Northland Power Inc. (“

Northland” or the

“

Company”) (TSX: NPI) today reported financial

results for the three months ended March 31, 2022. All dollar

amounts set out herein are in thousands of Canadian dollars, unless

otherwise stated.

“We delivered strong first quarter results

supported by improved performance and higher prices in the offshore

wind segment coupled with stable performance across the remainder

of our operating portfolio leading to a good start for the year,”

said Mike Crawley, Northland’s President and Chief Executive

Officer. “We continue to progress on our strategic priorities with

construction activities at our New York onshore wind projects and

Helios solar project in Colombia progressing as planned. Our team

continues to advance our Hai Long offshore wind project towards

achieving financial close, expected later this year and are

diligently working on securing the necessary agreements and

contracts. We also executed the sale of two of our efficient

natural gas facilities in Ontario, Iroquois Falls and Kingston,

resulting in a 24% reduction in our gas-fired generation capacity.

The sale further supports our efforts to reduce Northland’s carbon

intensity and repatriate capital to fund the growth of our

renewable development projects around the globe.”

First Quarter Highlights

Financial Results

-

Sales increased 13% to $695 million from $613

million in 2021 and Gross profit increased by 16%

to $636 million from $549 million in 2021.

- Adjusted

EBITDA (a non-IFRS measure) increased 17% to $420 million

from $360 million in 2021.

- Adjusted

Free Cash Flow per share (a non-IFRS measure) increased

15% to $0.84 from $0.73 in 2021.

- Free

Cash Flow per share (a non-IFRS measure) increased 17% to

$0.77 from $0.66 in 2021.

- Net

income increased 90% to $288 million from $151 million in

2021.

Sales, gross profit and net income, as reported

under IFRS, include consolidated results of entities not wholly

owned by Northland, whereas non-IFRS financial measures include

Northland’s proportionate ownership interest.

|

Summary of Consolidated Results |

|

|

|

| (in thousands of

dollars, except per share amounts) |

Three months ended March 31, |

|

|

|

2022 |

|

|

2021 |

|

FINANCIALS |

|

|

|

|

Sales |

$ |

695,054 |

|

$ |

612,766 |

|

Gross profit |

|

635,764 |

|

|

548,747 |

|

Operating income |

|

373,707 |

|

|

306,306 |

|

Net income (loss) |

|

287,580 |

|

|

151,389 |

|

Adjusted EBITDA (a non-IFRS measure) |

|

420,149 |

|

|

359,804 |

|

|

|

|

|

|

Cash provided by operating activities |

|

408,730 |

|

|

408,454 |

|

Adjusted Free Cash Flow (a non-IFRS measure) |

|

191,985 |

|

|

147,289 |

|

Free Cash Flow (a non-IFRS measure) |

|

174,375 |

|

|

134,448 |

|

Cash dividends paid |

|

47,393 |

|

|

39,953 |

|

Total dividends declared(1) |

$ |

68,496 |

|

$ |

60,740 |

| |

|

|

|

| Per

Share |

|

|

|

|

Weighted average number of shares - basic (000s) |

|

227,691 |

|

|

202,388 |

|

Net income (loss) - basic |

$ |

0.99 |

|

$ |

0.49 |

|

Adjusted Free Cash Flow - basic (a non-IFRS measure) |

$ |

0.84 |

|

$ |

0.73 |

|

Free Cash Flow - basic (a non-IFRS measure) |

$ |

0.77 |

|

$ |

0.66 |

|

Total dividends declared |

$ |

0.30 |

|

$ |

0.30 |

|

|

|

|

|

| ENERGY

VOLUMES |

|

|

|

|

Electricity production in gigawatt hours

(GWh) |

|

2,923 |

|

|

2,582 |

| (1) Represents

total dividends paid to common shareholders including dividends in

cash or in shares under the DRIP. |

Significant Events and Updates

Balance Sheet and Environmental, Social and Governance

Advancements:

- Sale of

Efficient Natural Gas Facilities – On April 7, 2022,

Northland completed the sale of its Iroquois Falls and Kingston

efficient natural gas facilities in Ontario, resulting in a 24%

reduction in gas-fired generation capacity. The sale further

supports efforts to reduce Northland’s carbon intensity and

repatriate capital to fund the growth of our renewable development

projects around the globe. The two facilities, with a combined

operating capacity of 230MW, had operated under long-term power

purchase agreements with the provincial system operator, which

expired at the end of 2021 and 2017, respectively.

