NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

All amounts are Canadian dollars unless otherwise indicated.

Sherritt International Corporation ("Sherritt" or the "Corporation") (TSX:S)

today reported a first-quarter 2014 loss of $48.2 million ($0.16 per share),

compared to earnings of $23.1 million ($0.08 per share) for first-quarter 2013.

Earnings were affected by the impact of higher financing expense related to

foreign exchange losses as a result of the weakening of the Canadian dollar

against the U.S. dollar ($9.8 million, after-tax, or $0.03 per share), and by

depreciation, depletion, and amortization being recognized at Ambatovy for the

first time following the declaration of commercial production in January 2014

($27.5 million for Sherritt's 40% share, or $0.09 per share).

Despite the impact of lower nickel prices, which averaged US$6.64 per pound in

first-quarter 2014, Adjusted EBITDA remained strong at $54.9 million ($0.18 per

share). Adjusted operating cash flow for first-quarter 2014 was $0.26 per share,

compared to $0.18 per share in first-quarter 2013.

First-Quarter Highlights

-- Ambatovy met the requirements for commercial production, (70% of ore

throughput of nameplate capacity in the pressure acid leach (PAL)

circuit, averaged over 30 days) in January 2014.

-- Ambatovy sold the first two months of commercial production at market

prices, generating $127.1 million (100% basis) in revenue. Net direct

cash costs for nickel of US$6.83 per pound at Ambatovy were within

guidance at reported production rates and lower than current market

prices.

-- On April 28, 2014 Sherritt completed the agreements to sell its Coal

operations. As a result of the sale, Sherritt received $793 million in

cash and expects to record a gain on the sale of the Coal royalty

operations in second-quarter 2014 in addition to changes to working

capital and other closing adjustments. The transaction is a part of the

Corporation's strategic focus of strengthening its balance sheet,

streamlining its business model and concentrating its focus on the base

metals and Cuba assets.

-- Unit operating costs were lower on a year-over-year basis in the main

businesses. In Metals, mining and processing costs were lower, primarily

due to lower sulphur and sulphuric acid input commodity prices. In Oil

and Gas, unit operating costs in Cuba decreased primarily due to higher

net production.

-- The Corporation continues to target savings in excess of $33 million in

2014 in general and administrative, and other costs. In the first

quarter of 2014, approximately 58% ($19 million) of the projected

savings were realized, including reduced headcount, salary freezes and

lower bonus payouts across the organization, as well as other cost

structure reductions. The cost saving measures will be partly offset by

other non-recurring costs such as the Coal transaction costs, consulting

costs related to the special Shareholders' meeting and severance costs.

"Momentum in our business increased during the quarter due to a number of

factors," said David Pathe, President and CEO. "We achieved an important

milestone at Ambatovy in meeting the requirements for commercial production.

Finished nickel sales volumes in our Metals business increased by 64%, largely

due to the first commercial sales at Ambatovy, further enhancing Sherritt's

position to benefit from the strengthening nickel price. We also closed the Coal

transaction and made significant strides in our ongoing efforts to reduce costs.

The market has begun to recognize the progress we have made in our business and

the improvements in our operating environment. Our near-term focus continues to

be paying down debt, meeting our cost reduction targets, and moving Ambatovy

forward."

CONSOLIDATED FINANCIAL DATA Three months ended

March 31,

($ millions unless otherwise noted) 2014 2013

----------------------------------------------------------------------------

Revenue

Metals $ 160.1 $ 103.7

Oil and Gas 76.9 71.1

Power 11.9 16.0

Corporate, other 1.8 1.2

Adjustments for Metals Joint Ventures(1) (129.8) (85.0)

----------------------------------------------------------------------------

Total revenue 120.9 107.0

----------------------------------------------------------------------------

Adjusted EBITDA(2)

Metals 2.8 16.9

Oil and Gas 60.4 57.4

Power 4.9 3.5

Corporate, other (13.2) (16.5)

----------------------------------------------------------------------------

Total Adjusted EBITDA(2) 54.9 61.3

----------------------------------------------------------------------------

Operating profit (loss)(2)

Metals (34.1) 7.0

Oil and Gas 43.6 41.4

Power 0.9 0.9

Corporate, other (14.2) (17.4)

Adjustments for Metals Joint Ventures(1) (12.5) (4.8)

----------------------------------------------------------------------------

Earnings (loss) from operations, associate and

joint venture (16.3) 27.1

----------------------------------------------------------------------------

Net finance expense 40.8 26.9

Income tax expense 13.4 2.8

----------------------------------------------------------------------------

Net (loss) from continuing operations (70.5) (2.6)

Net earnings from discontinued operations, net

of tax 22.3 25.7

----------------------------------------------------------------------------

Net earnings (loss) (48.2) 23.1

----------------------------------------------------------------------------

Basic and diluted earnings (loss) per share ($

per share)

Net earnings (loss) from continuing

operations (0.24) (0.01)

Net earnings (loss) (0.16) 0.08

Adjusted operating cash flow - total ($ per

share)(2) 0.26 0.18

Net working capital balance(3) 478.2 850.1

Spending on capital and intangibles(4) 25.6 23.3

Total assets 6,605.5 6,664.7

Shareholders' equity 3,176.7 3,707.9

Long-term debt to total assets (%) 38 32

Weighted-average number of shares (millions)

Basic 297.0 296.5

Diluted 297.3 296.9

----------------------------------------------------------------------------

(1) Reflects the adjustments for equity-accounted investments in the Moa and

Ambatovy Joint Ventures that are included within the Metals segment.

