Melcor Developments Ltd. (TSX: MRD), an Alberta-based real estate

development and asset management company, today reported results

for the third quarter and nine months ended September 30,

2019. Revenue was down 10% to $53.95 million compared to Q3-2018.

Year to date revenue was $129.92 million, down 12% compared to the

same period last year. Weaker residential markets in Alberta led to

a 17% decrease in Community Development revenue over the same

period last year. Investment Properties revenue grew by 21% over

Q3-2018 as a result of increased occupancy, transfers from the

Property Development division and third party acquisitions over the

past 12 months. Investment properties owned gross leasable area

grew by 9%.

Q3-2019 net income was up 40% at $16.07 million. Year to date

net income was $20.80 million or $0.62 per share (basic) compared

with a net income of $27.75 million or $0.83 per share (basic) in

the same period of 2018. Net income is impacted by non-cash fair

value adjustments on investment properties and on REIT units.

Q3-2019 net income was also positively impacted by a tax recovery

resulting from reduced tax rates in Alberta. Funds from operations

(FFO) was down 17% to $10.70 million or 0.32 per share in the

quarter and 4% to $24.35 million or $0.73 per share over the prior

period. The FFO decrease over last year is primarily due to the

overall decrease in Community Development revenues. Management

believes FFO better reflects Melcor's true operating

performance.

Darin Rayburn, Melcor’s President and Chief Executive Officer,

commented on the quarter: "Our results through nine months are in

line with expectations given the soft market for new homes in

Alberta. While we have tempered residential development this year,

we continue to actively develop commercial projects to meet demand,

particularly in neighbourhood shopping centres. Our Property

Development division transferred 20,832 square feet, valued at

$13.5 million in the quarter and has an additional 125,485 square

feet under active development or completed and awaiting lease-up.

This pipeline will eventually transfer to our Investment Properties

division for active management and then offered to the REIT.

Our income producing divisions continue to produce stable

results while maintaining occupancy and base rents in a challenging

market and contributed over 50% of revenue year to date. We are

pleased to continue growing this business and recently announced an

acquisition that will increase the REIT's gross leasable area by

10% and also be immediately accretive to AFFO.

The outlook for the housing market remains challenging and we

continue to focus on our income producing divisions to stabilize

results.

We are encouraged by the actions of the Alberta government in

their quest to restore our province's capacity to get business

done, support employment growth and attract a strong and diverse

group of businesses."

The Board today declared a quarterly dividend of $0.12 per

share, payable on December 31, 2019 to shareholders of record

on December 16, 2019. The dividend is an eligible dividend for

Canadian tax purposes.

Third Quarter Results

Revenues in Q3-2019 were down 10% over Q3-2018 and 12%

year-to-date as a result of the soft residential market in Canada

and the timing of sales in the US. Community Development was the

main contributer to the revenue decline, with revenue down 17%

year-to-date and 23% over Q3-2018.

Investment Properties revenue growth partially offset the

softness experienced in Community Development, with a 21% increase

in revenue over Q3-2018 and 23% year-to-date. Third-party

acquisitions and transfers from our Property Development division

have increased our owned and managed gross leasable area (GLA) by

9% over the last 12 months. US revenue will continue to be uneven

while we ramp up our Harmony project in Aurora, CO. Strategies

employed to diversify geographically and via product mix over the

past few years continue to positively impact our financial results

and serve as an offset to the impact of softer residential markets

in Alberta.

Our Community Development and Property Development divisions are

actively engaged in a number of projects as we continue through the

2019 construction season.

Highlights of the quarter and year-to-date periods include:

FINANCIAL HIGHLIGHTS

- Year-to-date revenue was down 12% to $129.92 million as a

result of softer residential sales and the timing of multi-family

and commercial sales, which tend to fluctuate quarter to

quarter.

- Year-to-date funds from operations (FFO) were down 4% to $24.35

million compared to the same period last year. FFO was down 17% to

$10.70 million in Q3-2019 from $12.84 million in Q3-2018 due to the

decrease in revenue earned in our Community Developments division

of 23% over Q3-2018 and 17% over the same period last year.

Management believes funds from operations is a more accurate

reflection of our true operating performance.

- Net income of $16.07 million in the quarter was positively

impacted by non-cash fair value gains on investment properties of

$3.30 million which were partially offset by non-cash fair value

losses on REIT units of $1.18 million. These gain and losses are

driven by market forces outside of Melcor's control.