-

At-The-Market Equity Program Established – On

March 1, 2022, Northland established an at-the-market equity

(“ATM program”) that allows Northland to issue up

to $500 million of common shares from treasury, at Northland’s

discretion. The program provides Northland with an additional

source of financing flexibility to fund its growth initiatives. As

at May 10, 2022, Northland issued a total of 3,844,500 common

shares for gross proceeds of $159 million.

-

Sustainability Report - Northland released its

fifth annual Sustainability Report, titled “Together our Power is

Boundless”, highlighting its 2021 Environmental, Social and

Governance (ESG) achievements. The report is available at

northlandpower.com.

-

Northland Corporate Credit Rating Re-affirmed – In

May 2022, Standard & Poor’s reaffirmed Northland’s corporate

credit rating of BBB (Stable). In addition, Northland’s preferred

share rating was reaffirmed on Standard & Poor’s Canada scale

of BB+.

Renewables Growth:

- Hai Long

Offshore Wind Project Update – Progress continues at

Hai Long in anticipation of achieving financial close later in the

year. The project team continues to work diligently to secure

agreements and contracts, including a corporate offtake agreement,

on the project ahead of financial close. The recent inflationary

and supply chain dynamics coupled with rising interest rates and

volatility in foreign exchange rates have created an environment

that requires close monitoring. As is normal business practice,

Northland continues to monitor and is working diligently to manage

these issues and their potential impacts on the project. The

Company continues to believe that Taiwan is a top tier jurisdiction

for offshore wind, and being a leader in this market developing the

largest project, alongside its partners and establishing supply

chain and strong government relations will benefit the Hai Long

project and the sector over the long term.

- Onshore

Renewable Projects – Construction activities at the two

New York onshore wind projects is progressing as planned with the

projects expected to complete all construction activities in 2022.

The first turbines are expected to be delivered to Bluestone Wind

in June and Ball Hill Wind in August 2022. At Northland’s Helios

solar project in Colombia, construction and energization of the

first phase of the project, encompassing 10MW, is complete.

Construction on the second phase (6MW) has commenced with full

commercial operations expected later in 2022.

- ScotWind

Offshore Wind Project – On January 17, 2022, Northland

announced that it was awarded two offshore wind leases in the Crown

Estate Scotland auction with a total combined capacity of 2,340MW.

The two leases, one fixed foundation (840MW) and one floating

foundation (1,500MW), will extend Northland’s development runway

into the next decade, with commercial operations expected at the

end of 2029/2030 for the fixed and early 2030s for the

floating.

- Nordsee Offshore Wind

Cluster – In January 2022, Northland and its German

partner, RWE Renewables GmbH (RWE), announced the formation of a

1,333MW Nordsee Offshore Wind Cluster partnership encompassing

Nordsee Two (433MW), Nordsee Three (420MW) and Nordsee Delta

(480MW). Northland holds a 49% interest in the new partnership,

with RWE holding 51%. The projects are expected to be developed and

managed on a joint basis by both parties and are expected to

achieve commercial operations between 2026 and 2028.

First Quarter Results Summary

Offshore wind facilities

Electricity production increased 11% or 143GWh

compared to the same quarter of 2021 primarily due to higher wind

resource and fewer uncompensated outages at the German facilities,

partially offset by reduced turbine availability at Nordsee One due

to the RSA replacement campaign.

Sales of $397 million increased 7% or $25

million compared to the same quarter of 2021 primarily due to

higher APX at Gemini and higher production across all facilities.

The continued higher prices in Europe resulted in the APX exceeding

the subsidy top-up for Gemini, allowing it to realize higher

revenues in the quarter. Whereas foreign exchange rate fluctuations

reduced sales by $29 million compared to the same quarter of 2021.

Free Cash Flow is largely hedged and was therefore unaffected. The

final APX income realized for 2022 will depend on average APX

levels over the course of the year.

