”)

which includes a new debt financing agreement.

Under the new agreement, Tilray Brands will

acquire US$211 million of senior secured convertible notes (the

“Notes”) that were originally issued by HEXO (the “Transaction”) to

HT Investments MA LLC (“HTI”). The new terms of the Notes are

significantly more favourable to HEXO and will enable the Company

to strengthen its balance sheet and accelerate its transformation

into a cash flow positive business within the next four quarters.

The new partnership also brings together Canada’s top two cannabis

market share leaders and is expected to create efficiencies of up

to C$50 million within two years which will be shared equally

between HEXO and Tilray Brands.

“My top priority since I joined in November has

been to fix a very challenged balance sheet as a result of the

Notes that were previously put in place, and today, after an

exhaustive search for alternatives, we are announcing the most

optimal agreement to strengthen our balance sheet, preserve value

for shareholders and provide HEXO with the capital to execute on

our The Path Forward plan,” said Scott Cooper, HEXO President &

CEO. “This strategic alliance will help lower our costs, preserves

our stand-alone optionality and we look forward to reaching a

definitive agreement shortly.”

Irwin D. Simon, Tilray Brands’ Chairman and CEO,

said, “We believe the proposed transaction is a win-win for Tilray

Brands and HEXO as it would launch a strategic partnership between

two leading Canadian cannabis producers with complementary brand

portfolios. For us, it provides a path for meaningful future equity

ownership of HEXO and enables us to participate in HEXO’s share

price appreciation as it continues to execute on its growth

initiatives. We also expect to realize further commercial and

production efficiency savings of up to C$50 million within two

years, which would be shared equally and would allow us to continue

being the leading, low-cost Canadian producer. I look forward to

working with HEXO’s management team and Board to create additional

brand awareness and shareholder value.”

“Restructuring HEXO’s debt is a critical first

step in allowing the Company to move forward with its Path Forward

strategy and to begin to unlock significant shareholder value,”

said Mark Attanasio, Chair of the Board of Directors of HEXO. “The

company has endured a crippling overhang for the past twelve

months, due to punitive redemptions and discounted dilutive

financings, and we needed to solve this issue in order to make

positive progress. This new deal accomplishes this and places HEXO

solidly on a path to growth.”

In addition to the restructured debt, HEXO has

also signed an agreement with KAOS Capital (“KAOS”) and its

partners to provide a C$180 million equity backstop to the Company,

to maintain HEXO’s newly strengthened balance sheet and ensure that

all interest and operational costs are covered going forward.

“Our first priority was to refinance the debt

that the Company had taken on,” said Adam Arviv, CEO of KAOS. “By

bringing on Tilray as a strategic partner and alleviating the

unsustainable monthly redemptions, we’ve allowed HEXO to refocus

their strategic plan. In order to reiterate our support and give

the Company room to grow and realize its immense potential, we’ve

also put a substantial backstop commitment in place, and in doing

so, we are very confident in HEXO’s new outlook.”

Strategic Rationales for Hexo and Tilray

Brands Strategic Alliance

We believe the strategic alliance between Hexo

and Tilray Brands will provide several financial and strategic

benefits including the following:

- Operational

Flexibility: The purchase of the Notes would provide HEXO

with immediate operational flexibility by eliminating the monthly

redemption feature, amending the financial covenants and extending

the maturity, among other things. The terms of the transaction

unlock US$80 million of previously-restricted cash which, when

combined with the C$180 million equity backstop commitment,

provides HEXO with significant liquidity to invest in organic

growth.

- Substantial

Synergies: Tilray Brands and HEXO have entered into an

agreement to form a strategic partnership, which is expected to

deliver up to C$50 million of cost synergies within two years of

the completion of the transaction. Both companies have been working

together to evaluate cost saving synergies as well as other

production efficiencies, including with respect to cultivation and

processing services, certain Cannabis 2.0 products, including

pre-rolls, beverages and edibles and shared services and

procurement.

