IntelGenx Technologies Corp. (TSX:IGX)(OTCQB:IGXT) (the

"Company" or "IntelGenx") today reported financial results for the

three- and twelve-month periods ended December 31, 2022. All

dollar amounts are expressed in U.S. currency, unless otherwise

indicated, and results are reported in accordance with United

States generally accepted accounting principles except where

noted otherwise.

"The progress we made throughout 2022 has led us

to now being potentially on the cusp of a stage of anticipated

rapid growth,” commented Dr. Horst G. Zerbe, CEO

of IntelGenx. “In April, we expect the FDA’s decisions on the

Buprenorphine Buccal Film ANDA, as well as the RIZAFILM® NDA. On

the development front, we are also looking forward to atai

announcing topline results from its Phase 1 clinical trial of

Buccal VLS-01, the first ever in-human clinical study evaluating an

all thin film psychedelic drug candidate.”

2022 Fourth Quarter Financial

Highlights:

- Revenue

was $173,000, compared to $494,000 in the 2021 fourth quarter,

mostly due to one-time licensing revenue received in 2021.

- Net comprehensive loss was $2.3

million, compared to $2.9 million in the 2021 fourth quarter.

- Adjusted EBITDA

loss was $2.3 million, essentially unchanged from

Q4-2021.

2022 Full-Year Financial

Highlights:

- Revenue

was $1.0 million, compared to $1.5 million in 2021, mostly due

to one-time licensing revenue received in 2021.

- Net

comprehensive loss was $11.6 million, compared to $9.8 million

in 2021.

- Adjusted EBITDA

loss was $8.5 million, compared to $7.1 million in 2021.

Fourth Quarter and Recent

Developments:

- Received a

fourth and final term loan tranche in the amount of $3.0 million

pursuant to the amended and restated secured loan agreement with

the Company’s strategic partner, atai Life Sciences (“atai’).

- Closed a private

placement offering of convertible notes due March 1, 2027 for

aggregate gross proceeds of approximately $760,000 (C$1

million).

- Received from

the U.S. Food and Drug Administration (‘FDA”) a Prescription Drug

User Fee Act (PDUFA) goal date of April 17, 2023 for completion of

the Agency’s review of the 505(b)(2) New Drug Application (“NDA”)

for RIZAFILM® VersaFilm®.

- Participated in

the 35th Annual ROTH Conference in Dana Point, California.

- Granted a Notice

of Allowance for U.S. Patent Application 16/053,383, entitled

"Loxapine Film Oral Dosage Form,” from the United States Patent and

Trademark Office.

- Entered into a

research collaboration with Per Svenningsson, MD, PhD, of the

Karolinska Institute, to plan and conduct a multicentre,

randomized, double-blind, placebo-controlled clinical study to

investigate the use of Montelukast VersaFilm® for the treatment of

Parkinson’s Disease.

- Entered into an

exclusive supply agreement for RIZAPORT® with ARWAN Pharmaceuticals

Industries Lebanon s.a.l. in various countries in the Middle East

and North Africa region.

- Entered into a

research collaboration with the University of Prince Edward Island

to assess palatability, owner-perceived acceptability, and ease of

administration of the Company’s VetaFilm™ platform in healthy dogs

and cats.

Financial Results:

Total revenues for the three-month period

ended December 31, 2022 amounted to $173,000, a

decrease of $321,000, or 65%, compared to $494,000 for

the three-month period ended December 31, 2021. The change is

mainly attributable to decreases in revenues from licensing

agreements of $249,000, R&D revenues of $43,000 and product

revenues of $36,000, offset partially by an increase in royalties

on product sales of $7,000. Operating costs and expenses were $2.7

million for the fourth quarter of 2022, versus $3.0 million for the

corresponding three-month period of 2021. For Q4-2022, the Company

had an operating loss of $2.5 million, essentially unchanged from

the operating loss for the comparable period of 2021. Net

comprehensive loss was $2.3 million, or $0.01 per basic

and diluted share, for the fourth quarter of 2022, compared to net

comprehensive loss of $2.9 million, or $0.02 per basic and

diluted share, for the comparable period of 2021.