Adjusted EBITDA of $262 million increased 8% or

$20 million compared to the same quarter of 2021 primarily due to

higher wind resource across all three facilities, higher APX at

Gemini and fewer unpaid curtailments at the German facilities,

partially offset by turbine availability losses at Nordsee One and

foreign exchange rate fluctuations.

An important indicator for the offshore wind

facilities is the historical average of the power production of

each offshore wind facility, where available. The following table

summarizes actual electricity production and the historical

average, high and low for the applicable operating periods of each

offshore facility:

|

Three months ended March 31, |

2022(1) |

|

2021(1) |

|

HistoricalAverage(2) |

|

HistoricalHigh(2) |

|

HistoricalLow(2) |

|

|

Electricity production (GWh) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Gemini |

722 |

|

668 |

|

704 |

|

826 |

|

629 |

|

| Nordsee One |

357 |

|

312 |

|

346 |

|

408 |

|

312 |

|

|

Deutsche Bucht |

322 |

|

279 |

|

316 |

|

348 |

|

279 |

|

|

Total |

1,401 |

|

1,259 |

|

|

|

|

|

|

|

| (1) Includes GWh

produced and attributed to paid curtailments. |

| (2) Represents the

average historical power production for the period since the

commencement of commercial operation of the respective facility

(2017 or Gemini and Nordsee One and 2020 for Deutsche Bucht) and

excludes unpaid curtailments. |

Onshore renewable facilities

Electricity production was 82% or 292GWh higher

than the same quarter of 2021 due to the contribution from the

Spanish portfolio acquired in August 2021.

Sales of $128 million were 140% or $75 million

higher than the same quarter of 2021 primarily due to the

contribution from the Spanish portfolio.

Adjusted EBITDA of $100 million was higher than

the same quarter of 2021. Excluding the contribution from the

Spanish portfolio, production, sales and Adjusted EBITDA in the

first quarter would have been 10%, 4% and 5% higher, respectively,

due to higher wind resource partially offset by heavier snowfall

affecting solar facilities. Refer to Northland’s 2021 Annual Report

for additional information on the Spanish portfolio.

Efficient natural gas facilities

Electricity production decreased 10% or 94GWh

compared to the same quarter of 2021 compared to the same quarter

of 2021 due to the effect of Kirkland Lake operating under the

enhanced dispatch contract (EDC) compared to the

baseload PPA until July 2021.

Sales and Adjusted EBITDA of $101 million and

$56 million, respectively, decreased 16% or $20 million and 27% or

$20 million compared to the same quarter of 2021 largely due to the

expiry of the PPA at Iroquois Falls in December 2021.

Utilities

Sales and Adjusted EBITDA of $65 million and $27

million, respectively, increased 14% or $8 million and 19% or $4

million compared to the same quarter of 2021 largely due to rate

escalations positively affecting EBSA’s performance.

In December 2021, Northland restructured and

upsized EBSA’s long-term, non-recourse financing (the “EBSA

Facility”), resulting in $84 million of incremental cash proceeds

to Northland, net of closing costs. The upfinancing was completed

on the basis of growth in EBSA’s projected EBITDA growth for 2022,

based on increases in the rate base. Net upsizing proceeds, in

excess of EBSA’s expansionary capital expenditures, of $13 million

are included in Free Cash Flow in the first quarter.

Statement of income (loss)

General and administrative

(G&A) costs of $20 million in the first

quarter increased 24% or $4 million compared to the same quarter of

2021 primarily due to higher personnel and other costs in support

of Northland’s global growth.

Development costs of $18 million in the first

quarter increased 30% or $4 million compared to the same quarter of

2021 primarily due to higher costs incurred to advance early- to

mid-stage development projects and overhead costs, including

personnel and other costs to support global growth.

Net finance costs of $82 million in the first

quarter decreased 6% or $5 million compared to the same quarter of

2021 primarily as a result of scheduled repayments on

facility-level loans.

Fair value gain on derivative contracts was $128

million in the first quarter primarily due to net movements in the

fair value of derivatives related to the commodity, interest rates

and foreign exchange contracts.

Foreign exchange loss of $32 million in the

first quarter primarily due to unrealized losses from fluctuations

in the closing foreign exchange rates.