(2) For additional information see the 'Non-GAAP Measures' section of this

release.

(3) Net working capital is calculated as total current assets less total

current liabilities.

(4) Spending on capital and intangibles includes accruals and does not

include spending at Coal, which is classified as a discontinued

operation, or service concession arrangements.

For the period ended March

CONSOLIDATED SALES DATA 31,

(units as noted) 2014 2013

----------------------------------------------------------------------------

Sales volumes

Nickel (thousands of pounds)

Moa Joint Venture (50% basis) 8,428 8,631

Ambatovy Joint Venture (40% basis)(1) 5,738 -

----------------------------------------------------------------------------

Total nickel (Sherritt's share) 14,166 8,631

----------------------------------------------------------------------------

Cobalt (thousands of pounds)

Moa Joint Venture (50% basis) 858 909

Ambatovy Joint Venture (40% basis)(1) 425 -

----------------------------------------------------------------------------

Total cobalt (Sherritt's share) 1,283 909

----------------------------------------------------------------------------

Oil and gas (boepd, net working-interest

production) 11,776 10,871

Electricity (GWh, 33 1/3% basis) 187 160

Thermal coal - Prairie Operations (millions of

tonnes) 4.9 5.7

Thermal coal - Mountain Operations (millions of

tonnes) 0.9 0.6

Average-realized prices(2)

Nickel ($/lb)(1) 7.23 7.85

Cobalt ($/lb)(1) 14.78 11.52

Oil and gas ($/boe) 71.24 70.34

Electricity ($/MWh) 46.21 41.87

Thermal coal - Prairie Operations ($/tonne) 20.99 18.20

Thermal coal - Mountain Operations ($/tonne) 87.95 94.44

----------------------------------------------------------------------------

(1) Includes the impact of the Ambatovy Joint Venture from February 1, 2014

onward.

(2) For additional information, see the "Non-GAAP Measures" section of this

release.

CORPORATE AND OTHER

The Corporation continues to target savings in excess of $33 million in 2014 in

general and administrative, and other costs. In the first quarter of 2014,

approximately 58% ($19 million) of the projected savings were realized,

including reduced headcount, salary freezes and lower bonus payouts across the

organization, as well as other cost structure reductions. The cost saving

measures will be partly offset by other non-recurring costs such as the Coal

transaction costs, consulting costs related to the special Shareholders' meeting

and severance costs.

LIQUIDITY, CAPITAL RESOURCES AND USE OF PROCEEDS FROM COAL TRANSACTION

Cash, cash equivalents and short-term investments were $603.9 million at March

31, 2014. This does not include cash, cash equivalents and short-term

investments of $31.5 million (100% basis) held by the Moa Joint Venture, $53.7

million (100% basis) held by the Ambatovy Joint Venture, or the $793 million of

cash proceeds from the sale of the Coal business.

Total long-term debt at March 31, 2014 was $2.2 billion, including approximately

$0.9 billion related to non-recourse Ambatovy partner loans to Sherritt.

Sherritt intends to use the proceeds of the Coal transaction to pay down a

significant portion of the outstanding debentures and to retain sufficient

flexibility to fund Ambatovy and investment opportunities in the core

businesses.

Review of Operations

METALS - Consolidated Results

For the period ended

($ millions) March 31, 2014

----------------------------------------------------------------------------

Moa Ambatovy Other Sherritt

(50%)(1) (40%)(4) (100%)(2) Metals(3)

Sales volumes (Sherritt's

share)

Nickel, finished (000

lbs) 8,428 5,738 - 14,166

Cobalt, finished (000

lbs) 858 425 - 1,283

Fertilizer (tonnes) 36,882 4,628 - 41,510

Average reference prices

Nickel (US$/lb) 6.64 6.77 - -

Cobalt (US$/lb)(6) 13.90 14.43 - -

Average-realized

prices(1)

Nickel ($/lb) 7.11 7.37 - 7.23

Cobalt ($/lb) 14.86 14.66 - 14.78

Fertilizer ($/tonne) 358 195 - 328

Revenue

Nickel $ 60.0 $ 43.0 $ - $ 103.0

Cobalt 12.7 6.8 - 19.5

Fertilizer 16.2 1.0 - 17.2

Other 1.5 18.9 20.4

----------------------------------------------------------------------------

Total revenue 90.4 50.8 18.9 160.1

----------------------------------------------------------------------------

Cost of sales 81.1 50.1 18.4 149.6

Administrative expenses 2.3 5.1 0.3 7.7

Adjusted EBITDA(5) 7.0 (4.4) 0.2 2.8

Depletion and

amortization 9.4 27.5 - 36.9

Earnings (loss) from

operations (2.4) (31.9) 0.2 (34.1)

Spending on capital 4.6 3.9 - 8.5

----------------------------------------------------------------------------

Three months ended

($ millions) March 31, 2013

----------------------------------------------------------------------------

Moa Ambatovy Other Sherritt

(50%) (40%)(4) (100%) Metals(3)

Sales volumes (Sherritt's

share)

