Qualcomm Bids $4.6 Billion for Veoneer in Bid to Trump Magna Deal -- Update

August 05 2021 - 9:45AM

Dow Jones News

By Colin Kellaher

Qualcomm Inc. on Thursday said it has offered to buy Veoneer

Inc. for $4.6 billion in cash in a bid to upend the safety

supplier's deal to be acquired by auto-parts giant Magna

International Inc.

The San Diego chip maker's $37-a-share bid represents an 18.4%

premium to the $31.25 a share Magna last month agreed to pay for

Stockholm-based Veoneer and an 85.6% premium to Veoneer's July 22

closing price of $19.93, before the Magna deal was announced.

But Veoneer shares surged more than 24% to $38.83 in early

trading Thursday, an indication that investors think a bidding war

may be underway.

A Magna spokeswoman said the Aurora, Ontario, company had no

comment on the Qualcomm bid, while Veoneer representatives weren't

immediately available for comment.

Magna in July had said its planned acquisition of Veoneer would

bolster its position in advanced driver assistance systems, or

ADAS, which includes features such as adaptive cruise control and

lane-keeping assistance.

Qualcomm on Thursday said the proposed combination of its

Snapdragon Ride platform with Veoneer's Arriver sensor perception

and drive policy software platform "will enable us to transform the

ADAS segment." The companies had previously struck a deal to

collaborate on autonomous driving technologies.

Qualcomm said its offer has no financing conditions, noting that

it would fund the transaction with existing cash resources. The

company said it is ready to begin a focused due-diligence process

that it expects to be able to complete in short order.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

August 05, 2021 10:31 ET (14:31 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

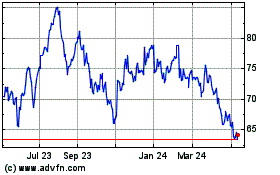

Magna (TSX:MG)

Historical Stock Chart

From Mar 2024 to Apr 2024

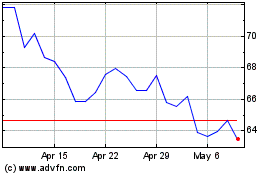

Magna (TSX:MG)

Historical Stock Chart

From Apr 2023 to Apr 2024