Methanex Corporation to Temporarily Idle New Zealand Operations to Assist in Improving Energy Balances

August 12 2024 - 4:32PM

Methanex Corporation (TSX:MX) (NASDAQ:MEOH) announced today that it

has entered into short-term commercial arrangements to provide its

contracted natural gas into the New Zealand electricity market. As

a result, it is temporarily idling its manufacturing operations in

New Zealand until the end of October 2024. These commercial

arrangements are expected to positively impact Methanex’s Q3 and Q4

2024 earnings with after-tax proceeds expected to meaningfully

exceed the margin lost on New Zealand methanol production delivered

to customers. The commercial arrangements are structured to provide

Methanex with a base price for each unit of gas delivered with

further incremental value shared between the parties depending on

electricity pricing over the period.

Rich Sumner, President and CEO, commented, “New

Zealand’s energy balances are currently very strained due to

seasonally high demand combined with low hydro levels and

relatively lower gas supply in 2024 compared with previous years.

We have been working closely with energy providers, other gas users

and the government of New Zealand on how we can be part of the

solution. We believe these agreements will play an important role

to support the energy sector and to facilitate this we’re making

the appropriate adjustments to utilize our global supply chain to

ensure we continue to provide our customers with methanol supply

security. We have natural gas contracted in New Zealand through

2029 and are committed to working with all parties to improve the

structural energy balances in the country.”

Methanex is a Vancouver-based, publicly traded

company and is the world’s largest supplier of methanol to major

international markets. Methanex shares are listed for trading on

the Toronto Stock Exchange in Canada under the trading symbol “MX”

and on the NASDAQ Global Market in the United States under the

trading symbol “MEOH”. Methanex can be visited online at

www.methanex.com.

Inquiries:Sarah HerriottDirector, Investor

RelationsMethanex Corporation 604-661-2600 or Toll Free:

1-800-661-8851www.methanex.com

Forward-Looking Statements:

These statements relate to future events or our

future performance. All statements other than statements of

historical fact are forward-looking statements. Statements that

include the words “expects”, “believe”, and “will”, or other

comparable terminology and similar statements of a future or

forward-looking nature identify forward-looking statements.

More particularly and without limitation, any

statements regarding the following are forward-looking

statements:

- expected shutdowns (either

temporary or permanent) or restarts of existing methanol supply

(including our own facilities), including, without limitation, the

timing and length of planned maintenance outages,

- expected methanol and energy

prices,

- expected levels, timing and

availability of economically priced natural gas supply to each of

our plants,

- anticipated operating rates of our

plants,

- expected operating costs, including

natural gas feedstock costs and logistics costs,

- expected tax rates,

- expected cash flows, cash balances,

earnings capability, debt levels and share price, and

- expected actions of governments,

governmental agencies, gas suppliers, courts, tribunals or other

third parties.

We believe that we have a reasonable basis for

making such forward-looking statements. The forward-looking

statements in this document are based on our experience, our

perception of trends, current conditions and expected future

developments as well as other factors. Certain material factors or

assumptions were applied in drawing the conclusions or making the

forecasts or projections that are included in these forward-looking

statements, including, without limitation, future expectations and

assumptions concerning the following:

- the supply of, demand for and price

of methanol, methanol derivatives, natural gas, coal, oil and oil

derivatives,

- our ability to procure natural gas

feedstock on commercially acceptable terms,

- operating rates of our

facilities,

- receipt or issuance of third-party

consents or approvals or governmental approvals related to rights

to purchase natural gas,

- operating costs, including natural

gas feedstock and logistics costs, capital costs, tax rates, cash

flows, foreign exchange rates and interest rates,

- absence of a material negative

impact from changes in laws or regulations, and

- enforcement of contractual

arrangements and ability to perform contractual obligations by

customers, natural gas and other suppliers and other third

parties.

However, forward-looking statements, by their

nature, involve risks and uncertainties that could cause actual

results to differ materially from those contemplated by the

forward-looking statements. The risks and uncertainties primarily

include those attendant with producing and marketing methanol and

successfully carrying out major capital expenditure projects in

various jurisdictions, including, without limitation:

- conditions in the methanol and

other industries, including fluctuations in the supply, demand and

price for methanol and its derivatives, including demand for

methanol for energy uses,

- the price of natural gas, coal, oil

and oil derivatives,

- our ability to obtain natural gas

feedstock on commercially acceptable terms to underpin current

operations and future production growth opportunities,

- actions of competitors, suppliers

and financial institutions,

- conditions within the natural gas

delivery systems that may prevent delivery of our natural gas

supply requirements,

- competing demand for natural gas,

especially with respect to any domestic needs for gas and

electricity,

- actions of governments and

governmental authorities, including, without limitation,

implementation of policies or other measures that could impact the

supply of or demand for methanol or its derivatives,

- changes in laws or regulations,

and

- other risks described in our 2023

Annual Management’s Discussion and Analysis and this Second Quarter

2024 Management’s Discussion and Analysis.

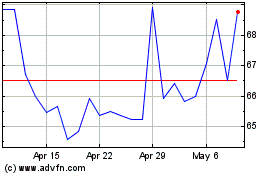

Methanex (TSX:MX)

Historical Stock Chart

From Oct 2024 to Nov 2024

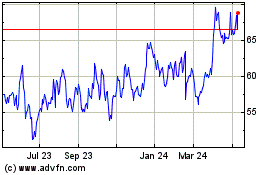

Methanex (TSX:MX)

Historical Stock Chart

From Nov 2023 to Nov 2024