DIVISIONAL OPERATING HIGHLIGHTS

- Our Community Development division began the initial phases of

two new communities adjacent to successful communities in west

Edmonton, and Airdrie, AB. All planned fall servicing and paving

have been completed. The Community Development team has engaged in

strategies and marketing programs to reduce slow-moving inventory,

and single-family lot inventory is down 34% since September

30, 2018 as a result.

- Our Property Development team transferred 20,832 sf of GLA in

Q3-2019 to our Investment Properties division and started 6,600 sf

of new development during the quarter with a total of 32,379 sf

currently under construction. A further 93,106 sf is complete and

awaiting lease-up and/or transfer.

- With the 4% growth in total GLA via acquisitions and transfer

from Property Development since September 30, 2018, our

income-producing divisions (Investment Properties and REIT) revenue

was up 7% over Q3-2018 and year-to-date. These divisions continue

to yield stable results in spite of market challenges and achieved

consistent occupancy and base rents.

- Our golf courses (Recreational Properties) enjoyed an early

spring start and good fall conditions, offset by a wet summer.

Overall, the total number of rounds played was up 7% at quarter

end.

ACQUISITIONS FOR FUTURE GROWTH

- Community Development purchased 158.03 acres of strategic land

in Red Deer, AB for $12.80 million and received vendor financing of

$8.80 million. This land will be planned for a residential

community with a commercial component for a neighbourhood shopping

centre. We have purchased 470.60 acres of land at a total cost of

$28.61 million and received total vendor financing of $16.11

million year to date.

- Property Development acquired land from a third-party at a

purchase price of $1.05 million on August 1, 2019. The land is

adjacent to and will be developed as part of the Kingsview Market

regional shopping centre in Airdrie, AB.

SUBSEQUENT EVENTS

- On October 10, 2019 we announced that the REIT had entered into

an agreement to acquire a $54.80 million third-party property (the

"REIT Property Acquisition"), which is expected to close on or

about November 12, 2019. This latest acquisition increases our

portfolio gross leasable area by 9.7% and is expected to be

immediately accretive to AFFO per unit. The purchase price will be

partially satisfied through the issuance of a 5.10% unsecured

convertible debenture (the "2019 REIT Debentures").

- On October 29, 2019 the REIT completed the placement of the

2019 REIT Debentures to the public for gross proceeds of $46.00

million, including $6.00 million issued pursuant to the exercise of

an over-allotment option in full. The 2019 Debentures were issued

in connection with the REIT Property Acquisition currently under

contract and our intention to redeem the 5.50% $34.50 million 2014

Debentures.

RETURNING VALUE

- We continue to return value to our shareholders and unit

holders:

- We paid a quarterly dividend of $0.12 per share on September

28, 2019. The REIT paid distributions of $0.05625 per trust unit in

July, August and September for a quarterly payout ratio of 97% and

100% year to date.

- On November 6, 2019 we declared a quarterly dividend of

$0.12 per share, payable on December 31, 2019 to shareholders

of record on December 16, 2019. The dividend is an eligible

dividend for Canadian tax purposes.

