Petrus Resources Ltd. ("

Petrus" or the

"

Company") (TSX: PRQ) is pleased to announce that

it has entered into a series of agreements (the

“

Transactions”) that will reduce the Company’s

total debt by approximately $49 million through the issuance of

$25.8 million of Petrus shares at $0.55 per share, and extend the

maturity date of the Company’s senior secured credit facility (the

"

First Lien Loan"). The Transactions will also

result in the full settlement of the Company’s subordinated secured

term loan (the "

Second Lien Loan") in the current

principal amount of $39.3 million (the "

Second Lien

Settlement") for $15.8 million of equity. Approval of the

Second Lien Settlement by the lenders of the Company’s First Lien

Loan was contingent on Petrus accelerating an incremental $10.0

million payment to further reduce its First Lien Loan. As a result,

concurrently with the Second Lien Settlement, Petrus will undertake

a private placement financing for proceeds of $10.0 million (the

"

Equity Financing"), which will be applied to

outstanding indebtedness under the First Lien Loan, resulting in a

substantial reduction of the Company’s indebtedness from an

aggregate of approximately $112 million to approximately $63

million, and additional stability under its First Lien Loan, with

expected annual interest savings of approximately $5 million and an

effective interest rate reduction of 2.4% from 7.4% to 5.0%. The

Second Lien Settlement and Equity Financing have been made possible

with additional investment by Don Gray, Glen Gray and Stuart Gray

(the Company’s “

Major Investors”).

The Transactions are expected to markedly

transform Petrus from a company with limited capital resources to a

company with the capital required to develop its currently

undeveloped land base, for the benefit of shareholders, employees

and all other stakeholders. Combined, the Equity Financing and

Second Lien Settlement will allow the First Lien Loan to be reduced

and the Second Lien Loan to be eliminated, which substantially

reduces the Company’s overall leverage and interest obligations.

This will provide Petrus with an opportunity to direct more cash

flow toward the development of its substantial inventory of liquids

rich gas wells in its core area, Ferrier. The Company’s most recent

Ferrier area well was drilled, completed and tied-in for $3.3

million and is currently producing 600 boe/d. At current commodity

prices, the well is expected to payout in less than 6 months. The

superior rates of return potential offered by the Company’s assets

strongly support continued investment to create shareholder

value.

Strategic Rationale for Transactions

In recent years, Petrus has faced an

increasingly challenging lack of liquidity. The Company has

actively sought out and evaluated a number of strategic

transactions intended to secure additional funding, but no viable

opportunities materialized. As a result of current debt levels, the

Company was forced to allocate a substantial portion of its cash

flow to pay down the First Lien Loan. First lien lenders also

required Petrus to make Second Lien Loan interest payments in kind,

which resulted in a constantly increasing level of high-interest

debt. This has left Petrus with limited ability to invest in

capital programs, stifling growth and the creation of shareholder

value. The Company’s first lien lenders indicated that the status

quo was not acceptable for continued lender support and further

extensions. The Equity Financing and Second Lien Settlement

transactions will effectively address all of these issues,

materially improving the Company’s balance sheet and providing

Petrus with the financial flexibility necessary to invest in the

future growth of the Company. In the absence of the Equity

Financing and Second Lien Settlement, if no alternative arrangement

can be negotiated prior to December 31, 2021, the lenders of the

First Lien Loan have the ability to declare all obligations under

the First Lien Loan to be due and payable at that time.

First Lien Extension

Petrus has completed its annual review of its

First Lien Loan. The Company’s syndicate of lenders under the First

Lien Loan have initially reconfirmed the borrowing base at $77.5

million and the maturity date of such loan has been updated to

December 31, 2021, provided that in the event the Second Lien

Settlement and the Equity Financing are completed on or before

October 1, 2021, the lenders under Petrus' First Lien Loan have

agreed to extend the maturity date thereof from December 31, 2021

to May 31, 2022. Petrus currently has approximately $73 million

drawn on the revolving credit facility of $77.5 million.

Second Lien Debt Settlement

In connection with the Second Lien Settlement,

Petrus has entered into a shares for debt agreement with Stuart

Gray and Glen Gray, who recently took assignment of the Company's

Second Lien Loan, pursuant to which Petrus will issue an aggregate

of 28,727,273 common shares of Petrus (the "Petrus

Shares") at an issue price of $0.55 per share (for total

consideration of $15.8 million), in consideration for the full

payment and discharge of amounts outstanding under the Second Lien

Loan, currently totalling $39.3 million. In connection with the

Second Lien Settlement, Stuart Gray will be issued 15,636,364

Common Shares and Glen Gray will be issued 13,090,909 Common

Shares.

