Royal Bank of Canada to Pay Fine Over Municipal Bonds Charges by SEC

September 17 2021 - 9:18AM

Dow Jones News

By Adriano Marchese

Royal Bank of Canada has agreed to pay $800,000 to resolve a

charge that it was engaged in unfair dealing in municipal-bond

offerings, the U.S. Securities and Exchange Commission said on

Friday.

The regulator said RBC improperly allocated bonds intended for

institutional customers parties that would buy and then resell

bonds--known as flipping--to other broker-dealers at a profit over

a period of nearly four years.

"In addition, the order finds that, in three instances where an

issuer had instructed RBC to place retail customer orders first,

RBC violated those instructions by allocating bonds to flippers

ahead of orders for retail customers," the SEC said.

Among the findings, the regulator said RBC knew or should have

known that flippers weren't eligible for retail or institutional

priority and it would violate RBC's internal priority policy on

those bonds in primary offerings.

RBC has consented to a public administrative and

cease-and-desist order that finds it had violated the rules, but it

has neither admitted nor denied the findings.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

September 17, 2021 10:03 ET (14:03 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

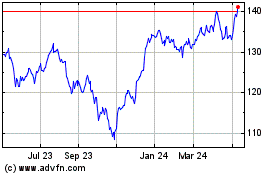

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

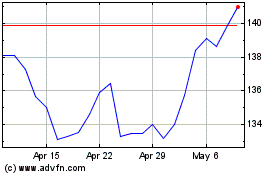

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024