Net income of $288 million in the first quarter

increased 90% or $136 million in the first quarter of 2022 compared

to the same quarter of 2021 primarily as a result of the factors

described above, partly offset by a $48 million higher total tax

expense.

Adjusted EBITDA

|

|

Three months ended March 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Net income (loss) |

$ |

287,580 |

|

|

$ |

151,389 |

|

| Adjustments: |

|

|

|

|

Finance costs, net |

|

81,757 |

|

|

|

87,090 |

|

|

Gemini interest income |

|

3,707 |

|

|

|

3,981 |

|

|

Share of joint venture project development costs |

|

2,795 |

|

|

|

(755 |

) |

|

Acquisition costs |

|

481 |

|

|

|

1,619 |

|

|

Provision for (recovery of) income taxes |

|

100,554 |

|

|

|

52,265 |

|

|

Depreciation of property, plant and equipment |

|

147,415 |

|

|

|

145,300 |

|

|

Amortization of contracts and intangible assets |

|

10,058 |

|

|

|

9,940 |

|

|

Fair value (gain) loss on derivative contracts |

|

(133,445 |

) |

|

|

(54,983 |

) |

|

Foreign exchange (gain) loss |

|

32,374 |

|

|

|

29,666 |

|

|

Impairment loss |

|

— |

|

|

|

29,981 |

|

|

Elimination of non-controlling interests |

|

(100,854 |

) |

|

|

(94,502 |

) |

|

Finance lease (lessor) |

|

(1,664 |

) |

|

|

(1,855 |

) |

|

Other adjustments |

|

(10,609 |

) |

|

|

668 |

|

|

Adjusted EBITDA |

$ |

420,149 |

|

|

$ |

359,804 |

|

Adjusted EBITDA of $420 million in the first

quarter, increased 17% or $60 million compared to the same quarter

of 2021. The significant factors increasing Adjusted EBITDA

include:

- $63 million

contribution from the Spanish portfolio of onshore wind and solar

facilities;

- $14 million

increase in operating results from the German facilities primarily

due to higher wind resource, fewer periods of uncompensated outages

and of negative prices, partially offset by reduced turbine

availability at Nordsee One due to the RSA replacement

campaign;

- $7 million

increase in operating results at Gemini primarily due to higher

wind resource and high APX; and

- $8 million

increase in operating results at EBSA due to rate escalations and

at Canadian wind facilities due to higher wind resource.

The factors partially offsetting the increase in

Adjusted EBITDA include:

- $25 million

decrease in operating results from Iroquois Falls due to the expiry

of its PPA in December 2021; and

- $9 million

increase in G&A costs and growth expenditures to support global

growth.

Adjusted Free Cash Flow and Free Cash Flow

|

|

Three months ended March 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Cash provided by operating activities |

$ |

408,730 |

|

|

$ |

408,454 |

|

| Adjustments: |

|

|

|

|

Net change in non-cash working capital balances related to

operations |

|

15,362 |

|

|

|

(15,049 |

) |

|

Non-expansionary capital expenditures |

|

(12,830 |

) |

|

|

(8,958 |

) |

|

Restricted funding for major maintenance, debt and decommissioning

reserves |

|

(5,094 |

) |

|

|

(1,533 |

) |

|

Interest paid |

|

(34,690 |

) |

|

|

(49,892 |

) |

|

Scheduled principal repayments on facility debt |

|

(40,441 |

) |

|

|

(33,810 |

) |

|

Funds set aside (utilized) for scheduled principal repayments |

|

(142,078 |

) |

|

|

(131,669 |

) |

|

Preferred share dividends |

|

(2,700 |

) |

|

|

(2,699 |

) |

|

Consolidation of non-controlling interests |

|

(46,448 |

) |

|

|

(41,740 |

) |

|

Investment income(1) |

|

4,176 |

|

|

|

5,165 |

|

|

Proceeds under NER300 and warranty settlement at Nordsee One |

|

17,712 |

|

|

|

7,766 |

|

|

Other(2) |

|

12,676 |

|

|

|

(1,587 |

) |

|

Free Cash Flow |

$ |

174,375 |

|

|

$ |

134,448 |

|

|

Add back: Growth expenditures |

|

17,610 |

|

|

|

12,841 |

|

|

Adjusted Free Cash Flow |

$ |

191,985 |

|

|

$ |

147,289 |

|

| (1) Investment

income primarily includes Gemini interest income. |

| (2) Other includes

adjustments for Nordsee One interest on shareholder loans, equity

accounting, acquisition costs and non-cash expenses adjusted in

working capital excluded from Free Cash Flow in the period. |

Adjusted Free Cash Flow of $192 million for the

three months ended March 31, 2022, was 30% or $45 million higher

than the same quarter of 2021.