Equity Financing

Concurrently with entering into the shares for

debt agreement in respect to the Second Lien Settlement, Petrus has

entered into binding subscription agreements with each of Don Gray

and Glen Gray to complete a private placement of Common Shares at

an issue price of $0.55 per share for total proceeds of $10.0

million (the "Equity Financing"). In connection

with the Equity Financing, Don Gray has committed to subscribe for

$8.6 million of Common Shares and Glen Gray has committed to

subscribe for $1.4 million of Common Shares. All of the proceeds of

the Equity Financing will be used to reduce amounts outstanding

under the First Lien Loan, which has approximately $73 million

currently outstanding.

Each of the Second Lien Settlement and the

Equity Financing are subject to customary terms and conditions,

including the concurrent closing of each of the Second Lien

Settlement and the Equity Financing.

Background and Considerations of the

Transactions

Since May 2021, Petrus and its lenders have

entered into a series of short term extensions, extending the

maturity dates of each of the First Lien Loan (originally due in

May 2021) and the Second Lien Loan (originally due in July 2021) to

provide Petrus an opportunity to come to terms with its lenders for

a longer term solution to the Company’s indebtedness and a general

debt reduction strategy. During this period, the original lender

under Petrus' Second Lien Loan, Macquarie Bank Limited, notified

Petrus that it had assigned its interest in the Second Lien Loan to

a new party, Blue Oak Partners (Canada) Inc. ("Blue

Oak") and that all amounts owing under the Second Lien

Loan were payable to Blue Oak.

In the course of discussions with the Company's

new creditor under the Second Lien Loan, Blue Oak, Petrus also

discussed a number of alternatives in relation to the reduction or

settlement of the Second Lien Loan, including various equity

conversion alternatives. As part of these discussions, Blue Oak

advised the Company that it may also be agreeable to sell, transfer

and assign its rights under the Second Lien Loan to a third party.

As such, certain of the Major Investors initiated discussions with

Blue Oak to acquire the Second Lien Loan. At the same time, Petrus

held numerous discussions with the lenders under its First Lien

Loan with respect to longer term extensions of the First Lien

Loan.

Such discussions have resulted in the agreement

of the lenders under the First Lien Loan to provide continued

support to Petrus and extend the term of the First Lien Loan,

provided that on or before October 1, 2021, the Equity Financing

(the proceeds of which would be used to pay down amounts under the

First Lien Loan) and the Second Lien Settlement are

completed. Further to this, certain of the Major

Investors have acquired the Second Lien Loan and have agreed with

Petrus to settle the obligations under the Second Lien Loan for

Petrus equity. Under the agreement with its lenders

under the First Lien Loan, the borrowing base of the First Lien

Loan will be reduced by $2.75 million on both September 30, 2021

and December 31, 2021 and by a further $5.0 million on March 31,

2022. In addition, Petrus and the lenders under the First Lien Loan

have agreed to a cash sweep provision under which 75% of excess

cash flow will be used to accelerate repayment of the Company’s

First Lien Loan.

Given the nature of the relationship of the

Major Investors to the Company (certain of the Major Investors

being "insiders" of the Company and each of the Major Investors

being siblings of one another and of Ken Gray, the President and a

director of Petrus), the board of directors of Petrus established a

committee of independent and disinterested directors of Petrus (the

"Independent Committee"), comprised of Don

Cormack, Patrick Arnell and Peter Verburg, to consider potential

matters in respect of any debt or equity transaction involving

Petrus and the Major Investors and to participate in any

discussions and negotiations on behalf of the Company in respect of

the same.

As part of their consideration of the Second

Lien Settlement and the Equity Financing, the Independent Committee

undertook a review of the Company's reasonable alternatives,

prospects and the Company's borrowing arrangements, including the

consideration of the factors and matters set forth below:

- the agreement of

the lenders under the First Lien Loan to extend the maturity date

of the First Lien Loan, provided the Equity Financing and Second

Lien Settlement are completed on or before October 1, 2021;

- the relative

absence of other alternatives reasonably available to Petrus to

refinance (by way of debt, equity or otherwise) its current

borrowing arrangements;

- the certainty

related to the full elimination of the Second Lien Loan, and the

potential for any defaults (which may lead to cross defaults under

the First Lien Loan) related thereto;