Selected Highlights

|

($000s except as noted) |

Three-months |

Nine-months |

|

|

30-Sept-19 |

30-Sept-18 |

Change |

30-Sept-19 |

30-Sept-18 |

Change |

|

Revenue |

53,946 |

|

60,245 |

|

(10.5 |

)% |

129,915 |

|

147,452 |

|

(11.9 |

)% |

|

Gross margin (%) * |

43.5 |

% |

46.6 |

% |

(6.7 |

)% |

49.5 |

% |

48.7 |

% |

1.6 |

% |

|

Net income |

16,068 |

|

11,469 |

|

40.1 |

% |

20,795 |

|

27,747 |

|

(25.1 |

)% |

|

Net margin (%) * |

29.8 |

% |

19.0 |

% |

56.8 |

% |

16.0 |

% |

18.8 |

% |

(14.9 |

)% |

|

Funds from operations * |

10,696 |

|

12,841 |

|

(16.7 |

)% |

24,348 |

|

25,456 |

|

(4.4 |

)% |

| Per Share Data ($) |

|

|

|

|

|

|

|

Basic earnings |

0.48 |

|

0.34 |

|

41.2 |

% |

0.62 |

|

0.83 |

|

(25.3 |

)% |

|

Diluted earnings |

0.48 |

|

0.34 |

|

41.2 |

% |

0.62 |

|

0.83 |

|

(25.3 |

)% |

|

Funds from operations * |

0.32 |

|

0.38 |

|

(15.8 |

)% |

0.73 |

|

0.76 |

|

(3.9 |

)% |

|

|

|

|

|

|

|

|

| As at

($000s except as noted) |

|

|

|

30-Sept-19 |

31-Dec-18 |

Change |

|

Shareholders' equity |

|

|

|

1,070,814 |

|

1,067,565 |

|

0.3 |

% |

|

Total assets |

|

|

|

2,044,964 |

|

2,023,076 |

|

1.1 |

% |

| |

|

|

|

|

|

|

| Per Share Data ($) |

|

|

|

|

|

|

|

Book value * |

|

|

|

32.20 |

|

32.01 |

|

0.6 |

% |

MD&A and Financial Statements

Information included in this press release is a summary of

results. This press release should be read in conjunction with

Melcor’s consolidated financial statements and management's

discussion and analysis for the three and nine months ended

September 30, 2019, which can be found on the company’s

website at www.Melcor.ca or on SEDAR (www.sedar.com).

About Melcor Developments Ltd.

Melcor is a diversified real estate development and asset

management company that transforms real estate from raw land

through to high-quality finished product in both residential and

commercial built form. Melcor develops and manages mixed-use

residential communities, business and industrial parks, office

buildings, retail commercial centres and golf courses. Melcor owns

a well diversified portfolio of assets in Alberta, Saskatchewan,

British Columbia, Arizona and Colorado.

Melcor has been focused on real estate since 1923. The company

has built over 140 communities and commercial projects across

Western Canada and today manages 4.23 million sf in commercial real

estate assets and 608 residential rental units. Melcor is committed

to building communities that enrich quality of life - communities

where people live, work, shop and play.

Melcor’s headquarters are located in Edmonton, Alberta, with

regional offices throughout Alberta and in Kelowna, British

Columbia and Phoenix, Arizona. Melcor has been a public company

since 1968 and trades on the Toronto Stock Exchange (TSX:MRD).

Forward Looking Statements

In order to provide our investors with an understanding of our

current results and future prospects, our public communications

often include written or verbal forward-looking statements.

Forward-looking statements are disclosures regarding possible

events, conditions, or results of operations that are based on

assumptions about future economic conditions, courses of action and

include future-oriented financial information.

This news release and other materials filed with the Canadian

securities regulators contain statements that are forward-looking.

These statements represent Melcor’s intentions, plans,

expectations, and beliefs and are based on our experience and our

assessment of historical and future trends, and the application of

key assumptions relating to future events and circumstances.

Future-looking statements may involve, but are not limited to,

comments with respect to our strategic initiatives for 2019 and

beyond, future development plans and objectives, targets,

expectations of the real estate, financing and economic

environments, our financial condition or the results of or outlook

of our operations.

By their nature, forward-looking statements require assumptions

and involve risks and uncertainties related to the business and

general economic environment, many beyond our control. There is

significant risk that the predictions, forecasts, valuations,

conclusions or projections we make will not prove to be accurate

and that our actual results will be materially different from

targets, expectations, estimates or intentions expressed in

forward-looking statements. We caution readers of this document not

to place undue reliance on forward-looking statements. Assumptions

about the performance of the Canadian and US economies and how this

performance will affect Melcor’s business are material factors we

consider in determining our forward-looking statements. For

additional information regarding material risks and assumptions,

please see the discussion under Business Environment and Risk in

our annual MD&A.

Readers should carefully consider these factors, as well as

other uncertainties and potential events, and the inherent

uncertainty of forward-looking statements. Except as may be

required by law, we do not undertake to update any forward-looking

statement, whether written or oral, made by the company or on its

behalf.

Contact Information:

Nicole ForsytheDirector, Corporate CommunicationsTel:

1.855.673.6931ir@melcor.ca

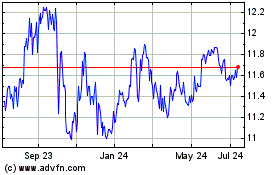

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

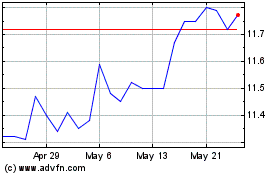

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Dec 2023 to Dec 2024