Veoneer to Hold Talks With Qualcomm on $4.6 Billion Bid

August 09 2021 - 5:26AM

Dow Jones News

By Colin Kellaher

Veoneer Inc. said it plans to hold takeover talks with Qualcomm

Inc. after the Swedish automotive-technology company's board

determined that Qualcomm's surprise $4.6 billion bid would

reasonably be expected to result in a superior proposal to

Veoneer's current agreement to be acquired by Magna International

Inc.

San Diego chip maker Qualcomm last week said it offered to pay

$37 a share for Veoneer, topping by 18.4% the $31.25 auto-parts

giant Magna agreed to pay last month when it struck a deal to buy

Veoneer.

Veoneer said its agreement with Magna allows the Stockholm

company to accept a superior proposal and walk away from the Magna

deal in exchange for a $110 million breakup fee.

Magna last week said it was evaluating its options and

considering next steps, adding that it plans to be disciplined in

its approach and that it is committed to earning good returns on

investments.

Shares of Veoneer closed Friday at $38.69, above Qualcomm's bid,

in an indication that investors may think a bidding war is in the

offing. The share slipped 3.3% to $37.42 in premarket trading

Monday.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

August 09, 2021 06:14 ET (10:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

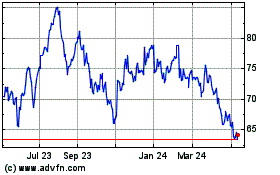

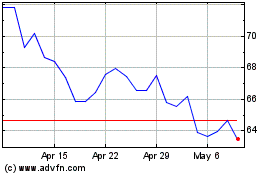

Magna (TSX:MG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Magna (TSX:MG)

Historical Stock Chart

From Apr 2023 to Apr 2024