- the complete

elimination of the Second Lien Loan and the repayment of $10.0

million under the First Lien Loan would reduce total debt from

approximately $112 million to approximately $63 million, a decrease

of approximately 44%;

- the Second Lien

Settlement and the Equity Financing, combined with the related

extension of the maturity date of the First Lien Loan, would

mitigate certain solvency risks associated with the Company’s

status quo position, including the risk of near immediate debt

maturities, and potential creditor or similar proceedings in

connection to the same, which may have the effect of reducing or

eliminating any value associated with Petrus' equity;

- based on current

production and the pricing forecast by the Company’s independent

reserve evaluator, Petrus anticipates it will generate

approximately $15 to $17 million in funds flow during Q4 2021 and

Q1 2022, much of which Petrus intends to apply to the reduction of

outstanding amounts under its First Lien Loan, further

de-leveraging the Company’s balance sheet and providing potential

liquidity to resume drilling and development opportunities;

- the proposed

issue price per share in the Transactions will be $0.55 per share,

representing a greater than 10% premium to the market price of the

Common Shares (based on the five-day VWAP of the Common Shares

prior to the initial announcement of the Transaction);

- the elimination of

the Second Lien Loan for $15.8 million in equity is approximately

$23 million less than the amounts outstanding under the Second Lien

Loan;

- the effective

payoff of the Second Lien Loan in equity, preserves the Company’s

cash resources which may be used for other expenditures, including

further payments under the First Lien Loan and for general

investment purposes;

- that since July

2020, all interest under the Second Lien Loan, which currently

carries interest at approximately 10% per annum, is capitalized as

principal under the Second Lien Loan, which has a compounding

effect to increase the principal amount payable thereunder from

time to time;

- the advantages

of having potential funding available to resume development of the

Company’s asset base, with a view to increase production, reserve

and revenue generating activities for the benefit of all

stakeholders;

- the risks

associated with trying to secure funding from other third parties,

including the risk that such funding may not be available, on any

reasonable terms, measured against the relative certainty of the

transaction; and

- the current and

proposed equity ownership level of each of the Major Investors,

noting that based on their current positions and that the Major

Investors have invested significant resources into Petrus,

including through investment in the Common Shares, and their

interest in acquiring additional Common Shares, indicate a strong

alignment of interest with the Company’s other equity holders.

As at June 30, 2021, Petrus has a working

capital deficiency (excluding non-cash risk management assets and

liabilities, and lease obligations) of $110.3 million. Furthermore,

Petrus has not serviced the interest on its Second Lien Loan in

cash since July 2020, and all interest obligations thereunder are

capitalized, which further compounds the amounts payable

thereunder.

Relationship of the Major Investors and the

Company

Don Gray is a director of the Company, who owns

or controls (directly or indirectly) 13,022,476 Common Shares

(representing 26.3% of the outstanding Common Shares). Glen Gray

owns or controls (directly or indirectly) 6,708,867 Common Shares

(representing 13.6% of the outstanding Common Shares). As such, the

Second Lien Settlement and the Equity Financing are each with

"related parties" and constitute a "related party transaction" for

the purposes of Multilateral Instrument 61-101 - Protection of

Minority Security Holders in Special Transactions ("MI

61-101") and are with "insiders" for the purposes of the

TSX Company Manual.

It is anticipated that the Second Lien

Settlement and the Equity Financing will result in the issuance of

Common Shares to Don Gray and Glen Gray, each "insiders" of the

Company, in an amount greater than 10% of the number of Common

Shares outstanding, such that shareholder approval of such issuance

would be required pursuant to subsection 607(g) of the TSX Company

Manual. In addition, the issuance of Common Shares pursuant to the

Second Lien Settlement and the Equity Financing may be considered

by the TSX to materially affect control of the Company as each of

the Major Investors will own or control in excess of 20% of the

Common Shares after giving effect to the Second Lien Settlement and

the Equity Financing, such that shareholder approval of such

issuances may also be required pursuant to subsection 604(a)(i) of

the TSX Company Manual. Additionally, in accordance with Section

604(a)(ii) of the TSX Company Manual, where a transaction involves

consideration paid or received by "insiders" of the issuer in

excess of 10% of the issuer's market capitalization in any 6-month

period, the TSX requires that the transaction be approved by the

issuer's security holders to the exclusion of those security

holders who are "insiders" of the Company.

