Petrus Resources Ltd. ("Petrus" or the "Company") (TSX: PRQ) is

pleased to announce that it has entered into an agreement for the

sale of its oil and natural gas interests in the Foothills area of

Alberta to an arm's length private company for total consideration

of $1.8 million, subject to customary closing conditions and

adjustments (the “Disposition”). The Disposition has an

effective date of November 1, 2019 and is expected to close in the

first quarter of 2020.

NON-CORE ASSET DISPOSITION

In the third quarter of 2019, production in the

Company’s Foothills area averaged approximately 390 boe/d (64%

natural gas), which comprised 5% of Petrus’ total production. The

Foothills assets include facility interests and 35,127 net acres of

undeveloped land. The Disposition is expected to reduce the

Company's indebtedness, operating expenses and future abandonment

liabilities. It is expected to reduce Petrus’ undiscounted,

uninflated decommissioning obligation by $7.5 million or 18%.

Following transfer of the non-core assets, Petrus’ liability

management ratio (LMR) is expected to improve from 4.6 to

approximately 5.2. Excluding the Foothills area assets,

Petrus’ third quarter 2019 operating expenses would have been

$3.39/boe.

The Company's total net debt at December 31,

2019 is expected to be approximately $124 million, down from $139.2

million and $226.7 million at the end of 2018 and 2015,

respectively. The cash proceeds from the Disposition will be

used to reduce the borrowings under the Company's revolving credit

facility.

OPERATIONS UPDATE

The previously announced drilling activity of 4

gross (1.6 net) Cardium light oil wells in the Company’s core area

of Ferrier, Alberta are now on production. The first 3 gross

(1.2 net) wells have been producing for approximately 3 months and

over the initial 30 days, their average production was

approximately 3,100 boe/d (1,200 boe/d net to Petrus) (85%

liquids). Cumulative gross light oil production from the 4

gross wells has been approximately 175 mbbl, and the Company

expects that two of these wells will have reached economic payout

by mid‑December (3.5 months). The Company expects to resume

drilling activity in the first quarter of 2020.

Petrus announces that Mr. Brett Booth, Mr.

Marcus Schlegel and Mr. Ross Keilly have resigned from their

management positions. The Company thanks them for their

service and wishes them the best in their future endeavours.

The Board of Directors is confident that the Company has sufficient

organizational capabilities to achieve the Company’s current

business objectives. Petrus intends to continue its

disciplined focus on balance sheet improvement and capital

deployment in 2020. The capital plan targets modest cash flow and

production growth while directing in excess of $10 million toward

debt reduction in 2020.

ABOUT PETRUS

Petrus is a public Canadian oil and gas company

focused on property exploitation, strategic acquisitions and

risk-managed exploration in Alberta.

For further information, please

contact:Neil Korchinski, P.Eng.President and Chief

Executive OfficerT: 403-930-0889E:

nkorchinski@petrusresources.com

ADVISORIES

Forward-Looking

StatementsCertain information regarding Petrus set

forth in this press release contains forward-looking statements

within the meaning of applicable securities law, that involve

substantial known and unknown risks and uncertainties. The

use of any of the words “anticipate”, “continue”, “estimate”,

“expect”, “may”, “will”, “project”, “should”, “believe” and similar

expressions are intended to identify forward-looking statements.

In particular, forward-looking statements in this press

release include, but are not limited to, statements with respect to

the use of proceeds of the Disposition, expected debt reduction,

impact of the Disposition on the Company's indebtedness, future

abandonment liabilities, decommissioning obligation, operating

expenses and LMR and 2020 capital plan. Such statements

represent Petrus’ internal projections, estimates or beliefs

concerning, among other things, an outlook on the estimated amounts

and timing of capital investment, anticipated future debt,

production, revenues or other expectations, beliefs, plans,

objectives, assumptions, intentions or statements about future

events or performance. These statements are only predictions

and actual events or results may differ materially. Although Petrus

believes that the expectations reflected in the forward-looking

statements are reasonable, it cannot guarantee future results,

levels of activity, performance or achievement since such

expectations are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Many factors could cause Petrus’ actual

results to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Petrus.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Petrus' expected total net debt at

December 31, 2019, which is subject to the same assumptions, risk

factors, limitations, and qualifications as set forth above.

Readers are cautioned that the assumptions used in the preparation

of such information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on FOFI. Petrus' actual results, performance

or achievement could differ materially from those expressed in, or

implied by, these FOFI, or if any of them do so, what benefits

Petrus will derive therefrom. Petrus has included the FOFI in order

to provide readers with a more complete perspective on Petrus'

expected 2019 year end net debt and such information may not be

appropriate for other purposes. Petrus disclaims any intention or

obligation to update or revise any FOFI statements, whether as a

result of new information, future events or otherwise, except as

required by law.

These forward-looking statements are subject to

certain risks and uncertainties, some of which are beyond the

Company’s control, including the impact of general economic

conditions; volatility in market prices for crude oil, NGL and

natural gas; industry conditions; currency fluctuation; any future

asset dispositions; and other risks described in Petrus’ annual

information form for the year ended December 31, 2018.

With respect to forward-looking statements contained in this

press release, Petrus has made certain assumptions, including in

relation to future borrowing base reviews and Petrus' acquisition

and divestiture program. Management has included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

shareholders with a more complete perspective on Petrus’ future

operations and such information may not be appropriate for other

purposes. Petrus’ actual results, performance or achievement

could differ materially from those expressed in, or implied by,

these forward-looking statements and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do so, what

benefits that the Company will derive therefrom. Readers are

cautioned that the foregoing lists of factors are not

exhaustive.

These forward-looking statements are made as of

the date of this press release and the Company disclaims any intent

or obligation to update any forward-looking statements, whether as

a result of new information, future events or results or otherwise,

other than as required by applicable securities laws.

Advisory Regarding Oil and Gas

InformationWhere applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. Boes may be misleading,

particularly if used in isolation. A boe conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil is based on

an energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead.

References herein to average 30-day initial

production rates and other short-term production rates are useful

in confirming the presence of hydrocarbons, however, such rates are

not determinative of the rates at which such wells will commence

production and decline thereafter and are not indicative of long

term performance or of ultimate recovery. While encouraging,

readers are cautioned not to place reliance on such rates in

calculating aggregate production for us or the assets for which

such rates are provided.

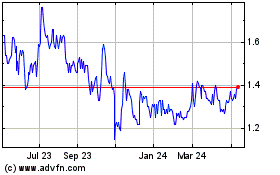

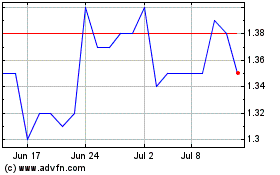

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024