Nickel, finished (000

lbs) 8,631 - - 8,631

Cobalt, finished (000

lbs) 909 - - 909

Fertilizer (tonnes) 31,513 - - 31,513

Average reference prices

Nickel (US$/lb) 7.85 - - 7.85

Cobalt (US$/lb)(6) 11.95 - - 11.95

Average-realized

prices(1)

Nickel ($/lb) 7.85 - - 7.85

Cobalt ($/lb) 11.52 - - 11.52

Fertilizer ($/tonne) 435 - - 435

Revenue

Nickel $ 67.8 $ - $ - $ 67.8

Cobalt 10.5 - - 10.5

Fertilizer 17.2 - - 17.2

Other 1.8 - 6.4 8.2

----------------------------------------------------------------------------

Total revenue 97.3 - 6.4 103.7

----------------------------------------------------------------------------

Cost of sales 78.8 5.9 84.7

Administrative expenses 1.9 0.5 (0.3) 2.1

Adjusted EBITDA(5) 16.6 (0.5) 0.8 16.9

Depletion and

amortization 9.3 - 0.6 9.9

Earnings (loss) from

operations 7.3 (0.5) 0.2 7.0

Spending on capital 4.7 5.0 - 9.7

----------------------------------------------------------------------------

(1) Moa Joint Venture (50%) + Fort Site operations (100%) that service the

Moa Joint Venture. For three months ended March 31, 2014.

(2) Under the Ambatovy Joint Venture agreements, the Corporation established

a marketing organization to buy, market and sell certain Ambatovy nickel

production.

(3) Sherritt's share of Joint Ventures + 100%-owned Fort Site Operations +

marketing support for the Ambatovy Joint Venture.

(4) Effective February 1, 2014, Ambatovy ceased capitalizing project costs

and commenced recognizing operating revenues and costs for accounting

purposes. Financial results are presented for the post-commercial period

only.

(5) For additional information, see the "Non-GAAP Measures" section of this

release.

(6) Average Metal Bulletin - Low Grade Cobalt published price.

In January 2014, Ambatovy met the requirements for commercial production (70% of

ore throughput of nameplate capacity in the pressure acid leach circuit on

average over a thirty-day period). Effective February 1, 2014, Ambatovy ceased

capitalizing project costs and commenced recognizing operating revenues and

costs for accounting purposes.

Average reference prices differ between Moa and Ambatovy, as Moa reference

prices are for a three-month period (January 1 to March 31) and Ambatovy

reference prices are for a two-month period (effective February 1 to March 31).

The average nickel reference price decreased compared to the prior-year period

as global nickel markets remained oversupplied despite the enactment of a

mineral export ban on raw ore exports on January 12, 2014 in Indonesia. The

average cobalt reference price strengthened compared to the prior-year period

due to ongoing power issues in the Democratic Republic of the Congo and Zambia

resulting in a shortage of certain cobalt metal grades as well as improving

demand in the rechargeable battery and superalloy sectors.

METALS - Unit Operations

Moa Joint Venture (50%) + Sherritt Fort Site Operations (100%)

Operating results at the 100% level are summarized in the following table:

Three months ended,

March 31,

(100% basis) 2014 2013

----------------------------------------------------------------------------

Production volumes

Mixed sulphides (Ni+Co contained, tonnes) 7,981 8,333

Nickel (tonnes) 7,278 7,803

Cobalt (tonnes) 712 810

Fertilizer (tonnes)

Moa Joint Venture 41,174 40,779

Fort Site 39,266 39,006

----------------------------------------------------------------------------

Total fertilizer 80,440 79,785

----------------------------------------------------------------------------

Sales volumes

Nickel (thousands of pounds) 16,856 17,262

Cobalt (thousands of pounds) 1,716 1,818

Fertilizer (tonnes)

Moa Joint Venture 28,254 19,988

Fort Site 22,755 21,519

----------------------------------------------------------------------------

Total fertilizer 51,009 41,507

----------------------------------------------------------------------------

Average unit operating costs (US$/lb)(1)

Mining, processing and refining costs 6.59 7.00

Third-party feed costs 0.23 0.22

Cobalt by-product credits (1.37) (1.20)

Fort-site credits (0.39) (0.65)

Other 0.24 (0.03)

----------------------------------------------------------------------------

Net direct cash costs of nickel (NDCC)(2) 5.30 5.34

----------------------------------------------------------------------------

Natural gas ($/GJ) 5.60 3.21

Fuel oil (US$/tonne) 604 641

Sulphur (US$/tonne) 127 238

Sulphuric acid (US$/tonne) 128 163

Spending on capital

Sustaining 3.8 4.7

Expansion 0.8 -

----------------------------------------------------------------------------

Total 4.6 4.7

----------------------------------------------------------------------------

(1) For additional information, see the "Non-GAAP Measures" section of this

release.

(2) Net direct cash costs of nickel (NDCC) after cobalt and other by-product

credits.

(3) Moa Joint Venture (50% interest) + Fort Site operations (100% interest)

that provides services to the Moa Joint Venture.

Production of mixed sulphides in first-quarter 2014 was 4% (352 tonnes, 100%

basis) lower than in the prior-year period, due to poor metallurgical recoveries

of mined ore (first encountered on transition to a new mining concession in

fourth-quarter 2013) and low leach train availability due to unplanned

maintenance activities on one of the five pressure acid leach (PAL) trains.