- Increases Product Breadth

and Commitment to Innovation: Leveraging both companies’

commitment to innovation, brand building and operational

efficiencies, both companies will share expertise and know-how in

order to strengthen market positioning and capitalize on

opportunities for growth through a broadened product offering and

new innovation.

Transaction Details:

- Under the terms of the transaction,

and subject to negotiation of the definitive documents and the

satisfaction of specific conditions, Tilray Brands has agreed to

acquire 100% of the remaining US$211.3 million outstanding

principal balance of the Notes, all of which were originally issued

by HEXO to HTI.

- As consideration for Tilray Brands’

purchase of the Notes, Tilray Brands will pay HTI 95% of the then

current outstanding principal for the Notes (“Purchase

Price”). Until closing, HTI may continue to redeem the

Notes pursuant to their terms, however in no event shall the

principal of the purchased Notes be less than US$182 million prior

to the closing of the Transaction.

- Among the various amendments to be

made to the Notes, the initial conversion price will be C$0.90

(subject to adjustments as set forth in the certificates for the

Notes and the indenture governing the Notes), which, as of March 2,

2022, implies that Tilray Brands has the right to convert the Notes

into approximately 37% of the outstanding common shares of HEXO (on

a basic basis), inclusive of all equity issuances associated with

the Transaction at closing. The Purchase Price will be satisfied in

cash, common shares of Tilray Brands, or a combination

thereof.

- In connection with the purchase of

the Notes, Tilray Brands and HEXO intend to extend the maturity

date by three years, to May 1, 2026, in order to provide HEXO with

the flexibility and time to continue implementing its strategic

“The Path Forward” growth plan.

Transaction Conditions

The Transaction is subject to a number of

conditions, including (i) completion of all required amendments to

the terms of the Notes; (ii) execution of definitive documentation

relating to the Notes; (iii) receipt of approvals from the Toronto

Stock Exchange and the Nasdaq Stock Market LLC, satisfactory to

both HEXO and Tilray Brands, as applicable; (iv) Tilray Brands’

satisfactory completion of confirmatory financial due diligence;

(v) receipt of all consents and approvals required by any

regulatory authorities; (vi) final approval of the boards of

directors of each of HEXO and Tilray Brands; (vii) receipt of

shareholder approval from the HEXO shareholders; (viii) no material

adverse effect having occurred in respect of HEXO; and (ix) receipt

of all necessary approvals relating to the C$180 million committed

equity line provided by KAOS.

Standby Commitment

In addition to the restructured debt, HEXO has

entered into an agreement with KAOS pursuant to which HEXO, KAOS

and such other parties that may be added to the standby commitment

(collectively, the “Standby Parties”) are expected

to negotiate a standby equity purchase agreement (the

“Standby Agreement”). It is expected that the

Standby Agreement will permit HEXO to demand the Standby Parties to

subscribe for an aggregate of C$5 million of Common Shares per

month over a period of 36 months. The Common Shares are expected to

be issued at a 10% discount to the 20 day volume weighted average

price of HEXO’s shares on the Toronto Stock Exchange (the

“TSX”) at the time the demand is made. The maximum

standby commitment is expected to be C$180 million over the term of

the Standby Agreement (the “Standby Commitment”).

A 5% standby commitment fee payable in Common Shares will be due

upon the execution of the Standby Agreement. It is expected that

all Common Shares issued to the Standby Parties will be freely

tradeable under applicable securities law. HEXO and the Standby

Parties intend to enter into, concurrently with the Standby

Agreement, a nomination rights agreement on customary terms.

The proceeds from the Standby Commitment are expected to be

used to fund interest payments under the Notes and general

corporate purposes.

The Standby Agreement remains subject to

negotiation and, among other things, receipt of necessary

regulatory and TSX approvals.

Commercial Transactions

As consideration for entering into the

Transaction, HEXO and Tilray Brands have agreed to work together,

in good faith, to evaluate cost saving synergies as well as other

production efficiencies and propose to enter into definitive

agreements related to certain mutually agreed commercial

transactions. These mutually beneficial commercial transactions are

expected to include (i) cultivation and processing services, (ii)

certain Cannabis 2.0 products (including pre-rolls), each with a

view to achieving optimal profitability between HEXO and Tilray

Brands, and (iii) establishing a joint venture company that will

provide shared services to both companies. Total savings, which

will be shared equally between HEXO and Tilray Brands, are expected

to be up to C$50 million within two years.