The significant factors increasing Adjusted Free

Cash Flow were:

- $36 million

contribution from the Spanish portfolio of onshore wind and solar

facilities;

- $13 million

increase primarily from the net proceeds of the EBSA

refinancing;

- $6 million

decrease in net interest costs as a result of scheduled principal

repayments on facility-level loans; and

- $7 million

decrease due to timing of capital expenditures and of major

maintenance performed at operating facilities compared to last

year.

The factors partially offsetting the increase in

Adjusted Free Cash Flow were:

- $18 million

increase in current taxes primarily at the offshore wind facilities

as a result of better operating results; and

- $3 million

decrease in overall contribution across all facilities, excluding

the Spanish portfolio, as described in Adjusted EBITDA, primarily

due to the expiry of the Iroquois Falls PPA and higher project

development and corporate costs to support growth.

Free Cash Flow, which includes all

non-capitalized growth expenditures, amounted to $174 million for

the three months ended March 31, 2022, and was 30% or $40 million

higher than the same quarter of 2021. The significant factors

increasing Free Cash Flow were as described for Adjusted Free Cash

Flow but include the $5 million increase in growth

expenditures.

The following table reconciles Adjusted EBITDA

to Adjusted Free Cash Flow.

|

|

Three months ended March 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Adjusted EBITDA |

$ |

420,149 |

|

|

$ |

359,804 |

|

| Adjustments: |

|

|

|

|

Scheduled debt repayments |

|

(147,701 |

) |

|

|

(128,629 |

) |

|

Interest expense |

|

(61,281 |

) |

|

|

(61,663 |

) |

|

Income taxes paid |

|

(56,384 |

) |

|

|

(30,639 |

) |

|

Non-expansionary capital expenditure |

|

(10,919 |

) |

|

|

(8,599 |

) |

|

Utilization (funding) of maintenance and decommissioning

reserves |

|

(4,656 |

) |

|

|

(1,073 |

) |

|

Lease payments, including principal and interest |

|

(3,007 |

) |

|

|

(2,225 |

) |

|

Preferred dividends |

|

(2,700 |

) |

|

|

(2,699 |

) |

|

Foreign exchange hedge gain (loss) |

|

15,162 |

|

|

|

2,444 |

|

|

Proceeds under NER300 and warranty settlement at Nordsee One |

|

15,055 |

|

|

|

6,601 |

|

|

EBSA Refinancing proceeds, net of growth capital expenditures |

|

12,824 |

|

|

|

— |

|

|

Other(1) |

|

(2,167 |

) |

|

|

1,126 |

|

|

Free Cash Flow |

$ |

174,375 |

|

|

$ |

134,448 |

|

|

Add Back: Growth expenditures |

|

17,610 |

|

|

|

12,841 |

|

|

Adjusted Free Cash Flow |

$ |

191,985 |

|

|

$ |

147,289 |

|

| (1) Other includes

Gemini interest income and interest received on third-party loans

to partners. |

Refer to Northland’s 2021 Annual Report for

additional information on sources of liquidity in addition to

Adjusted Free Cash Flow.