Measures taken to improve leaching of the ore improved production by the end of

the quarter with production returning to normal levels. Repairs to the one leach

train were completed during the quarter and full availability was restored.

Consolidated metals sales volumes reflected production trends. Fertilizer sales

volumes were 23% (9,502 tonnes, 100% basis) higher than in the prior-year

period, reflecting a strong spring fertilizer season as customers have taken

shipments of ammonium sulphate earlier in the season than is usual.

The net direct cash cost (NDCC) decreased 1% (U.S.$ 0.04/lb) compared to the

prior-year period as lower mining and processing costs and higher cobalt

by-product credits were offset by lower net fertilizer by-product credits. Lower

mining and processing costs largely reflected lower sulphur and sulphuric acid

input commodity prices, partly offset by the impact of lower mixed sulphide

production. Lower net fertilizer by-product credits largely reflected lower

realized sale prices and higher natural gas input commodity prices.

Spending on capital during the quarter was focused on sustaining activities.

Mobilization of resources for the construction of the 2,000 tonne per day acid

plant at Moa continued during the quarter. Acid plant project expenditures were

included in expansion spending and largely related to engineering and

procurement activities. The Moa Joint Venture has obtained project financing for

the estimated capital cost of the plant (U.S.$65 million) from a Cuban financial

institution, and completed additional draws of $1.1 million (50% basis) on the

facility during the quarter.

Ambatovy Joint Venture (40%)

In January 2014, Ambatovy met the requirements for commercial production (70% of

ore throughput of nameplate capacity in the pressure acid leach circuit on

average over a thirty-day period). Effective February 1, 2014, Ambatovy ceased

capitalizing project costs and commenced recognizing operating revenues and

costs for accounting purposes.

Operating results at the 100% level are summarized in the following table:

For the period ended March 31,

(100% basis) 2014 2013

----------------------------------------------------------------------------

Production volumes(1) (3 months)

Mixed sulphides (Ni+Co contained, tonnes)(2) 9,631 7,803

Nickel (tonnes) 8,782 5,830

Cobalt (tonnes) 693 540

Fertilizer (tonnes) 20,842 21,958

Sales volumes(3) (2 months)

Nickel (thousands of pounds) 14,345 -

Cobalt (thousands of pounds) 1,063 -

Fertilizer (tonnes) 11,571 -

Average unit operating costs (US$/lb)(3),(4) (2

months)

Mining, processing and refining costs 7.42 -

Cobalt by-product credits (0.98) -

Other (0.39) -

----------------------------------------------------------------------------

Net direct cash costs of nickel (NDCC) (5) 6.83 -

----------------------------------------------------------------------------

Sulphur (US$/tonne) 171 -

Limestone (US$/tonne) 19 -

Coal (US$/tonne) 97 -

Spending on capital ($ millions)(6) 3.9 5.0

----------------------------------------------------------------------------

(1) Production volumes are presented for three months ended March 31, 2014.

(2) Net of recycle to the refinery.

(3) Sales volumes are presented from February 1, 2014 onward.

(4) For additional information, see the "Non-GAAP Measures" section of this

release.

(5) Net direct cash costs of nickel (NDCC) after cobalt and other by-product

credits for the period from February 1, 2014 onward.

(6) Sustaining capital only.

The average ore throughput in the PAL circuit was 67% for the quarter (compared

to 53% in fourth-quarter 2013) as further improvement in autoclave availability,

solids density and volumetric flow to the autoclaves continued to advance the

ramp-up. All autoclaves were available for service during the quarter. Finished

nickel production volumes averaged 108 tonnes per day in February and March.

Nickel reduction volumes peaked at record 159 tonnes per day for one day in

March.

Finished metal sales volumes were consistent with production levels. Fertilizer

sales volumes were lower than production volumes due largely to inventory

establishment in key warehouses and the timing of sales.

The net direct cash cost (NDCC) of nickel for the quarter was within guidance

and expectation for the facility when operating at approximately 60% of its

finished metal production capacity. Guidance was for NDCC of U.S.$6.00 per pound

to U.S.$8.00 per pound when operating near this rate.

Spending on capital focused on sustaining activities and construction of Phase

II of the Tailings Management Facility.

Subsequent to the end of the quarter, Ambatovy received ISO 9001:2008

certification for the management system for refining, analytical services and

shipping of nickel, cobalt and ammonium sulphate products from the plant site in

Toamasina. ISO 9001:2008 certification is a requirement for registration of

primary nickel brands on the London Metal Exchange.

Ambatovy ceased capitalizing project costs on January 31, 2014. Cumulative

spending on capital at Ambatovy was US$5.3 billion (100% basis), excluding

financing charges, working capital and foreign exchange, below the US$5.5

billion (100% basis) estimate established in June 2011. Cumulative total project

costs at January 31, 2014 (including operating costs, financing charges, working

capital and foreign exchange, and net of sales revenue) were US$7.2 billion

(100% basis), with US$49.9 million (100% basis) spent in January 2014.

In first-quarter 2014, a total of US$90.0 million (100% basis) in funding was

provided by the Ambatovy Joint Venture partners. Sherritt's 40% share of funding

for first-quarter 2014 was US$36.0 million ($39.5 million), and was sourced from

cash on hand.