Conference Call

Tilray Brands and HEXO will host a conference

call to discuss today’s announcement at 8:30 a.m. ET, details of

which are provided below.

Call-in Number: (877) 407-0792 from Canada and

the U.S. or (201) 689-8263 from international locations. Please

dial in at least 10 minutes prior to the start time.

There will be a simultaneous, live webcast

available on the Investors section of HEXO’s website at

www.hexocorp.com. The webcast will also be archived.

Transaction Advisors

Lazard is serving as financial advisor, and

Norton Rose Fulbright Canada LLP is serving as legal counsel, to

HEXO.

Canaccord Genuity Corp. is serving as financial

advisor, and DLA Piper (Canada) LLP is serving as legal counsel, to

Tilray Brands.

Forward-Looking Statements

This press release contains forward-looking

information and forward-looking statements within the meaning of

applicable securities laws ("Forward-Looking Statements"),

including with respect to: the proposed acquisition of the Notes,

including the conditions thereto; the efficiencies to be created

between HEXO and Tilray Brands; the Company’s cash flow

projections; the entering into of the Standby Agreement on the

terms described herein, if at all; the amount of the Standby

Commitment and the funding schedule; the issue price of any Common

Shares issued under the Standby Commitment; the nature and amount

of the Standby Commitment fee the terms; the use of the proceeds

from the Standby Commitment; and terms of any nomination rights

agreement that may be entered into with the Standby Parties, if

any. Forward-Looking Statements are based on certain expectations

and assumptions and are subject to known and unknown risks and

uncertainties and other factors that could cause actual events,

results, performance and achievements to differ materially from

those anticipated in these Forward-Looking Statements.

Forward-Looking Statements should not be read as guarantees of

future performance or results. Readers are cautioned not to place

undue reliance on these Forward-Looking Statements, which speak

only as of the date of this press release. The Company disclaims

any intention or obligation, except to the extent required by law,

to update or revise any Forward-Looking Statements as a result of

new information or future events, or for any other reason.

This press release should be read in conjunction

with the management's discussion and analysis ("MD&A") and

unaudited condensed consolidated interim financial statements and

notes thereto as at and for the three months ended October 31,

2021. Additional information about HEXO is available on the

Company's profile on SEDAR at www.sedar.com and EDGAR at

www.sec.gov, including the Company's Annual Information Form for

the year ended July 31, 2021 dated October 29, 2021.

About HEXO

HEXO is an award-winning licensed producer of

innovative products for the global cannabis market. HEXO serves the

Canadian recreational market with a brand portfolio including HEXO,

Redecan, UP Cannabis, Namaste Original Stash, 48North, Trail Mix,

Bake Sale, REUP and Latitude brands, and the medical market in

Canada, Israel and Malta. The Company also serves the Colorado

market through its Powered by HEXO® strategy and Truss CBD USA, a

joint venture with Molson-Coors. With the completion of HEXO's

recent acquisitions of Redecan and 48North, HEXO is a leading

cannabis products company in Canada by recreational market share.

For more information, please visit hexocorp.com.

For further information, please

contact:Investor

Relations:invest@hexo.comwww.hexocorp.com

For media inquiries please contact:

media@hexo.com

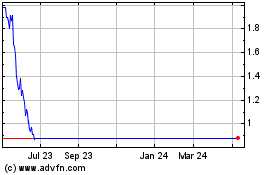

HEXO (TSX:HEXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

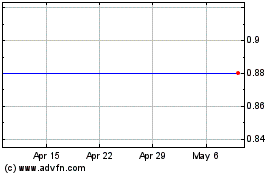

HEXO (TSX:HEXO)

Historical Stock Chart

From Dec 2023 to Dec 2024