Total revenues for the twelve-month period

ended December 31, 2022 amounted to $1.0 million,

representing a decrease of $585,000, or 38%, compared to $1.5

million for the year ended December 31, 2021. Operating costs and

expenses were $10.4 million for the full year 2022,

versus $9.5 million for the corresponding twelve-month

period of 2021. For the twelve-month period of 2022, the Company

had an operating loss of $9.4 million, compared to an

operating loss of $8.0 million for the comparable period of

2021. Net comprehensive loss was $11.6 million,

or $0.07 per basic and diluted share, for the

twelve-month period of 2022, compared to net comprehensive loss

of $9.8 million, or $0.07 per basic and diluted

share, for the comparable period of 2021.

As at December 31, 2022, the Company's cash

and short-term investments totalled $2.5 million, which did

not include the $3.0 million secured loan granted to IntelGenx

Corp. by atai in January 2023, nor the $760,000 in gross proceeds

from the private placement offering of convertible notes, which

closed in March 2023.

Annual Filings:

The Company's annual report on Form 10-K and

financial statements for the year ended December 31,

2022, as well as the 2023 Proxy Statement, will be filed with

the United States Securities and Exchange Commission and

the Canadian Securities regulatory authorities today,

March 29, 2023.

Conference Call Details:

IntelGenx will host a conference call to

discuss these 2022 fourth quarter and full year financial results

today at 4:30 p.m. ET. The dial-in number for the conference

call is (888) 506-0062 (Canada and the United States) or (973)

528-0011 (International); access code 884881. The call will be also

be webcast live and archived on the Company's website at

www.intelgenx.com under "Webcasts" in the Investors section.

About IntelGenx

IntelGenx is a leading drug delivery company

focused on the development and manufacturing of pharmaceutical

films.

IntelGenx’s superior film technologies,

including VersaFilm®, DisinteQ™, VetaFilm™ and transdermal

VevaDerm™, allow for next generation pharmaceutical products that

address unmet medical needs. IntelGenx’s innovative product

pipeline offers significant benefits to patients and physicians for

many therapeutic conditions.

IntelGenx's highly skilled team provides

comprehensive pharmaceuticals services to pharmaceutical partners,

including R&D, analytical method development, clinical

monitoring, IP and regulatory services. IntelGenx's

state-of-the-art manufacturing facility offers full service by

providing lab-scale to pilot- and commercial-scale production. For

more information, visit www.intelgenx.com.

Forward-Looking Information and

Statements

This document may contain forward-looking

information about IntelGenx's operating results and business

prospects that involve substantial risks and uncertainties.

Statements that are not purely historical are forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and Section 27A of the Securities

Act of 1933, as amended. These statements include, but are not

limited to, statements about IntelGenx's plans, objectives,

expectations, strategies, intentions or other characterizations of

future events or circumstances and are generally identified by the

words "may," "expects," "anticipates," "intends," "plans,"

"believes," "seeks," "estimates," "could," "would," and similar

expressions. All forward looking statements are expressly qualified

in their entirety by this cautionary statement. Because these

forward-looking statements are subject to a number of risks and

uncertainties, IntelGenx's actual results could differ materially

from those expressed or implied by these forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to, those discussed under

the heading "Risk Factors" in IntelGenx's annual report on Form

10-K, filed with the United States Securities and Exchange

Commission and available at www.sec.gov, and also filed with

Canadian securities regulatory authorities at www.sedar.com.

IntelGenx assumes no obligation to update any such forward-looking

statements.

Source: IntelGenx Technologies Corp.

For IntelGenx:

Stephen KilmerInvestor Relations(647)

872-4849stephen@kilmerlucas.com

Or

Andre Godin, CPA, CAPresident and CFOIntelGenx Corp.(514)

331-7440 ext 203andre@intelgenx.com

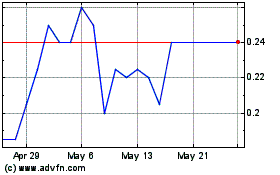

Intelgenx Technologies (TSX:IGX)

Historical Stock Chart

From Jan 2025 to Feb 2025

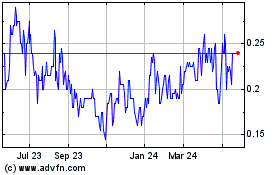

Intelgenx Technologies (TSX:IGX)

Historical Stock Chart

From Feb 2024 to Feb 2025