NorthWest Healthcare Properties REIT Announces $165 Million Equity Financing

March 23 2022 - 3:32PM

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:

NWH.UN) (“NorthWest” or the “REIT”) announced today a public

offering, on a "bought deal" basis, of 10,870,000 trust units (the

“Units”) at a price of $13.80 per Unit (the “Offering Price”)

representing gross proceeds of approximately $150 million (the

"Public Offering"). The Public Offering is being made through a

syndicate of underwriters co-led by Scotiabank and RBC Capital

Markets.

The REIT has also granted the underwriters the

option to purchase up to an additional 1,630,500 Units to cover

over-allotments, if any, exercisable in whole or in part anytime up

to 30 days following closing of the Public Offering.

Concurrently with the Public Offering, the REIT

has also entered into an agreement to sell 1,086,955 trust units to

NorthWest Value Partners Inc. (“NWVP”), NorthWest's largest

unitholder, on a non-brokered private placement basis at the

Offering Price for gross proceeds of approximately $15 million (the

“Private Placement”, and together with the Public Offering, the

“Offering”). NWVP currently holds an approximate 13.1% interest in

NorthWest and is wholly-owned by Paul Dalla Lana, Chairman and CEO

of the REIT. Upon closing of the Private Placement, which is

expected to occur in May 2022, NWVP will hold an approximate 12.9%

effective interest in the REIT through ownership of trust units and

Class B LP units (or approximately 12.8% assuming the exercise in

full of the over-allotment option).

The REIT intends to use the net proceeds of the

Offering to partially fund its previously announced binding

agreement to acquire a portfolio of US healthcare real estate for

$764.3 million, as described in its March 15, 2022 press release

(the “US Acquisition”). The remaining proceeds, if any, will be

used to fund future acquisitions, to repay amounts outstanding on

its credit facilities and for general trust purposes.

Pro forma the US Acquisition and the Offering, NorthWest’s

proportionate leverage is expected to increase by 400 bps from

approximately 48.6% to approximately 52.6% and is expected to be

accretive on a leverage neutral basis. As the REIT executes on its

strategic initiatives, including the planned UK joint venture which

is expected to generate over $350 million in net proceeds,

proportionate leverage is expected to decrease by 590 bps to

approximately 46.7% and in line with the REIT’s previously stated

targets.

About the Offering

The Offering is subject to normal regulatory

approvals, including approval of the Toronto Stock Exchange. The

Public Offering is expected to close on or about March 31, 2022 and

the Private Placement is expected to close in May 2022.

The Units issued under the Public Offering will

be offered pursuant to the REIT's base shelf prospectus dated

November 27, 2020. The terms of the Offering will be described in a

prospectus supplement to be filed with securities regulators in all

provinces and territories of Canada and may also be offered by way

of private placement in the United States.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful.

About NorthWest Healthcare Properties

Real Estate Investment Trust

NorthWest Healthcare Properties Real Estate

Investment Trust (TSX:NWH.UN) is an unincorporated, open-ended real

estate investment trust established under the laws of the Province

of Ontario. As at Q4-2021 and pro forma the US Acquisition, the

REIT provides investors with access to a portfolio of high quality

international healthcare real estate infrastructure comprised of

interests in a diversified portfolio of 224 income-producing

properties and over 17.6 million square feet of gross leasable area

located throughout major markets in Canada, Brazil, Europe,

Australia and New Zealand. The REIT's portfolio of medical office

buildings, clinics, and hospitals is characterized by long term

indexed leases and stable occupancies. With a fully integrated and

aligned senior management team, the REIT leverages over 250

professionals across 11 offices in eight countries to serve as a

long term real estate partner to leading healthcare operators.

Forward Looking Information

This press release contains "forward-looking

statements" within the meaning of applicable securities laws,

including statements about the Offering and the proposed use of

proceeds thereof, the expected closing of the Private Placement and

the US Acquisition, NWVP’s expected ownership levels, the planned

UK joint venture, and pro forma and expected leverage levels. The

forward-looking statements in this news release are based on

certain assumptions, including without limitation that all

conditions to completion of the Offering will be satisfied or

waived, and that the REIT will be able to complete the US

Acquisition and planned UK joint venture on the terms previously

proposed and disclosed. These forward-looking statements are

subject to a number of risks and uncertainties that could cause

actual results or events to differ materially from current

expectations including the risk that the Offering, the US

Acquisition and the planned UK joint venture will not be completed

on the terms proposed or at all; or that other developments may

arise that result in the REIT having to further increase its

leverage. The statements in this news release are made as of the

date of this release. Although the REIT believes that the

assumptions inherent in the forward-looking statements are

reasonable, forward-looking statements are not guarantees of future

performance and, accordingly, readers are cautioned not to place

undue reliance on such statements due to the inherent uncertainty

therein. A discussion of the risk factors applicable to the REIT is

contained under the heading "Risk Factors" in the REIT's annual

information form dated March 29, 2021, a copy of which may be

obtained on the SEDAR website at www.sedar.com.

These securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any state securities laws

and may not be offered or sold in the United States or to U.S.

persons except in compliance with the registration requirements of

the U.S. Securities Act and applicable state securities laws or

pursuant to an exemption therefrom. Accordingly, this news release

does not constitute an offer for sale of securities in the United

States.

For Further Information:Paul

Dalla Lana CEO, NorthWest Healthcare Properties REIT(416) 366-8300

x1001

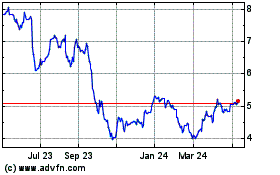

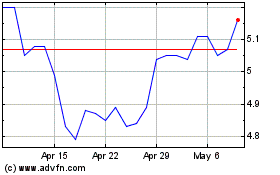

Northwest Healthcare Pro... (TSX:NWH.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Healthcare Pro... (TSX:NWH.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024