Sustainability Report

The 2021 sustainability report provides enhanced

disclosures on Northland’s sustainability strategy including

reporting additional metrics and information related to supply

chain (including contractor health & safety, scope 3 greenhouse

gas emissions and supplier management) as well as additional detail

on human capital and talent development and engagement. The report

has been prepared in accordance with the Global Reporting

Initiative (GRI) Standards core option and in

alignment with the Sustainability Accounting Standards Board

(SASB) recommendations, and the Taskforce for

Climate-Related Financial Disclosures (TCFD). This

year’s report showcases the achievements that Northland has made on

its ESG initiatives including:

- Northland

renewables facilities have helped avoid 2.15 million tonnes of

C0₂e

- 26% reduction in

GHG emissions intensity from generation since 2019

- 24% reduction in

gas-fired generation capacity

- Provided

renewable energy to power over 1.7 million homes with renewable

energy

To read the report in full,

visit northlandpower.com

2022 Financial Outlook

As of May 10, 2022, management’s 2022

financial outlook remains unchanged from prior guidance. Adjusted

EBITDA in 2022 is expected to be in the range of $1.15 billion to

$1.25 billion, Adjusted Free Cash Flow per share in 2022 is

expected to be in the range of $1.65 to $1.85 and Free Cash Flow

per share in 2022 is expected to be in the range of $1.20 to

$1.40.

Northland continues to have sufficient liquidity

available to execute on its growth objectives. As at May 10,

2022, Northland had access to approximately $890 million of

cash and liquidity, comprising $590 million of liquidity

available under a syndicated revolving facility and

$300 million of corporate cash on hand.

First-Quarter Earnings Conference Call

Northland will hold an earnings conference call

on May 11, 2022, to discuss its 2022 first quarter results.

The call will be hosted by Northland’s Senior Management, who will

discuss the financial results and company developments as well as

answering questions from analysts.

Conference call details are as follows:

Wednesday, May 11, 2022, 10:00 a.m. ET

Conference ID: 7157118

Toll free (North America): (833) 693-0550

Toll free (International): (661) 407-1589

The call will also be broadcast live on the

internet, in listen-only mode and may be accessed on

northlandpower.com. For those unable to attend the live call, an

audio recording will be available on northlandpower.com on

May 12, 2022.

Northland’s unaudited interim condensed

consolidated financial statements for the three months ended March

31, 2022, and related Management’s Discussion and Analysis can

be found on SEDAR at www.sedar.com under Northland’s profile and on

northlandpower.com.

Annual Meeting of Shareholders

Northland Power will hold its Annual Meeting of

Shareholders (“Meeting”) on Wednesday, May 25, 2022, at 11 a.m. ET.

Northland Power’s Annual meeting of shareholders will be held in a

virtual-only meeting format. Shareholders will not be able to

attend the meeting physically. Shareholders can attend the Meeting

online, vote their shares electronically and submit questions

during the Meeting, by visiting

www.virtualshareholdermeeting.com/NPI2022. Instructions are

available

at northlandpower.com/en/investor-centre/annual-general-meeting.aspx

ABOUT NORTHLAND POWER

Northland Power is a global power producer

dedicated to helping the clean energy transition by producing

electricity from clean renewable resources. Founded in 1987,

Northland has a long history of developing, building, owning and

operating clean and green power infrastructure assets and is a

global leader in offshore wind. In addition, Northland owns and

manages a diversified generation mix including onshore renewables,

efficient natural gas energy, as well as supplying energy through a

regulated utility.

Headquartered in Toronto, Canada, with global

offices in eight countries, Northland owns or has an economic

interest in 3.0GW (net 2.6GW) of operating capacity. The Company

also has a significant inventory of projects in construction and in

various stages of development encompassing over 14GW of potential

capacity.

Publicly traded since 1997, Northland's common

shares, Series 1, Series 2 and Series 3 preferred shares trade on

the Toronto Stock Exchange under the symbols NPI, NPI.PR.A,

NPI.PR.B and NPI.PR.C, respectively.

NON-IFRS FINANCIAL MEASURES

This press release includes references to the

Company’s adjusted earnings before interest, income taxes,

depreciation and amortization (“Adjusted EBITDA”),

Adjusted Free Cash Flow, Free Cash Flow and applicable payout

ratios and per share amounts, measures not prescribed by

International Financial Reporting Standards (IFRS), and therefore

do not have any standardized meaning under IFRS and may not be

comparable to similar measures presented by other companies.