OIL AND GAS

Three months ended

March 31,

($ millions unless otherwise noted) 2014 2013

----------------------------------------------------------------------------

Production volumes (boepd)(1)

Gross working-interest - Cuba(2), (3) 20,200 19,551

Net working-interest(4)

Cuba - cost recovery 3,844 2,631

Cuba - profit oil 7,341 7,614

----------------------------------------------------------------------------

Cuba - total 11,185 10,245

Spain 278 290

Pakistan 313 336

----------------------------------------------------------------------------

Total net working-interest 11,776 10,871

----------------------------------------------------------------------------

Average reference prices (US$/bbl)

U.S. Gulf Coast Fuel Oil No.6 (GCF6) 89.30 97.07

Brent crude 109.13 113.59

Average-realized prices(5)

Cuba ($/bbl) 71.80 71.17

Spain ($/bbl) 118.75 112.99

Pakistan ($/boe) 9.13 8.26

----------------------------------------------------------------------------

Weighted average ($/boe) 71.24 70.34

----------------------------------------------------------------------------

Average unit operating costs(5)

Cuba ($/bbl) 12.10 12.24

Spain ($/bbl) 49.43 14.62

Pakistan ($/boe) 5.97 7.95

----------------------------------------------------------------------------

Weighted average ($/boe) 12.91 12.18

----------------------------------------------------------------------------

Revenue 76.9 71.1

Cost of sales 13.7 11.9

Administrative expenses 2.8 1.8

Adjusted EBITDA(5) 60.4 57.4

Depletion, depreciation and amortization 16.8 16.0

Earnings from operations 43.6 41.4

Spending on capital(6) 15.8 11.5

----------------------------------------------------------------------------

(1) Oil production is stated in barrels of oil per day ("bopd"). Natural gas

production is stated in barrels of oil equivalent per day ("boepd"),

which is converted at 6,000 cubic feet per barrel. Oil and natural gas

production are referred to collectively as "boepd".

(2) In Cuba, Oil and Gas delivers all of its gross working-interest oil

production to Union Cubapetroleo (CUPET) at the time of production.

Gross working-interest oil production excludes: (i) production from

wells for which commercial viability has not been established in

accordance with production-sharing contracts, and (ii) working-interest

of other participants in the production-sharing contracts.

(3) Gross working-interest oil production is allocated between Oil and Gas

and CUPET in accordance with production-sharing contracts. The

Corporation's share, referred to as 'net working-interest oil

production', includes: (i) cost recovery oil (based upon the recoverable

capital and operating costs incurred by Oil and Gas under each

production-sharing contract), and (ii) a percentage of profit oil (gross

working-interest production remaining after cost recovery oil is

allocated to Oil and Gas). Cost recovery pools for each production-

sharing contract include cumulative recoverable costs, subject to

certification by CUPET, less cumulative proceeds from cost recovery oil

allocated to Oil and Gas. Cost recovery revenue equals capital and

operating costs eligible for recovery under the production-sharing

contracts.

(4) Net working-interest production (equivalent to net sales volume)

represents the Corporation's share of gross working-interest production.

(5) For additional information see the 'Non-GAAP Measures' section of this

release.

(6) Exploration and evaluation spending incurred prior to the technical

feasibility and commercial viability of extracting the resources is

recorded as an intangible asset.

Gross working-interest (GWI) oil production in Cuba increased 3% (649 bopd)

primarily due to production increases from a new well drilled and the

optimization of production from existing wells. Cost-recovery production in Cuba

increased 46% (1,213 bopd) primarily due to higher recoverable spending, partly

offset by higher oil prices. Profit-oil production, which represents Sherritt's

share of production after cost recovery volumes are deducted from GWI volumes,

decreased by 4% (273 bopd) in 2014 due to the increase in cost recovery oil.

Production in Spain and Pakistan was lower than the prior-year period due to

natural reservoir declines.

The average-realized price for oil produced in Cuba and Spain both increased

compared to the prior-year period as the impact of a weaker Canadian dollar more

than offset a decline in the reference prices (GCF6 and Brent respectively).

Unit operating costs in Cuba decreased 1% ($0.14/bbl) primarily due to higher

net production. Unit operating costs in Spain increased 238% ($34.81/bbl)

compared to the prior-year period due to an adjustment in first-quarter 2013

related to 2012 costs, the impact of a weaker Canadian dollar relative to the

Euro, and costs associated in 2014 related to a major well work-over.

Spending on capital was 37% ($4.3 million) higher than in the prior-year period,

reflecting the planned increase in development drilling in Cuba, partly offset

by lower equipment and inventory purchases. During the quarter, one development

well was drilled and completed, and is currently producing oil. A second

development well was initiated during the quarter and was completed in April

2014.

Negotiations with Cuban authorities have been completed with respect to four new

exploratory production sharing contracts (PSCs) and the extension of the term of

the existing PSC covering the Puerto Escondido/Yumuri oil fields until March

2028 for all development wells drilled. The contracts are now under internal

review by certain Cuban ministries with final approval anticipated in

second-quarter 2014.

