Northland Power Inc. (“

Northland” or the

“

Company”) (TSX: NPI) and RWE Renewables GmbH

(FRA: RWE AG) strengthen their position in the German offshore wind

market through an agreement to co-develop a cluster of offshore

wind projects in the German North Sea with a total gross capacity

of 1.3 gigawatts (GW). The partners signed an agreement to

establish a joint venture company through which they plan to

jointly develop, construct and operate the cluster of three

offshore wind projects. The cluster will include the 433 MW N-3.8

(Nordsee 2) site, the 420 MW N-3.5 (Nordsee 3) site and the 480 MW

N-3.6 (Delta Nordsee) site.

In addition to its position in the N-3.8

(Nordsee 2) and N-3.5 (Nordsee 3) sites, Northland will also gain

access to the N-3.6 (Delta Nordsee) site, which RWE has step-in

rights for 100% of the lease, while at the same time, RWE will

increase its position in the N-3.8 (Nordsee 2) and N-3.5 (Nordsee

3) sites. The size and scale from the formation of the cluster is

expected to allow the partnership to unlock synergies.

Specifically, the realization of synergies in development and

construction costs as well as operating costs are expected to

result in enhanced returns for the projects. Northland will also

benefit from enhanced offtake opportunities through the formation

of the partnership and the cluster to secure offtake agreements for

the projects, once complete. The cluster will be in close proximity

to the existing 332 MW Nordsee One wind facility in which Northland

and RWE are partners already.

“The formation of the cluster aligns with our

offshore wind ambitions and strategy of growing our position as a

global leader in offshore wind,” said Mike Crawley, President and

Chief Executive Officer of Northland. “We are proud to enhance our

partnership with RWE to form the cluster to further strengthen our

position in the North Sea. This cluster will provide us with

significant size and scale and allows us to support the

decarbonization efforts in Germany.”

Sven Utermöhlen, CEO Wind Offshore, RWE

Renewables: “Germany has set itself ambitious climate targets,

thereby establishing a significant growth potential for renewable

energies. Offshore wind power plays a central role in this and is

indispensable for supporting the decarbonization of industry in

particular. RWE is making its contribution to this and is

significantly stepping up the pace here. This includes the

collaborative delivery of the 1.3 GW offshore cluster with

Northland Power, through which we can achieve considerable

synergies to deploy at our new wind farms, while at the same time

actively supporting the energy transition in our home market

Germany.”

Northland and RWE hold step-in rights for N-3.8

(Nordsee 2) and N-3.5 (Nordsee 3), while RWE holds step-in rights

for the N-3.6 (Delta Nordsee) lease. In early November, the

partners exercised their step-in rights for N-3.8 (Nordsee 2),

allowing them to match the awarded bid in the auction and retain

the lease. The auction for the remaining leases, will be held in

2023. For both sites the joint venture holds step-in rights.

Northland will hold a 49 percent interest in the

new joint venture with RWE holding 51 percent. The projects will be

developed and managed on a joint basis by both parties and are

expected to achieve commercial operations between 2026 and

2028.

NORTHLAND POWER

Northland Power is a global power producer

dedicated to helping the clean energy transition by producing

electricity from clean renewable resources. Founded in 1987,

Northland has a long history of developing, building, owning and

operating clean and green power infrastructure assets and is a

global leader in offshore wind. In addition, Northland owns and

manages a diversified generation mix including onshore renewables,

solar and efficient natural gas energy, as well as supplying energy

through a regulated utility.

Headquartered in Toronto, Canada, with global

offices in eight countries, Northland owns or has an economic

interest in 3.2 GW (net 2.8 GW) of operating generating capacity

and a significant inventory of early to mid-stage development

opportunities encompassing approximately 4 to 5 GW of potential

capacity.

Publicly traded since 1997, Northland's common

shares, Series 1, Series 2 and Series 3 preferred shares trade on

the Toronto Stock Exchange under the symbols NPI, NPI.PR.A,

NPI.PR.B and NPI.PR.C, respectively.

RWERWE is leading the way to a

green energy world. With an extensive investment and growth

strategy, the company will expand its powerful, green generation

capacity to 50 gigawatts internationally by 2030. RWE is investing

€50 billion gross for this purpose in this decade. The portfolio is

based on offshore and onshore wind, solar, hydrogen, batteries,

biomass and gas.