Non-IFRS financial measures are presented at Northland’s share of

underlying operations. These measures should not be considered

alternatives to net income (loss), cash flow from operating

activities or other measures of financial performance calculated in

accordance with IFRS. Rather, these measures are provided to

complement IFRS measures in the analysis of Northland’s results of

operations from management’s perspective. Management believes

that Northland’s non-IFRS financial measures and applicable payout

ratio and per share amounts are widely accepted and understood

financial indicators used by investors and securities analysts to

assess the performance of a company, including its ability to

generate cash through operations.

FORWARD-LOOKING STATEMENTS

This press release contains statements that

constitute forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”)that are

provided for the purpose of presenting information about

management’s current expectations and plans. Readers are cautioned

that such statements may not be appropriate for other purposes.

Northland’s actual results could differ materially from those

expressed in, or implied by, these forward-looking statements and,

accordingly, the events anticipated by the forward-looking

statements may or may not transpire or occur. Forward-looking

statements include statements that are predictive in nature, depend

upon or refer to future events or conditions, or include words such

as “expects,” “anticipates,” “plans,” “predicts,” “believes,”

“estimates,” “intends,” “targets,” “projects,” “forecasts” or

negative versions thereof and other similar expressions or future

or conditional verbs such as “may,” “will,” “should,” “would” and

“could.” These statements may include, without limitation,

statements regarding future Adjusted EBITDA, Free Cash Flow and

Adjusted Free Cash Flow, respective per share amounts, dividend

payments and dividend payout ratios, guidance, the timing for the

completion of construction, attainment of commercial operations,

the potential for future production from project pipelines, cost

and output of development projects, litigation claims, plans for

raising capital, and the future operations, business, financial

condition, financial results, priorities, ongoing objectives,

strategies and the outlook of Northland and its subsidiaries. These

statements are based upon certain material factors or assumptions

that were applied in developing the forward-looking statements,

including the design specifications of development projects, the

provisions of contracts to which Northland or a subsidiary is a

party, management’s current plans and its perception of historical

trends, current conditions and expected future developments, as

well as other factors that are believed to be appropriate in the

circumstances. Although these forward-looking statements are based

upon management’s current reasonable expectations and assumptions,

they are subject to numerous risks and uncertainties. Some of the

factors include, but are not limited to, risks associated with

sales contracts, Northland’s reliance on the performance of its

offshore wind facilities at Gemini, Nordsee One and Deutsche Bucht

for approximately 50% of its Adjusted EBITDA and Free Cash Flow,

counterparty risks, contractual operating performance, variability

of sales from generating facilities powered by intermittent

renewable resources, offshore wind concentration, natural gas and

power market risks, operational risks, recovery of utility

operating costs, Northland’s ability to resolve issues/delays with

the relevant regulatory and/or government authorities, permitting,

construction risks, project development risks, acquisition risks,

financing risks, interest rate and refinancing risks, liquidity

risk, credit rating risk, currency fluctuation risk, variability of

cash flow and potential impact on dividends, taxation, natural

events, environmental risks, health and worker safety risks, market

compliance risk, government regulations and policy risks, utility

rate regulation risks, international activities, reliance on

information technology, labour relations, reputational risk,

insurance risk, risks relating to co-ownership, bribery and

corruption risk, legal contingencies, and the other factors

described in the “Risks Factors” section of Northland’s 2021 Annual

Information Form, which can be found at www.sedar.com under

Northland’s profile and on Northland’s website at

northlandpower.com. Northland’s actual results could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurances can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur.

The forward-looking statements contained in this

release are based on assumptions that were considered reasonable on

May 10, 2022. Other than as specifically required by law,

Northland undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after such date or to

reflect the occurrence of unanticipated events, whether as a result

of new information, future events or results, or otherwise.

For further information, please

contact:

Mr. Wassem Khalil, Senior Director, Investor

Relations647-288-1019investorrelations@northlandpower.comnorthlandpower.com

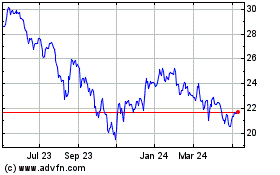

Northland Power (TSX:NPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

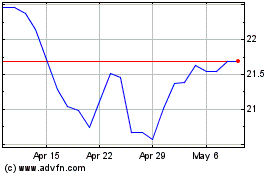

Northland Power (TSX:NPI)

Historical Stock Chart

From Apr 2023 to Apr 2024