POWER

Three months ended

March 31,

($ millions unless otherwise noted) 2014 2013

----------------------------------------------------------------------------

Electricity sold (GWh, 33 1/3% basis) 187 160

Average-realized price ($/MWh)(3) 46.21 41.87

Average unit operating cost ($/MWh) (3)

Base(1) 14.93 16.79

Non-base(2) 2.50 9.91

----------------------------------------------------------------------------

Total unit cash operating costs 17.43 26.70

----------------------------------------------------------------------------

Net capacity factor (%) 56% 69%

Revenue 11.9 16.0

Cost of sales 4.5 11.0

Administrative expenses 2.5 1.5

Adjusted EBITDA(3) 4.9 3.5

Depletion, depreciation and amortization 4.0 2.6

Earnings from operations 0.9 0.9

Spending on capital (33 1/3% basis)(4) 1.0 1.8

Spending on SCAs (33 1/3% basis)(5) 1.2 6.1

----------------------------------------------------------------------------

Total spending on capital and SCAs 2.2 7.9

----------------------------------------------------------------------------

(1) Base costs relate to the operations in Cuba and do not include the

impairment of receivables and property, plant and equipment related to

the operations in Madagascar or the impairment of intangible assets.

(2) Costs incurred at the Boca de Jaruco and Puerto Escondido facilities

that otherwise would have been capitalized if these facilities were not

accounted for as service concession arrangements.

(3) For additional information see the 'Non-GAAP Measures' section of this

release.

(4) Spending on capital includes sustaining capital at the Varadero site as

well as capitalized interest relating to the 150 MW Boca de Jaruco

Combined Cycle Project.

(5) Service Concession Arrangement ("SCA") spending is primarily related to

the 150 MW Boca de Jaruco Combined Cycle Project. Sherritt provided 100%

of the funding for the 150 MW Boca de Jaruco Combined Cycle Project and

accounts for the Project as an SCA. Two thirds of the project spending

(relating to the non-Sherritt partners' share) is recorded as a loan

receivable. The remaining one third of project spending (Sherritt's

share) is recorded as a construction cost, and is offset by the same

amount recorded as construction revenue.

Electricity production was 17% (27 GWh) higher for first-quarter 2014, primarily

due to a decrease in maintenance activity which resulted in less downtime, and

additional production from the 150 MW Boca de Jaruco Combined Cycle which became

operational on February 2, 2014. The net capacity factor declined 13% primarily

due to the completion of the 150 MW Boca de Jaruco Combined Cycle which is

forecast to operate at 47% of capacity until additional fuel sources are

identified. A project to capture natural gas that is otherwise being flared has

been initiated and is expected to be completed before the end of the year. This

incremental natural gas will be consumed at the Boca de Jaruco facility to

produce electricity.

The average-realized price of electricity was 10% ($4.34/MWh) higher in

first-quarter 2014 primarily due to the impact of a weaker Canadian dollar

relative to the U.S. dollar.

Average unit operating costs were 35% ($9.27/MWh) lower than in 2013 due to

lower scheduled turbine maintenance costs and higher production in 2014.

Spending on capital is primarily related to capitalized interest on the 150 MW

Boca de Jaruco Combined Cycle Project, which became operational on February 2,

2014. In addition, service concession arrangement expenditures primarily relate

to the 150 MW Boca de Jaruco Combined Cycle Project. As a result of the Project

becoming operational, interest on the Project ceased to be capitalized (recorded

as spending on expansion capital) and SCA spending will no longer include any

expenditures related to the Project.

DISCONTINUED OPERATIONS - COAL

On April 28, 2014, the Corporation completed the agreements to sell its Coal

operations. As a result of the sale, the Corporation received $793 million in

cash and expects to record a gain on the sale of the Coal royalty operations in

second-quarter 2014 in addition to changes to working capital and other closing

adjustments. Coal was classified as a discontinued operation for first-quarter

2014.

($ millions

unless

otherwise Three months ended March 31, Three months ended March 31,

noted) 2014 2013

----------------------------------------------------------------------------

Prairie Mountain Prairie Mountain

Operations Operations Total Operations Operations Total

Production

(millions of

tonnes) 5.2 0.8 6.0 5.6 0.8 6.4

Sales (millions

of tonnes) 4.9 0.9 5.8 5.7 0.6 6.3

Average-realized

prices

($/tonne)(1) 20.99 87.95 - 18.20 94.44 -

Unit operating

costs ($/tonne)

(1) 15.74 75.69 - 13.97 91.05 -

Revenue(2) 121.4 82.2 203.6 122.9 56.6 179.5

Cost of sales 89.8 76.1 165.9 85.3 52.5 137.8

Administrative

expenses 5.7 - 5.7 2.1 2.0 4.1

Adjusted

EBITDA(3) 32.7 11.5 44.2 35.5 2.1 37.6

Depletion,

depreciation

and

amortization(4) - - - 15.4 10.8 26.2

Earnings (loss)

from operations 25.9 6.1 32.0 42.1 (8.7) 33.4

Spending on

capital 8.1 6.8 14.9 13.0 20.3 33.3

----------------------------------------------------------------------------

(1) Prairie Operations realized pricing and unit operating costs exclude

royalties and the results of the char and activated carbon businesses.

(2) Prairie Operations revenue is comprised of mining revenue, coal

royalties and potash royalties ($110.5 million, $8.5 million and $2.4

million for 2014; $112.2 million, $7.5 million and $3.2 million for

2013).

(3) For additional information see the 'Non-GAAP Measures' section of this

release.

(4) Depletion, depreciation and amortization is not recognized for the three

months ended March 31, 2014 as a result of being classified as a

discontinued operation in December 2013.

Prairie Operations production volumes were 7% (0.4 million tonnes) lower than

the prior-year period, reflecting lower Highvale sales volumes and reduced

customer demand at the Boundary Dam mine.