A summary of the current and anticipated Common

Share ownerships of each of the Major Investors is set forth

below:

|

Name of Shareholder |

|

Securities Currently Owned, Controlledor

Directed (and % of issued and outstanding) |

|

Securities to be Owned, Controlledor

Directed (and % of issued and outstanding) (1) |

|

Don Gray |

|

13,022,476 (26.3%) |

|

28,658,840 (29.7%)(2) |

|

|

|

|

|

|

|

Glen Gray |

|

6,715,867 (13.7%) |

|

22,352,231 (23.2%)(3) |

|

|

|

|

|

|

|

Stuart Gray |

|

4,941,867 (9.9%) |

|

20,578,231 (21.3%)(4) |

Notes:(1) Based on 49,558,622 issued

and outstanding Common Shares.(2) Assumes Mr. Don Gray

subscribes for and acquires 15,636,364 Common Shares pursuant to

the Equity Financing.(3) Assumes Mr. Glen Gray

subscribes for and acquires 2,545,455 Common Shares pursuant to the

Equity Financing and is issued 13,090,909 Common Shares pursuant to

the Second Lien Settlement.(4) Assumes Mr. Stuart Gray

is issued 15,636,364 Common Shares pursuant to the Second Lien

Settlement.

The Company has applied to the TSX for relief

from the foregoing shareholder approval requirements on the basis

that the Independent Committee has determined that Petrus is in

serious financial difficulty and that the Equity Financing together

with the Second Lien Settlement, is designed to improve Petrus'

financial situation and the terms of the Equity Financing and the

Second Lien Settlement are reasonable for the Company in the

circumstances. The Independent Committee also considered the need

for a timely completion of the Equity Financing and the Second Lien

Settlement, as required by its lenders under the First Lien Loan,

and the ability of the Company to complete such transactions in the

timelines required by its lenders. There is no certainty that the

TSX will approve the Equity Financing or the Second Lien

Settlement.

In connection with reliance on the above

described "financial hardship" exemption from the TSX's shareholder

approval requirements, it is expected that the TSX will place

Petrus under a delisting review, which is normal practice when a

listed issuer seeks to rely on this exemption. No assurance can be

provided as to the outcome of such review and, therefore, on the

Company's continued qualification for listing on the TSX.

Petrus has determined that the Equity Financing

together with the Second Lien Settlement is also exempt from the

formal valuation and minority approval requirements applicable to

related party transactions under MI 61-101 pursuant to the

financial hardship exemptions set forth in Sections 5.5(g) and

5.7(1)(e) of MI 61-101. In connection with the same, and as noted

above, the Independent Committee has determined that: (i) Petrus is

in serious financial difficulty; (ii) the Equity Financing and the

Second Lien Settlement is designed to improve the financial

position of the Company; and (iii) the terms of the Equity

Financing and the Second Lien Settlement are reasonable in the

circumstances of the Company. A discussion and description of the

review and approval process adopted by the Independent Committee

and other information required by MI 61-101 in connection with the

Equity Financing and the Second Lien Settlement will be set forth

in the Company's material change report to be filed under the

Company's SEDAR profile at www.sedar.com.

Petrus expects to announce additional

information respecting the Equity Financing and the Second Lien

Settlement, in particular related to the Company's reliance on the

"financial hardship" exemption from the TSX's shareholder approval

requirements.

ABOUT PETRUS

Petrus is a public Canadian oil and gas company

focused on property exploitation, strategic acquisitions and

risk-managed exploration in Alberta.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Ken Gray President and Chief Executive Officer

T: 403-930-0889 E: kgray@petrusresources.com

CAUTIONARY STATEMENTS:

Forward-Looking Statements

This news release contains forward‐looking

statements regarding the Second Lien Settlement and Equity

Financing, closing of the Second Lien Settlement and Equity

Financing and the timing of the same, use of proceeds of Equity

Financing and the benefits and impacts thereof on Petrus, the

Company's ability to continue as a going concern, the payout

periods for certain of the Company's new wells and the Company’s

continued qualification for listing on the TSX. These

forward‐looking statements are provided as of the date of this news

release, or the effective date of the documents referred to in this

news release, as applicable, and reflect predictions, expectations

or beliefs regarding future events based on the Company's beliefs

at the time the statements were made, as well as various

assumptions made by and information currently available to them. In

making the forward-looking statements included in this news

release, the Company has applied several material assumptions,

including, but not limited to, the assumption that regulatory

approval of the Second Lien Settlement and Equity Financing will be

obtained in a timely manner; that all conditions precedent to the

completion of the Second Lien Settlement and Equity Financing will

be satisfied in a timely manner; and that general economic and

business conditions will not change in a materially adverse manner,

well production rates and commodity prices,. Although management

considers these assumptions to be reasonable based on information

available to it, they may prove to be incorrect. By their very

nature, forward‐looking statements involve inherent risks and

uncertainties, both general and specific, and risks exist that

estimates, forecasts, projections and other forward‐looking

statements will not be achieved or that assumptions on which they

are based do not reflect future experience. We caution readers not

to place undue reliance on these forward‐looking statements as a

number of important factors could cause the actual outcomes to

differ materially from the expectations expressed in them. These

risk factors may be generally stated as the risk that the

assumptions expressed above do not occur, but specifically include,

without limitation, risks relating to: general market conditions;

the Company’s ability to secure financing on favourable terms; the

failure to receive all applicable third party and regulatory

approvals for the Transaction, and the additional risks described

in the Company's latest Annual Information Form, and other

disclosure documents filed by the Company on SEDAR. The foregoing

list of factors that may affect future results is not exhaustive.

When relying on our forward‐looking statements, investors and

others should carefully consider the foregoing factors and other

uncertainties and potential events. The Company does not undertake

to update any forward‐looking statement, whether written or oral,

that may be made from time to time by the Company or on behalf of

the Company, except as required by law.

Where amounts are expressed on a barrel of oil

equivalent (“Boe”) basis, natural gas volumes have been converted

to Boe using a ratio of 6,000 cubic feet of natural gas to one

barrel of oil (6 Mcf: 1 Bbl). This Boe conversion ratio is based on

an energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. Given the value ratio based on the current price of crude

oil as compared to natural gas is significantly different from the

energy equivalency of 6 Mcf: 1 Bbl, utilizing a conversion ratio at

6 Mcf: 1 Bbl may be misleading as an indication of value. In this

release, mboe refers to thousands of barrels of oil equivalent,

while mbbls refers to thousands of barrels of oil, and mmcf refers

to millions of cubic feet of natural gas.

Production volumes stated herein may include

production from wells that have recently commenced production.

Initial production rates are useful in confirming the presence of

hydrocarbons, however, such results and rates are not determinative

of the rates at which such wells will continue production and

decline thereafter. While encouraging, readers are cautioned not to

place reliance on such rates in calculating the aggregate

production for the Company. Initial production rates may be

estimated based on other third party estimates or limited data

available at the time. In all cases herein, initial production

results are not necessarily indicative of long-term performance of

the relevant well or fields or of ultimate recovery of

hydrocarbons.

This press release also contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about the Company's

estimated funds flow during Q4 2021 and Q1 2022, all of which are

subject to the same assumptions, risk factors, limitations, and

qualifications as set forth in above. Readers are cautioned that

the assumptions used in the preparation of such information,

although considered reasonable at the time of preparation, may

prove to be imprecise and, as such, undue reliance should not be

placed on FOFI. Our actual results, performance or achievements,

estimated funds flow during Q4 2021 and Q1 2022, could differ

materially from those expressed in, or implied by, these FOFI, or

if any of them do so, what benefits we will derive therefrom. We

have included the FOFI in this press release in order to provide

readers with a more complete perspective on our prospective results

of operation, including the Company's estimated funds flow during

Q4 2021 and Q1 2022, and such information may not be appropriate

for other purposes. The FOFI and other information contained in

this press release are made as of the date hereof and we undertake

no obligation to update publicly or revise any FOFI, whether as a

result of new information, future events or otherwise, unless so

required by applicable securities laws.

This press release shall not constitute

an offer to sell or the solicitation of an offer to buy securities

of the Company in the United States nor shall there be any sale of

securities of the Company in any jurisdiction in which such offer,

solicitation or sale would be unlawful. The securities described

herein have not been, and will not be, registered under the United

States Securities Act of 1933, as amended, or the securities laws

of any state of the United States. Accordingly, any of the

securities described herein may not be offered or sold in the

United States or to U.S. persons unless an exemption from

registration is available.

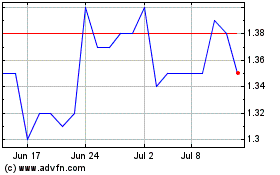

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

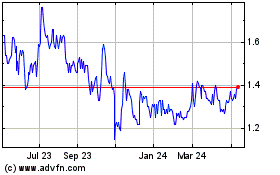

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024