RWE Supply & Trading provides tailored

energy solutions for large customers. RWE has locations in the

attractive markets of Europe, North America and the Asia-Pacific

region. The company is responsibly phasing out nuclear energy and

coal. Government-mandated phaseout roadmaps have been defined for

both of these energy sources. RWE employs around 19,000 people

worldwide and has a clear target: to get to net zero by 2040. On

its way there, the company has set itself ambitious targets for all

activities that cause greenhouse gas emissions. The Science Based

Targets initiative has confirmed that these emission reduction

targets are in line with the Paris Agreement. Very much in the

spirit of the company’s purpose: Our energy for a sustainable

life.

FORWARD-LOOKING STATEMENTS

This press release contains certain

forward-looking statements including certain future oriented

financial information that are provided for the purpose of

presenting information about management’s current expectations and

plans. Readers are cautioned that such statements may not be

appropriate for other purposes. Northland’s actual results could

differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, the events anticipated

by the forward-looking statements may or may not transpire or

occur. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or

conditions, or include words such as “expects,” “anticipates,”

“plans,” “predicts,” “believes,” “estimates,” “intends,” “targets,”

“projects,” “forecasts” or negative versions thereof and other

similar expressions or future or conditional verbs such as “may,”

“will,” “should,” “would” and “could.” These statements may

include, without limitation, statements regarding Northland’s

expectations for future expected adjusted EBITDA, Free Cash Flows

(and as adjusted) and per share amounts, guidance, the completion

of construction, attainment of commercial operations, the potential

for future production from project pipelines, cost and output of

development projects, litigation claims, plans for raising capital,

and the future operations, business, financial condition, financial

results, priorities, ongoing objectives, strategies and outlook of

Northland and its subsidiaries. These statements are based upon

certain material factors or assumptions that were applied in

developing the forward-looking statements, including the design

specifications of development projects, the provisions of contracts

to which Northland or a subsidiary is a party, management’s current

plans and its perception of historical trends, current conditions

and expected future developments, as well as other factors that are

believed to be appropriate in the circumstances. Although these

forward-looking statements are based upon management’s current

reasonable expectations and assumptions, they are subject to

numerous risks and uncertainties. Some of the factors that could

cause results or events to differ from current expectations

include, but are not limited to, risks associated with revenue

contracts, impact of COVID-19 pandemic, Northland’s reliance on the

performance of its offshore wind facilities at Gemini, Nordsee One

and Deutsche Bucht for approximately 60% of its Adjusted EBITDA and

Free Cash Flow, counterparty risks, contractual operating

performance, variability of revenue from generating facilities

powered by intermittent renewable resources, offshore wind

concentration, natural gas and power market risks, operational

risks, recovery of utility operating costs, permitting,

construction risks, project development risks, acquisition risks,

financing risks, interest rate and refinancing risks, liquidity

risk, credit rating risk, currency fluctuation risk, variability of

cash flow and potential impact on dividends, taxation, natural

events, environmental risks, health and worker safety risks, market

compliance risk, government regulations and policy risks, utility

rate regulation risks, international activities, reliance on

information technology, labour relations, reputational risk,

insurance risk, risks relating to co-ownership, bribery and

corruption risk, legal contingencies, and the other factors

described in the “Risks Factors” section of Northland’s 2020 Annual

Information Form, which can be found at www.sedar.com under

Northland’s profile and on Northland’s website at

northlandpower.com. Northland’s actual results could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurances can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur.

The forward-looking statements contained in this

release are based on assumptions that were considered reasonable as

of the date hereof. Other than as specifically required by law,

Northland undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after such date or to

reflect the occurrence of unanticipated events, whether as a result

of new information, future events or results, or otherwise.

For further information, please

contact:

Northland Power Inc.Wassem Khalil,Senior

Director, Investor Relations & Strategy+1 (647)

288-1019Investorrelations@northlandpower.com

RWE Renewables GmbHSarah KnauberPress

spokesperson+49 201 5179-5404sarah.knauber@rwe.com

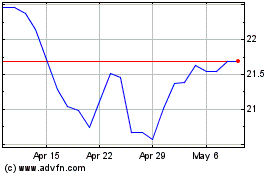

Northland Power (TSX:NPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

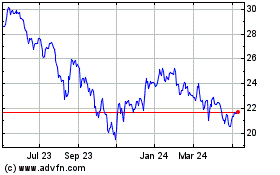

Northland Power (TSX:NPI)

Historical Stock Chart

From Apr 2023 to Apr 2024