Mountain Operations sales volumes were 50% (0.3 million tonnes) higher in 2014

as a result of the incident at the Westshore Terminals which reduced throughput

at the port from December 2012 through February 2013.

Prairie Operations average-realized pricing increased due to contract price

escalations and the impact of a contract extension for a new mining area at the

Paintearth mine. Mountain Operations average-realized pricing for the quarter

reflected weaker international coal reference pricing due to oversupply in the

international coal market.

Prairie Operations unit operating costs increased primarily due to the impact of

the mining area at the Paintearth mine. Mountain Operations unit operating costs

decreased due to Coal's successful cost reduction initiative that was a focus in

2013. This included streamlining mining to lower cost areas, raising equipment

utilization and a significant reduction in workforce and administration

expenses.

Coal royalties were 13% ($1.0 million) higher than in 2013 due to mining in

royalty-assessable areas. Potash royalties were 25% ($0.8 million) lower than

the prior-year period due to weaker global potash pricing.

Spending on capital was lower at both the Prairie and Mountain Operations (38%

or $4.9 million and 67% or $13.5 million, respectively) due to deferrals and

cost-cutting programs aimed at maintaining a disciplined capital spending

profile in light of challenging coal market conditions.

On October 31, 2013, a breach of an onsite water containment pond occurred at

the Obed Mountain mine near Hinton, Alberta. The total costs of assessment,

clean-up, and remediation (including ongoing water management, but excluding

insurance recoveries) remain unchanged at $52.2 million. Total costs incurred to

date and for first-quarter 2014 were $23.5 million and $12.6 million

respectively. Following closing of the Coal sale transaction, Sherritt has

retained the obligations associated with the October 2013 Obed water containment

pond breach.

Outlook

Production volumes and spending on capital projected for full-year 2014 are

shown below.

Projected

for the year ending

(units as noted) December 31, 2014

----------------------------------------------------------------------------

Production volumes

Mixed sulphides (tonnes, Ni+Co contained, 100%

basis)

Moa Joint Venture 38,000

Ambatovy Joint Venture 44,000 - 50,000

----------------------------------------------------------------------------

Total 82,000 - 88,000

----------------------------------------------------------------------------

Nickel, finished (tonnes, 100% basis)

Moa Joint Venture 34,000

Ambatovy Joint Venture 40,000 - 45,000

----------------------------------------------------------------------------

Total 74,000 - 79,000

----------------------------------------------------------------------------

Cobalt, finished (tonnes, 100% basis)

Moa Joint Venture 3,350

Ambatovy Joint Venture 3,300 - 3,800

----------------------------------------------------------------------------

Total 6,650 - 7,150

----------------------------------------------------------------------------

Oil - Cuba (gross working-interest, bopd) 19,000

Oil - All operations (net working-interest, boepd) 11,200

Electricity (GWh, 33 1/3% basis) 750

Spending on capital ($ millions)

Metals - Moa Joint Venture (50% basis), Fort Site

(100% basis)(1) 70

Metals - Ambatovy Joint Venture (40% basis) 34

Oil and Gas (2) 73

Power (33 1/3% basis)(3) 4

----------------------------------------------------------------------------

Spending on capital (excluding Corporate) 181

----------------------------------------------------------------------------

(1) Spending on capital relating to the Corporation's 50% share of the Moa

Joint Venture and to the Corporation's 100% interest in the fertilizer

and utilities assets in Fort Saskatchewan.

(2) Exploration and evaluation spending incurred prior to the technical

feasibility and commercial viability of extracting the resources is

recorded as an intangible asset.

(3) Spending on capital for Power includes sustaining capital at the

Varadero site as well as capitalized interest in respect of the 150 MW

Boca de Jaruco Combined Cycle Project.

-- Projected numbers remain unchanged from the 2013 year-end results

release issued in February 2014.

Non-GAAP Measures

The Corporation uses adjusted net earnings, adjusted EBITDA, average-realized

price, unit operating cost, and adjusted operating cash flow to monitor the

performance of the Corporation and its operating divisions and believes these

measures enable investors and analysts to compare the Corporation's financial

performance with its competitors and evaluate the results of its underlying

business. These measures do not have a standard definition under IFRS and should

not be considered in isolation or as a substitute for measures of performance

prepared in accordance with IFRS. As these measures do not have a standardized

meaning, they may not be comparable to similar measures provided by other

companies. See Sherritt's Management's Discussion and Analysis for the period

ended March 31, 2014 for further information.

About Sherritt

Sherritt is a world leader in the mining and refining of nickel from lateritic

ores with operations in Canada, Cuba, and Madagascar. The Corporation is the

largest independent energy producer in Cuba, with extensive oil and power

operations on the island. Sherritt licenses its proprietary technologies and

provides metallurgical services to commercial metals operations worldwide. The

Corporation's common shares are listed on the Toronto Stock Exchange under the

symbol "S".

Forward-Looking Statements

This press release contains certain forward-looking statements. Forward-looking

statements can generally be identified by the use of statements that include

such words as "believe", "expect", "anticipate", "intend", "plan", "forecast",

"likely", "may", "will", "could", "should", "suspect", "outlook", "projected",

"continue" or other similar words or phrases. Specifically, forward-looking

statements in this document include, but are not limited to, statements set out

in the "Outlook" sections of this press release and those respecting certain

expectations regarding the closing of the Coal sale transaction; certain

expectations about capital costs and expenditures; capital project commissioning

and completion dates; production and sales volumes; revenue, costs, and

earnings; sufficiency of working capital and capital project funding; completion

of development and exploration wells; amounts of certain joint venture

commitments; compliance and ability to remedy financial covenant breaches in a

timely manner.

Forward-looking statements are not based on historic facts, but rather on

current expectations, assumptions and projections about future events, including

commodity and product prices and demand; realized prices for production;

earnings and revenues; development and exploratory wells and enhanced oil

recovery in Cuba; environmental rehabilitation provisions; availability of

regulatory approvals; compliance with applicable environmental laws and

regulations; the impact of regulations related to greenhouse gas emissions and

credits; debt repayments; collection of accounts receivable; and certain

corporate objectives, goals and plans for 2014. By their nature, forward-looking

statements require the Corporation to make assumptions and are subject to

inherent risks and uncertainties. There is significant risk that predictions,

forecasts, conclusions or projections will not prove to be accurate, that those

assumptions may not be correct and that actual results may differ materially

from such predictions, forecasts, conclusions or projections. The Corporation

cautions readers of this press release not to place undue reliance on any

forward-looking statement as a number of factors could cause actual future

results, conditions, actions or events to differ materially from the targets,

expectations, estimates or intentions expressed in the forward-looking

statements.

Key factors that may result in material differences between actual results and

developments and those contemplated by this press release include global

economic and market conditions, and business, economic and political conditions

in Canada, Cuba, Madagascar, and the principal markets for the Corporation's

products.

Other such factors include, but are not limited to, uncertainties in the

development, construction, ramp-up and operation of large mining, processing and

refining projects; risks related to the availability of capital to undertake

capital initiatives; changes in capital cost estimates in respect of the

Corporation's capital initiatives; risks associated with the Corporation's

joint-venture partners; expectations of the timing of financial completion at

the Ambatovy Joint Venture; risk of future non-compliance with financial

covenants; risk of inability to remedy covenant breaches; potential

interruptions in transportation; political, economic and other risks of foreign

operations; the Corporation's reliance on key personnel and skilled workers; the

possibility of equipment and other unexpected failures; the potential for

shortages of equipment and supplies; risks associated with mining, processing

and refining activities; uncertainty of gas supply for electrical generation;

uncertainties in oil and gas exploration; risks related to foreign exchange

controls on Cuban government enterprises to transact in foreign currency; risks

associated with the United States embargo on Cuba and the Helms-Burton

legislation; risks related to the Cuban government's and Malagasy government's

ability to make certain payments to the Corporation; risks related to

exploration and development programs; uncertainties in reserve estimates; risks

associated with access to reserves and resources; uncertainties in environmental

rehabilitation provisions estimates; risks related to the Corporation's reliance

on partners and significant customers; risks related to the Corporation's

corporate structure; foreign exchange and pricing risks; uncertainties in

commodity pricing; credit risks; competition in product markets; the

Corporation's ability to access markets; risks in obtaining insurance;

uncertainties in labour relations; uncertainties in pension liabilities;

uncertainty in the ability of the Corporation to enforce legal rights in foreign

jurisdictions; uncertainty regarding the interpretation and/or application of

the applicable laws in foreign jurisdictions; risks associated with future

acquisitions; uncertainty in the ability of the Corporation to obtain government

permits; risks associated with governmental regulations regarding greenhouse gas

emissions; risks associated with government regulations and environmental,

health and safety matters; uncertainties in growth management; interest rate

risk; risks related to political or social unrest or change and those in respect

of aboriginal and community relations; risks associated with rights and title

claims; and other factors listed from time to time in the Corporation's

continuous disclosure documents.

Readers are cautioned that the foregoing list of factors is not exhaustive and

should be considered in conjunction with the risk factors described in this

press release and in the Corporation's other documents filed with the Canadian

securities authorities.

The Corporation may, from time to time, make oral forward-looking statements.

The Corporation advises that the above paragraph and the risk factors described

in this press release and in the Corporation's other documents filed with the

Canadian securities authorities including, but not limited to, the Corporation's

Annual Information Form for the year ended December 31, 2013 should be read for

a description of certain factors that could cause the actual results of the

Corporation to differ materially from those in the oral forward-looking

statements. The forward-looking information and statements contained in this

press release are made as of the date hereof and the Corporation undertakes no

obligation to update publicly or revise any oral or written forward-looking

information or statements, whether as a result of new information, future events

or otherwise, except as required by applicable securities laws. The

forward-looking information and statements contained herein are expressly

qualified in their entirety by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Sherritt International Corporation

Investor Relations

416.935.2451

Toll-free: 1.800.704.6698

investor@sherritt.com

www.sherritt.com

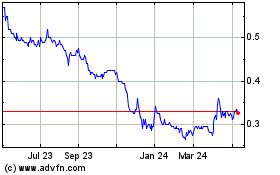

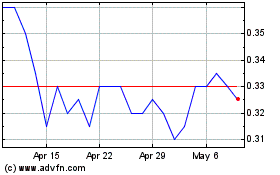

Sherritt (TSX:S)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sherritt (TSX:S)

Historical Stock Chart

From Nov 2023 to Nov 2024